DRI - Mark E. Moore

advertisement

An Equity Valuation and Analysis of

As of June 1, 2007

Ashley Boaz

a.boaz@yahoo.com

Kristie Lee

kristie.lee@ttu.edu

Robert Tabb

robert.tabb@ttu.edu

Nick Traweek

nick@traweek.net

Robert Durrant

michael.durrant@ttu.edu

Table of Contents

Executive Summary……………………………………………………………..…………….3

Industry Analysis……………………………………………………………………………….4

Accounting Analysis……………………………………………………………………………4

Financial Analysis Forecast Financials and Cost of Capital Estimation…..….6

Valuations…………………………………………………………………………………………6

Industry Analysis……………………………………………………………………………….8

Company Overview………………………………………………………………………..….8

Five Forces Model…………………………………………………………………………….10

Rivalry Among Existing Firms…………………………………………………………….10

Threat of New Entrants………………………………………………………………..…..13

Threat of Substitute Products………………………………………………………..….15

Bargaining Power of Buyers………………………………………………………….…..16

Bargaining Power of Suppliers…………………………………………………………..16

Value Chain Analysis…………………………………………………………………………17

Firm Competitive Advantage Analysis……………………………………….………..18

Accounting Analysis………………………………………………………………………….21

Key Accounting Policies…………………………………………….………………………21

Areas of Accounting Flexibility……………………………………………………….....23

Quality of Disclosure…………………………………………………………………………25

Potential Red Flags…………………………………………………………………………..43

Fixing Accounting Distortions…………………………………………………………….44

Financial Analysis Forecast Financials and Cost of Capital Estimation…….45

Liquidity Analysis……………………………………………………………………………..45

Profitability Analysis…………………………………………………………………………55

Capital Structure Analysis………………………………………………………………….64

Extended Ratio Analysis……………………………………………………………………68

Forecasting Analysis…………………………………………………………………………72

Cost of Capital Estimation…………………………………………………………………80

Weighted Average Cost of Capital……………………………………………………..83

Method of Comparables……………………………………………………………………85

Other Method of Comparables…………………………………………………………..90

Intrinsic Valuation Models…………………………………………………………………92

2

Credit Risk Analysis…………………………………………………………………..99

Analyst Recommendation…………………………………………………………100

Appendix………………………………………………………………………………..102

Works Cited……………………………………………………………………………119

3

Executive Summary

Investment Recommendation as of 6/1/07: Overvalued, Sell

DRI trading Price 6/1/07: $45.80

52 Week Range: $32.91- $47.60

Revenue (5/28/06): $5,720,640,000

Market Capitalization: $6.09 B

Shares Outstanding: 146,998

3-Month Avg. Daily Trading Volume:1,399,270

Percent Institutional Ownership: 81.84%

Book Value Per Share: $1.29

ROE: .266

ROA: .115

Cost Of Capital Est.

Estimated

3-Month

11.64

6-Month

2 Year

13.63

5 Year

13.58

10 Year

13.58

Kd: 6.4%

WACC: 10.57%

R2

.068

Beta

.98

.9821

Ke

11.29

.059

.06

.1.266

1.259

13.60

.059

1.254

.0588

1.258

Altman Z-Score

2002 2003 2004

9.44

17.64

7.82

Moneycentral.msn.com

2005

23.04

EPS Forecast

2007 2008 2009 2010 2011 2012

3.08

3.59

4.18

4.86

5.66

6.59

Ratio Comparison DRI

EAT APPB

Trailing P/E

18.79 17.38 30.13

Forward P/E

16.11 16.02 19.09

PEG

1.52

1.19 1.77

P/B

5.43

3.47

3.81

Valuation Estimates

Actual Price (6/1/07): 45.80

Ratio Based Evaluations

Trailing P/E:

$57.89

Forward P/E:

$52.74

PEG:

$24.92

P/B:

$29.51

P/EBITDA:

$69.02

P/FCF:

$98.3

EV/EBITDA:

$43.07

Intrinsic Valuations

Discounted Dividends:

Residual Income:

LR ROE:

Free Cash Flows:

AEG:

$6.29

$39.23

$35.63

$9.79

$61.14

2006

23.58

Moneycentral.msn.com

4

Industry Analysis

“Darden Restaurants, Inc. is the largest publicly held casual dining

restaurant company in the world.” (Darden 2006 10-K) Darden operates in the

specialty foods dining industry. They target consumers that are looking for high

quality prepared foods with high quality service and atmosphere. In May of

1995, Darden became a publicly traded company. Based out of Florida, the firm

currently has approximately 1400 restaurants and are opening an average of

about 54 stores per year. Darden is constantly growing, having a record setting

year in 2006 for sales, earnings and share price.

Direct competitors of Darden include Applebee’s, Brinker, The Cheesecake

Factory, OSI Restaurant Partners, and Texas Roadhouse. During the authoring

of this report, OSI Restaurant Partners became a privately owned company

which cannot be monitored on the stock exchange. Therefore there is not

sufficient information to completely compare them to Darden.

The specialty foods dining industry is a market that thrives on

differentiation of product and specialization. There is a low threat of new

entrants into the industry, but the threat of substitute products is a moderate

factor in sales. The customer has a moderate amount of bargaining power with

regards to price since there is a large amount of possible substitute products.

