Solutions - Accounting & Finance Student Association

advertisement

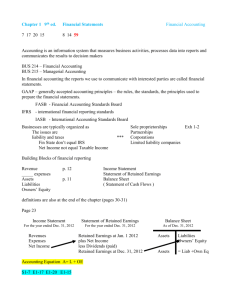

Midterm Fall 2012 Solution Instructions: 1) Answers for the multiple-choice questions must be recorded on the UW answer card. All other questions must be answered in the space provided on the examination paper. Answers written outside of the provided space will not be graded. You must submit both this examination paper and the UW answer card. 2) Show details of all calculations. 3) The final page of the examination contains a list of ratios. For your convenience, this page may be detached from the examination paper. Additional Materials Allowed: 1) Cordless calculators may be used. The calculator must be standalone with no other communication or data storage features Marking Scheme: Question 1 2 3 4 5 Total Maximum Marks 16 16 20 8 25 85 Score Question 1 (16 marks) The Brisley Bagel Bin is a local shop known for its delicious bagels, coffee, and other breakfast and dessert items. Brisley Bagel operates a shop in the university area and also provides delivery service to local businesses. The fiscal year end is December 31.The account balances from the statement of financial position on December 31, 2011, are as follows: Cash Trade Receivables Inventory Delivery Truck Accumulated Depreciation - Truck Furniture, Fixtures & Equipment $12,700 16,100 55,600 39,000 (32,000) 92,800 Trade Payables Deferred Revenues (deposits) Utilities Payable (for Dec. 2011) Note Payable (due in 4 years) Common Shares Retained Earnings $21,200 17,750 500 30,000 60,000 54,750 Required: Provide the journal entries required to record the following transactions that occurred in January 2012. You do not need to include explanations. Answers must appear in the space provided. A) The company purchased flour and other raw material inventory for $35,000 on account. Brisley expects to pay the suppliers in February. Inventory Trade Payables $35,000 $35,000 B) Brisley sold the delivery truck for $5,000 cash. Cash Accumulated Depreciation – Truck Loss on Sale of Truck Delivery Truck $5,000 32,000 2,000 $39,000 C) The shop paid $2,000 in dividends to the owner. Retained Earnings / Dividend Cash $2,000 $2,000 D) The company purchased a new delivery truck for $43,000. The company paid $10,000 cash for the new truck and received a loan from the bank for the remainder of the purchase price. Delivery Truck Cash Bank Loan $43,000 $10,000 33,000 E) The outstanding utilities bill from December 2011 was paid. Utilities Payable Cash $500 $500 F) Brisley Bagel Bin delivered products worth $4,400 to local businesses during January that had been paid for in advance. Deferred Revenues / Unearned Revenues Revenue $4,400 $4,400 G) Brisley Bagel Bin paid interest for the month of January on the outstanding note. The interest rate is 12% per year. Interest Expense Cash $300 $300 $30,000 * 12% 1/12 = $300 Question 2 (16 marks) Webb Fit operates a fitness club which is open every day of the year for its members. The fiscal year end is December 31. The unadjusted trial balance has been prepared but no adjusting entries have been prepared. Required: Provide the adjusting entries required at December 31, 2012. You do not need to include explanations. Answers must appear in the space provided. A) Webb Fit purchased advertising in local media on December 1. The contract cost $8,000 and provides advertising for December 2012 to March 2013. Advertising Expense Prepaid Advertising $2,000 $2,000 B) Webb Fit borrowed $65,000 on September 1, 2012, to renovate the fitness club. The interest rate is 6% per year and interest must be paid every 6 months until the load is repaid on August 31, 2014. Interest Expense Interest Payable $65,000 * 6% * 4/12 = $1,300 $1,300 $1,300 C) Most members of the fitness club pay their fees in advance to take advantage of discounts for prepayment. The current balance in the Deferred Revenues (Membership Fees) account is $75,800. A review of membership records shows that the ending balance at December 31 should be $61,250. Deferred Revenues (Memberships Fees) Revenue $75,800 - $61,250 = $14,550 $14,550 $14,550 D) The fitness equipment was purchased on July 1, 2010, at a cost of $120,000. It has an estimated life of 4 years with an expected residual value of $5,000. The company uses straight-line depreciation. Depreciation Expense $28,750 Accumulated Depreciation ($120,000 – 5,000) / 4 years = $28,750 $28,750 E) Employee salaries are paid biweekly on Fridays. The total salaries for the two week (14 day) period ending on Friday, January 4, 2013, are $17,500. Salaries Expense Salaries Payable $17,500 * 10/14 = $12,500 $12,500 $12,500 F) The telephone bill of $425 for December has not been recorded. Telephone Expense Telephone Charges Payable $425 $425 G) Income before calculation of income tax expense was $176,500. The income tax rate is 30%. Income Tax Expense Income Tax Payable $176,500 * 30% = $52,950 $52,950 $52,950 Question 3 (20 marks) The Balance Sheet and Income Statement for Berberich Limited are shown below: Comparative Balance Sheet Cash Trade receivable