Omnibus II agreement on long-term guarantee package

advertisement

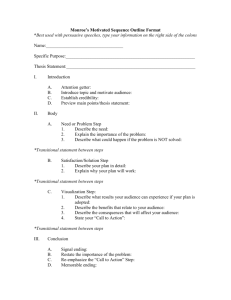

Omnibus II agreement on long-term guarantee package and transitional measures Solvency Consulting Knowledge Series Authors 1 Introduction Dr. Manijeh McHugh Dr. Simon Schiffel All’s well that ends well: For many years the insurance industry has been waiting for an agreement on the Omnibus II Directive. The publication of the Directive in May 2014 – together with the European Commission’s suggested final version of the Delegated Acts in October 2014 – herald the last lap of Solvency II implementation. Contact solvency-solutions@munichre.com November 2014 One of the main reasons for the delayed introduction of Solvency II was the intensive debate on the evaluation of long-term liabilities and the long-term guarantee (LTG) package. Fundamentally, the LTG problem concerns the valuation and discounting of long-term liabilities, which is of particular interest in life business. After a long debate about this issue, Solvency II now includes regulatory measures that are supposed to mitigate the impact of short-term market movements with respect to insurance business of a long-term nature. A further challenge in the focus of the insurance industry was the appropriate transition between Solvency I and Solvency II in order to allow for a smooth introduction without market disruptions, while at the same time providing policyholder protection. The aim of this article is to illustrate the agreement reached on both of these topics, and to discuss the implications based on the Omnibus II Directive and the Delegated Acts as at October 2014. The article is divided in two parts: The next chapter discusses the permanent measures of the LTG package, i.e. extrapolation, volatility adjustment, matching adjustment and extension of recovery period. Those parts of the LTG package which are only applicable temporarily, and transitional measures defined in the Omnibus II Directive are presented in Chapter 3. 2 Long-term guarantee package 2.1 Background and overview In the first half of 2013, the European Insurance and Occupational Pensions Authority (EIOPA) carried out a quantitative impact study on longterm guarantees (“Long-Term Guarantees Assessment” – LTGA) to clarify key issues relating to the valuation of long-term liabilities. The main objective of the impact study was to test different regulatory measures to evaluate the long-term obligations under Solvency II, the impact of the interest rates used for the valuation of liabilities, and the calculation of the risk-capital requirement. The following measures were tested: Counter-cyclical premium (CCP), various extrapolation methods, classical matching adjustment, extended matching adjustment, transitional measures, and extension of recovery period. For a summary of the results and the discussion about the LTGA in summer 2013, please refer to our Knowledge Series “EIOPA publishes the findings of the quantitative impact study on long-term guarantees”. 1 1 See Munich Re Knowledge Series “EIOPA publishes the findings of the quantitative impact study on long-term guarantees”. Available at: <http://www.munichre.com/de/group/focus/ solvency-ii/knowledge-series/index.html>. Munich Re Omnibus II agreement on LTG package and transitional ­measures Page 2/8 The six measures were tested in various combinations in thirteen scenarios in order to quantify the impact of different interest-rate curves according to the standard formula as at 31 December 2011. As a result, EIOPA proposed the LTG package, even though there were some points that EIOPA had not clarified at this stage. The LTG package included a volatility balancer (to replace the CCP), classic matching adjustment, and extrapolation. Further, the transitional measures on risk-free interest rates and technical provisions and the extension of recovery period were part of the transitional agreement. Figure 1: Interest-rate curve and extrapolation % 4,0 3,5 3,0 2,5 2,0 1,5 1,0 0,5 0 The Omnibus II Directive, published in the Official Journal of the European Union in May 2014, finally adopted the following LTG measures, which will be described in the next sections. −−Yield-curve extrapolation −−Volatility adjustment −−Matching adjustment −−Extension of recovery period −−Transitional measures on interest rates and technical provisions While this chapter describes the ­permanent measures of the LTG package (i.e. extrapolation, volatility adjustment, matching adjustment, and extension of recovery period), chapter 3 discusses the transitional measures of the LTG package and other transitional measures formulated in Omnibus II. 2.2 Yield curve extrapolation The yield curve shows the level of interest rates for different maturities. Yield curves are built from market prices of financial instruments by using an interpolation method.2 For longer durations, the yield curve cannot be derived directly from financial instruments, but has to be extrapolated to a long-term yield level. The extrapolation impacts the evaluation 2 In general, a yield curve can be derived by different methods, and is basically a curve-fitting problem which uses interpolation and extrapolation techniques. 