1.Piecemeal Distribution

advertisement

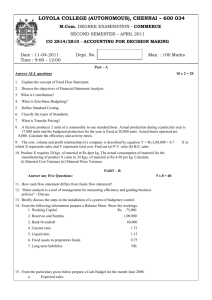

1.Piecemeal Distribution As and when money is received from sale of assets, it is used to pay liabilities. The liabilities are also paid in stages or gradually. The money, in short, is distributed piecemeal – in stages and not in a single shot. This is known as Piecemeal Distribution. 2.Settlement of Liabilities In a piecemeal distribution, the amounts realised from assets are used to settle the liabilities in the following order: [1] Realisation expenses [2] Reserve for Unrecorded/Contingent Liabilities [3] Outside Liabilities [4] Partners’ loans and [5] Partners’ capitals. Surplus, if arising at the last stage, is distributed to all partners in their profit sharing ratio. 2.1 Realisation Expenses Realisation expenses are paid or provided for, first. 2.2 Reserve for Unrecorded /Contingent Liabilities A reserve is created to meet any unrecorded liability or a contingent liability (e.g. bills discounted). 2.3 Outside Liabilities 2.3.1 Types Outside liabilities are the amounts due to outsiders other than partners such as creditors, banks etc. These include amounts due to even relatives of partners e.g. loan from partner’s wife etc. Outside liabilities may be broadly classified into [1] Secured Creditors and [2] Unsecured Creditors. 2.3.2 Secured Creditors In case of Secured Creditors, the dues are secured by pledge, charge, hypothecation or mortgage of an asset e.g. bank overdraft secured against machinery and stock. Secured creditors may be (a) fully secured or (b) partly secured. (1) Fully Secured: In case of a fully secured creditor, the amount due is fully covered by the value of asset pledged etc. On dissolution, such creditors can fully recover their dues out of the realisations of the secured assets. Thus, on dissolution the bank can fully recover the amount due on bank overdraft out of the amounts realised from the sale of the machinery and stock. The surplus, if any, belongs to the firm. (2) Partly Secured: Partly Secured Creditors are those liabilities which are only partly secured against an asset of the firm. In such cases the amount due is only partly covered by the value of asset pledged etc. On dissolution, such creditors can only partly recover their dues out of the amounts realised from such assets. The remaining amount is treated as unsecured creditors and added to the amount of unsecured liabilities. 2.3.3 Unsecured Creditors Unsecured Creditors have no specific security at all. Unsecured Creditors are further classified into preferential creditors and other creditors. (1)Preferential: Preferential creditors means (a) amounts due to the Government e.g. income tax, municipal taxes etc. (b) amounts due to the employees e.g. salaries and wages, compensation for termination of services, contribution to provident fund etc. These amounts are paid first in preference to other unsecured creditors. (2) Other: Other unsecured creditors are all the remaining outside liabilities of the firm. These also include the balance of partly secured creditors not met out of the secured asset. 2.3.4 Order of Payment Outside liabilities are paid in the following order: (1) Out of the realisation from ‘charged’ (as security) assets, secured creditors are paid first. Balance realisation, if any is used to pay other creditors. Remaining secured creditors, if any, are added to other creditors. (2) Out of the other realisations, preferential creditors are paid first in the following order: (a) Amounts Due to Government (b) Amounts Due to employees. (3) Once all the preferential creditors are paid balance cash is used to pay the unsecured creditors. 2.3.5 Pro-rata Payment If the cash is insufficient to pay off all dues, the payment is made to the concerned creditors (in each category) proportionately i.e. in the ratio of the outstanding balances. 2.4 Partners’ Loans After all the outside liabilities are paid off, the internal liabilities i.e. the partners’ loans are paid off in the next stage. If the cash is insufficient, payment is made against all partners’ loans proportionately i.e. in the ratio of outstanding balances. 2.5 Partners’ Capitals After all the outside as well as internal liabilities are paid, the partners’ capitals are paid off in the last stage. If the cash is sufficient, all the capitals can be paid off. But if the balance is insufficient, payment must be made against all capital accounts prorata or proportionately. If the capital balances are in the profit sharing ratio, there is no problem at all. The payment is made to all partners in the ratio of their capital balances. But if the capitals are not in the profit sharing ratio, payments at each stage must be done in such a manner that: (a)The payments are in the ratio of the balances of capitals at each stage and (b) The payments ensure that the ultimate profit or loss on realisation is distributed among all the partners in their profit sharing ratio. 3.Proportionate Capital Method 3.1 Meaning This method is also known as Surplus Capital Method, Highest Relative Capital Method, Excess Capital Method or Quotient Method. The excess capital (actual capital less capital proportionate to the profit sharing ratio) is paid first. After excess capitals are paid, all capitals are in the profits sharing ratio. Then the payments can be made in the profit sharing ratio. 