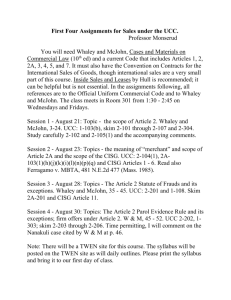

The law of consignment sales of goods, under which merchandise is

advertisement

by Raymond W. Dusch T he law of consignment sales of goods, under which merchandise is delivered by a seller (a “consignor”) to another person (a “consignee”) to hold for sale to a third party, has long been a source of confusion and uncertainty for both consignors (seeking to protect their rights to their consigned goods) and creditors of the consignee (seeking to satisfy their claims against the consignee and its assets). Prior to the enactment in 2001 of revised Article 9 of the Uniform Commercial Code, the treatment of consignment sales had straddled both Article 2 of the UCC, which covers the sale of goods, and Article 9 of the UCC, which covers the creation and perfection of a security interest in goods. The drafters of revised Article 9 sought to eliminate this confusion by removing all regulation of consignment sales from UCC Article 2, and lodging all regulation of consignments under the UCC (to the extent not covered by common law) squarely within UCC Article 9. However, the recent Bankruptcy Court decision in the case of In re Morgansen’s Ltd., 302 B.R. 784 (Bankr. E.D.N.Y., October 14, 2003) would, if sustained on appeal, negate many of the improvements introduced by revised Article 9 and wreak havoc on the treatment of consignment sales of consumer goods and other “true” consignments not expressly covered by revised Article 9. Consignments under revised Article 9 A true “consignment” (to the extent governed by, and as defined in, revised Article 9) is deemed to create a purchase money security interest (PMSI) in the consigned goods in favor of the consignor (UCC Sections 9-103(d) and 1-201(37)), so that a consignor who fails to file a UCC financing statement against the consignee with respect to the consigned goods risks losing its rights in the goods to a trustee in bankruptcy or a secured party having a perfected security interest in the consignee’s inventory. Although the pre-2001 version of the UCC had also provided a consignor with a security interest in the consigned goods, these security interests were not expressly designated as PMSIs (putting in doubt the status of these interests vis-a-vis holders of prior perfected liens on inventory), and the rights of the consignee’s creditors in the consigned goods were covered by both former Section 2-326(3) of the UCC article on sales, as well as by several sections of UCC Article 9. The drafters of revised Article 9 attempted to rationalize this dichotomy by deleting the references to consignment sales from former UCC Section 2326(3), and adding new UCC Section 9-102(a)(20) to define the types of consignments to be covered by UCC Article 9, as well as new UCC Sections 9-103(d) and 9-319 to specify JULY/AUGUST 2004 Copyrighted material. For website posting only. Reproduction or bulk printing prohibited. altogether, the Bankruptcy Court in the case of In re Morgansen’s Ltd. recently held that Non-Article 9 Consignments (including those made by consumers) should not be treated as consignments at all, but as outright sales on a “sale or return” basis under UCC Section 2-326. As a result of this “pretzel logic,” if a consumer delivers “consumer goods” (e.g., jewelry, works of art, antiques, etc., “used or bought primarily for personal, household or family purposes” under UCC Section 9-102(a)(23)) to a known consignee to hold for sale to a third party (whether or not the consignee is a merchant or auctioneer), then unless the consumer (i) enters into an express security agreement with the consignee with respect to the goods, and (ii) files a UCC financing statement against the consignee to perfect its security interest in consigned goods, the consumer will lose all rights to its property to the consignee’s trustee in bankruptcy (or other lienholder) if the consignee goes bankrupt (or grants a voluntary lien on its inventory or has its property attached by a judgment lien creditor), and will thus be relegated to the status of an unsecured creditor of the bankrupt consignee’s estate. the perfection and priority of these Article 9 Consignments vis-a-vis trustees in bankruptcy and other competing security interests. Under revised UCC Section 9-102(a)(20), a “consignment” (an “Article 9 Consignment”) is defined as a transaction in which: (i) a person delivers goods (other than “consumer goods” and goods valued at less than $1,000) to a merchant for the purpose of sale, where the merchant (a) deals in goods of that kind, (b) is not an auctioneer, and (c) is not generally known by its creditors to be substantially engaged in selling goods of others; and (ii) where the transaction does not expressly create a security interest in the goods to secure an