Not only could the consumer easily switch to another restaurant in the specialty

dining industry, but they also have other choices, such as cooking food

themselves or paying less to eat at a restaurant with low differentiation among

products (i.e. fast food restaurants). Threats to business and competition have

many forms in multiple industries for Darden Restaurants Inc.

Accounting Analysis

A key factor in valuing any firm is its accounting methods. To effectively

evaluate Darden, we had to take into account their accounting practices and

relate them back to their key success factors. The SEC allows a great deal of

5

flexibility in accounting, so reporting across firms in Darden’s industry may be

difficult to compare.

A main accounting policy that is taken into account is their pension

plans. Darden uses a defined benefit plan to attract and keep high quality

employees. Since defined benefit plans are considered high risk to the company,

this should be a concern of the company. They are liable for future costs of

these pension plans. Darden has planned for these costs, however, with a very

reasonable estimated growth rate of 9%.

Inventory is one area of accounting that has much flexibility. Darden

must keep customers happy by absorbing the cost of bad meals and spoilage.

Their financial statements do not make it clear in any way how much is written

off from these comped meals and spoilage of food. Although the costs may be

lumped with other liabilities, this shows a low level of disclosure for the

company’s financial statements.

Land leases are another concern in Darden’s accounting practices.

Darden records their leases as operating leases instead of capital leases. This

allows them to have no effect on assets or liabilities, which can understate both

of these sections of the balance sheet and can cover up future obligations.

Darden is clear in stating their future lease obligations in their financial reports

even though they use operating leases.

The amount of transparency that Darden’s financial statements have help

to show a true value of the company. Even though they do not break everything

down completely to show as much information as possible, they further discuss

all sections to adequately convey important information.

Processing of Darden’s accounting policies can identify “red flags” for the

company. Although no major red flags were found for Darden, some small

issues are considered later in the report.

6

Financial Analysis, Forecast Financials and Cost of Capital Estimation

To value a firm, all future performance must be taken into account. After

all, a company’s stock price in the future depends on it’s performance in the

future. To take this into account, several ratios were first calculated to show the

past performance of Darden and several of its competitors. After assessing past

performance based on these ratios, we used them to forecast financial

statements for Darden for the next ten years. We then estimated a beta for the

company, calculated the cost of equity and debt, and finally computed Darden’s

cost of capital using the Weighted Average Cost of Capital method.

Our ratio analysis revealed that Applebee’s is at the top of the industry for

liquidity. Darden has the best accounts receivable turnover, showing that the

company collects on its receivables quicker than its competitors. In general, the

liquidity ratios computed are slightly favorable for Darden. The profitability ratios

that were computed showed that the net profit margin for Darden is about

average for the industry. Gross profit margin was extremely low, which could

indicate value in the company that is not recognized. Capital structure ratios

showed bad trends for Darden in general. Their debt to equity, times interest

earned and debt service margin are all on the low side of the industry. In short,

their current capital structure is inferior compared to the rest of the industry.

We used the ratios we computed to forecast Darden’s financial statements

for the next ten years. We forecasted the income statement based off of the

past sales of the company. This growth rate was 8.4%. We used the asset

turnover ratio as a base for forecasting the balance sheet. We then used other

ratios and growth rates to forecast the rest of the balance sheet and statement

of cash flows.

Valuations

Once we evaluated the three major aspects of the firm that give it value,

we used several models to calculate the value of the company’s share price. We

7

used the method of comparables and five intrinsic valuation models to valuate

the company’s share price.

The method of comparables used information from several firms in the

industry to value the company. We took statistics from each company to get

industry averages for several different ratios. We then used the industry average

to estimate Darden’s share price. These ratios included Forward and trailing

price to earnings, Price to Book Value and the PEG ratio among others. These

valuations showed that Darden is slightly overvalued. These valuations are not

as reliable as the intrinsic valuations, though.

The formulas for the intrinsic valuations are based on financial and

accounting theory, and tend to be more accurate. The intrinsic valuations we

used were the Free Cash Flows, Residual Income, Long Run ROE Residual

Income, Abnormal Earnings Growth, and the Discounted Dividends Models.

Using these models, we found that the firm is slightly overvalued.

8

Industry Analysis

Company Overview

Darden Restaurants, Inc. operates in the casual dining industry. Their

mission statement is “To nourish and delight everyone we serve.” (Darden’s’

2006 10k) Darden is composed of two main restaurants, Red Lobster and Olive

Garden, and two smaller units, Bahama Breeze and Seasons 52. Red Lobster

was founded in 1968 by William Darden, and was later acquired by General Mills.

In May of 1995, Darden became an independent publicly traded company.

Today, Darden Restaurants is based out of Florida. As of May 28th, 2006,

Darden operated 1,427 restaurants in 49 states (excluding Alaska) and Canada.

This was up from the previous year’s total of 1,381 stores. Over the previous 5

years, Darden has opened up an average of 54 restaurants per year. (Darden

2006 10k) We believe this represents a strong trend towards commitment to

constant growth. Forecasts are for the firm to open up additional 39-45 units

during the fiscal year of 2007. This is below the firms stated goal of 5%-7%

annual expansion, but Darden anticipates accelerated growth in the near future.

(S&P Stock Report) The year of 2006 was a record setting year for the firm,

which reported the highest sales, net earnings, net earnings per share, and

share price in its history.

