Leveraging Sarbanes-Oxley (SOX) to Build Better Practices

Powering Strategies and Managing

Risks — Using SOX compliance to

build disciplined, repeatable, and

auditable practices.

Running a successful business just got a lot more complicated

for many publicly traded and GAAP-compliant organizations.

Fraud and mismanagement by executives of highly visible

public companies such as Enron, Tyco, WorldCom, Global

Crossing and others have created an atmosphere of executive

mistrust. At the same time, many Internet Companies had

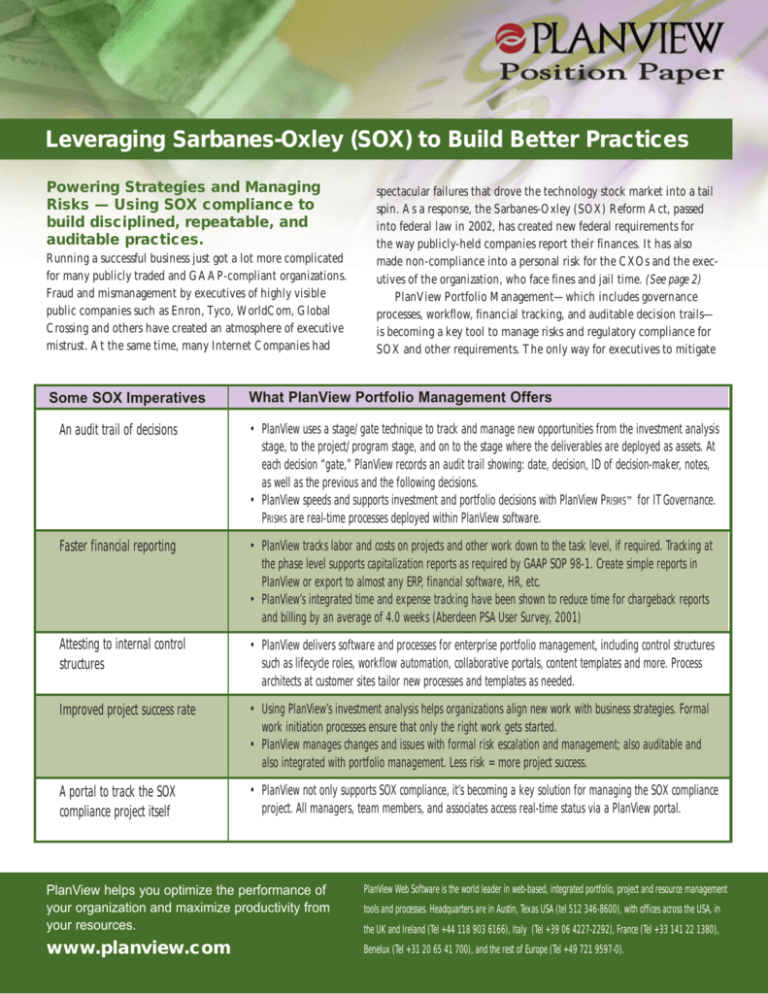

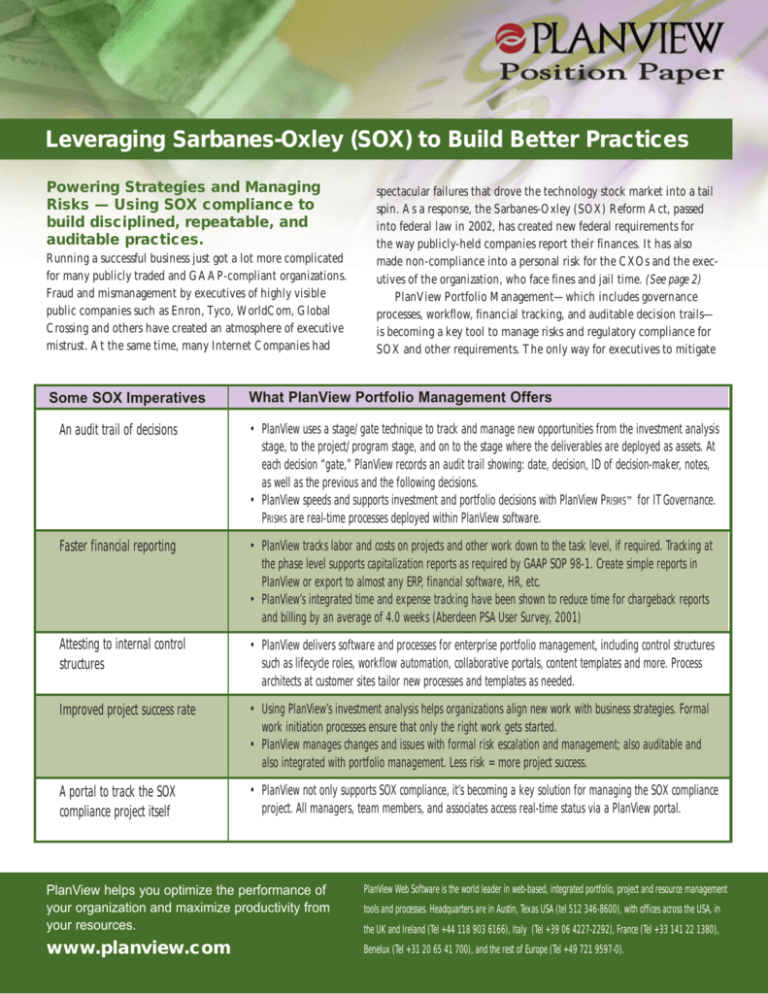

Some SOX Imperatives

spectacular failures that drove the technology stock market into a tail

spin. As a response, the Sarbanes-Oxley (SOX) Reform Act, passed

into federal law in 2002, has created new federal requirements for

the way publicly-held companies report their finances. It has also

made non-compliance into a personal risk for the CXOs and the executives of the organization, who face fines and jail time. (See page 2)

PlanView Portfolio Management—which includes governance

processes, workflow, financial tracking, and auditable decision trails—

is becoming a key tool to manage risks and regulatory compliance for

SOX and other requirements. The only way for executives to mitigate

What PlanView Portfolio Management Offers

An audit trail of decisions

• PlanView uses a stage/gate technique to track and manage new opportunities from the investment analysis

stage, to the project/program stage, and on to the stage where the deliverables are deployed as assets. At

each decision “gate,” PlanView records an audit trail showing: date, decision, ID of decision-maker, notes,

as well as the previous and the following decisions.

• PlanView speeds and supports investment and portfolio decisions with PlanView PRISMS™ for IT Governance.

PRISMS are real-time processes deployed within PlanView software.

Faster financial reporting

• PlanView tracks labor and costs on projects and other work down to the task level, if required. Tracking at

the phase level supports capitalization reports as required by GAAP SOP 98-1. Create simple reports in

PlanView or export to almost any ERP, financial software, HR, etc.

• PlanView’s integrated time and expense tracking have been shown to reduce time for chargeback reports

and billing by an average of 4.0 weeks (Aberdeen PSA User Survey, 2001)

Attesting to internal control

structures

• PlanView delivers software and processes for enterprise portfolio management, including control structures