obligation. Non-Article 9 Consignments By removing any mention of Consignments from UCC Article 2 on sales and then narrowly defining the types of consignments that would be governed by UCC Article 9, the drafters of revised Article 9 determined that only certain (but not all) types of consignments would be governed by the UCC. Accordingly, if a transaction (i) constitutes a true Consignment under common law (i.e., in which the title and risk of loss to the goods are retained by the consignor, until the goods are sold by the consignee on its behalf), as opposed to an outright sale of goods (i.e., in which the title and risk of loss to the goods pass to the purported “consignee,” with the purchase price thereof secured by the “consigned” goods themselves), and (ii) does not meet the statutory definition of an Article 9 Consignment under revised Article 9 (a “Non-Article 9 Consignment”), these Non-Article 9 Consignments should be governed by law other than the UCC (usually, the common law of “bailments” for the purpose of sale) and not by revised Article 9 or UCC Article 2. Nevertheless, despite a statutory scheme clearly designed to protect consumers (and others dealing with known consignees and auctioneers, etc.) and to remove Non-Article 9 Consignments from regulation under the UCC In re Morgansen’s Ltd. Morgansen’s Ltd. was a dealer in expensive items, such as jewelry, art, collectibles and furniture. It was located in a small retail shop in the exclusive community of Southampton, New York. It sold these items to retail customers, other dealers and interior decorators in its store and at public auctions. Approximately 30 percent of these items were purchased outright by Morgansen’s in estate sales and from walk-in customers, and the remaining 70 percent were placed with it “on consignment” by ordinary consumers (who had held these items for their personal use and enjoyment) and other dealers (who had acquired and held the items as inventory for resale). Goods obtained both by direct purchase and by consignment were commingled in the shop, often in the same display cases, and were not labeled as being “held for sale on consignment” or otherwise. 2 Section 2-326(3) in connection with revised Article 9, which had provided that goods delivered to a person for sale on consignment were “deemed to be on sale or return” under that section, unless the person making the delivery (a) complied with any applicable consignment “sign law,” or (b) could prove that the consignee was “generally known by his creditors to be substantially engaged in the selling of the goods of others,” or (c) duly filed a financing statement under UCC Article 9 against the consignee with respect to the consigned goods. However, after noting the deletion of former sub-section (3), which had been expressly incorporated into the UCC in order to “deem” a true consignment to be a “sale or return” (and thus subject to the claims of the consignee’s creditors), the court made a profound logical leap by deciding to treat all Non-Article 9 Consignments as “sales or returns” under UCC Section 2-326 (and subject to the claims of the consignee’s creditors), despite the absence of the deleted statutory authority and irrespective of whether these transactions would otherwise be treated as “sales” under the UCC or common law. Again, after properly noting that Official Comment No. 1 to UCC Section 2-236, as in effect after the 2001 amendments, provides that “[a] sale or return is a present sale of goods that may be undone at the buyer’s option,” the court simply concluded that any Non-Article 9 Consignment must constitute a “sale or return” under UCC Section 2-236. However, the court failed to recognize that in order for there to be a “buyer” in a sale or return transaction under UCC Section 2-236, a court must first determine that the transaction constitutes a “sale” under the UCC. Although a consignment and a sale or return may seem to be the same type transaction — with goods delivered by Party A to Party B for the purpose of sale to Party C, and with Party B having the right to return the goods to Party A for any reason whatsoever — the court simply ignored that, under common law as embodied by the UCC, there is a basic difference between a transaction involving a “sale or return” and a “true” consignment, which can be summarized as follows: ➤ A “sale or return” is a real sale of delivered goods in which title to the goods and, unless otherwise agreed by the parties, the risk of loss to the goods (under UCC Section 2-327(2)(b)), is initially transferred to a buyer for ultimate resale to a third party. (Under UCC Section 2-106(1), a “sale” consists of “the passing of title from a seller to a buyer for a price.”) ➤ A true consignment is not a real sale but a “bailment” transaction