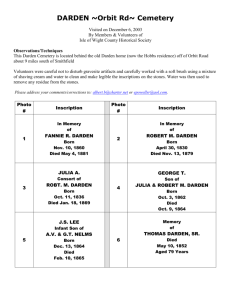

Fiscal Year

Sales

Costs &

Expenses

Earnings

EPS

2002

4,366,911

4,011,476

2003

4,654,971

4,317,368

2004

5,003,355

4,670,579

2005

5,278,110

4,854,193

2006

5,720,640

5,238,122

232,711

1.33

225,979

1.33

227,173

1.39

290,606

1.85

338,194

2.26

$18.70

$22.37

$32.48

$36.13

Stock Price $25.54

(Darden 2006 10-K)

9

Darden faces competition from many different firms in the casual dining

industry. Direct competitors include Applebee’s International (APPB), Brinker

International (EAT), Cheesecake Factory (CAKE), OSI Restaurant Partners (OSI),

and Texas Roadhouse (TXRH). Brinker International possesses the most assets

of this group with just over $2.2 billion. Darden is larger than all of its direct

competitors, with over $3 billion in assets. We believe the firm’s aggressive

expansions are intended to maintain and increase this gap. Darden also has the

largest market capitalization of this group with $6.4 billion, with Brinker

International the next largest, at $3.6 billion. This shows that the firm is the

highest valued firm among its direct competitors. From 2002-2005, Darden’s

stock lagged behind its competitors and the market index. From 2005-present,

the stock has rebounded and has outperformed the market and many of its

competitors. As of June 1 2007, the companies stock was at an all time high of

$46.59/share.

http://moneycentral.msn.com

10

Five Forces Model

The Five Forces Model allows for an “outside-in business strategy that is

used to make an analysis of the attractiveness or value of an industry structure”

(www.valuebasedmanagement.net). This method does this by the identification

of five fundamental competitive forces: rivalry among existing firms, threat of

new entrants, threat of substitute products, bargaining power of buyers, and

bargaining power of suppliers. High competition among firms can cause for a

loss in profit for a firm. With there being several different firms for a customer to

choose from, a firm must differentiate itself from the competition, thereby

getting more power and allow them to gain a higher profit share. These “five

forces” are important because it shows that the average profitability is influenced

by these forces on a daily basis. In other words, firms can not compete or grow

sufficiently if they do not have a basic understanding of each of these five

headings that we will explain below.

CASUAL DINING RESTAURANT INDUSTRY

RIVALRY AMONG EXISTING FIRMS:

MODERATE

THREAT OF NEW ENTRANTS:

THREAT OF SUBSTITUTE PRODUCTS:

BARGAINING POWER OF CUSTOMERS:

BARGAINING POWER OF SUPPLIERS:

LOW

MODERATE

MODERATE

LOW

Rivalry among Existing Firms

When discussing this topic, it is only appropriate to say that the

profitability of a firm is influenced the most by the rivalry among existing firms

section of the “five forces” model. This force looks at how strong the competition

between the existing firms are, looks at a firms ability to dominate over the

competition, or shows if all firms are among equal size and strength. Industry

growth tells us how well the industry is doing among its competitors financially

11

and economically. Having a well rounded industry can not only influence

customer inflow but also make room for potential profits to expand.

Industry Growth:

By keeping up with the current restaurant industry growth levels, we can

tell if these areas are expanding, contracting, or remaining stagnant. As

researched, the Restaurant Performance Index (RPI), which is a “monthly

statistical barometer that tracks the health of the restaurant industry”

(www.restaurant.org), stood at 101 points in April 2007, down .9 percent from

its March 2007 levels. The industry as a whole has remained above 100 points

for 48 consecutive months concluding a growth within the restaurant casual

dining industry.

Sales have also shot up for Darden Industries, recording “$5.72 billion in

fiscal 2006, $5.28 billion in fiscal 2005 and $5.00 billion in fiscal 2004” (Darden 10K). Compared to its competitors, Brinker Incorporated showed revenues for

“fiscal 2006 of $4.15 million, $3.74 million in fiscal 2005 and finally $3.54 million

for fiscal 2004” (Brinker 10-K). This slight growth in sales each year proves that the

casual dining restaurant industry is increasing slowly each fiscal year. With this

said, industries will not have to take market share from each other in order to

grow steadily.

Concentration:

If you have one company who dominates the industry and sets extensive

rules to its competitors, this industry is said to have high concentration. The

casual dining industry deals with a monopolistic competition atmosphere because

of its many producers and consumers in its market. Sellers in this case will

attempt to differentiate their products from those of their competitors instead of

specifically competing on product price. This allows this industry to have a low

concentration field of study. Darden Incorporated currently is the largest dining

12

restaurant company in the world based on market share, sales and number of

company owned restaurants. The graph below proves this theory by comparing

Darden’s (DRI) three main competitors, Brink (EAT), Applebee’s (APPB) and OSI

(OSI) with the percentage change over the past two years. Clearly Darden’s

growth exceeds its competitors by a long shot. As you can see Darden’s percent

increase in the number of new restaurants overshadows the competition by at

least seventy percent.

http://finance.yahoo.com

Switching Costs and Differentiation:

The restaurant industry differentiates their products from their

competitors to gain the advantage. Since these competitors are continually

changing and re-innovating their products and services, customer switching costs

are reasonably high. This allows customers’ propensity to move from one

product to another to increase. Price competition is not a main focus within these

companies because they are trying to set themselves apart from one another.

