Accounting Problems Study Guide September 2009

advertisement

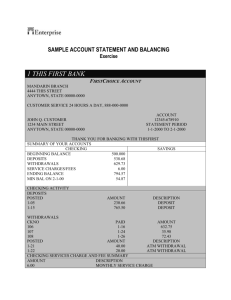

County of Yuba Accounting Problems Examination Study Guide The following study guide will familiarize and assist you with preparing for a written examination containing multiple-choice accounting practice items. The sample questions provided in this study guide are intended to give you an idea of the types of items you may encounter on the County examinations. However, it is important to note that actual test questions will vary in content and level of difficulty, depending on the job class being tested. For example, the Accounting Assistant (an entry-level classification) examination will ask questions of a lower difficulty level than the Accounting Specialist (an advanced journey-level classification) examination. To determine if the examination you are scheduled to take contains the content in this study guide, refer to the Invitation to Examination letter you have received. This letter will clearly state which subject areas are included on the examination. The Personnel Department recommends you also review the “Preparing for a Written Examination” guide available on our website for general tips and advice for preparing for and taking written examinations with Yuba County. If you have any questions or concerns regarding written examinations or the recruitment process, please contact the Personnel Department. About this Examination Guide: This guide contains a sample of the different types of questions that may be asked within this content area. None of the sample questions will be on the actual examination; however, the questions in this guide will be similar to the actual questions you will encounter. After each practice exam you will be given the correct answers to the questions and an explanation (if necessary) for why it is the best choice. You should carefully study each sample question to become familiar with questions of the same type on the examination. How to Use this Examination Guide: Read each question carefully. Then read all of the answer choices to each question before deciding which answer is correct. If you are having difficulty in determining the correct answer to a question, skip the question and come back to it later. It is to your advantage to answer each question even if you must guess. With a few exceptions (the exam proctor will be very clear if this is the case) there are no penalties for wrong answers. Your score is determined by the number of correct answers. After you complete each practice examination you should review the solutions page to determine areas for improvement. You may take the practice exams multiple times until you are familiar and comfortable with the format and content of the exam. Do not be discouraged if you are not able to answer some of the sample questions correctly. If you feel you need more practice than this study guide offers, the local library may have reference materials to help you or the Personnel department may be able to help you locate additional study guides on the Internet. 1 Practice Exam 1 DIRECTIONS: questions. 1. A discount of $25 was given on a purchase for a new hard drive. The amount due was $225. The discount rate was most nearly __ percent? a. b. c. d. 2. $25,000 $27,000 $20,000 $23,400 A boat valued at $50,000 was purchased with a $5,000 down payment and a 10% loan contract for the balance. The contract requires a monthly payment of $1,000. The purchase was made on January 1st, with the first payment due on January 31st. Of the $1,000 payment to be made on January 31st, how much will apply to the principal? (Use a 360-day year to compute interest). a. b. c. d. 5. 33 30 37 26 Cinthia purchases a house for its appraised value of $250,000 with $20,000 down payment. Assuming her loan is interest-only and at 8% and her sole additional expense is property taxes at 2% annually, what will her yearly expense be? a. b. c. d. 4. 10 11 90 5 A company had 12 clients in 2000, which increased to 21 clients in 2001. If the same percentage rate of increase continues, how many clients will the company have in 2002? a. b. c. d. 3. Darken the box corresponding to the single best answer for each of the following $625 $583 $375 $417 Jon Taylor makes $840 in gross wages. Out of these wages the auditor holds back $50 for insurance, resulting in a net pay of $714. What percentage of gross wages is Jon receiving as net pay? a. b. c. d. 70% 85% 6% 118% 2 Practice Exam 1 – Solutions 1. 2. 3. 4. 