Inventories Land Long term investment Equipment Accumulated depreciation, equipment Total assets December 31 2012 2011 $97,600 $25,000 58,800 66,000 83,200 75,000 400,000 0 0 88,000 480,000 425,000 (210,000) (212,000) $909,600 $467,000 Liabilities and Shareholders’ Equity Trade payable Interest payable Bonds payable Mortgage payable Common shares Retained earnings Total liabilities and shareholders’ equity $57,700 2,900 95,000 400,000 150,000 204,000 $909,600 Assets Income Statement For the Year Ended December 31, 2012 Revenues (including gains) Cost of goods sold $656,700 Depreciation expense 39,000 Interest expense 8,800 Other expenses (including losses) 42,000 Net income $49,000 4,500 110,000 0 120,000 183,500 $467,000 $787,000 746,500 $40,500 The following additional information relates to 2012: a) Dividends were paid in cash. b) The company purchased the land on September 1. The company paid for the land by giving the seller a mortgage for the full amount. c) Sold the long-term investment on June 1 for $80,100. d) Sold equipment on February 15 for $54,000 that had originally cost $80,000 and had $41,000 of accumulated amortization. e) Issued $60,000 of bonds payable at face value on April 30. f) Purchased equipment for $135,000 cash on October 31. Required: Prepare the statement of cash flows for the Berberich Company for 2012 using the indirect method. Please use the following table to complete this question. Berberich Company Statement of Cash Flows For the Year Ended December 31, 2012 Operating Activities: Net income________________ ____$40,500 Add (deduct) items not affecting cash __________ Depreciation expense_______ _____39,000 Gain on sale of equipment___ ___(15,000) Loss on sale of investment___ ______7,900 Decrease in accounts receivable ______7,200 Increase in inventories______ _____(8,200) Increase in accounts payable_ ______8,700 Decrease in interest payable__ _____(1,600) Net cash flow from operating activities ___$78,500 Investing Activities: Sale of equipment__________ ____$54,000 Purchase of equipment______ __(135,000) Sale of long term investment_ ____80,100 _________________________ __________ Net cash flow from investing activities ______(900) Financing Activities Payment of dividends_______ __($20,000) Issue of bonds payable______ ____60,000 Repayment of bonds payable_ ___(75,000) Issue capital stock_________ ____30,000 Net cash flow from financing activities _____(5,000) Net increase in cash________ ____$72,600 Cash balance on December 31, 2011 ____$25,000 Cash balance on December 31, 2012 ____$97,600 Non-cash Investing and Financing Activities Purchase of land costing $400,000 financed with a mortgage _________________________ Question 4 (8 marks) The answers to the following questions must appear in the space provided. Responses can be in point form. A. The article “The Lowdown on Salesforce Bottom Line” alleges that the company (Salesforce.com) is making aggressive accounting choices. Discuss the concept of aggressive accounting. • • When flexibility exists in IFRS: o Recognizing as much revenue as possible and as soon as possible o Delaying the recording of expenses as long as possible o Shift income from one period to another The opposite of conservatism, where conservatism is defined as: o Recognizing expenses as soon as possible, even when uncertainty exists about the outcome o Recognizing revenues only when they are assured of being received B. The article “Playing by the Rules” discusses earnings management. Discuss reasons why a manager would want to manipulate earnings. • • • • • • • Meet analysts’ or managers’ earnings expectations Increase the manager’s compensation if his compensation contract is based on earnings numbers or stock prices Meet debt covenants that are based on earnings Reduce interest rates charged on debt by showing a stable pattern of earnings Lower tax expense Increase investor and/or creditor confidence in financial statements Appear more attractive relative to competitors C. The article “Informative or Misleading” discusses the use of non-GAAP earnings measures. Discuss reasons why a manager would report a non-GAAP earnings measure. • • Manage investor expectations / mislead investors o Use the non-GAAP earnings measure to help exceed analyst earnings forecasts o Compensate for negative earnings surprises o Focus attention away from a GAAP loss and towards a pro forma profit Provide additional value relevant information to investors o Highlight non-recurring events D. Discuss the role of the financial analyst in the accounting communication process. • • • Gather & evaluate information about publicly traded companies Leads to reports evaluating companies and forecasting future earnings Provide recommendations to investors about potential investments Question 5 (25 marks) Choose the correct response from the answers provided. There is no mark penalty for incorrect responses. Mark the correct responses by completing the University of Waterloo answer card, using a black lead HB pencil only. Write your name and student number on the answer card and mark your student number in the appropriate ovals. You do not need to complete the section number and card number. Answers recorded on the following pages will not be marked. 