Since this industry consists of mostly differentiation, firms must compete mainly

on customer service, restaurant layout, and product separation.

13

Fixed/Variable Costs and Scale Economies:

Firms in every industry are continually fighting for market share and if

fixed costs (Ex. utilities, rent) are higher than variable costs (Ex. cheese, bread)

companies are able to reduce their prices to level out the difference. Darden

reportedly increased its food and beverage variable costs in 2006 to more than

6.2% from 2005. In this case, since the competitors in this industry strive for

quality and not price, fixed costs will ultimately be lower than its variable costs.

Gradually, firms are opening up new chain locations nation wide. For instance,

Applebee’s opened up an additional 41 restaurants from 2005 to 2006. As new

locations transpire, so will the overall scale of the businesses explode. This

allows a restaurant to accommodate a greater number of people and increase

their profit margin.

Excess Capacity and Exit Barriers:

Excess capacity exists when marginal cost is less than the average cost, or

in other words, when the amount of inventory held exceeds the demand from

customers. Knowing that the casual dining industry operates at a monopolistic

level and the market demand has been steadily growing, excess capacity will

most likely rise as well. The casual dining industry has been known for its little

exit barriers over the past few decades. Firms are finding that the cost to leave

the competition exceeds the benefits of staying. This low exit barrier dilemma

reduces rivalry and makes the industry more attractive to customers.

The restaurant casual dining industry is a highly competitive yet growing

market. There is a low level of concentration, low fixed to variable cost ratio,

high switching costs, and very few exit barriers within this industry. Each of the

firms in this sector competes on a unique product, high level of quality, but at

the same time focuses on low costs.

14

Threat of New Entrants

The threat of new entrants is how easy or difficult it is for new firms to

start competing with existing firms. Like all profitable industries, new entrants

are drawn toward that particular market to hopefully grab at a piece of market

share. There are several barriers of entry that new firms must overcome before

officially claiming a name stake in an industry. These include how loyal

customers are to existing products, how quickly they can achieve economies of

scale, would they have access to suppliers, would government legislation prevent

them or encourage them to enter the industry, switching costs, and capital

requirements. It is extremely important in the restaurant industry for new

entrants to be able to establish a strong customer backing and to have a good

relationship with its suppliers.

Economies of Scale:

When new firms want to enter a competitive market, they will be forced

to match the scale of size of the previous existing firms. The two largest firms in

the casual dining industry are currently Darden Incorporated with 1,427

restaurants and $3,010,170 in total assets and Applebee’s standing at 1,804 total

locations and $935,465 in total assets. Since Darden is a top competitor and has

a key influence over the market share in this industry, they are able to utilize

fully the economies of scale within the market. This means that these two

companies are able to set the costs for the casual dining restaurant industry as a

whole.

Distribution Access and Supplier Relationships:

New firms trying to enter into a highly competitive market may have

major barriers that they must overcome. Experienced companies have most likely

established networks and relationships with distributors and suppliers that are

contract based. This competitive advantage can sometimes monopolize larger

15

firms like Brinker or Darden Incorporated from smaller companies trying to enter

into the restaurant chain business. For example, as a regulation for restaurant

chains, each company must have at least $1 million in annual sales with two or

more operating stores. This first mover advantage can limit entry into this

industry by a significant amount.

Darden currently has contracts with Jtech communications, General Mills,

and 1,998 other suppliers around the world. Applebee’s has partnered up with

Weight Watchers, Tyler Florence (world renowned chef) and Cue Search. Brinker

Incorporated has thousands of exclusive contracts currently. The relationships

these firms hold puts them one step ahead in the casual dining industry allowing

them to promote and sell their products at a discounted price. New entrants will

have a hard time keeping up and competing with billion dollar firms with well

established networks.

Legal Barriers to Entry:

The legal barriers to enter into the restaurant business are few and far

between. Like all businesses, there are legal complications that have to be faced

at some point in time. If an industry has locations in countries other then the

United States, their rules of business and currency conversions are undoubtedly

going to be different than that of the United States. Also, new entrants may be

faced with civil lawsuits like customer injuries, or racial discrimination. Regardless

of the industry, all businesses face public and private issues daily which make

smaller firms that more hesitant to enter into the competition.

As obvious as it sounds, new firms will have a difficult time entering a

market with significantly low barriers of entry. Relationships between firms and

distributors/suppliers already exist between larger firms who have been in the

business longer. The majority of revenue generated and market share companies

will also have higher benefits when establishing economies of scale. With this

said, new entrants will find it difficult to enter into the casual restaurant dining

16

industry. This being so, they will have a hard time establishing themselves and

will be more likely to not last long in the market.

Threat of Substitute Products

In any industry, companies must be aware of possible substitute products.

In the casual dining industry, there is a great threat of competition from other

restaurants and the supermarket industry. Because the casual dining restaurants

cater to a specific type of food, a main factor effecting customer’s willingness to

switch products is their preference in food type. People are willing to pay a

premium to eat the specific type of food they want prepared in specialty ways.

Customer’s that choose restaurants in this industry are also willing to pay a

premium for good service, such as well trained wait staff and cooks.