1 3 5 7 9 11 13 15 17 19 21 23 25 27 29 31 33 35 37 39 41 43 45 47 49 years EUR Spots (derived on the basis of interest rate swap rates) Basic RFR (after CRA) Extrapolated (Smith-Wilson, LLP 20, UFR@60) of long-term liabilities (e.g. life products) in particular. The following principles for a Solvency II yield curve should be applied to all currencies, if possible. 35 basis points (cap). The EUR-yield curve can be used as a basis for pegged currencies if the conditions of Art. 48 of the Delegated Acts are met. The observed financial instruments should be traded in markets which are deep, liquid and transparent.3 The interest-rate curve should be derived on the basis of interest-rate swap rates. For markets where no swap rates exist, government bonds should be used. For longer maturities, where liquid financial instruments are not available, the long-term range of the yield curve is determined by extrapolation based on forward rates.4 According to the LTG package, the last liquid point (LLP) for the Euro is at year 20. The extrapolated curve converges over a period of 40 years to the ultimate forward rate (UFR) of 4.2%. The UFR should be stable over time and not include a term premium to reflect the additional risk of holding long-term investments.5 The UFR is derived from assumptions on the long-term interest rate and inflation rate, and will be provided by EIOPA. The derived interest-rate curve (EUR Spots) should be adjusted by the credit risk in order to obtain the basic risk-free rate (basic RFR). The credit risk adjustment (CRA) should be determined on the basis of the difference between rates capturing the credit risk reflected in the floating rate of interest rate swaps and overnight indexed swap rates of the same maturity. The calculation is based on 50% of the average of that difference over a time-period of one year; it should not be lower than 10 basis points (floor) and not higher than 3 Art. 77a Directive. Figure 1 shows an illustrative example of the derivation of the interestrate curve and the extrapolation. 4 The Smith–Wilson method should be used for the interpolation between the data points and the extrapolation beyond the LLP. 5 Art. 46 and 47 Delegated Acts. Munich Re Omnibus II agreement on LTG package and transitional ­measures Page 3/8 For other currencies, the characteristics of the local bond and swap markets should be taken into account when determining the LLP and the appropriate convergence period to the UFR. Figure 2: Interest-rate curve – applying volatility adjustment 2.3 Volatility adjustment 3,0 The volatility adjustment aims to prevent pro-cyclical investment behaviour (avoidance of “forced sales”) by mitigating the effect of an extreme widening of bond spreads in stressed market conditions. In addition to forced sales, pro-cyclical behavior could influence the asset-management strategy (e.g. a switch from long-term to short-term assets) and reduce the insurers’ traditional role as a stabiliser of market volatility. 2,5 The volatility adjustment replaces the former countercyclical premium (CCP), which was tested in the LTGA. Basically, it is an adjustment of the risk-free curve by addition of a constant spread. This spread is derived from the difference between the interest rates that can be earned from a reference portfolio and the basic risk-free rate for each currency. Additionally, if market spreads are very wide in a country, a conditional country spread could be added to the currency spread. The reference portfolio for each currency and each country is defined by EIOPA, and includes different assets typically held by insurers to cover the best-estimate liabilities.6 These are bonds, including securitisations, equity and property. If applicable, publicly available indices should be used. 6 Art. 49 Delegated Acts. % 4,0 3,5 2,0 1,5 1,0 0,5 0 1 3 5 7 9 11 13 15 17 19 21 23 25 27 29 31 33 35 37 39 41 43 45 47 49 years EUR Spots (derived on the basis of interest rate swap rates) Basic RFR (after CRA) Adjusted RFR (after CRA and volatility adjustment) Extrapolated (Smith-Wilson, LLP 20, UFR@60) For the calculation of the spread, the portfolio is divided into two classes: government bonds, and non-government bonds, including loans and securitisation. The (portfolio) spread can be calculated by using the portfolio weights and the average spreads of the two components.7 The spread should be corrected in order to remove the portion of the spread that is attributable to a realistic assessment of expected losses, ­unexpected credit risk, or any other risks of the assets.8 Based on the derived and risk-corrected spreads, the volatility adjustment can be calculated by means of the following formula:9 Volatility adjustment = 65% (CuS + maxif CoS>100bps (CoS – 2 • CuS;0)) 7 Art. 50 Delegated Acts. 8 For more details on the concept of the spread correction, also known as fundamental spread, please refer to the section about the matching adjustment. 