in which goods are not sold but are entrusted with another person (much like a coatchecking service or auto-repair garage), but in which title and the risk of loss to the goods is retained by the consignor (as the “entrustor” of the goods) until they are sold to the third-party purchaser. Under a true consignment, the consignee of the goods bears the risk of loss merely as a “bailee” (like a coat Being located in a wealthy summer resort community, Morgansen’s business was cyclical at best, and its overhead ultimately proved too costly for it to remain in business. On February 20, 2003, Morgansen’s (“Debtor”) filed for voluntary bankruptcy under Chapter 11 of the Bankruptcy Code and, on August 26, 2003, the case was converted to a Chapter 7 liquidation. The Debtor had significant unsecured claims from utility companies and other thirdparty suppliers of goods and services. With the Debtor incurring monthly costs for rent, utilities and insurance in excess of $10,000, the court ordered the immediate sale of all the Debtor’s merchandise, including all of its consigned goods, at a public auction to be held on the Debtor’s premises, with the net proceeds retained by the Debtor’s estate to satisfy the claims of its unsecured creditors, which would include the claims of its consignors, but only as unsecured creditors of the Debtor’s bankrupt estate. In its decision, the court expressly noted that, commingled among the goods that the Debtor had purchased outright in estate sales and from dealers, were numerous items it had held for sale “on consignment” on behalf of numerous consumers pursuant to written consignment agreements. In analyzing whether the creditors of the Debtor’s estate had claims against the consigned goods, the court correctly noted the new statutory scheme under revised Article 9: “The standard approach is first to go to section 9102(a)(20), and if the transaction does not fit under this section, then to go next to section 2-326; if the transaction does not fit under section 2-236, then the transaction falls entirely outside the Uniform Commercial Code, and the Court must then fall back on the common law of bailments and other traditional practices.” However, the court fell far short in applying this approach. The court first determined that, for several reasons, the consignments did not constitute Article 9 Consignments under UCC Section 9-102(a)(20). Although it was clear that the Debtor was a “merchant,” there was no proof that the Debtor was “not generally known by its creditors to be substantially engaged in selling the goods of others,” and most of the consigned goods constituted “consumer goods” under the UCC immediately prior to delivery to the Debtor. The court’s analysis then proceeded to UCC Section 2-326, as amended in 2001 in connection with revised Article 9, which provides that: “(1) Unless otherwise agreed, if delivered goods may be returned by the buyer even though they conform to the contract, the transaction is...(b) a ‘sale or return’ if the goods are delivered primarily for resale,” and that “(2)...goods held on sale or return are subject to [the claims of the buyer’s creditors] while in the buyer’s possession.” The court then noted the deletion of former UCC 3 risk of loss to the goods to the consignee prior to their resale to a third party. Absent this kind of mutual intent, there was no authority whatsoever under revised UCC Articles 2 or 9 for the Morgansen’s court to treat any Non-Article 9 Consignment as a “sale” to the consignee or a “sale or return” subject to the rights of the consignee’s creditors. The court concluded that, under Debtor’s written consignment agreements themselves, “the intention of the parties to these transactions is beyond reasonable dispute.” The Debtor was authorized to sell the consignors’ goods with an obligation to pay the consignors the net proceeds of the sale, less its commission. The court chose to ignore the “form” of the consignment agreement, under which the consignor designated the consignee as its “exclusive agent” for the purpose of offering the goods for sale on the consignor’s behalf, at public auction or otherwise. However, the court fatally failed to note that these agreements were completely devoid of evidence of the consignors’ intent to convey “title” to the goods to the consignee or to anyone else, other than the ultimate purchasers of the consigned goods. The court further ignored express provisions of those agreements that the consumer-consignors bore the risk loss (and the risk of insuring the goods against loss), and that the consignee’s only duty was to “exercise reasonable care in handling and safeguarding the property.” The consignment agreements further evidenced the parties’ intent not to initially pass title to the Debtor by