The supermarket industry also poses a threat by offering ingredients to

make the food yourself, and also by providing quality made entrees and side

dishes that are pre-made in the deli section (Darden 10-K). Price plays a role in

customer’s decision of eating cheaper from the supermarket or eating at a

restaurant. Darden’s main customer bases are those who are willing to pay

extra to dine in a nice atmosphere while eating well cooked food.

Bargaining Power of Buyers

Customers have some control over prices in casual dining restaurants.

Switching costs are low to none, so extremely high prices could easily force

customers to choose alternative products. Most casual dining restaurants do

have a degree of specialization and differentiation in the products sold at each

restaurant. Therefore customers are less price sensitive and the business is able

to charge an amount greater than other restaurants that have more generalized

items on their menus.

The casual dining customer base does not have much relative bargaining

power because each customer represents only a small fraction of a restaurant’s

business. The volume of customers is high and the volume of product bought

17

per customer is low. If a single customer is lost, the impact on the company is

minimal, so bargaining has little effect on prices.

Bargaining Power of Suppliers

Each casual dinning restaurant purchases food and supplies from

approximately 2000 different suppliers in several countries around the world.

There is little price sensitivity with respect to many of the seafood products that

they buy. Seafood is shipped from around the world, and availability can be

dependant on many factors of nature. Because of the specialty of some of its

product, the company has little control over prices it pays. All other supplies are

bought from competitive suppliers that can be replaced on short notice and with

little hassle. This gives the business a lot of bargaining power with all other

supplies.

Value Chain Analysis

Industry Classification

The restaurant business is an extremely aggressive industry that

competes heavily on price, cost, and the opening of new restaurants, therefore

using a differentiation strategy making them a low competition firm. An industry

that can execute the key success factors of this strategy can gain a competitive

advantage over other industries. The restaurant with the best food selection for

the price and most accessible locations will gain the majority market share.

Superior Product Quality and Variety

In the casual restaurant industry a company must have a superior product

to offer that is of the utmost quality to gain the highest customer base. With

there being a large amount of casual restaurants one must offer a variety of

products of the best quality to stand above their competitors. If a company does

18

not provide a unique dining experience it will fall below the competition and lose

all demand for its product.

Superior Customer Service

The restaurant business relies heavily on its customer service. The

restaurant has to ensure that its customers have an enjoyable experience

therefore ensuring their continued business. Customer service is the key

component in surviving the restaurant industry. A customer will remember the

service that they receive while dining at the establishment and that will

determine if they return or not.

Investment in Brand Imaging

Brand imaging is a key element of a successful company. A memorable

atmosphere must be created to ensure that customers have an enjoyable time

and would guarantee their return. Customers associate company names with the

atmosphere they have experienced. A company must have a unique distinction

about them that diversifies them from their competitors. This will ensure that

customers will recognize these characteristics and associate them with a certain

brand.

Firm Competitive Advantage Analysis

Competitive Strategies

Darden Restaurants Incorporated has strived to be “the best casual

dining, now and for generations” and “to nourish and delight everyone we serve”

since 1995 (Darden’s 2006 10-K). They focus to give an enjoying, casual dining

experience that is affordable. Through superior product quality and variety,

19

superior customer service, and investment in brand imaging, Darden Restaurants

Incorporated has risen to the casual dining leader.

Superior Product Quality and Variety

According to Darden’s 2006 10-K, the restaurant industry is “intensely

competitive with respect to the type and quality of food, price, service,

restaurant location, personnel, concept, attractiveness of facilities, and

effectiveness of advertising and marketing.” Darden offers a variety of dishes to

complement the atmosphere and design of the restaurant. Red Lobster, the

largest casual seafood restaurant, provides fresh fish, shrimp crab, lobster,

scallops, and other seafood. Olive Garden, the market share leader among casual

dining Italian restaurant, imports numerous wines and coffee straight from Italy.

Their menu includes appetizers; soups, salads, and breadsticks; a variety of

baked pastas; sautéed dishes with chicken; seafood; grilled meats; and an

assortment of desserts. Bahama Breeze mirrors their Caribbean atmosphere by

offering Caribbean style food, such as seafood, chicken, and steaks, along with

exotic, tropical drinks. Finally, Smokey Bones provides barbequed pork, beef, and

chicken.

Not only do the four restaurants of Darden supply a variety of food

choices, but their food is have excellent quality because it is all fresh. Darden’s

ability to provide fresh and tasty food depends on their relations with their

suppliers. Their purchasing staff analyzes, negotiate, and purchase from more

than 2,000 suppliers in 45 different countries. One of Darden’s requirements is

that the suppliers must meet “strict quality control standards in the development,

harvest, catch and production of food products” (Darden’s 2006 10-K). For

example, the seafood is tested to make sure they are microbiologically safe.

Darden’s variety and quality of food gives them a great advantage over their

competitors.

20

Superior Customer Service

Since Darden began in 1995, they have focused their attention of their

guests having excellent food, service, and experience. They desire “to nourish

and delight everyone we serve,” the core purpose of Darden (Darden’s 2006 10K). This would not be accomplished without the great customer service Darden

provides. Darden believes that the customer is the top priority. For example,

Olive Garden’s purpose is “Hospitaliano!, our passion for 100% guest delight”

(www.olivegarden.com). When you dine at Olive Garden, you are catered to your

every need. Also, Darden provides a Guest Service Satisfaction Survey in which

the guests rate their customer service on a scale of one to ten. Without Darden’s

excellent customer service, they would not have risen to the top casual dining

restaurants in the United States.

