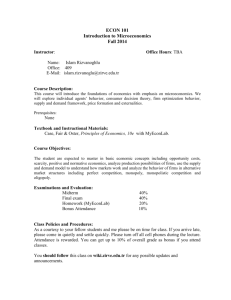

Foundation Course

Economics

OUfc008

2

Open University of Mauritius - Foundation Course in Economics - Module 1

FOUNDATION COURSE

IN ECONOMICS

Module 1

OUfc 008

April 2013

3

Open University of Mauritius - Foundation Course in Economics - Module 1

ACKNOWLEDGEMENTS

Course Author : Vinod Seegoolam

Course Reviewer : Dr Chong Wang Cheong Ah Tow

OPEN UNIVERSITY STAFF

Course Supervisor : Perienen Appavoo (Open School Division)

Project Coordinator: Premanand Koonjal (Open School Division)

Copyright : Open University of Mauritius, 2013

All rights reserved. No part of this course may be reproduced in any form

by any means without prior permission in writing from:

Open University of Mauritius

Réduit, Republic of Mauritius

Fax: (230) 464 8854

Tel: (230) 403 8200

Email : openuniversity@open.ac.mu

4

ii

Open University of Mauritius - Foundation Course in Economics - Module 1

Programme Overview

The growing complexity of economic condition in the work place requires a

basic undestanding of economic concepts. This Foundation course in Economics is divided into 2 modules and each awards four credits. Module 1

covers one semester( 3 months) and 80 hours of study time comprising 4

units. Students are advised to spend 20 hours on each unit. Duration of the

course is one year minimum and a maximum of two years. Assessment will

be based on written examination of 2 hours duration and Tutor marked assessment will carry 30% of the total marks and the final examination is 70%

of the total marks. Students will be supported by tutorials. Integrated video

programmes will also be provided to explain key concepts.

Module Overview

Module 1 covers 4 units and after completion of these units, students will be

able to undestand the basic economic problems of scarcity choice and opportunity cost, the production possibility curves and the different allocative

mechanism, the concept of Demand and Supply and Elasticity of Demand,

Government intervention in the Market and the Cost and Benefit Analysis

amd finally the theory of Firms and the Production Functions.

iii

Open University of Mauritius - Foundation Course in Economics - Module 1

5

Table of Contents

Unit 1

- Basic Economic Ideas

Unit 2

- The Price System

19

Unit 3

- Government Intervention in the Prices System

39

Unit 4

- Firms and The Production Function

53

6

1

iv

Open University of Mauritius - Foundation Course in Economics - Module 1

SELF STUDY GUIDE

COURSE TITLE

MODULE

COURSE DURATION

TOTAL STUDY TIME

: Foundation Course in Economics

:1

: One semester (3 months)

:80 hours (The course carries 8 credits for Modules I and II and students are advised to spend

20 hours of study on each unit).

COURSE OVERVIEW :The growing complexity of economic conditions in the works requires a basic understanding of economic concepts. The course gives an

overview of the main economic concepts both

at micro and macro levels.

COURSE OBJECTIVES:Upon completion of the course, learners will

be able to understand :

Basic Economic problems of scarcity,

choice and opportunity cost

The Production Possibility Curve and the

different allocative mechanism

The concepts of Demand and Supply and

Elasticity of Demand

Government intervention in the market

and Cost Benefit Analysis

Firm and the production functions

COURSE OUTLINE

: Module I covers 4 units

UNITS TITLES

1

2

3

4

STUDY TIME

Basic Economic Ideas

The Price System

Government Intervention in the Price System

Firms and the Production Function

20 hours

20 hours

20 hours

20 hours

COURSE DELIVERY : Written materials

Video programmes

Tutorials (optional)

ASSESSMENT MODE : Self-Marked Assessment

Tutor Marked Assessment

End of Course Examination

EVALUATION SCHEME:The Tutor- Marked Assessment will carry 30%

and the final examination 70% of the total

marks.

v

Open University of Mauritius - Foundation Course in Economics - Module 1

7

GLOSSARY

8

PPC

-

Production Possibility Curves

PED

-

Price Elasticity of Demand

YED

-

Income Elasticity of Demand

XED

-

Cross Elasticity of Demand

PES

-

Price Elasticity of Supply

AFC

-

Average Fixed Cost

TFC

-

Total Fixed Cost

TVC

-

Total Variable Cost

AVC

-

Average Variable Cost

TC

-

Total Cost

MC

-

Marginal Cost

AC

-

Average Cost

CBA

-

Cost Benefit Analysis

PC

-

Private Cost

ATC

-

Average Total Cost

vi

Open University of Mauritius - Foundation Course in Economics - Module 1

UNIT

1

BASIC ECONOMIC IDEAS

Introduction or unit overview

This unit provides an exposure to the basic concepts in economics and explains how scarce resources have to be allocated in order to maximize welfare.

It also describes the different economic systems and the role of specialisation.

Learning Objectives

On completion of this unit, students should be able to:

l Understand what is meant by the problem of scarcity and choice

l Describe what economists mean by the economic problem

l Understand the factors of production as economic resources

l Explain the concept of specialisation and the economic benefit it offers

l Explain the concept of opportunity cost and the nature of trade offs

l Explain the principles underlying the production possibility curves

Unit content

Scarcity, Choice and Resource Allocation

lThe nature of the basic economic problem and the production possibility

curve

lDifferent allocative mechanisms - market economies, planned economies,

mixed economies.

l Factors of production – Land, Labour, Capital and Enterprise

l Divison of labour and specialisation

l

Study Time: 20 hours each unit

1

Open University of Mauritius - Foundation Course in Economics - Module 1

1.1 FORMULATING A DEFINITION FOR ECONOMICS

Economics is basically concerned with the use of scarce resources to satisfy

the maximum possible wants. We should in other words economise. It is the

study of the conflict between Man and Nature. This conflict arises because

man has unlimited wants while nature has provided very limited resources.

According to Lionell Robbins “Economics is a social science which

studies rational human behavior as a relationship between ends and

scarce means having alternative uses”. This implies that human wants

being unlimited while the resources being scarce, the human being has to decide rationally as to which want to satisfy and which one not to satisfy. Whenever a person chooses to satisfy one want, an alternative has to be forgone.

Economics is therefore considered as a social science which shows how rational human beings allocate their existing limited resources among their unlimited wants in order to derive the maximum possible satisfaction.

According to Alfred Marshall “Economics studies human behavior

in the everyday business of life”. Every individual is required to make

a number of choices everyday and the way we behave while making such

choice represents the core issue of economics. For example, when someone

is buying less tomatoes at a high price and more of it when it is very cheap is

a clear indication of how the individual behaves in his or her everyday life.