such as lifecycle roles, workflow automation, collaborative portals, content templates and more. Process

architects at customer sites tailor new processes and templates as needed.

Improved project success rate

• Using PlanView’s investment analysis helps organizations align new work with business strategies. Formal

work initiation processes ensure that only the right work gets started.

• PlanView manages changes and issues with formal risk escalation and management; also auditable and

also integrated with portfolio management. Less risk = more project success.

A portal to track the SOX

compliance project itself

• PlanView not only supports SOX compliance, it’s becoming a key solution for managing the SOX compliance

project. All managers, team members, and associates access real-time status via a PlanView portal.

PlanView helps you optimize the performance of

your organization and maximize productivity from

your resources.

PlanView Web Software is the world leader in web-based, integrated portfolio, project and resource management

www.planview.com

Benelux (Tel +31 20 65 41 700), and the rest of Europe (Tel +49 721 9597-0).

tools and processes. Headquarters are in Austin, Texas USA (tel 512 346-8600), with offices across the USA, in

the UK and Ireland (Tel +44 118 903 6166), Italy (Tel +39 06 4227-2292), France (Tel +33 141 22 1380),

SOX in a Nutshell:

Personal Liability, the Audit Trail

& Fast, Fast, Fast

The Sarbanes-Oxley (SOX) package of reforms

signed into law 2002 through 2003 defines personal liabilities for the CEO and CFO and requires a digital audit trail of financial decisions. The act which

affects all publicly traded companies with a market

capitalization of over $75-million (under $75M get

an extra year) includes the following:

“Sarbanes-Oxley is providing the impetus for a series of

compliance issues related to IT. CEOs and CFOs are now

required to attest that annual and quarterly financial reports

contain no material errors or omissions. With their own necks

suddenly on the line, these executives are scrambling to make

sure their systems are more timely and accurate. Short of

giving a blank cheque to IT, CEOs should be more willing to

sign off costly overhauls of their existing financial reporting,

budgeting, and supporting business intelligence systems.”

—Computer Business Review, May 2003

• Quarterly reporting must be done in 35 days compared

to the previous 45 days.

• Annual reporting must be done in 60 days compared

to the previous 90 days.

