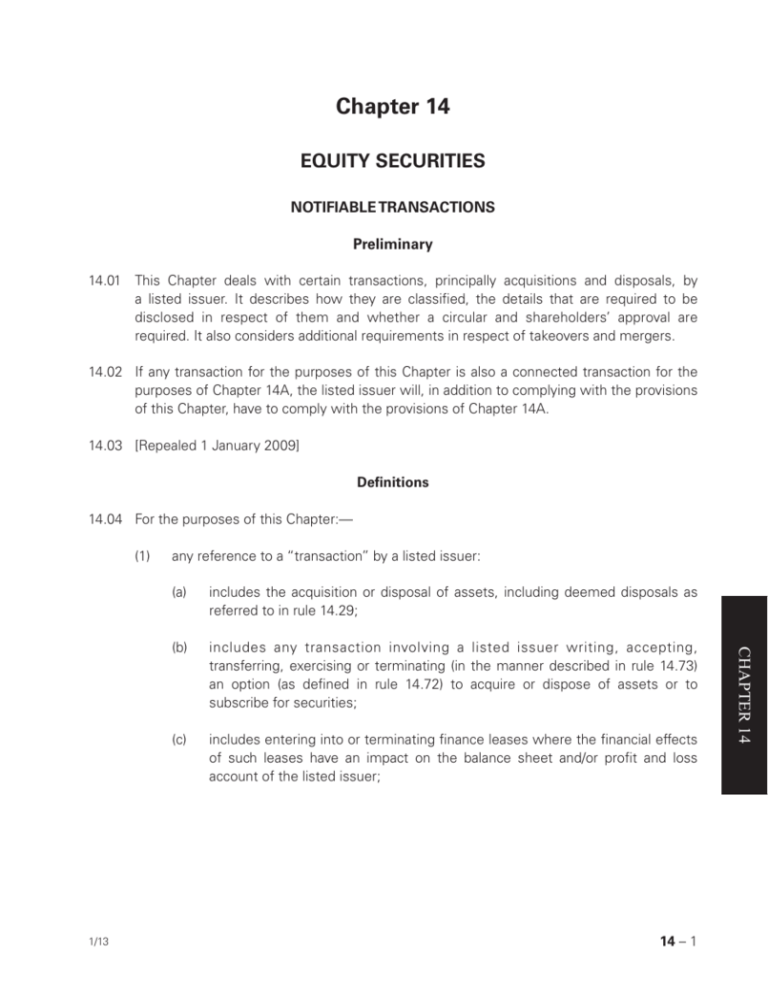

Chapter 14

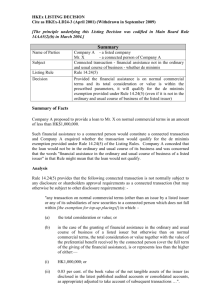

advertisement