1.2 THE NATURE OF THE ECONOMIC PROBLEM

The basic economic problem is to satisfy human wants.

1.2.1. What is a want?

Wants are desires which people have. They are unlimited because human

beings are greedy by nature. Wants are not always backed by the ability to

pay. Examples of wants include the need for food, clothing, housing, entertainment and luxuries. It is however necessary to differentiate between wants

and needs. A want is just a desire to possess something whereas a need is a

commodity or service which is necessary for the survival of human being. For

example, food, shelter and clothing are needs while a want can comprise the

above needs as well as the desire to go on the moon.

Do we have sufficient resources to satisfy these wants?

Resources are provided by nature and are also created by human being over

time. They are used to produce goods and services which can satisfy human

wants. These resources which are known as the means which can satisfy our

daily wants are extremely limited. For example, the world does not have

2

Open University of Mauritius - Foundation Course in Economics - Module 1

sufficient rice or wheat which can feed satisfactorily everyone in this world.

Resources are therefore scarce that is their supply is limited in relation to their

demand. Human wants are therefore insatiable thus making it necessary for

people to choose as to which want to satisfy and which not to. This necessitates choice.

1.2.2. What is choice?

Choice is a selection out of alternatives. Every choice therefore involves an

alternative forgone. The next best alternative forgone is known as the opportunity cost.

Choice has to be exercised at all levels for example

l

A consumer has to choose so as to decide on which combination of

goods that will yield the maximum satisfaction or utility.

lA producer has to choose so as to minimize cost by using the best possible combination of factor inputs so as to maximize profits.

lThe government has to choose because national resources are insufficient to satisfy national wants. Government should therefore decide on

a. What to produce?

That is how to allocate the existing resources so as to maximize

welfare of the nation.

b. How to produce?

Given the scarcity of resources every country should use the best

possible techniques of production which can ensure maximum

utilisation of resources. For example, over populated countries can

use labour intensive techniques.

c. For whom to produce?

This concerns the problem of distribution. That is, once the goods

have been produced how do we distribute them among the population. Should government decide to distribute it equally among the

people or should we leave it to the market forces which normally

leads to an unequal distribution.

The above three questions represent the basic economic problem which all

societies face.

For more details about these concepts

view the video programme:

Unit 1 - Programme 1

3

Open University of Mauritius - Foundation Course in Economics - Module 1

1.3. The production possibility curve (PPC)

Given the scarcity of resources, there is a limit to the amount of goods and

services which an economy can produce if it makes full use of all its existing

resources andoperates with a given state of technology. This limit is shown

by the production possibility curve.

What is a PPC ?

The PPC which is also known as the Production Possibility Frontier or the

Transformation curve of an economy shows the maximum possible combination of two goods which an economy is capable of producing if it makes full

use of all its existing resources and operates with a given state of technology.

The PPC is constructed on the basis of the following assumptions, namely:

l

l

l

The economy has a given stock of resources which will not change.

The resources will be fully utilised for producing two types of goods,

for example Good X and Good Y.

The level of technology remains constant.

roduction is subject to increasing opportunity cost because factor inputs

P

used in the production of goods X and Y are not homogeneous. Increasing

opportunity cost means that as we produce more of one good, the amount of

the other good which is given up will go on rising. This is so because resources are not homogeneous that is, they are not equally productive for all goods.

For example, some plots of land are better for cultivating tomatoes while others are better for rice. If we want to produce more tomatoes we will have to

divert land away from rice towards tomatoes. Since the land is not good for

rice, the opportunity cost of tomatoes in terms of rice will therefore rise.

Example to calculate opportunity cost

The opportunity cost is the next best alternative forgone. For example, if a

country is producing 100 tons of rice and 10 tons of tomatoes and now decides to produce 12 tons of tomatoes it will have to reduce the production of

rice. If now it produces only 95 tons of rice the opportunity cost of the 2 tons

of tomatoes is 5 tons of rice.

On the basis of the above assumptions we can construct a Production Possibility scheduled as follows.

4

Open University of Mauritius - Foundation Course in Economics - Module 1

Production Possibility Schedule

COMBINATION

AMOUNT

OF GOOD A

OF GOODS

AMOUNT OF GOOD B

OPPORTUNITY

COST

A 0100

B

1

95

C

2

85

3

70

E

4

40

F

5

0

D

0

5

EXERCISE 1

Complete the opportunity cost column in the above schedule

Plot the curve by showing good A on the X-axis and good B on Y-axis.

Y

Good B

X

Good A

Characteristics of the normal PPC

l

l

It slopes downwards from left to right. This is so because of scarcity of

resources. That is, if we want to produce more of one good, we must

give up part of the other good. The PPC therefore has a negative slope.

It is concave to the origin. This is so because factors of production are

not homogeneous and so production takes place under increasing opportunity cost. In case of homogeneous factors, the opportunity cost

will become constant and the PPC will become a downward slopping

straight line. It will become convex if we have diminishing opportunity

cost.

5

Open University of Mauritius - Foundation Course in Economics - Module 1

Good B

Good B

Good A

Good B

Good A

(I) Increasing

opportunity cost

Good A

(II) Constant

opportunity cost

(III) Diminishing

opportunity cost

The concave curve as shown at (I) above means that when more of A is produced, the country will have to sacrifice an increasing amount of the other

good. When it is a straight line as at (II) above it means that the same amount

of one good has to be given up when an additional unit of the other is produced. In case it is convex as at (III) above, it implies that as we produce more

than of one good, a decreasing amount of the other good has to be sacrificed

l

A

ny combination inside the PPC represents an inefficient output combination because resources will be unemployed. Efficiency occurs only

when we cannot produce more of one good without producing less of

the other good. For an economy to be efficient it must be using its resources fully and will therefore operate along the PPC. For example the

diagram below showing efficiency indicates that when more of good A is

produced, the amount of good Y will automatically fall. In contrast the

diagram on inefficiency below indicates that the country can produce

more of good A without reducing the production of good B. Combinations outside the PPC are unattainable unless there is a change in the

stock of resources or in the level of technology. This can be illustrated by

the following diagrams

Y

Y

A

P

O

A B

Q

B

Q1

Inefficiency

X

O

X

Efficiency

6

Open University of Mauritius - Foundation Course in Economics - Module 1

l

hifts in the PPC. The PPC can shift outwards or inwards. An outS

ward shift represents an increase in the country’s productive potential

while an inward shift represents a fall in the productive potential.

The outward shift can be caused by:

a. An improvement in technology.

b. The discovery of new resources.

c. An increase in productivity.

d. An increase in economic growth.

