De Beers, diamonds and Angola : developing an understanding of

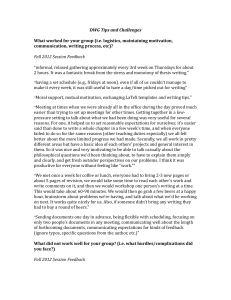

advertisement