Disability Initiatives - Information Document

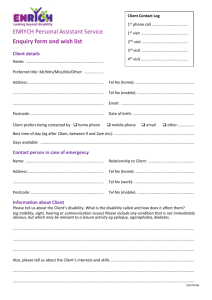

advertisement