Year 1

advertisement

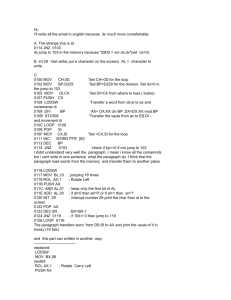

Chapter 2 Conceptualizing and Initializing The IT Project 1 Chapter 2 Objectives Define what a methodology is and describe the role it serves in IT projects. Identify the phases and infrastructure that makes up the IT project methodology introduced in this chapter. Develop and apply the concept of a project’s measurable organizational value (MOV). Describe and be able to prepare a business case. Distinguish between financial models and scoring models. Describe the project selection process as well as the Balanced Scorecard approach. Methodology A strategic level plan for managing and controlling IT projects A template for initiating, planning, & developing an information system Recommends in support of an IT project: phases deliverables processes tools knowledge areas Must be flexible and include best “practices” learned from experiences over time Phases Phase 1: Conceptualize and Initialize Phase 2: Develop the Project Charter and Detailed Project Plan defined in terms of project’s: scope schedule budget quality objectives Phases continued Phase 3: Execute and Control the Project using approach such as the SDLC . Phase 4: Close Project Phase 5: Evaluate Project Success Post mortem by project manager and team of entire project Evaluation of team members by project manager Outside evaluation of project, project leader, and team members Evaluate project’s organizational value IT Project Management Foundation Project Management Processes Initiating processes Planning processes Executing processes Controlling processes Closing processes Project Objectives IT Project Management Foundation Tools - e.g. CASE Infrastructure Organizational Infrastructure Project Infrastructure Project Environment Roles and Responsibilities of team members Processes and Controls Technical Infrastructure Project Management Knowledge Areas The Business Case Definition of Business Case: an analysis of the organizational value, feasibility, costs, benefits, and risks of the project plan. Attributes of a Good Business Case Details all possible impacts, costs, benefits Clearly compares alternatives Objectively includes all pertinent information Systematic in terms of summarizing findings Principles of Cost Management Most CEOs and boards know a lot more about finance than IT, so IT project managers must speak their language Profits are revenues minus expenses Life cycle costing is estimating the cost of a project plus the maintenance costs of the products it produces Cash flow analysis is determining the estimated annual costs and benefits for a project Benefits and costs can be tangible or intangible, direct or indirect Sunk cost should not be a criteria in project selection Cost of Software Defects When Defect is Detected User Requirements Coding/Unit Testing System Testing Acceptance Testing After Implementation Typical Cost of Correction $100-$1,000 $1,000 or more $7,000 - $8,000 $1,000 - $100,000 Up to millions of dollars It is important to spend money up-front on IT projects to avoid spending a lot more later. Resource Planning The nature of the project and the organization will affect resource planning Some questions to consider: How difficult will it be to do specific tasks on the project? Is there anything unique in this project’s scope statement that will affect resources? What is the organization’s history in doing similar tasks? Does the organization have or can they acquire the people, equipment, and materials that are capable and available for performing the work? Cost Estimating An important output of project cost management is a cost estimate There are several types of cost estimates and tools and techniques to help create them It is also important to develop a cost management plan that describes how cost variances will be managed on the project Types of Cost Estimates Type of Estimate Rough Order of Magnitude (ROM) Budgetary Definitive When Done Why Done How Accurate Very early in the project life cycle, often 3–5 years before project completion Early, 1–2 years out Provides rough ballpark of cost for selection decisions –25%, +75% Puts dollars in the budget plans –10%, +25% Later in the project, < 1 year out Provides details for purchases, estimate actual costs –5%, +10% Cost Estimation Tools and Techniques 3 basic tools and techniques for cost estimates: analogous or top-down: use the actual cost of a previous, similar project as the basis for the new estimate bottom-up: estimate individual work items and sum them to get a total estimate parametric: use project characteristics in a mathematical model to estimate costs Problems with IT Cost Estimates Developing an estimate for a large software project is a complex task requiring significant effort. Estimates are done at various stages of the project Many people doing estimates have little experience doing them. Try to provide training and mentoring People have a bias toward underestimation. Review estimates and ask questions to make sure estimates are not biased Management wants a number for a bid, not a real estimate. Project managers must negotiate with project sponsors to create realistic cost estimates Cost Budgeting Cost budgeting involves allocating the project cost estimate to individual work items and providing a cost baseline Cost Control Project cost control includes monitoring cost performance ensuring that only appropriate project changes are included in a revised cost baseline informing project stakeholders of authorized changes to the project that will affect costs Earned value management is an important tool for cost control Earned Value Management (EVM) EVM is a project performance measurement technique that integrates scope, time, and cost data Given a baseline (original plan plus approved changes), you can determine how well the project is meeting its goals You must enter actual information periodically to use EVM. Earned Value Management Terms The planned value (PV), also called the budget, is that portion of the approved total cost estimate planned to be spent on an activity during a given period Actual cost (AC), is the total of direct