1. Lori Company sold an operational asset, a machine, for cash. It originally cost $20,000. The accumulated depreciation at the date of disposal was $15,000. A gain on the disposal of $2,000 was reported. What was the cash inflow from this transaction? A. $3,000. B. $4,000. C. $5,000. D. $7,000. 2. The relationship between current assets and current liabilities is important in evaluating a company's A. profitability. B. liquidity. C. fair value. D. solvency. 3. Toga Corporation reported profit of $50,000 for the year. During the year, trade receivables increased by $8,000, trade payables decreased by $4,000 and depreciation expense of $6,000 was recorded. Net cash provided by operating activities for the year, using the indirect method, is A. $54,000. B. $44,000. C. $56,000. D. $50,000. 4. During the accounting period, Luxor Company had the following data: Sale of products: For cash $70,000 On credit (not yet received) $10,000 Expenses incurred: Paid in cash $35,000 On credit (not yet paid) $3,000 This is the first year of business. What were the sales revenue and expenses? Sales Revenue Expenses A. $60,000 $32,000 B. $70,000 $35,000 C. $80,000 $35,000 D. $80,000 $38,000 5. At the end of its accounting period, December 31, 2012, May Corporation owed $1,000 for property taxes which had not been recorded nor paid. Therefore, the 2012 adjusting entry should be which of the following? A. $1,000 credited to an expense account and debited to a liability account. B. $1,000 debited to an expense account and credited to an asset account. C. $1,000 credited to a liability account and debited to an expense account. D. $1,000 debited to a liability account and credited to an asset account. 6. As prepaid expenses expire with the passage of time, the correct adjusting entry will be a A. debit to an expense account and a credit to an asset account. B. debit to an asset account and a credit to an asset account. C. debit to an expense account and a credit to an expense account. D. debit to an asset account and a credit to an expense account. 7. At the beginning of 2012, Down Company had office supplies inventory of $400. During 2012, the company purchased office supplies amounting to $2,500 (paid for in cash and debited to office supplies inventory). At December 31, 2012 (end of the accounting year), a count of office supplies on hand reflected $300 worth of supplies inventory remaining. Therefore, the adjusting entry should include which of the following? A. credit to office supplies inventory of $2,400. B. credit to office supplies inventory of $2,500. C. debit to supplies expense of $2,500. D. debit to supplies expense of $2,600. 8. If a loss of $20,000 is incurred in selling (for cash) office equipment that cost $90,000 and had accumulated depreciation of $22,500, the total amount reported in the investing activities section of the statement of cash flows is A. $70,000. B. $67,500. C. $47,500. D. $87,500. 9. Typical financing activities do NOT include the following: A. Proceeds from issuance of short- and long-term borrowings. B. Principal payments on short- and long-term borrowings. C. Purchase of short- or long-term investments for cash. D. Purchase of shares for retirement. 10. On December 31, 2012, Ted Corporation paid $2,000 for next year's insurance coverage. How should this transaction be recorded by Ted Corporation? A. B. C. D. Insurance Expense Insurance Payable Prepaid Insurance Insurance Payable Cash Retained Earnings Prepaid Insurance Cash $2,000 $2,000 $2,000 $2,000 $2,000 $2,000 $2,000 $2,000 11. To prepare a statement of cash flows (indirect method), which of the following items should be added back to profit to derive "cash flow from operating activities"? A. Loss on a sale of equipment. B. Increase in trade receivables. C. Gain on a sale of equipment. D. Decrease in trade payables. 12. On April 1, 2012, Allen Company signed a $12,000, one-year, 10 percent note payable. At due date, April 1, 2013, the principal and interest will be paid. Interest expense should be reported on the income statement (for the year ended December 31, 2012) as which of the following? A. $700. B. $800. C. $900. D. $1,200. 13. Cash receipts from customers are greater than sales revenues when there is a(n) A. increase in cost of goods sold B. decrease in cost of goods sold C. increase in trade receivables D. decrease in trade receivables 14. On September 1, 2012, Beta Company purchased a two-year fire insurance policy on their building and equipment. The policy cost $4,800 and was paid in cash. For the year ended December 31, 2012, the income statement for 2012, would report which of the following? A. Insurance expense, $0. B. Insurance expense, $800. C. Insurance expense, $2,400. D. Insurance expense, $4,800. 15. What are current liabilities? A. obligations which are incurred during the past year. B. debts at the statement of financial position date which must be paid within two years. C. debts at the statement of financial position date which are expected to be paid with the current assets listed on the same statement of financial position. D. trade payables and bonds payable. 