Y

X

EXERCISE 2

As you have noted above the PPC can shift to the right or to the left. A leftward shift means that the country’s productive capacity is falling, in other

words, the country can now produce less goods.

List down 4 factors which can cause the PPC to shift to the left?

1.………………………………………………………………………

2.………………………………………………………………………

3.………………………………………………………………………

4.………………………………………………………………………

For more details about PPP curve

view the video programme :

Unit 1 - Programme 2

7

Open University of Mauritius - Foundation Course in Economics - Module 1

1.4 THE DIFFERENT ALLOCATIVE MECHANISMS :

THE MARKET ECONOMIES, THE PLANNED ECONOMIES

AND THE MIXED ECONOMIES

All economies are basically similar because they face the same economic

problem. They all have to ensure the most efficient utilization of resources

in order to generate maximum welfare. The term welfare indicates the wellbeing of the people in a country and this is normally reflected in terms of

their income, living standard, entertainment, satisfaction of basic need, level

of luxuries and so on. However the way the economy goes about solving the

three basic economic problems can differ. This explains why we have four

different economic systems namely:

1. The market economy

2. The centrally planned economy

3. The mixed economy

4. The subsistence economy

1.0 The market economy

The market economy which is also known as the free market system,

laisser-faire economy or the capitalist economy is one where the government has no role to play and all economic decisions are taken solely on the basis of market forces. The main features of the market

economy include the following:

l

l

l

l

l

Private ownership of all the means of production.

The existence of the profit motive, that is, producers undertake

production with the main objective of maximizing profits.

The operation of the free price mechanism, that is, prices are determined solely by the free market forces of demand and supply.

Consumers decide what goods and services will be produced and

producers have to produce according to the desires of consumers.

Absence of government intervention. Consumers express their desires through their purchasing power and producers will have to

respond to those desires. The government does not intervene to

indicate what should be produced.

8

Open University of Mauritius - Foundation Course in Economics - Module 1

The main advantages of the market economy include:

Consumer sovereignty.

It is the consumer who decides what producers should produce

l

Benefits of competition.

Since private firms are allowed to compete, the nation will benefit from

such competition for example better quality goods, lower prices, larger

variety of choice and so on.

l

Greater motivation for producers to produce and to expand.

Since producers know that they will enjoy all the benefits individually

they are motivated to put in more effort and to do better so that they

can get more rewards.

l

Greater efficiency among firms.

Competition ensures that only the best firms will survive. Thus everyone is forced to improve and become more efficient.

l

A higher level of output and a better standard of living.

Since a large number of firms are producing goods under such a system, the total amount of goods produce will rise and people in the

country will become better off.

l

However the main disadvantages of such a system are:

The wastes of competition.

Firms are not able to operate on a large scale and many of them have

unutilized capacity.

l

Huge advertising expenditure leading to higher price.

Firms advertise massively thus spending a large amount of money

which increases cost forcing people to pay higher prices.

l

Over production of luxuries and under production of basic

needs.

Given that producers are profit motivated, they lay more emphasis

on producing luxuries which are very profitable. The basic needs

which are less profitable are therefore produce in smaller quantities

thus affecting the poor.

l

l

N

on provision of public goods.

Public goods which will be consumed by everyone irrespective of

whether payment is made or not. For example street lighting will

not be produced by the private sector.

9

Open University of Mauritius - Foundation Course in Economics - Module 1

Huge inequalities of income and wealth.

The market economy leads to unequal distribution of income and

wealth that is some people are very rich while the majority remain

poor.

l

A very high degree of economic instability.

Since all decisions are taken by market forces which keep on changing

the economy becomes highly unstable economically.

l

2.0. The centrally planned economy

The centrally planned economy also known as the command economy or the communist system is one where the government takes all

the decisions about what to produce, how to produce and for whom

to produce. A government planning office decides what will be produced. Detailed instructions are then given to households, firms and

workers.

The main features of the planned economy include the following:

l

Government ownership of all the means of production.

l

Absence of profit motive.

l

Decisions are based on the needs of the people.

l

Use of “shadow” pricing instead of the free price mechanism.

This means that the government artificial prices for goods instead

of prices which are determined by the market forces of demand

and supply. Thus these “shadow prices” do not really reflect the

true value of the good.

Directives are given by government.

The centrally planned economic system has, over the past two decades declined in importance as command economies have gradually moved towards the greater use of the market forces thus giving

rise to the Transition Economies like China. This change from

the planned to the transition economies is mainly explained by the

disadvantages of the centrally planned economies. These include:

l

2.1. The absence of economic freedom at all levels,

In a command economy neither consumers nor producers have any

freedom. It is the government which takes all the decisions. People

therefore do not have the freedom to own property or to decide on

what they are willing to do.

10

Open University of Mauritius - Foundation Course in Economics - Module 1

2.2.Absence of incentive to work or expand because the profit

motive is absent

Since private enterprise is not allowed and the government does

not operate on a profit motive people managing these enterprises has no incentive to do better or to expand because they know

that such additional efforts will not be compensated.

2.3.Greater bureaucracy and red tape

Government procedures and regulations have to be followed

thus much time is lost while making decisions and this affects the

efficient operation of the enterprises.

2.4.Absence of consumer sovereignty

Consumers have no say in what is produced by government enterprises. In fact the government authority take the decision on

the basis of the needs of the population and these do not always

turn out to be the right mix.

2.5. The high risk of human error

Since decisions must be taken arbitrarily the risk that errors will

be made is very high. This explains why planned economies

often suffer from severe lack of some goods or excessive production of other goods.

3.0 The mixed economy

All economies today are mixed. This is mainly explained by the factthat both the free market economy and the centrally planned economy suffer from a number of disadvantages. The right approach will

therefore be to go for a mix between the two systems so that people

can take advantage of the benefits of both and yet minimize the disadvantages of both. The mixed economy therefore allows simultaneously the presence of both the public sector and the private sector. Resources are therefore owned by both the government and the private

sector. Economic decisions are taken partly by the market forces and

partly by government directives. The government will normally set

the national objectives and allow the private firms to operate according to those objectives. If government finds that the private firms are

not obeying those objectives it will take necessary measures in order to

control the private sector. The relative importance of the private and

public sector can differ between countries.

The mixed economy is considered to be the best economic system as it

allows the simultaneous advantages of both the market economy and

the planned economy while it minimizes the disadvantages of both the

systems. For example:

11

Open University of Mauritius - Foundation Course in Economics - Module 1

l

l

l

l

l

It ensures that the government sets the economic goals in the interest of the nation.

It allows government to guarantee the production of basic needs as

well as the public goods which the private sector will not be producing because they are not profitable.