and indirect costs incurred in accomplishing work on an activity during a given period The earned value (EV), is an estimate of the value of the physical work actually completed Earned Value Formulas Rules of Thumb for Earned Value Numbers Negative numbers for cost and schedule variance indicate problems in those areas. The project is costing more than planned or taking longer than planned CPI and SPI less than 100% indicate problems Process for Developing the Business Case Developing the Business Case Step 1: Select the Core Team with a goal of providing the following advantages: Credibility Alignment with organizational goals Access to the real costs Ownership Agreement Bridge building Developing the Business Case Step 2: Define Measurable Organizational Value (MOV) the project’s overall goal MOV must: be measurable provide value to the organization be agreed upon be verifiable Aligning the MOV with the organizational strategy and goals. The IT Value Chain Project Goal ? Install new hardware and software to improve our customer service to world class levels versus Respond to 95% of our customers’ inquiries within 90 seconds with less than 5% callbacks about the same problem. A Really Good Goal Our goal is to land a man on the moon and return him safely by the end of the decade. John F. Kennedy Steps to develop MOV MOV Step 1 - Identify the desired area of impact Strategic: increased market share Customer: more choices for products or services Financial: increased profits or margins Operational: increased operational effectiveness Social: education, health, safety, environment Steps to develop MOV MOV Step 2 - Identify the desired value of the IT project Better Faster Cheaper Do more Steps to develop MOV MOV Step 3 - Develop an Appropriate Metric • provide target • set expectations • enable success/failure determination • common metrics Money ($ £ ¥) Percentage (%) Numeric Values Steps to develop MOV MOV Step 4 - Set a time frame for Achieving MOV MOV Step 5 - Verify and Get Agreement from the Project Stakeholders MOV Step 6 - Summarize MOV in a Clear, Concise Statement or Table. Year 1 MOV 20% return on investment 500 new customers 2 25% return on investment 1,000 new customers 3 30% return on investment 1,500 new customers Developing the Business Case Step 3: Identify Alternatives Base Case Alternative Alternative Strategies Change existing process sans IT investment Adopt/Adapt systems from other organizational areas Reengineer Existing System Purchase off-the-shelf Applications package Custom Build New Solution Developing the Business Case Step 4: Define Feasibility and Asses Risk Economic feasibility Technical feasibility Organizational feasibility Other feasibilities Risk focus on Identification Assessment Response Developing the Business Case Step 5: Define Total Cost of Ownership Direct or Up-front costs Ongoing Costs Indirect Costs Step 6: Define Total Benefits of Ownership Increasing high-value work Improving accuracy and efficiency Improving decision-making Improving customer service Developing the Business Case Step 7: Analyze Alternatives using financial models and scoring models Payback Payback Period = Initial Investment / Net Cash Flow = $100,000 / $20,000 = 5 years Return on Investment Return on investment (ROI) is calculated by subtracting the project costs from the benefits and then dividing by the costs ROI = (total discounted benefits - total discounted costs) / discounted costs The higher the ROI, the better Many organizations have a required or minimum acceptable rate of return on an investment Internal rate of return (IRR) can by calculated by setting the NPV to zero Developing the Business Case Return on Investment Project ROI =(total expected benefits – total expected costs) total expected costs = ($115,000 - $100,000) $100,000 = 15% Net Present Value Analysis Net present value (NPV) analysis is a method of calculating the expected net monetary gain or loss from a project by discounting all expected future cash inflows and outflows to the present point in time Projects with a positive NPV should be considered if financial value is a key criterion The higher the NPV, the better NPV Calculations Determine estimated costs and benefits for the life of the project and the products it produces Determine the discount rate (check with your organization on what to use) Calculate the NPV (see text for details) Notes: Some organizations consider the investment year as year 0, while others start in year 1. Some people enter costs as negative numbers, while others do not. Check with your organization for their preferences. Developing the Business Case Net Present Value Year 0 Year 1 Year 2 Year 3 Year 4 Total Cash Inflows $0 $150,000 $200,000 $250,000 $300,000 Total Cash Outflows $200,000 $85,000 $125,000 $150,000 $200,000 Net Cash Flow ($200,000) $65,000 $75,000 $100,000 $100,000 NPV = -I0 + Σ (Net Cash Flow / (1 + r)t) Where: I = Total Cost or Investment of the Project r = discount rate t = time period Developing the Business Case Net Present Value Time Period Calculation Discounted Cash Flow Year 0 ($200,000) ($200,000) Year 1 $65,000/(1 + .08)1 $60,185 Year 2 $75,000/(1 + .08)2 $64,300 Year 3 $100,000/(1 + .08)3 $79,383 Year 4 $100,000/(1 + .08)4 $73,503 Net Present Value (NPV) $77,371 Developing the Business Case Step 8: Propose and Support the Recommendation Business Case Template Project Selection and Approval The IT Project Selection Process The Project Selection Decision IT project must map to organization goals IT project must provide verifiable MOV Selection should be based on diverse measures such as tangible and intangible costs and benefits various levels throughout the organization Balanced Scorecard Approach Reasons Balanced Scorecard Approach Might Fail Nonfinancial variables incorrectly identified as primary drivers Metrics not properly defined Goals for improvements negotiated not based on requirements No systematic way to map high-level goals Reliance on trial and error as a methodology No quantitative linkage between nonfinanacial and expected financial results MOV and the Organization’s Scorecard จบหัวขอ 2 คําถาม ………..