5. A. The total bill was $225 + $25 = $250. $25/$250 is 0.10 or 10 percent. C. The answer is 37. The rate of increase can be found by dividing the new total by the previous amount; 21 by 12. The rate of increase is thus 175%, represented by 1.75. To find the expected total for the next period you want to multiply the current total by the rate of increase, or 21 x 1.75. As the total is 36.75 and you cannot have a partial client you need to round up. D. The loan amount is found by subtracting $20,000 from $250,000, resulting in a loan of $230,000. To find the annual interest expense you will multiply the loan amount by the interest rate; $230,000 x 0.08, resulting in $18,400. The property taxes will be based on the entire home purchase amount, or $250,000. To find the annual expense you will multiply the purchase amount by the property tax rate; $250,000 by 0.02, resulting in $5,000. To find her total expense these values should be added together; $18,400 + $5,000 = $23,400. A. $625. The purchase was for $50,000 but the loan amount is the purchase price minus the deposit; $50,000 - $5,000 = $45,000. The yearly interest can be found by multiplying the loan amount by the interest rate; $45,000 x 0.10 = $4,500. To find the daily interest rate you will divide the yearly rate by the number of days in the year. The question has specified that you are to use a $360 day year; $4,500 / 360 = $12.50 a day. The day of the purchase will not be subject to interest, so from January 1st through January 31st there are 30 days, multiply the daily interest rate by the number of days to find the interest currently due on the loan; $12.50 x 30 days = $375. The payment made is for $1,000 less the interest accumulated on the loan; $1,000 - $375 = $625. B. 85%. To find the percentage of gross pay Jon is receiving in net pay, you need to divide the gross pay by the net pay amount; 714 / 840 = 0.85 or 85%. 3 Practice Exam 2 DIRECTIONS: The questions below are based on the information given on the chart below. TABULATION I consists of data that affect the capital account. Certain information has been inserted in each set of data reading horizontally. On each line, one or more numbers are missing. These blank spaces are identified by a number in parenthesis. Each question is also identified by a number in parenthesis that corresponds to the number in the blank spaces. You are to answer the questions by determining the correct entry for each blank. Capital at Beginning of Period $5,000 $15,000 (3) $12,000 $5,000 DIRECTIONS: 1. a. $1,000 b. $4,000 c. $2,000 d. $8,000 2. a. $12,000 b. $0 c. $3,000 d. $18,000 3. a. $8,000 b. $17,000 c. $23,000 d. $19,000 4. a. $8,000 b. $2,000 c. $3,000 d. $9,000 5. a. $9,000 b. $11,000 c. $7,000 d. $3,000 Net Profit $2,000 $6,000 $4,000 TABULATION I Net Loss Investments During Period (1) $3,000 $1,000 $2,000 (4) $2,000 $3,000 Withdrawals During Period (2) $2,000 Capital at End of Period $7,000 $15,000 $25,000 $9,000 (5) Answer the following questions based on the information given in the chart above. 4 Practice Exam 2 - Solutions 1. 2. 3. 4. 5. A. $1,000. The Capital at the Beginning of the period minus any net loss, plus the investments made during that period should equal the capital at the end of the period; thus $5,000 – x + $3,000 = $7,000, where x is the net loss. Solving for x gives you $1,000. C. $3,000. The Capital at the Beginning of the period plus any net profit, plus the investments made during that period minus any withdrawals for the same period should equal the capital at the end of the period; thus $15,000 + $2,000 + $1,000 – x = $15,000, where x is the withdrawals during the period. Solving for x gives you $3,000. B. $17,000. The Capital at the beginning of the period plus any net profit, plus the investments made during that period should equal the capital at the end of the period; thus x + $6,000 + $2,000 = $25,000, where x is the Capital at the beginning of the period. Solving for x gives you $17,000. B. $2,000. The Capital at the beginning of the period minus any net loss, plus the investments made during that period, minus any withdrawals for the same period should equal the capital at the end of the period; thus $12,000 - $3,000 + x - $2,000 = $9,000, where x is the investments during the period the period. Solving for x gives you $2,000. B. $11,000. The Capital at the beginning of the period plus any net profit, plus the investments made during that period should equal the capital at the end of the period; thus $5,000 + $4,000 + $2,000 = x, where x is the Capital at the end of the period. Solving for x gives you $11,000. 5 Practice Exam 3 DIRECTIONS: Answer the questions based on the chart below. The chart shows bank reconciliation information for five bank accounts, including beginning monthly balances, total checks written, current month deposits, checkbook balance, checks outstanding, and the bank statement balance. For each account, one of the entries is missing. These blank spaces are number (1) through (5). You are to answer the questions by determining the correct entry for each blank. (Assume that all current month deposits are shown on the bank statement). Account 10-300-4916 10-300-3619 20-500-4692 20-600-5001 1. Beginning Monthly Balances $352.53 (2) $728.64 $14.22 Total Checks Written $52.96 $322.17 (3) $352.12 Current Month Deposits $928.37 $125.96 $2,346.03 (4) Checkbook Balance Checks Outstanding (1) $17.25 $1,296.38 $952.73 $24.92 $16.00 $326.42 $100.00 The checkbook balance in space (1) should be a. $1,333.86 b. $1,280.90 c. $1,227.94 d. $299.57 2. The beginning monthly balance in space (2) should be a. $213.46 b. $108.71 c. $339.42 d. $212.21 3. The total checks written balance in space (3) should be a. $1,049.65 b. $1,778.29 c. $567.74 d. $3,968.83 4. The current month deposits balance in space (4) should be a. $1,290.63 b. $1,277.85 c. $938.51 d. $614.83 5. The bank statement balance in space (5) should be a. $852.73 b. $938.51 c. $952.73 d. $1,052.73 6 Bank Statement Balance $1252.86 $33.25 $1,622.80 (5) Practice Exam 3 - Solutions 1. 