It allows government to exercise necessary control over the private

sector so as to ensure that the interest of the public is safeguarded.

The mixed economy allows necessary freedom of consumption,

freedom to own property and freedom to operate where profits can

be maximized.

It helps government to reduce the economic instability associated

with the free market forces. For example, in a mixed economy the

government can ensure full employment of resources by proving

the necessary incentives. It can also encourage the private sector

to move into areas which are necessary for the benefit of the nation

and which can promote economic development.

4.0 The subsistence economy

This represents a traditional economic system where money is normally not in use and people exchange good and services directly. The

production in such an economy takes place mainly for consumption

purposes. For example, the nomadic life or the tribal living. Such

subsistence systems are nowadays phasing out as all economies are

becoming monetized and are moving towards the mixed economy system.

12

Open University of Mauritius - Foundation Course in Economics - Module 1

EXERCISE 3

1. List five benefits of the market economy system.

a .............................................................................................................

b .............................................................................................................

c .............................................................................................................

d .............................................................................................................

e .............................................................................................................

2.Explain three reasons why centrally planned economies like China

have moved towards the market system.

a .............................................................................................................

b .............................................................................................................

c .............................................................................................................

In order to differentiate among the Different Allocative

mechanics watch the video programme :

Unit 1 - Programme 3

13

Open University of Mauritius - Foundation Course in Economics - Module 1

1.4 Factors of production

A factor of production is a productive resource which helps in the production of other goods and services. We classify factors of production into four

categories, namely:

1.Land

Land refers to all the gifts of nature. A gift of nature represents an asset or

something which is available naturally and where no other factor is involved

in its production. It includes the soil, the rivers, the sea, the mineral resources

and other natural gifts. Land is the only factor which can be considered as

being a free good because no one has sacrificed for the production of these

natural gifts. The reward for land takes the form of rent.

2.Labour

Labour is defined as the mental and the physical effort made by a worker towards production of goods and services. Labour is therefore represented by the

worker and a country’s labour force represents its labour potential. The labour

force normally depends on the size and the age composition of the population, the age of retirement, the school leaving age and the number of hours for

which people are legally required to work. Labour as a factor is different from

the other factor of production because it is influenced by the human element.

For example the productivity of labour can be influenced by the attitude of the

worker and by trade union pressure which normally does not occur in the case

of other factors of production.

Given that labour is productive it has to be rewarded in the form of wages

and salaries. Some workers can be paid on a piece rate, on a time rate or on

a combined rate.

Labour is one of the most difficult factors to manage. This is mainly explained

by the fact that a human being has its sensitivity. For example the mood of

the worker influences his or her productivity. Similarly the worker gets tired

when he is exposed continuously to a work situation. His productivity is also

affected by the environment in which he is operating. The attitude of his supervisor or boss has a direct influence on his performance. This explains why

we have a whole management science known as Human Resources Management and Development in order to ensure maximum returns from labour.

14

Open University of Mauritius - Foundation Course in Economics - Module 1

3.Capital

The term Capital as a factor of production is viewed differently in economics

and in accounting. To the economist Capital is a stock of productive wealth

which can be used to produce other goods and services.Capital refers to all

the man made assets. It includes machinery, tools and equipment, the infrastructure and the buildings. In contrast the accountant looks at Capital in

the form of money that is invested in order to undertake production of goods

and services. It can comprise, for example the operating capital of the firm

that is the amount of money that the firm has in order to finance day to day

operation. In accounting terms capital is therefore viewed in terms of liquid

capital while to the economist it is a basic man made productive asset.

Capital represents the productive potential of a firm or of a country. To

accumulate capital, we must save and invest. Our future productive capacity therefore depends on the existing stock of capital. When the total value

of the existing stock of capital is added up, it gives us the National Capital

of a country. Capital as a factor of production is therefore necessary for the

promotion of economic development. The production of capital involves the

use of all the other factors.

The reward for capital normally takes the form of interest.

4.Entrepreneurship

This represents one of the most important factors of production because it is

the entrepreneur is the one who is responsible to bring together all the other

factors and combine them in the right proportion in order to produce goods

and services. He also bears all the risk of the business. The entrepreneur

therefore fulfills two main roles namely:

a. The organiser of the means of production

This means that the entrepreneur is responsible to look after the day

to day functioning of the business. He has to manage the workers, to

buy all the raw materials and machinery, to organize the production

system and to provide all the facilities which will allow the smooth

production of goods and services. This will allow the firm to operate

smoothly. The firm is also known as the enterprise which the entrepreneur is responsible to look after. In fact an enterprise is an initiative by an individual to create the physical infrastructure including

the building and machinery and it also comprises of the workers and

all other factors and facilities which are used for producing a good or

a service. In modern times, however, this role of the entrepreneur is

increasingly being performed by paid managers.

15

Open University of Mauritius - Foundation Course in Economics - Module 1

b.The risk bearer

Businesses have to face risk some of which are insurable and others

are non-insurable. It is the entrepreneur who bears these risks. That’s

why the entrepreneur is more of a risk bearer than that of a manager. This might not however always be the case, especially in small

enterprises where the owner is also the manager of the business. For

example, a small retail shop in a village. The reward for the entrepreneur takes the form of profits.

EXERCISE 4

List four examples of Capital in a textile factory.

a .............................................................................................................

b .............................................................................................................

c .............................................................................................................

d .............................................................................................................

2. What is the difference between Labour and Entrepreneurship?

.....................................................................................................................

.....................................................................................................................

.....................................................................................................................

1.5. Division of labour and specialisation

Division of labour is also known as specialisation and such a specialisation

can occur at different levels. For example

l

l

Specialisation at the level of the worker (Division of labour)

Specialisation at the level of a region (Regional Specialisation). This

can occur because of a common facility like climate, availability of

skilled labour or an airport/seaport in the region. For example the

central plateau region in Mauritius specializes in the tea industry because of the climatic factor.

16

Open University of Mauritius - Foundation Course in Economics - Module 1

l

Specialisation at the national and international levels. Each country

normally specializes in the production of a good or service in which

it has a comparative advantage. For example in the 1960’s Mauritius

was specializing in sugar production.

Division of labour is defined as the process by which a job is broken down

into different stages and each stage is performed by a particular worker. For

example in a textile factory some workers work on the machines others are

involved in spinning, some work in packaging others in ironing and so on.

They all however work towards a common goal that is to produce the piece

of a t-shirt or a dress which will be sold to the consumer.

The concept of the division of labour was emphasised by Adam Smith who

showed how the division of labour in the pin manufacturing factory led to a

substantial increase in total output of pins.