9 Art. 77d Directive. It consists of two components, the risk-corrected Currency Spread (CuS) plus a conditional risk-corrected Country Spread (CoS), which are calibrated at 65%. Therefore, the volatility adjustment is normally 65% of the CuS. A calibrated CoS can be added only in exceptional circumstances, when the spreads in a particular country are very wide. Preconditioned that the CoS is higher than 100 basis points, the difference between the risk-corrected country spread and twice the risk-corrected currency spread can be added. Figure 2 shows an illustrative example of the effect of a volatility adjustment on the yield curve. Note that the yield curve is extrapolated after accounting for the volatility adjustment. The implementation of a volatility adjustment should be allowed by the national supervisory authorities. However, some Member States may require prior approval. In exceptional circumstances, the volatility adjustment can be rejected by the supervisor. The impact of the volatility Munich Re Omnibus II agreement on LTG package and transitional ­measures Page 4/8 adjustment on the financial position of a company should publicly disclosed in order to ensure transparency. Figure 3: Interest-rate curve – applying matching adjustment 2.4 Matching adjustment The matching adjustment is a constant addition to the risk-free curve for portfolios where the obligation and the assigned asset portfolio can be identified, organised and managed separately from other activities of the undertaking.10 Figure 3 shows an illustrative example of the effect of a matching adjustment on the yield curve. Unlike the approach of the volatility adjustment, the matching adjustment is added to the yield curve after extrapolation. A combination of matching adjustment and volatility adjustment or transitional measures is not permitted. It is especially appropriate for life-annuity products with their extended maturities, but also applicable to non-life annuities. The matching adjustment will link the interest rate to discount a liability to the credit-risk-adjusted yield earned on the assets backing those liabilities. Thus, the matching adjustment is calculated by the following formula: Matching adjustment = market rate of assets – risk-free rate – fundamental spread The difference of the market rate of assets and the corresponding riskfree rate is adjusted by the fundamental spread. The fundamental spread reflects the probability of default of the assets (based on longterm statistics) and the expected loss resulting from downgrading the assets. The fundamental spread for exposures to Member States’ central governments and central banks shall be no lower than 30% of the longterm average of the spread over riskfree interest rate of assets of the same duration, credit quality and 10 Art. 77b Directive. % 4,0 3,5 3,0 2,5 2,0 1,5 1,0 0,5 0 1 3 5 7 9 11 13 15 17 19 21 23 25 27 29 31 33 35 37 39 41 43 45 47 49 years EUR Spots (derived on the basis of interest rate swap rates) Basic RFR (after CRA) Extrapolated (Smith-Wilson, LLP 20, UFR@60) RFR after matching adjustment asset class as observed in financial markets. For all other assets, it shall be no lower than 35%. The matching adjustment for noninvestment-grade assets shall not exceed the adjustment for investment-grade assets with otherwise similar characteristics. Therefore, to ensure this happens the fundamental spread shall be increased where necessary. The impact of the matching adjustment on the financial position should be publicly disclosed in order to ensure adequate transparency. There are restrictive conditions on the underlying business (insurance obligation) and assets. Table 1 summarises the eligibility criteria for insurance obligations and assets according to Art. 77b of Omnibus II. Additionally, the application of such a matching adjustment is subject to prior approval by the supervisor. Once approved, it applies at all times and not only during stressed market conditions. This means, in particular, that the matching adjustment could become negative in times of extremely low spreads. 2.5 Extension of recovery period The financial crisis has shown that certain adverse situations may last longer than expected, and that increased flexibility on the side of the supervisors might contribute to greater stability in times of financial distress. Therefore, Omnibus II allows supervisory authorities to extend the recovery period by a maximum of seven years, where appropriate, if an exceptional situation has been declared by EIOPA after consultation with the European Systemic Risk Board (ESRB). Under normal circumstances, the time period for recovery is six months from the observation of non-compliance with the solvency capital requirement. Munich Re Omnibus II agreement on LTG package and transitional ­measures Page 5/8 Table 1: Eligibility criteria for applying a matching adjustment Insurance Obligations Assets −− The obligations to which the matching adjustment (MA) is applied and the assigned portfolio of assets are identified, organized and managed separately from other business −− Similar cash-flow characteristic to cover the best estimate liabilities; assignment maintained over the lifetime of the obligations except for the purpose of maintaining replication where cash-flows have materially changed −− Applicable for life insurance obligations and non-life annuities −− No future premium payments in underlying business −− Only underwriting risks connected to the obligations are longevity, expense, revision and immaterial mortality risk −− If mortality risk is included the BE liability does not increase by more than 5% under the mortality shock (SCR calculation) −− Only option for policyholder is to surrender and the surrender value may not exceed the value of the assets covering the obligation at the time the