Investment in Brand Imaging

Brand Imaging is one of the main commitments to strengthen this multibrand casual dining company. They want to leave a lasting impression in their

guests’ minds of the enjoyable atmosphere, the terrific food they ate, and the

excellent service they received while dining with the Darden restaurants. For

example, Olive Garden focuses on providing their guests with a family fun

environment that is a genuine Italian dining experience, “when you’re here your

family” (www.olivegarden.com). Also, Bahama Breeze focuses on the Caribbean

theme by providing “Caribbean-inspired food, handcrafted tropical drinks, [and

a] vibrant atmosphere” (www.bahamabreeze.com). From these examples, we

have concluded that Darden Restaurants does an excellent job at providing

brand imaging.

21

Accounting Analysis

In order for an analyst to properly “evaluate the degree to which a firm’s

accounting captures its underlying business reality,” he/she must conduct a

thorough accounting analysis (Palepu 3-1). There are six steps to this process

that must be completed. First, the analyst must identify key accounting policies.

The policies are used to measure the firm’s critical factors and risks. The next

step is to assess the accounting flexibility of the firm that is allowed under the

Generally Accepted Accounting Practices (GAAP). Third, the analyst must

evaluate the accounting strategy that the firm chooses to implement. The fourth

step is to evaluate the quality of disclosure. Fifth, the analyst must identify

potential red flags that point to questionable accounting practices. Finally, if the

accounting analysis suggests that the firm has misleading numbers, then the

analyst must undo the accounting distortions by using the statement of cash

flows and the financial statement footnotes.

Key Accounting Policies

To be able to value a firm properly, the key success factors of Darden

Restaurants must be analyzed to see if they correspond with the accounting

practices that they choose. Under the five forces model, we stated that Darden

Restaurants’ key success factors include the following: superior product quality

and variety, inventory management, and investment in brand imaging. These

key success factors and the accounting policies chosen by Darden should be

closely related. If they do not somewhat mirror each other, then red flags are

identified and further analysis is needed.

22

Pensions

One key accounting policy for Darden centers on its need for superior

product quality and variety. In order to achieve this, the firm must continuously

attract superior employees. One of the ways in which Darden attracts and

retains these high talent individuals is by offering both a non-contributory

defined benefit pension plan for their salaried employees as well as a

contributory postretirement benefit plan for retirees. These funds are “primarily

invested in U.S., international and private equities, long duration fixed-income

securities and real assets” (Darden 10-K).

Capital Lease vs Operating Lease

Next, we will take a look at the effect of capitalizing some of the longterm leases the firm currently identifies as operating leases. It is often

advantageous for firms to recognize leases as operating leases, which are

treated as rent expense, because it does not recognize the liability of future

obligations. However, it is also misleading, as most leases are non-cancelable.

We will examine how Darden accounts for leases, as well as what effect these

choices have on our perception of the company.

Inventory Waste

Another key accounting policy, not only for Darden but for the restaurant

industry as a whole, is how firms deal with inventory losses. Two of Darden’s

key success factors were offering superior quality and variety and enhancing

brand image. In order to do this, they must continuously offer only fresh foods

and take steps to sooth any dissatisfied customers. Darden attempts to

accomplish this in three ways. First, the company has a meal replacement

policy. That is, if a customer doesn’t like the meal they ordered, they can send it

back to the kitchen and order something else, with the restaurant absorbing the

cost of one of the meals. Second, the firm has a policy of compensating

23

customer meals to prevent an incident in a wide variety of cases. (This can

include long wait times, a hair in the food, undercooked meats, etc.) Finally, the

company minimizes its inventory loss due to spoilage by maintaining strict levels

of inventory and observing proper storage techniques.

Areas of Accounting Flexibility

While there is a minimum accounting standard (GAAP in the U.S.) which

all companies must conform to, there remains a large degree of flexibility in

accounting methods. In an ideal world, this flexibility would be used by

managers to provide a clearer picture of “the economic consequences of its

business activities” (Palepu). However, this flexibility can also be used to

manipulate the financial statements, either for the manager’s personal gain or to

mislead investors. Areas of flexibility in the casual dining industry include

inventory valuation, pension plans, and capital and operating leases. In the

following sections, we will examine how Darden utilizes this flexibility in regards

to its key accounting policies.

Pension Plans

Defined benefit plans, by definition, represent a high level of risk for the

beneficiary (in this case, Darden.) The firm is responsible for providing the

necessary funds to cover future costs of providing these benefits. It is difficult to

assign a particular dollar amount to this total due to the uncertainty of future

economic conditions. Darden estimates their long term rate of return on these

assets to be 9%. “The expected long-term rate of return on plan assets and

health care cost trend rates are based upon several factors, including our

historical assumptions with actual results, an analysis of current market

conditions, asset allocations and the views of leading financial advisers and

economists” (Darden’s 10-K). The 9% rate represents the liability Darden books

to cover its expected future pension costs. We find that a 9% rate of return is

very reasonable given the company’s investment strategy and previous results.