Division of labour has various advantages namely:

l

l

l

l

It leads to a substantial rise in total output.It is good to differentiate

between the term production and the productivity of the worker. Production refers to the total output produce by the firm while productivity refers to the output per unit of labour. The division of labour

leads to an increase in productivity, that is each worker is now able to

produce more of the good because he or she is a specializing in that

task only. This rise in productivity automatically leads to a rise in the

level of output.

It allows each worker to develop his/her potential fully in the area

where the person is best.

It minimizes the waste of time in production as workers do not have to

shift between tasks.

It increases the dexterity of the worker and encourages him/her to

come up with suggestions on the development of better tools and

equipment.

The main disadvantages of the division of labour however are:

l

l

It increases the degree of dependence among workers as the absence

of one worker can affect the whole production process.

The work becomes boring as the worker does the same thing everyday

and does not get the opportunity to develop new skills.

17

Open University of Mauritius - Foundation Course in Economics - Module 1

l

l

It increases the risk of unemployment specially because workers cannot do alternative jobs.

It has led to the decline in craftsmanship because it has necessitated

the standardization of products.

EXERCISE 5

1. Give five examples of division of labour in a textile factory.

a .............................................................................................................

b .............................................................................................................

c .............................................................................................................

d .............................................................................................................

2.Consider the case of a car mechanic who concentrates in this job.

What are the benefits and dangers of such concentration.

.....................................................................................................................

.....................................................................................................................

.....................................................................................................................

Watch the video programme Unit 1 – Programme 4

to have a better idea regarding Factors of Production,

Division of Labour and Specialisation

18

Open University of Mauritius - Foundation Course in Economics - Module 1

UNIT

2

THE PRICE SYSTEM

Unit objective and learning outcomes

The objective of this unit is to introduce the students to the concept of the

market and to the forces of demand and supply which influence the price

level. It also aims at allowing students to understand how the equilibrium

price is determined as well as the concepts of elasticity.

Upon completion of this unit, students should be able to:

Understand what is meant by a market and the role of markets.

l

Understand the different objectives of consumers and producers in

the markets.

lUnderstand what is meant by individual demand and supply curves as

well as market demand and supply curves.

l Explain the factors influencing demand and supply.

lExplain what is meant by the concept of price elasticity, income elasticity and cross elasticity of demand as well as the elasticity of supply.

l Evaluate the business relevance of these elasticity concepts.

l

Unit content

l

l

l

l

l

l

l

l

2.1

The concept of the market and the different types of markets.

Individual demand curves and market demand curves.

Factors influencing demand.

Price, income and cross elasticity of demand.

Individual supply curves and market supply.

Factors determining supply.

Price elasticity of supply.

Determination of equilibrium price.

MARKETS

A market comprises all the buyers and the sellers of a good. To have a market the good must be scarce that is markets do not exist for free goods. In

everyday language, markets are associated to a specific place or building. In

19

Open University of Mauritius - Foundation Course in Economics - Module 1

economics, however, the market is viewed differently. We can define a market

as any situation, either local, national or international, over which buyers and

sellers who have a common interest in an economic good or service, come

into contact with each other either directly or indirectly in order to transact

in that good or service. The market can be local for example the fish market

or the vegetable market. It can be national, for example, the labour market

and it can even be international, for example, the Foreign Exchange Market.

2.1.1. Types of markets

Markets can be of different types namely

Consumer good markets

These are markets which deal in final goods and services which can

directly satisfy consumer wants. For example, the vegetable market.

The public mostly deals in such markets because they have to buy

goods and services which can directly satisfy their daily wants.

l The Spot market

This is a market where the good being transacted is available at the

time of transaction. The buyer can therefore take delivery of the good

on the spot. For example the market for bread.

l

l

l

l

The future market.

This is a market where the good being transacted is not available at the

time of transaction. The buyer and the seller can meet and agree on

the terms but the good will be delivered at a future date on the terms

and conditions agreed at the time of transaction. For example, a textile firm which collects orders internationally before it starts planning

its production for the coming year.

Factor markets

These are markets which deal in the factors of production. For example, the labour market where workers looking for jobs can meet

employers who have job opportunities or a bank where investors willing to borrow liquid capital can get their loans.

Markets for securities

These markets are exemplified by the Stock Exchange where people

can buy or sell shares and other securities.

Markets can also be classified according to the degree of competition which

exist in these markets. For example:

20

Open University of Mauritius - Foundation Course in Economics - Module 1

a.The monopoly market which is dominated by a single producer or seller. For example, the Central Electricity Board in Mauritius.

b.The monopsony market which is dominated by a single buyer

of a good or service. For example the government which is the

sole employer of labour in a planned economy. Such markets can

however also exist in a market economy or in a mixed economy.

c.A duopoly market which is dominated by two firms for example, the Beer market in Mauritius.

d.The oligopoly market which allows for a few large firms to

compete with each other. For example, the Petroleum market in

Mauritius which is dominated by four firms.

e.The monopolistic competition market which has a large

number of small firms dealing in differentiated products. For example the Retail shops in Mauritius.

f.The perfect market which has a very large number of small

firms dealing in a homogeneous product. This is considered to be

the best possible marker form but, it does not exist in practice.

EXERCISE 6

1. Give three examples of oligopoly markets in your country.

a .............................................................................................................

b .............................................................................................................

c .............................................................................................................

d .............................................................................................................

2.Give two reasons why some people would like to deal on a futures

market

a .............................................................................................................

b .............................................................................................................

21

Open University of Mauritius - Foundation Course in Economics - Module 1

2.2. DEMAND

The concept of demand explains how consumers behave in a market. Demand can be defined as the quantity of a commodity that a consumer is willing to buy and is capable of paying for it, at a particular price, during a given

period of time, all other things remaining constant.

Demand must be effective, that is, we demand a commodity only when we

can pay for it.

The quantity demanded of a commodity depends on the price of the good.

The demand function is normally written as follows

Qdx = f(Px)

In the above equation Qdx represents the quantity demanded of the good

and Px represents the price of the good. The equation shows that the quantity demanded is function of the price.

The relationship between quantity demanded and price is an inverse one.

That is, when price increases, quantity demanded will fall. When price falls,

quantity demanded will rise, all other things remaining constant. This inverse

relationship is known as the Law of demand.

The relationship between price and quantity demanded can be illustrated by

a demand schedule as follows:

Demand Schedule

Price of the good (Rs) Quantity demanded (Units)

5

110

6

100

7

90

8

80

9

70

10

60

11

50

If we plot the schedule on a graph we get the demand curve

22

Open University of Mauritius - Foundation Course in Economics - Module 1

Price

D

P

D

P₁

O

Q

Q₁

Quantity demanded

The normal demand curve will slope downwards showing that the consumer

buys more of a good at a lower price than at a higher price. For example,

when tomatoes become cheaper, we normally buy more of it and when price

goes up we buy less of it. A fall in price leads to an increase in quantity demanded which is also known as an expansion in demand. A rise in price

leads to a contraction in demand. The effects of a change in price is shown

by a movement along the same demand curve as shown below.