surrender option is exercised −− Every insurance obligation has to be taken into account entirely when composing the portfolio of insurance obligations, i.e. no splitting into parts that do fulfill and parts that do not fulfill the requirements, the obligation in total has to comply According to Art. 138 (4) of the Omnibus II Directive, an exceptional adverse situation exists when one or more of the following conditions are present: −−a fall in financial markets which is unforeseen, sharp and steep, −−a persistent low-interest-rate environment, −−a high-impact catastrophic event. EIOPA and the supervisory authorities concerned should assess the situation on a regular basis. The affected undertakings are required submit a progress report on a ­quarterly basis. −− The assets covering the obligations cannot be used to cover losses arising from other activities −− Replication of liability cash-flows in same currency −− Any mismatch does not give rise to any risks which are material in relation to the risks inherent in the insurance business to which the MA is applied. −− Cash-flows fixed and cannot be changed by the issuers of the assets or any third party, but: −− Cash-flows with dependence on inflation qualify if covering obligations depend on inflation −− If issuers or third parties have the right to change the cash flows of an asset in such a manner that the investor receives sufficient compensation to allow it to obtain the same cash flows by re-investing, the right to change the cash flows shall not disqualify the asset for admissibility 3 Transitional measures Omnibus II defines a set of transitional measures to allow for a smooth progression from the current solvency regime to Solvency II. Unlike those measures of the LTG package described above, the relaxation of requirements achieved by these arrangements only applies for a certain period, or is phased out over time. While some of these measures result in a better solvency position, others aim to give undertakings more time to fulfil certain requirements. In sum, these relaxations aim to put insurance companies in a position to be able to comply with the full spectrum of Solvency II requirements over time. 3.1 (Re)insurance undertakings in run-off or in administration This transitional measure is applicable to undertakings in run-off or in administration, and aims to avoid these companies losing their authorisation in case of non-compliance with the minimum capital requirements.11 Undertakings in run-off should ensure the settlement of policyholder claims. However, the loss of authorisation in case of non-compliance would impose unnecessary costs on the undertakings, and as such contradict with this goal. Undertakings qualify for the transitional measure if one of the following conditions are met: −−The undertaking has to end its business before 1 January 2019. Should the undertaking’s effort in the run-off process raise any doubts about the termination of the business, the undertaking will not be exempted from the requirements formulated in Titles I-III of the Directive. To be more precise, the undertaking has to comply with all requirements once the violation of the termination condition is declared by the supervisor or after 1 January 2019 at the latest. −−The exemption may also be applied to undertakings in reorganisation. In this case, the termination of existing activities has to be completed by 1 January 2021. Similar to the case above, the exemption may be cancelled if the supervisory authority is not satisfied with progress in the termination process. 11 According to Art. 308b (1.-4.) Omnibus II, re(insurance) undertakings in run-off or administration can be granted an exemption of the requirements formulated in Titles I-III of the Directive, covering “General rules on the taking-up and pursuit of direct insurance and reinsurance activities”, “Taking-up of business” and “Supervisory authorities and general rules”. Munich Re Omnibus II agreement on LTG package and transitional ­measures Page 6/8 (Re)insurance undertakings that apply this transitional measure are obliged to inform their supervisory authority beforehand. Further, the undertaking has to submit an annual report that enables the supervisory authority to evaluate the progress made by the undertaking in terminating its activities. reduced by two weeks per year for the next four years, so the initial submission period of 14 weeks14 applies for all financial years ending on or after 30 June 2019. transitional measure, reference is made to our Knowledge Series “Omnibus II brings more clarity: ­Transitional measures for own funds”.17 Further, the suspense period for information that has to be submitted to the supervisory authority on a quarterly basis will be eight weeks for any quarter ending on or after 1 January 2016. This period will be reduced by one week per financial year, resulting in a final submission period of five weeks for quarter endings on or after 1 January 2019.15 3.4 Market risk In order to take into account the complexity inherent to group level reporting, Omnibus II allows for an extension of the above-mentioned deadlines by six weeks, respectively. −−The standard parameters defined in the concentration and spread risk sub-modules, and applied to debt issued by European Economic Area (EEA) states’ central governments or central banks denominated and funded in the domestic currency of another EEA state, will effectively be zero until 2017. As of 2018, the standard parameter will be phased in, with a reduction by 80% (in 2018) and 50% (in 2019) respectively. The full stress will be applied as of 2020.18 Companies belonging to a group may not make use of this measure unless all group companies are in run-off. In order to support the exchange of information between Member States, each Member State should share the names of the undertakings applying this transitional measure with other Member States. 