2. 3. 4. 5. C. $1,227.94. To find the checkbook balance you will need to take the beginning monthly balance and subtract the total checks written and add the current month deposits; $352.53 - $52.96 + $928.37 = $1,227.94 A. $213.46. To find the beginning monthly balance you will need to reverse engineer the checkbook ledger which is accomplished by starting with the checkbook balance, subtracting any deposits that were made (as they had not occurred at the beginning of the checkbook period) and adding back in any checks that were written (as they had not been written yet); $17.25 + $322.17 - $125.96 = $213.46 B. $1,778.29. To find the total checks written you will need to start with the beginning monthly balance and add the current month deposits (to find the new balance before the checks were written) and then subtract the checkbook balance (the difference between what you should have and actually have represents the checks that were written on the account); $728.64 + $2346.03 -$1296.38 = $1778.29. A. $1,290.63. To find the current month deposits you will need to start with the ending checkbook balance and compare with the beginning monthly balance and total checks written; take the ending checkbook balance and add in the total checks written and subtract the beginning monthly balance; $952.73 + $352.12 - $14.22 = $1,290.63 D. $1,052.73. To find the bank statement balance you will need to account for the checks outstanding, which represent an obligation that has not been reflected on the account. To do this you begin with the checkbook balance, which is an accurate reflection of the account balance, and add in the checks outstanding; $952.73 + $100.00 = $1,052.73. 7 Practice Exam 4 DIRECTIONS: Include below is a chart representing the allocation of various expenses among the five departments of the Health and Human Services Department. Choose one answer to each question based upon the allocation chart below. Division Admin Eligibility Child Welfare Public Health Payroll Allocation 12% 34% 27% 27% Rent 10% 38% 30% 22% Supplies 27% 17% 18% 38% General 18% 28% 27% 27% 1. What amount of supplies expense is allocated to the Public Health Division if the total supply expense is $9,800? a. $3,724 b. $372.40 c. $1,764 d. $2,646 2. How much more does the Eligibility Division pay in rent than the Admin Division if the total rent expense is $150,000? a. $15,000 b. $72,000 c. $57,000 d. $42,000 3. How much do the Child Welfare and Public Health Division pay combined in payroll allocation if the total payroll expense is $2,500,000? a. $675,000 b. $1,350,000 c. $1,525,000 d. $2,025,000 4. How much more does the Eligibility Division pay in payroll allocation than it does in general expenses if the total payroll expense is $2,500,000 and the total general expense is $500,000? a. $150,000 b. $710,000 c. $30,000 d. $990,000 5. If the Child Welfare Division is spending $5,850 on supplies what is the total supply expense budget? a. $29,250 b. $10,647 c. $32,500 d. $7,134 8 Practice Exam 4 - Solutions 1. 2. 3. 4. 5. A. $3,724. To find the supplies expense allocated to the Public Health Division you need to look up on the chart where “Supplies” and “Public Health” meet, 38%. The total expense for supplies is $9,800. To find the portion for Public Health you will multiply the total expense by the 38% allocated to Public Health; $9,800 x 0.38 = $3,724. D. $42,000. To find the rent expense allocated to the Admin and Eligibility Divisions you need to look up on the chart where “Rent” and “Eligibility” meet, 38%, and where “Rent” and “Admin” meet, 10%. The different between the two is 38% - 10% = 28%. You will multiply the total rent expense by the difference between the Eligibility and Admin allocations; $150,000 x .28 = $42,000. B. $1,350,000. To find the payroll allocated to the Child Welfare and Public Health Divisions you need to look up on the chart where “Payroll Allocation” and “Child Welfare” meet, 27%, and where “Payroll Allocation” and “Public Health” meet, 27%. The statement ‘combined’ means we are looking for the sum of the two, so we should add them together; 27% + 27% = 54%. You will multiply the total payroll allocation by the sum of the Child Welfare and Public Health Divisions allocations to find the answer; $2,500,000 x .54 = $1,350,000. B. $710,000. To find the appropriate allocations for the Eligibility Division you need to look up on the chart where “Eligibility” and “Payroll Allocation” meet, 34%, and where “Eligibility” and “General” meet, 28%. To find the difference between the two expenses you will want to first calculate the appropriate expenses for each and then subtract them to find the difference; $2,500,000 x .34 = $850,000 and $500,000 x .28 = $140,000 and then $850,000 - $140,000 = $710,000. C. $32,500. To find the total supply expense you first need to look up the percentage of the budget that is allocated to Child Welfare, which is found on the chart where “Child Welfare” and “Supplies” meet, 18%. We know that the Child Welfare Division is spending $5,850 on supplies, which accounts for 18% of the budget. To determine the entire supply expense you divide the Child Welfare Division individual expense by the allocation percentage; $5,850 / .18 = $32,500. 9