Price

Price

D

P₁

P

P

D

P₁

O

D

Q

Q₁

Expansion in demand

Quantity

D

O

Q₁

Q

Quantity

Contraction in demand

Other factors determining demand

Apart from price, the quantity demanded of a good will also depend on certain other factors which are known as the conditions of demand. These

include the following:

1.

Changes in income of the consumer.

A rise income will normally increase demand while a fall in income will reduce demand.

2.

Changes in the price of substitute goods.

A substitute is a good which can replace another good. For example tea and

coffee. They are in competitive demand. For example if price of tea rises

the consumer will demand more coffee.

23

Open University of Mauritius - Foundation Course in Economics - Module 1

3.

Changes in the price of complements.

A complement is a good which must be jointly demanded with another

good. For example, car and petrol. A rise in the price of petrol will reduce

the demand for cars.

4.

Changes in taste and fashion.

If a good becomes fashionable or goes out of fashion, its demand will

change.

5.

Changes in climatic conditions.

Some goods have a seasonal demand. For example, the demand for ice

cream falls in winter while the demand for umbrellas rises in the rainy season.

6.

Changes in the size of the population

An increase in population will increase the demand for a good. Similarly an

ageing population will reduce the demand for sports cars.

7.

Advertising and marketing strategies by firms.

If firms advertise aggressively or provide easy credit facilities demand will

rise.

8.

Government policy.

A tax on a good will reduce demand because it makes the good more expensive while a subsidy will make the good cheaper and increase its demand.

The effects of a change in any of the above conditions of demand is shown

by a shift in the demand curve. A rightward shift represents an increase in

demand while a leftward shift represents a decrease in demand as shown

below:

Price

P₁

D

P₂

P

T₂

T₁

T

D₁

D₂

0

Q₂

D

Q

Q₁

Quantity demand

24

Open University of Mauritius - Foundation Course in Economics - Module 1

EXERCISE 7

1.List five factors which determine the demand for holidays in Mauritius.

a .............................................................................................................

b .............................................................................................................

c .............................................................................................................

d .............................................................................................................

e .............................................................................................................

2. Why does a consumer normally buy more of a good when price falls.

.....................................................................................................................

.....................................................................................................................

.....................................................................................................................

Individual demand curve and market demand curve

The individual demand curve shows how a specific consumer will behave

when price changes. The market demand curve shows how all consumers

taken together behave when price changes. In other words, it shows the

change in the total demand for a commodity resulting from a change in price.

The market demand curve is the horizontal summation of all the individual demand curve and will slope downwards just like the individual demand

curve.

To have a better understanding of Demand and Supply

and how to obtain the equilibrium between Demand and

Supply watch video programme:

Unit 2 – Programme 1

25

Open University of Mauritius - Foundation Course in Economics - Module 1

2.3 ELASTICITY OF DEMAND

2.3.1 Price Elasticity of demand (PED)

Price Elasticity of demand measures the degree of responsiveness in the

quantity demanded of a commodity as a result of a given change in the price

of that commodity, all other things remaining constant. In other words, it

shows how quantity demanded changes when there is a change in price.

The Price elasticity of demand (PED) can be calculated as follows

PED =

% or proportionate change in quantity demanded

% or proportionate change in price

Proportionate change in change in quantity demanded Q

quantity demanded =

Original quantity Q

P

Proportionate

change in price = change in price

P

Original price

PED therefore =

Q X

P

Q

P

Example:

If price of a good increases from Rs 20 to Rs 22 per unit and the quantity

demanded falls from 1000 units to 800 units the PED will be

200

X

1000

20

2

= -2

EXERCISE 8

Calculate the PED if the price of good falls from Rs 10 to Rs 8 per unit

and quantity demanded rises from 50 units to 55 units.

.....................................................................................................................

.....................................................................................................................

.....................................................................................................................

.....................................................................................................................

26

Open University of Mauritius - Foundation Course in Economics - Module 1

Significance of the values of PED

The coefficient of the PED will vary between zero and infinity.

If PED is zero it means that a change in price does not lead to any

change in quantity demanded. Demand becomes perfectly inelastic

and the demand curve will be a vertical straight line.

l

If PED is less than one but greater than zero a change in price will lead

to a less than proportionate change in quantity demanded. Demand

becomes inelastic and the demand curve will be downwards slopping

but steep.

l

If PED is equal to one, a change in price will lead to a proportionate

change in quantity demanded. Demand becomes unit elastic and the

demand curve will be a rectangular hyperbola.

l

If PED is greater than one a change in price leads to a more than proportionate change in quantity demanded. Demand becomes elastic

and the demand curve will slope downwards but will be flatter.

l

If PED is infinity, then the good will be demanded only at given price.

A change in price will disrupt the whole quantity demanded. Demand

is perfectly elastic and the demand curve will be a horizontal straight

line.

l

Price

0

a

<1

>1

<1

0

Quantity demanded

Factors determining PED

As explained above the quantity demanded of different goods will respond

differently to a given change in price. For example an increase in the price of

electricity will reduce demand for electricity by very little making the demand

inelastic. On the other hand, a rise in the price of diamond can reduce the

demand by a large amount as consumers will shift to other form of metals

which can replace diamond. This will make the demand elastic.

The quantity demanded of different goods will therefore respond differently

to a given change in price. This is due to the following factors:

l

The nature of the good, that is, whether it is a basic necessity or a

luxury. Basic needs have an inelastic demand.

27

Open University of Mauritius - Foundation Course in Economics - Module 1

l

l

l

l

l

The level of income of the consumer. High income earners have an

inelastic demand because they are less affected by a price increase than

low income earners.

The availability of substitutes. Goods having many substitutes have an

elastic demand.

The percentage of income spent on the good. If the consumer spends

a high percentage of his income on the good demand becomes elastic

because a rise in price will affect him directly.

The price of the goods. Normally cheap goods have an inelastic demand while expensive goods like luxuries have an elastic demand.

The degree of addiction to the commodity. Some goods are habit forming and they make demand inelastic.

EXERCISE 9

1. Give five examples of goods which have an inelastic demand.

a .............................................................................................................

b .............................................................................................................

c .............................................................................................................

d .............................................................................................................

e .............................................................................................................

2. Give five examples of good which have an elastic demand.

a .............................................................................................................

b .............................................................................................................

c .............................................................................................................

d .............................................................................................................

e .............................................................................................................