providing that, if the consigned goods were not sold by the Debtor and remained in its possession (and were not taken back by the consignor) within 60 days after the “ready pick-up date” for the goods specified by the Debtor, “title [to the consigned property] will be deemed to have passed from Consignor to [the Debtor] and this Agreement shall act as a binding bill of sale.” Accordingly, despite the obvious intention of these parties not to pass title and risk of loss to the goods to the Debtor, and the clear statutory scheme of revised UCC Articles 2 and 9 not to regulate consignments that were, by definition, Non-Article 9 Consignments (which are supposed to be completely outside the scope of the UCC), the court held that ordinary, unsophisticated consumers, who are most in need of the protections afforded by the 2001 clarifications and improvements to the UCC (when they entrust personal items to a consignment store for ultimate sale to third parties), have no way of protecting their rights to their personal items under UCC Article 9 or otherwise, other than to contractually obtain and perfect a PMSI under UCC Article 9. Thus, in order to be fully protected, the consumer must (a) at a minimum, enter into a written security agreement with the consignee and file a financing statement against the consignee covering the goods, and checker or repair garage) only to the extent the bailee is negligent by failing to meet its duty of ordinary care with respect to the goods (as implied by common law or as otherwise agreed by the parties). To understand this crucial distinction, the court needed to look no further than Official Comment No. 6 to UCC Section 9-109, which states that (a) Article 9 Consignments “include many but not all ‘true’ consignments (i.e., bailments for the purpose of sale),” (b) former UCC Section 2-236(3) had changed the common law result to treat true consignments as “sales or returns” under the UCC, and (c) revised Article 9 again changes the common law result, but “in a different manner” than former Section 2-236(3). Accordingly, without former Section 2-326(3) in effect to change the operation of common law and cause a NonArticle 9 Consignment to be treated as a “sale or return,” consignments such as the Debtor’s should now only be treated as a “sale or return” if the parties intend, by some express or implied agreement, to initially transfer title and 4 (b) in many cases, also fulfill the other requirements for obtaining a perfected, first priority PMSI under UCC Section 9-324 (i.e., before the item is delivered to the consignee, he or she must (i) file the financing statement against the consignee, (ii) conduct a UCC financing statement search against the consignee, and, (iii) send separate notices directly to anyone with a financing statement on file against the consignee’s inventory). In so ruling, the court ignored longstanding commonlaw rules that, absent an intent to sell goods to a “consignee” on a “sale or return” basis, goods that are the subject of a “true” consignment (and which are not otherwise governed by UCC Article 9) belong to the consignor until they are sold by the consignee, and are therefore not subject to the claims of the consignee’s creditors. Conclusion To add insult to the consignors’ injury, the court refused to stay its sale order pending appeal and, on December 4, 2003, all of the consigned goods were sold at auction, with those consumers able to afford it bidding on and buying back their own property. If their appeal is successful, consumers with winning bids would receive a refund of the purchase price and be able to retain their prized possessions. However, those consumers that did not bid (or were not successful bidders) will have only the sale price paid by the buyer at auction to satisfy them. If the decision in the Morgansen’s case is sustained on appeal, then the drafters of the UCC may well have to go back to the drawing board and refine the statute even further to make it crystal clear (to courts and creditors alike) that property delivered and held under a Non-Article 9 Consignment is protected by the fact that the consignee has no interests in or rights to such property under statutory or common law that can be reached by their creditors or trustees in bankruptcy. ▲ This article first appeared in the February 2004 issue of LJN’s Equipment Leasing Newsletter, and is being republished with its permission. Raymond W. Dusch is an attorney with the law firm of Schulte Roth & Zabel LLP, New York, NY. He is also a member of the Board of Editors of LJN’s Equipment Leasing Newsletter, and a former member of the Legal Committee of the Equipment Leasing Association of America. Reprinted from The Secured Lender, July/August, 2004 by The Reprint Dept., 800-259-0470; Part #9505-1004