3.2 Submission of information to supervisory authority For many insurance companies, compliance with the various reporting formats is proving to be a major challenge. The EIOPA guidelines on “Submission of information to national competent authorities” ­published in October 2013 already addressed this issue by requiring undertakings to prepare first reporting formats in the preparatory phase (i.e. in 2015). Omnibus II eases the reporting requirements by temporarily extending the suspense period. To be more precise, for the financial year ending on or after 30 June 2016 but before 1 January 2017, information that has to be provided to the supervisory authority at least annually12 and the report on solvency and financial condition13 may be submitted no later than 20 weeks after the undertaking’s financial year ends. The submission period will be 12 Art. 35 Directive. 13 Art. 51 Directive. 3.3 Own funds The strict application of the criteria for basic own fund items as of January 2016 could force a variety of undertakings to replace existing capital instruments at the same time. In order to avoid the market dislocation and the related costs for undertakings, Art. 308 b (9-10) of the Omnibus II Directive allows for transitional own fund measures. The UK country report on the fifth quantitative impact study underlines the importance of these transitional measures for the UK industry.16 Under the transitional arrangement, basic own fund items which were issued before the earlier of (a) 1 January 2016 or (b) the date of entry into force of Delegated Acts, may be accounted for as transitional own fund items if they qualify as own fund items under the existing Solvency I regime, and do not qualify as a regular Solvency II basic own fund item. The grandfathering rule may be applied for a period of up to ten years. For a detailed analysis of this 14 Art. 312a and Art. 312c Delegated Acts. 15 Art. 312d Delegated Acts. 16 See: FSA UK Country Report: The Fifth ­Quantitative Impact Study (QIS5) for Solvency II, March 2011. Omnibus II foresees a temporary reduction of stresses applied to certain asset classes in order to avoid market disruptions. These relaxations aim to reduce the solvency capital requirements for these modules in the first years after introduction of Solvency II. −−Further, according to Art. 308b (13) of Omnibus II in conjunction with Art. 173 of the Delegated Acts, the stress applied on Type 1 equities19 other than duration-based equities purchased before 1 January 2016 can be phased in over seven years. The stress will increase, at least on a linear basis, from 22% in 2016 to the full stress equal to 39% and the symmetric adjustment in 2023. 17 See Munich Re Knowledge Series “Omnibus II brings more clarity: Transitional measures for own funds”. Available at: <http://www. munichre.com/site/corporate/get/documents_ E786737397/mr/assetpool.shared/ Documents/5_Touch/_Publications/ 302-08331_en.pdf>. 18 Art. 308b (12) Omnibus II Directive. 19 These are equities listed in regulated markets in the countries which are members of the EEA or the Organisation for Economic Cooperation and Development (OECD). Further, Art. 168 (6) Delegated Acts provides a list of instruments which should be classified in any case as Type 1 equity. Munich Re Omnibus II agreement on LTG package and transitional ­measures Page 7/8 −−(Re)insurance undertakings may only invest in tradable securities, and other financial instruments that are based on repackaged loans and were issued after 1 January 2011, if the originator, sponsor or original lender retains a material net economic interest of at least 5%.20 In addition, Art. 256 of the Delegated Acts summarises the qualitative requirements for investments in securitisation. A breach of these requirements may be penalised by an increase in the solvency capital requirement.21 However, for those instruments issued before 1 January 2011 these requirements must only be fulfilled if new exposures were added or substituted after 31 December 2014. 