• Significant events must be reported in “plain English”

and within 2 days compared to the previous 5 to 15

days.

• The CEO and CFO are required to verify the effectiveness of the financial controls they use to keep auditors

up to date. The impact of not complying: personal fines

of up to $1

million and up to 10 years in prison, or both. If a CEO

or CFO is found to be willfully misleading, the fine

goes to $5 million and up to 20 years in prison or

both.

• Other parts of the act address the liabilities of accounting firms.

Achieving the agile or real-time enterprise has been

a key business strategy for the past several years

because it can lead to higher revenues and market

share. Now it’s seen as a way to fight risk.

Executives have developed a keen focus on business

risks because they are being held personally responsible by the government, stockholders and employees for the results of their business decisions. The

only way for executive to mitigate their risks is to

use IT to power business processes that operate in

near real-time, that are repeatable and auditable. •

their risks is to empower business processes that operate in near real-time, that are

repeatable and auditable. IT is the engine that drives business processes, so the IT

group has now been made even more critical to the well-being of the CXO. While

at the same time, the CIO is getting more visibility at the board level and must justify and support his or her technology decisions in business terms.

PlanView would like to offer some thoughts on how to go beyond mere SOX

compliance. The idea behind the SOX reforms is to establish a broad, digital paper

trail to prove the corporate financial reports are open and honest. Yet SOX is the

tip of a much broader effort to use IT to improve business processes. In one 2003

study by the Meta Group, 65% of the respondents are seeking to use SOX to

achieve process enhancements to improve efficiency and competitive advantage.

Only 20% were focused merely on compliance. As PlanView customers are doing,

implementing governance processes, work initiation processes, investment analysis,

and just-in-time mentoring can help your organization elevate your business

processes to a competitive advantage.

The CIO Impact: Technology + Business Issues

IT expenditures can no longer be justified on their technical merit alone; they have

to be justified in clear business terms. IT expenditures are now as intensely scrutinized as any other expense, and a backlash is partly to blame. Many senior executives who authorized large IT capital expenditures in the boom years now have the

impression that IT organizations are wasteful, willful and need to be controlled.

This has driven the CIO to look for greater understanding of business strategies

and strategic alignment. In some cases the CIO is evolving into the owner of the

organization’s strategic processes. Titles like “CIO and VP of Strategy” are growing

common in companies where IT acts as the engine of corporate growth. The result?

IT governance processes are becoming essential not only to the advancement of the

CIO, but to the survival of the corporation.

www.planview.com • Sarbanes-Oxley Paper

p. 2

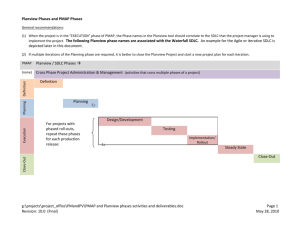

PlanView uses a stage/gate

structure for workflow and

internal control of projects

Distribute Decisions Through Governance

Converging Trends

IT Governance is defined as repeatable, disciplined and auditable

methods of decision-making, communicating, performing and delivering real benefits to the organization. It integrates strategic decision-making with the work and resource management in a consistent, auditable workflow to give a comprehensive picture to everyone with a vested interest in the process.

• Measure portfolios of work and resources to make early decisions about their

performance to eliminate non-productive work and realign resources.

Improving corporate processes will reduce risk, and meet the real

business needs of saving costs and improving productivity, while

also supporting the internal control structures required by SOX regulations. Some organizations look at regulatory requirements and

believe they can be satisfied just by giving executives more information. They are missing the point, or are at least far behind the

power curve. Compliance comes from management decisions being

made based on disciplined, repeatable and auditable processes. IT

governance is how technology becomes the pedal that accelerates

business strategies.

Managing business strategies & risks and IT governance are on

converging paths. IT is the only way to meet the speed, accuracy,

repeatability and auditability that are required in business processes.

IT is the engine of corporate processes.

• Plan to the capacity of the organizational resources to align the workforce with

the pipeline of projects, service requests and on-going work.

PlanView Portfolio Management

Some of the key components of IT Governance are:

• Apply a work initiation process to focus resources on the right work.

• Clarify investment decisions by analyzing risks and dependencies before

funding and then clearly communicate the results.

• Execute all work to a high standard of quality and eliminate surprises by

collaborating across the enterprise during execution and managing changes and

risks.

• Assure the work really delivers the promised benefits to the organization and

capture knowledge about best practices and resource performance.

Our solution provides a set of IT governance processes that nest

within internal control processes of the whole organization.