24

In comparison to the industry, Darden is unique among its direct

competitors as the only corporation that offers a defined benefit plan. As such, it

is difficult to analyze the believability discount rates, expected rate of return and

estimated liabilities provided. However, it is still possible to assess these

variables to some degree. The firm uses a discount rate of 5.75% (used to find

the present value of future benefit obligations), a number that we believe

represents a conservative estimate. However, we are dissatisfied with Darden’s

estimation of future health care costs. In their 10-K report, Darden assumes an

8.5% annual increase in health care expenses for 2007, and forecasts that this

will gradually decrease to 5% in 2011. This does not reflect what we believe to

be the current trend in rising health care costs. This concern is illustrated in the

following chart depicting historic health care costs in the U.S.

Year

1999

2000

2001

2002

2003

% Increase in

7.3%

8.1%

11.2%

14.7%

10.1%

total health care

benefit cost

(http://www.commondreams.org/headlines03/1208-03.htm)

Factoring in estimates for 2005 (8%) and 2006 (12%, as estimated by

the Segal Group), we find that Darden’s stance on the deceleration of health care

costs is misleading.

Inventory Management

it is how Darden accounts for these policies that we will ultimately focus

on. We were not able to find any information on how the firm accounts for

these losses. Given that it is possible the charges are simply lumped into some

other liability, this is not necessarily an indication of aggressive accounting. It

does however raise questions as to whether or not these costs are being

accurately represented in the company’s financial statements. We will examine

25

this problem further when we discuss what we see to be “red flags” within

Darden’s accounting policies.

Leases

Generally speaking, there are two acceptable methods for recording

leases under GAAP. First, there are “capital” leases. A capital lease is used

when the company will have the rights to use the asset for all (or close to all) of

the assets useful life. When a company enters a capital lease, the entire amount

of the asset is debited to assets and credited to liabilities. For this reason, it is

common for companies to attempt to classify leases as operating leases. Under

an operating lease, there is no effect on either assets or liabilities. Instead, the

company recognizes the lease by recording rent expense charges. The problem

with this is that, in general, leases are long-term, non-escapable contracts.

Failing to recognize the future obligations of the company leads investors to

underestimate liabilities and over-value the firm.

Darden recognizes their leases as operating leases. However, the

company is very open in its disclosure of future obligations in regards to these

leases. The following table illustrates the amount of future obligations the

company is carrying in operating leases.

OPERATING LEASES (figures in thousands)

Payments due in

< 1 year

1-3 years

3-5 years

5+ years

Amount

$72876

$124505

$93046

$134987

By breaking down the costs of their future obligations, Darden

acknowledges that they have a total future obligation of $425 million. We

believe that this is a fairly accurate representation of the unrecognized liability

facing the company.

26

Quality of Disclosure

The quality of disclosure is an important measure of the firm’s accounting

quality. It helps the outsiders of a company see inside the company. The better

the quality of disclosure, the more transparent the company will be. Having

transparent financial reporting practices means the company allows users to get

a true and fair picture of the firm. This allows analysts the ability to make a more

precise evaluation of the company.

Qualitative Analysis

The majority of the information needed for the qualitative analysis is

found in the company’s SEC filing of the 10-K. This report is “an annual report

required by the U.S. Securities and Exchange Commission (SEC), that gives a

comprehensive summary of a public company's performance….[It] includes

information such as company history, organizational structure, executive

compensation, equity, subsidiaries, and audited financial statements, among

other information” (www.wikipedia.org). Overall, Darden Restaurants does a

superb job at reporting its financial condition.

Darden does not necessarily provide a transparent view of their assets,

liabilities, and equity in their financial statements, but they do break down each

segment in their 10-K to further explain. For example, they explain in depth their

long-term debt and pension plans.

The company did an excellent job at providing a transparent view of their

long-term debt. Because they list each of the note and debentures along with

their interest rates and dates to maturity, an investor has a very enlightened

view of the company’s long-term debt. They can clearly see how much money

they owe in each category and year.

27

May 28, 2006

May 29, 2005

----------------------------------------------------------------------------8.375% senior notes due September 2005

$

-$ 150,000

6.375% notes due February 2006

-150,000

5.750% medium-term notes due March 2007

150,000

150,000

4.875% senior notes due August 2010

150,000

-7.450% medium-term notes due April 2011

75,000

75,000

7.125% debentures due February 2016

100,000

100,000

6.000% senior notes due August 2035

150,000

-ESOP loan with variable rate of interest (5.41% at May 28,

2006) due December 2018

22,430

26,010

-------------------------------------------------------------------------------------------------Total long-term debt

647,430

651,010

Less issuance discount

(2,829)

(763)

-------------------------------------------------------------------------------------------------Total long-term debt less issuance discount

644,601

650,247

Less current portion

(149,948)

(299,929)

-------------------------------------------------------------------------------------------------Long-term debt, excluding current portion

$ 494,653

$ 350,318

#’s from Darden’s 10-K

Darden Restaurants explain their retirement plans in detail. They break

down these plans into defined benefit plans and postretirement plans. They

describe what they are currently paying and also give a future forecast of what

they expect to pay in each of these plans. For example, they expect to contribute

about $400 to their postretirement plan during the fiscal year 2007. The

company reveals the relevant information, such as the discount rates, the future

discount rates, and the expected return on plan assets. This important

information has a “significant effect on amounts reported for defined benefit

pension plans” (Darden’s 10-K).