3.6 Internal models 3.5 Non-compliance with solvency capital requirements According to Art. 308b (14) of the Omnibus II Directive, undertakings that do not comply with solvency capital requirements in 2016, but at the same time do comply with the Required Solvency Margin applicable under the Solvency regime before Solvency II enters into force, may be allowed to restore their solvency position by 31 December 2017. However, the respective undertakings are required to submit a progress report every three months, proving that ­significant progress has been made. This transitional measure allows undertakings with an inadequate Solvency II position to thoroughly analyse and compare the adequacy of different measures. Groups may apply for the approval of an internal group model that is applicable only to a part of that group until 31 March 2022, provided that (a) the ultimate parent undertaking and the respective part of that group are located in the same Member State, and (b) the risk profile of that part of the group differs significantly from the rest of the group. Note that the application of this transitional measure is at the discretion of the national supervisory authority.22 3.7 Risk-free interest rates Art. 308(c) of the Omnibus II ­Directive allows for an adjustment of risk-free interest rates that may be applied to (re)insurance obligations concluded before 1 January 2016, subject to prior approval by their supervisory authority. The adjustment is equal to the difference between the interest rate as determined under Solvency I at the last date at which Solvency I is in force, and the annual effective rate as determined under Solvency II. Those undertakings that apply the volatility adjustment have to account for the volatility adjustment before performing the described adjustment. The adjustment will be fully taken into account at the year-end 2016, i.e. when insurance undertakings disclose their solvency position for the first time after Solvency II comes into force. In the following years, the adjustment will decrease in a linear manner until the benefit vanishes at the year-end 2032. Further, please note that this measure may neither be combined with the matching adjustment described in chapter 2 nor with the transitional measure on technical provisions described in the next section. 3.8 Technical provisions As an alternative to the transitional measure on the risk-free interest rate, undertakings can seek approval for a transitional deduction to technical provisions which has to be applied at the level of homogenous risk groups, i.e. segments which are used for reserving.23 The transitional deduction is equal to the difference of (a) technical provisions net of recoverable from reinsurance and special purpose vehicles as prescribed under Solvency II, and (b) technical provisions net of recoverable from reinsurance as prescribed under Solvency I. Similar to the transitional measure on risk-free interest rates, the deduction will be fully applied in 2016 and reduced in a linear manner to 0% in 2032. It may be combined with the volatility adjustment, but not with the matching adjustment. Also, the solvency position without the application of the transitional measure has to be publicly disclosed. However, in cases where the undertaking would not comply with solvency capital requirements without using the transitional measure, the undertaking has to provide an annual report to the supervisory authority that lays down the measures taken to restore the solvency position, and the progress made. In order to maintain policyholder ­protection, public disclosure must be made with and without the application of the transitional measure on the risk-free interest rate. In cases where the application of this transitional measure results in solvency requirements less than those prescribed by Solvency I, the supervisory authority may reduce the deduction. 22 Art. 23 Art. 20 For more information on the requirements for retentions, please refer to Art. 254 Delegated Acts. 21 Art. 257 Delegated Acts. 308b (16) Omnibus II Directive. 308c Omnibus II Directive. Munich Re Omnibus II agreement on LTG package and transitional ­measures Page 8/8 4 Summary The LTG package and the transitional measures are intended to pave the way for a smooth introduction of Solvency II in 2016. While the spectrum of instruments covers many challenges faced by insurance companies, it remains to be seen how many insurers effectively will make use of these instruments. Firstly, the effectiveness of the measures under the economic conditions prevailing at the start of Solvency II has to be considered. Secondly, the application comes with a ‘price’ in the form of restrictive prerequisites, e.g. disclosure of Solvency II positions must be made with and without the instrument or, in some cases, no possibility to revert back from the implementation. The pros and cons of an application have to be thoroughly balanced. Munich Re supports clients with expertise across the whole range of enterprise risk management topics. Solvency Consulting shares knowledge and offers services regarding quantitative and qualitative risk management from both the management and regulatory perspective. Despite offering knowledge and expertise, we provide assistance with solutions in the area of capital management and capital optimisation. © 2014 Münchener Rückversicherungs-Gesellschaft Königinstrasse 107, 80802 München, Germany Order number 302-08521 Münchener Rückversicherungs-Gesellschaft (Munich Reinsurance Company) is a reinsurance company organised under the laws of ­Germany. In some countries, including in the United States, Munich Reinsurance Company holds the status of an unauthorised reinsurer. Policies are underwritten by Munich Reinsurance Company or its affiliated insurance and reinsurance subsidiaries. Certain coverages are not available in all jurisdictions. Not if, but how Any description in this document is for general information purposes only and does not constitute an offer to sell or a solicitation of an offer to buy any product.