PlanView’s IT Governance includes initializing, scoping, ranking,

prioritizing, resource planning and monitoring of projects, service

work, and standard activities through portfolios. Our portfolio management software uses a web-based application infrastructure which

—Continued on page 6

p.3

www.planview.com

PlanView portfolio management includes

time-phased cost & benefit forecasting & tracking,

lifecycle workflow with role assignments,

full-featured document management,

investment analysis and more.

www.planview.com • Sarbanes-Oxley Paper

p. 4

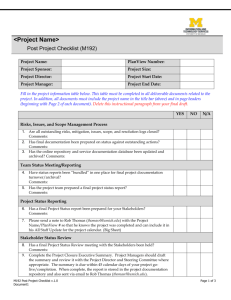

PlanView’s Audit Trails Incorporate Organizational Roles

Role

Description

Governance Board (GB)

Executive management sets the governance process, which varies by the investment

type, size of investment and other key factors. PlanView’s default set-up includes

three governance boards depending on the investment classification — Local, Group

and Strategic — since strategies are different for each one.

Project Management

Office (PMO)

The Project Management Office (PMO) is responsible for setting and encouraging

standards and acting as an agent for the governance board for lifecycle steps before

the project manager is assigned.

Investment Owner (IO)

The investment owner decides which investments to fund and is responsible for

tracking performance and adjusting the portfolio of investments based on changes in

strategy, performance, market conditions, etc.

Customer (Customer)

The customer initializes the investment request and is responsible for defining basic

request information. Customers can be internal LOBs or external.

Executive Sponsor (ES)

The executive sponsor reviews the goals of the project and is the authority for scope

changes, risk planning and changes to the deliverables.

Project Manager (PM)

The project manager is responsible for the planning and execution of the project.

The resource manager is responsible for supplying skilled resources to meet work

Resource Manager (RM) requirements.

Project Team (PT)

p.5

The project team includes all lifecycle roles associated with the project.

Financial Manager (FM)

The financial manager is responsible for confirming the funding for projects is within

organizational guidelines and is properly identified in the organization’s accounts.

Business Analyst (BA)

The business analyst is responsible for reviewing the project definition and completing

the appropriate documents to guide the governance board on the project scope.

www.planview.com

has core functionality for work initiation, workflow, content management, collaboration, configurable portals and business intelligence to

deliver a broad range of functionality including:

project management, service management,

resource management, time & expense tracking, strategic management, investment analysis,

performance tracking and financial forecasting.

PlanView’s PRISMS for IT are governance

processes that include workflows, best practices,

collaboration, content documents, manager

tools and more. You can implement the

processes, modify them to your unique needs or

automate your own methods with the PlanView

process architecture tools. The processes are a

part of software and services that automates the

delivery of mature, proven solutions. Giga

Group reports in 2003 estimated that a 20%

process improvement can reap productivity

improvements of up to 80%. PlanView offers

tools and pre-built processes to improve your own business

processes by making them consistent, repeatable, disciplined and

auditable. You reduce executive liability to stockholder or regulatory reviews and improve organizational performance.

Create Real Value With PlanView

A large cross-section of the organization will typically be involved

in SOX compliance. PlanView helps you speed your decision cycle

with access to repeatable methods, real-time metrics and information at the level of detail each user wants and needs. The results:

➺ Costs are controlled

➺ Redundant work is identified and eliminated

➺ Dependencies are clarified and managed

➺ Risks are recognized and mitigated

➺ Staff is focused on the right work

PlanView Portfolio Management Software integrates a set of

governance processes into a single application infrastructure to

provide strategic management, project & service management and

resource management. Through the PlanView solution, individual

www.planview.com • In the U.S. Tel: 512 .346 . 8600

Manage SOX compliance in its own

project portal in PlanView.

projects, service requests and on-going work are managed in context of the overall organizational strategies. Resource demands can

be forecasted and capacities evaluated for staff, capital and other

resources. Projects and service are linked into portfolios to evaluate their larger impact on strategies for programs, products, initiatives and more. Investment decisions are based on concise, repeatable models to focus resources on the right work. Resource overloads and under-utilization are addressed with real-time information to optimize resource usage. Your governance processes are

encouraged and monitored by PlanView software. Time and

expenses are managed and tracked down to the task level for

reporting and chargeback. Documents, tools, notifications and

information are delivered to the appropriate person at the appropriate time through workflow. Real-time performance information

is shared across the organization.

For more information, additional PlanView Position Papers, or

to see a demo, please contact us at www.planview.com. •

p.6

© Copyright 2003 PlanView, Inc. All rights reserved. Level I document. Version 2003-September-18.

PlanView is a registered trademark of PlanView, Inc. PRISMS, Scoreboard and HomeView are trademarks of PlanView Inc.

All other trademarks are acknowledged. PlanView may vary the specifications and availability of these products and services without notice.