28

Open University of Mauritius - Foundation Course in Economics - Module 1

2.3.2. Income elasticity of demand (YED)

Income elasticity measures the rate of responsiveness in quantity demanded

as a result of a given change in the income of the consumer. The YED can

be calculated as follows:

% or proportionate change in quantity demanded

YED =

% or proportionate change in income

Y

Q

YEDX

=

Y

Q

Example

If the income of a consumer increases from $1000 to $1500 as a result of

which the quantity demanded of a good increases from 50 units to 60 units

weekly the YED will be:

10 X

50

1000

500

= 0.4

The coefficient of the income elasticity will be positive in the case of normal

goods and negative in the case of inferior goods.

The value of the coefficient will vary between zero and infinity implying that

demand can be perfectly income inelastic, income inelastic, unit income elastic, income elastic or perfectly income elastic. Normally luxuries have an

income elastic demand while basic needs have an income inelastic demand.

EXERCISE 10

Give three examples of goods which you would consider as having an income inelastic demand and explain why.

a .............................................................................................................

b .............................................................................................................

c .............................................................................................................

29

Open University of Mauritius - Foundation Course in Economics - Module 1

2.3.3. Cross Elasticity of demand (XED)

The cross elasticity of demand measures the rate of responsiveness in the

demand for a good as a result of a given change in the price of some other

related good like a substitute or compliment. For example, if the price of

petrol increases by how much will the demand for cars fall. XED can be calculated as follows:

% or proportionate change in quantity demanded of good X

XED =

% or proportionate change in price of good Y

Q x X

XED =

Q

x

Py

Py

Example

If bus fares rise by 10% and this leads to an increase in the demand for travel

by rail of 20%, the XED for rail travel in relation to the price of bus travel

will be

20%

=2

10%

The coefficient of the cross elasticity will be positive if the goods are substitutes and will be negative if the goods are compliments.

The value of the coefficient indicates the degree to which the goods are related. If it is zero, it means that the goods are not related and if it is infinity

it implies a perfect relationship.

2.3.4.Importance of elasticity concepts for

management and society at large.

Management relies heavily on elasticity notions for decision making. Elasticity of demand helps management to decide on the following:

l

Whether it can increase price of the good or not when cost of production is rising (this is possible only when demand is inelastic)

30

Open University of Mauritius - Foundation Course in Economics - Module 1

l

l

l

l

l

Whether it can go for sales promotion by reducing the price of the

good (this is possible only when demand is elastic)

Whether it can shift the burden of a tax on the consumer (this is possible only when demand is inelastic)

Whether it can charge different prices for the same good from different customers or at different time periods (this is possible only when

the PED is different for different customers)

Whether a rise in price will increase the total revenue from sales (this

is possible only when demand is inelastic)

Which type of good should the firm produce. Normally when income

is rising firms benefit by producing goods which have an income elastic demand.

The three elasticity concepts are equally important for society at large. For

example government can equally used these elasticity concepts to decide on

which goods to tax so as to raise revenue and which goods to tax if it wants to

reduce consumptions. Firms and other organisations which want to compete

with each other can equally use elasticity concepts to decide on their strategies.

2.4SUPPLY

The theory of supply studies the behavior of the producer in a market.

Supply can be defined as the quantity of a commodity which a producer is

willing to offer for sale and is capable of doing so at a particular price, during

a given period of time all other things remaining constant.

The quantity supplied of a good is directly related to its price. The supply

function is written as follows :

Qxs = f(Px)

In the above equation Qxs represents the quantity supplied by the producer

or the seller and Px represents the price of the good. In fact producers who

are profit motivated will normally look at the price before deciding on the

quantity of the good that they will offer for sale.

31

Open University of Mauritius - Foundation Course in Economics - Module 1

The direct relationship between price and quantity supplied represents the

law of supply. This law states, that all other things remaining constant, a

producer will be willing to sell more of good when price increases and less

of it when price falls. This is mainly due to the fact that producers are profit

motivated and higher prices therefore generate higher profits.

Other reasons which can explain such a behavior include the following:

l

l

Producers accumulate stocks when prices fall thus reducing the market

supply and they off load existing stocks on the market when price rises.

New firms join in when price is rising, thus increasing the market supply.

A supply schedule shows the relationship between price and quantity supplied as follows:

Supply Schedule

Price of the good

Quantity supplied

(Rs) (Units)

1

50

2

55

3

60

4

65

If we plot the supply schedule we will get the supply curve which is a normal

upward sloping one.

Price

S

S

0

Quantity supplied

Factors determining supply

The quantity supplied of a commodity depends on the price of the commodity as well as on the following factors:

32

Open University of Mauritius - Foundation Course in Economics - Module 1

1.

Changes in the cost of production.

An increase in cost will reduce supply.

2.

Government policy

A tax on the commodity will discourage production and reduce supply

while a subsidy will encourage the producer to expand output.

3.

Variation in climatic condition

For example bad weather conditions will reduce supply in agriculture

while a favorable climate will increase supply.

4.

Changes in technology

Technological improvements will increase the supply of a good as it

allows producers to produce more from the same resources.

5.

Speculation about future prices

If producers speculate that price will fall in future, they will increase

the present supply in order not to make a loss in future.

The effect of a change in price leads to an expansion or a contraction in

supply and it is normally shown by a movement along the same supply curve.

The effect of a change in the other factors determining supply leads to a shift

in the supply curve. A rightward shift represents an increase in supply and a

leftward shift represents a decrease in supply.

S

P₁

S₁

P

P

0

S₂ S

S₂

Q

Q₁

Effect of price charge

0

Q₂

S

S₁

Q

Q₁

Effect of change in other factors

33

Open University of Mauritius - Foundation Course in Economics - Module 1

2.5 PRICE ELASTICITY OF SUPPLY (PES)

The PES measures the rate of responsiveness in quantity supplied resulting

from a change in the price of the good, all other things remaining constant.

Thus like PED, the PES is calculated by looking at the percentage or the

proportionate change:

PES =

% or proportionate change in quantity supplied

% or proportionate change in price

Q

PES therefore =

Q

X

P

P

EXERCISE 11

Calculate the PES if an increase in the price of a good from $10 to $12

increases the quantity supplied from 200 units to 225 units.

.....................................................................................................................

.....................................................................................................................

.....................................................................................................................

.....................................................................................................................

.....................................................................................................................

The coefficient of the PES will just like that of the PED vary between zero

and infinity.

1. If PES is zero a change in price will not affect the quantity supplied

and the supply curve will become a vertical straight line.