3.2 Procedure 3.2.1 Compute Adjusted Capitals Adjusted Capital means the amount due to each partner by way of capital adjusted for current account balances, reserves, funds, accumulated profits, deferred revenue expenses not written off etc. Particulars Rs. Capital A/c (Cr.) as per Balance Sheet xxx Add: Current Account (Cr.) xxx Reserves/Funds (credited in PSR) xxx P & L A/c (Cr.) (credited in PSR) xxx Less: Current Account (Dr.) P & L A/c (Dr.) (debited in PSR) Deferred Revenue Expenses (debited in PSR) Adjusted Capital Balances Rs. xxx xxx xxx xxx xxx xxx 3.2.2 Compute Unit Capital Unit Capital (UC) of a partner means his Adjusted capital divided by his Share of profit. 3.2.3 Take Lowest UC as Base Capital The next step is to take the lowest Unit Capital as the Base Capital (BC). This is called the Minimum Capital or the Core Capital. 3.2.4 Compute Proportionate Capital Proportionate Capital (PC) of a partner is equal to the Base Capital x His Share of Profit. 3.2.5 Compute Excess Capital Excess Capital of a partner is equal to his Capital Balance Less his Proportionate Capital. In case of the partner whose unit capital is taken as a Base his Proportionate Capital is equal to his Capital Balance, and hence his Excess Capital is Nil. 3.2.6 Compute Next/Final Excess Capital If there are two partners, there will be only one partner whose capital is excess; in case of three partners, there may be two partners whose capitals are in excess, and so on. In case of three partners, the excess capital is to be computed twice; in case of four partners, it is to be computed thrice and so on. The computation at first stage (First Excess) is done as explained above. In the next stages the steps are same, except that, the Excess Capital in the next stage is equal to Old Proportionate capital Less New Proportionate capital. The Excess Capital in the last stage is called the Final Excess or the Absolute Excess Capital. 3.2.7 Order of Payment First, the Final Excess Capital is paid. Next, the Proportionate Capital in the last stage is paid. Next, the proportionate Capital in the last But one stage is paid and so on. Finally, after all the excess amounts are paid, the balance cash is paid I the profit sharing ratio of the partners. Assignment Sums Q1 A, B and C were in partnership sharing profit & losses in the ratio 3:2:1. They dissolved the firm on 31-12-2003. On which date their balance sheet appeared as follows: Liabilities Rs. Creditors 40,000 Cash 10,000 Loan from A 10,000 Debtors 80,000 General Reserve 12,000 Stock 27,000 Capital : A 20,000 B 25,000 C 10,000 1,17,000 Assets Rs. 1,17,000 The realisation and expenses were as under: Date Debtors Rs. Stock Rs. Expenses Rs. Jan,2004 12,000 6,000 1,000 Feb,2004 22,000 1,000 1,500 March,2004 6,000 10,000 1,200 April,2004 18,000 5,000 900 May,2004 15,500 3,000 1,500 It was agreed that available cash and net realisation should be distributed at the end of each month. It was decided in May,2004, that C would take the remaining debtors at Rs 2,500. Prepare a statement by proportionate Capital method showing the distribution of cash. Also show realisation account. Q2 A, B and C were partners sharing in the ratio of 4:3:1. Their balance sheet as on 31st March, 2003 was as follows: Liabilities Rs. Creditors 26,250 Building Bank Loans (Secured) Assets Rs. 60,000 8,750 Plant 20,000 Loan from A 10,000 Stock 55,000 Capital 70,000 Debtors 60,000 :A B 30,000 C 50,000 1,95,000 1,95,000 They decided to dissolve the business. The assets are realised gradually and the net amount were distributed immediately as given below: Date Assets Realised Rs. Expenses Paid Rs. May 20,2003 22,000 2,000 July 30,2003 16,800 1,800 Sept 20,2003 38,000 Nil Nov 15,2003 45,000 5,000 Dec 30,2003 72,000 7,000 Show the distribution of cash and the loss to be borne by the partners. Objective test Match the column • • • • Group ‘A’ A. Income tax payable by a firm as on the date of dissolution B. Balance of partly secured creditors not met out of the secured asset C. Bank loan obtained by hypothecation of Machinery • • • • Group ‘B ’(1) Secured Creditor (2) Preferential Creditor (3) Unsecured Creditor Multiple Choice Questions: (1) Income tax payable by a firm as on the date of dissolution is treated ________ (a) As preferential creditors (b) as secured creditors (c) as unsecured creditors (d) as non-recoverable. (2) Salaries and wages payable by a firm as on the date of dissolution is treated _______ (a) As preferential creditors (b) as secured creditors (c) as unsecured creditors (d) as non-recoverable. (3) Unsecured Creditors are paid in the following order(a) All creditors pro data (proportionately) (b) Due to Government, Due to Employees, Other Creditors (c) Due to Employees, Due to Government, Other Creditors (d) None of the above (4) If cash is insufficient to pay off all partners’ loan, payment is made ________ (a) in the profit sharing ratio (b) in the profit sharing ratio (c) in the ratio of capitals (d) None of the above. In the ratio of outstanding loan balances Answers • • • • Match the column answers A-2 , B-3 , C-1 MCQ answers 1 a , 2 a, 3 c, 4 b