16. The category that is generally considered to be the best measure of a company's ability to continue as a going concern is A. cash flows from investing activities. B. cash flows from operating activities. C. cash flows from financing activities. D. usually different from year to year. 17. Adherence to the same accounting principles from year to year is an example of the characteristic of A. relevance. B. faithful representation. C. understandability. D. comparability. 18. If total liabilities decreased by $14,000 during a period of time and shareholders' equity increased by $6,000 during the same period, then the amount and direction (increase or decrease) of the period's change in total assets is a(n) A. $20,000 increase. B. $8,000 decrease. C. $8,000 increase. D. $14,000 increase. 19. Winsome Inc. reports total assets and total liabilities of $225,000 and $100,000, respectively, at the conclusion of its first year of business. The company earned $75,000 during the first year and distributed $30,000 in dividends. What was the corporation's share capital? A. $125,000 B. $95,000 C. $80,000 D. $50,000 20. In the years 2005-2008, B Co.'s capital acquisitions ratio was 2.74 and from 2009-2012, it was 1.24. From 2009-2012, R Co.'s ratio was .30. Which of the following statements about the capital acquisitions ratio is potentially correct? A. B Co.'s capital acquisitions ratio is relatively low and indicates inability to finance property, plant and equipment with cash flow from operations. B. It appears that R Co. is more aggressive about investing in additional property, plant and equipment than is B Co. C. B Co.'s ratio has improved in the period 2009-2012. D. It appears that B Co. is more aggressive about investing in additional property, plant and equipment than is R Co. 21. During 2012, Blue Corporation incurred operating expenses amounting to $100,000, of which $75,000 were paid in cash; the balance will be paid in January 2013. Transaction analysis of operating expenses for 2012, should reflect which of the following? A. decrease shareholders' equity, $75,000; decrease assets, $75,000. B. decrease assets, $100,000; decrease shareholders' equity, $100,000. C. decrease assets, $100,000; increase liabilities, $25,000; decrease shareholders' equity, $100,000. D. decrease shareholders' equity, $100,000; decrease assets, $75,000; increase liabilities, $25,000. 22. On January 1, 2012, Virginia Company had $22,000 of Retained Earnings. During 2012 Virginia earned profit of $40,000 and declared and paid dividends of $20,000. In addition, the company received cash of $15,000 as an additional investment by its owners. What is the ending balance in Retained Earnings at December 31, 2012? A. $32,000. B. $42,000. C. $57,000. D. $67,000. 23. At the end of 2012, the following data were taken from the accounts of Timberline Company: Share capital Retained earnings, beginning balance January 1, 2012 Total revenue earned during 2012 Total expenses incurred during 2012 Total cash collected during 2012 $209,000 100,000 190,000 180,000 200,000 The 2012 closing entries would include which of the following? A. $10,000 net credit to retained earnings. B. $10,000 net debit to retained earnings. C. $190,000 debit to retained earnings. D. $180,000 credit to retained earnings. 24. Abe Cox is the sole owner and manager of Cox Auto Repair Shop. In 2012, Cox purchased a new automobile for personal use and continued to use an old truck in the business. Which of the following fundamentals prevents Cox from recording the cost of the new automobile as an asset to the business? A. Separate-entity assumption. B. Revenue principle. C. Full disclosure. D. Cost principle. 25. The statement of cash flows (indirect method) reports depreciation expense as an addition to profit because depreciation does which of the following? A. causes an inflow of funds for the replacement of assets. B. reduces reported profit of the period but does not involve an outflow of cash for that period. C. is a direct use of cash. D. reduces reported profit and causes an inflow of cash. Ratios Price-Earnings Ratio Market Price per Share Earnings per Share Debt to Equity Ratio Total Liabilities Total Shareholders’ Equity Total Asset Turnover Ratio Return on Assets _____Sales_____ Average Total Assets ____Profit + Interest Expense (net of tax)____ Average Total Assets Earnings per Share __Profit Available to Common Shareholders__ Average Number of Common Shares Outstanding Net Profit Margin _Profit_ Net Sales Return on Equity ________Profit________ Average Shareholders’ Equity Quality of Income Ratio __Cash Flow from Operating Activities__ Profit Capital Acquisition Ratio ____Cash Flow from Operating Activities____ Cash Paid for Property, Plant, and Equipment Answer Key for Multiple Choice Questions 1. D 2. B 3. B 4. D 5. C 6. A 7. D 8. C 9. C 10. D 11. A 12. C 13. D 14. B 15. C 16. B 17. D 18. B 19. C 20. B 21. D 22. B 23. A 24. A 25. B