S

34

Open University of Mauritius - Foundation Course in Economics - Module 1

2. If PES is infinite a change in price will lead to a total change in

supply that is supply becomes perfectly elastic and the supply curve

becomes a horizontal straight line.

S

3. If PES is unit elastic a change in price will lead to a proportionate

change in quantity supplied. The supply curve will be an upward

sloping straight line passing through the point of origin.

S

4. If PES is less than one a change in price leads to a less than proportionate change in quantity supplied and supply becomes inelastic.

The supply curve will slope upwards steeply.

S

If PES is greater than one a change in price will lead to a more than

proportionate change in quantity supplied. Supply becomes elastic and

the supply curve will be upward sloping but flatter.

35

Open University of Mauritius - Foundation Course in Economics - Module 1

Factors determining PES

The price elasticity of supply will normally depend on the following factors

1.

2.

3.

4.

The nature of the good (whether agricultural or manufactured good)

The time period (supply is inelastic in the short run)

The level of technology being utilized.

The existence of idle capacity (firms having huge idle capacity will

have a more elastic supply)

5. Type of market condition (barriers to entry will make supply inelastic )

2.5 DETERMINATION OF MARKET EQUILIBRIUM

The market is influenced by two opposing forces namely demand and supply. Consumers are willing to pay the lowest possible price while producers

are willing to charge the highest possible price. The equilibrium price in the

market is determined when producers are willing to sell the same amount

of good as consumers are willing to buy. In other words equilibrium occurs

when quantity demanded equates quantity supply. The equilibrium price

can be determined as follows:

Demand and Supply Schedule

Price of the good Quantity demanded Quantity Supplied

(Rs)

(Units)

(Units)

10

600

200

20

500

300

30

400

400

40

300

500

50

200

600

The equilibrium price will be Rs30 because demand equates supply at this

price. If price is less than Rs30 the excess demand will force up the price.

If price is above Rs 30 the excess supply will cause the price to fall.

36

Open University of Mauritius - Foundation Course in Economics - Module 1

Diagrammatically the equilibrium price is given by the point where the demand curve cuts the supply curve as shown below.

Price

D

S

T

P

D

S

0

Equilibrium Price

Q

Quantity

The equilibrium is determined by assuming that demand and supply conditions do not change. Any change in either demand or supply will cause the

price to fluctuate.

EXERCISE 12

1.Give two examples of how changes in demand will affect equilibrium

price (use diagrams)

a .............................................................................................................

b .............................................................................................................

2.Give two examples of how changes in supply will affect equilibrium

price (use diagrams)

a .............................................................................................................

b .............................................................................................................

Since Elasticity of Demand is quite a complex sub-topic,

watch video programme: Unit 2 – Programme 2 to have

a better idea about PED, YED, XED

37

Open University of Mauritius - Foundation Course in Economics - Module 1

38

Open University of Mauritius - Foundation Course in Economics - Module 1

UNIT

3

GOVERNMENT INTERVENTION

IN THE PRICES SYSTEM

Unit objective and learning outcomes

The objective of this unit is to introduce students to the Cost Benefit Analysis (CBA) and its importance in decision making. It also aims at exposing

students to the different types of goods and to understand how and why the

presence of government is necessary in order to promote social welfare.

Upon completion of this unit students should be able to:

Describe what is meant by positive and negative externalities and explain

them in terms of divergences.

Differentiate between public goods, private goods, merit goods and demerit goods.

Explain why public goods may not be provided by the private sector.

Explain how a cost benefit analysis exercise is carried out.

Understand the concept of a maximum and a minimum price.

Unit content:

Private goods, public goods, merit goods and demerit goods.

Private, external and social costs and benefits.

Decision making using the cost benefit analysis.

The concept of maximum and minimum pricing.

Other forms of government intervention in the operation of the free market.

39

Open University of Mauritius - Foundation Course in Economics - Module 1

3.1PUBLIC GOODS, PRIVATE GOODS, MERIT GOODS

AND DEMERIT GOODS

Goods consumed by people can be of different types. They are broadly classified into the public and the private goods.

3.1.1. PUBLIC GOODS AND PRIVATE GOODS

The distinction between a public good and a private good is made on the

basis of four basic principles namely:

a. The principle of exclusion.

If the consumption of the good can be restricted only to those who are

paying for it and the non payer is excluded, the commodity becomes a

private good. In contrast if the principle of exclusion does not apply and

the good can be consumed by anyone, irrespective of whether payment

is made or not, the commodity becomes a public good. Public goods are

also known as “free riders”. Examples of such goods include street lighting or the police force.

b. The principle of the diminishability.

If increased consumption by some people affects the amount left for others, the good is a private good. In contrast if increased consumption by

some does not affect the amount left for others, the good becomes a public good. For example, a fire cracker display or radio broadcast.

c. The principle of divisibility.

A public good is one which is indivisible. Thus, once it is provided everyone, will take advantage. It cannot be subdivided to restrict its consumption. For example defence. In contrast a private good is one which

is divisible so that its consumption can be restricted to some people. For

example electricity supply or water supply.

d. Principle of additional cost

If increased provision or consumption of the good leads to an increase

in the total cost of providing the good the commodity becomes a private

good. In contrast if the total cost does not rise even when more of the

good is consumed, the good becomes a public good. For example a public

road.

40

Open University of Mauritius - Foundation Course in Economics - Module 1

3.1.2. Merit goods and demerit goods

A merit good is one whose consumption leads to an improvement in the quality of life of the people in a country. For such a good, government believes

that it will be underprovided if left solely to the private sector. For such goods

the social benefits exceed the private benefits. Examples of merit goods include health care, education, housing and transport.

A demerit good is one whose consumption leads to a deterioration in the

quality of life of the people in a country. These goods are normally overprovided by the private sector because they are very profitable. In the case of

such goods, the private benefit is far greater than the social benefit. Example

of demerit goods include alcoholic drinks, cigarettes and drugs.

3.1.3 Who should provide these goods?

Given the nature of the public, private, merit and demerit goods there is

much controversy over who should provide these goods.

As far as public goods are concerned, they cannot be provided by the private

sector because the profit motive will not encourage a private producer to allow the non payer to consume his good. This explains why all public goods

are provided by the government. In contrast private goods can be provided

by both the private sector and the public sector. For example a private commodity like electricity is provided by a state enterprise in Mauritius.

As far as merit goods are concerned, it is necessary that both the government and the private sector should provide them simultaneously. For example health care in Mauritius is provided both by government hospitals and

private clinics. It is necessary to have such co-provision in order to

l

l

l

Ensure competition between the private and the public sector. This

will help to improve the quality of the good for the public.

To ensure sufficient provision of the good. The private sector or the