Despite Darden’s excellent disclosure of their long-term debt and

retirement plans, they give very little information about their inventory. Besides

giving the amount of inventories that they hold on the balance sheet, the only

information that was given about their inventory is that they “consist of food and

beverages and are valued at the lower of weighted-average cost or market”

(Darden’s 10-K). We believe that they do not disclose this information because

28

they don’t want to advertise to their competitors how much they expect of their

inventory to sell in the next year.

In summary, Darden Restaurants has clearly done an outstanding job in

disclosing its financial performance throughout its 10-K. Despite the poor job of

disclosing its inventories, we believe that the report is sufficient and helpful.

Anyone can read and understand their financial status to make an informed

decision about possibly investing.

Quantitative Analysis

Quantitative information is found using ratios in either raw form or change

form. Raw form is finding the ratio using the numbers from the same year.

Change form is finding the ratio by using the difference of two years. This

quantitative information expresses the company’s performance in number terms.

In order for red flags to be identified, the ratios must be computed. Therefore,

conducting a quantitative analysis is very important in valuing a firm.

Sales Manipulation Diagnostics

Since managers have the incentives to alter the sales numbers in order to

benefit them personally, sales manipulation should be a general concern for most

companies. We compared the ratios of Darden Restaurants with those of its

competitors to see where DRI stands. Neither Darden nor any of its competitors

disclose warranty liabilities. We believe this is due to the fact that they do not

offer a guarantee that their customers will be satisfied with their purchase after

five years. Therefore, a graph of Net Sales/Warranty Liabilities ratios is not

available.

29

Sales Manipulation Diagnostics

DRI

Net

Net

Net

Net

Net

Sales/Cash from Sales

Sales/Net Accounts Receivable

Sales/Unearned Revenues

Sales/Warranty Liabilities

Sales/Inventory

2006 2005 2004 2003 2002

1.01

1.01

1.01

1.01

1.01

154.15 144.57 165.36 160.39 150.12

56.77

59.66

66.26

64.04

N/A

N/A

N/A

N/A

N/A

N/A

28.79

22.42

25.17

26.81

25.33

EAT

Net

Net

Net

Net

Net

Sales/Cash from Sales

Sales/Net Accounts Receivable

Sales/Unearned Revenues

Sales/Warranty Liabilities

Sales/Inventory

2006

1.01

79.01

62.33

N/A

102.93

2005

1.01

86.01

73.01

N/A

77.08

2004

1.01

93.35

85.13

N/A

92.91

2003 2002

1.01

1.01

91.21 127.67

121.05 106.37

N/A

N/A

134.63 114.61

2006

1.01

77.93

20.96

N/A

45.02

2005 2004 2003 2002

1.01

1.00

1.00

1.00

115.30 146.69 170.97 197.38

20.96

34.52

32.03

33.03

N/A

N/A

N/A

N/A

52.28

50.17

44.42

65.73

2006

1.04

25.04

24.79

N/A

103.81

2005

1.04

28.60

27.65

N/A

53.14

OSI

Net

Net

Net

Net

Net

Sales/Cash from Sales

Sales/Net Accounts Receivable

Sales/Unearned Revenues

Sales/Warranty Liabilities

Sales/Inventory

APPB

Net

Net

Net

Net

Net

Sales/Cash from Sales

Sales/Net Accounts Receivable

Sales/Unearned Revenues

Sales/Warranty Liabilities

Sales/Inventory

2004

1.04

24.95

32.24

N/A

27.18

2003

1.03

27.14

35.95

N/A

40.69

2002

1.04

27.77

N/A

N/A

63.00

#’s from 10-K’s

30

Net Sales/Cash from Sales

1.05

1.04

1.03

1.02

1.01

1.00

0.99

2002

2003

DRI

2004

EAT

2005

OSI

2006

APPB

The ratio of net sales/cash from sales is computed by taking the net sales

of the company and dividing it by the net sales minus net accounts receivable.

This ratio helps to indicate the amount of cash collected each year from

customers. If the ratio equals one, then the company collects cash from sales

equal to the net sales. Each of the companies’ ratios are very close to one. This

ratio is a measure of how well sales are supported by cash received from sales.

If the ratio begins to increase dramatically, we would worry that the firm might

be artificially inflating their numbers to increase net income. However, since the

firm has a consistent ratio at (or close to) $1 in cash from sales for every $1 net

sales, we find their sales figures to be highly reliable.

31

Net Sales/Net Accounts Receivable

200

190

180

170

160

150

140

130

120

110

100

90

80

70

60

50

40

30

20

2002

2003

DRI

2004

EAT

2005

OSI

2006

APPB

When analyzing net sales/net accounts receivable, a higher ratio is

preferred to a lower ratio. A higher ratio suggests that accounts receivable make

up a smaller portion of sales. If the receivables make up a smaller portion of

sales, then there are higher cash sales than there are sales on account. In our

case, we are attempting to deduce how reliable the firms sales figures are.

Darden consistently has over $150 in sales for every $1 in accounts receivable, a

number which could possibly raise a red flag in our evaluation of the reliability of

the firms sales. However, since it is relatively in line with its competitors, and its

sales/cash from sales ratio is near 1, we do not find this to be a significant

concern.

32

Net Sales/Unearned Revenue

125

120

115

110

105

100

95

90

85

80

75

70

65

60

55

50

45

40

35

30

25

20

2002

2003

DRI

2004

OSI

2005

EAT

2006

APPB

When analyzing the ratio of net sales to unearned revenue, an analyst

would look for a sudden decrease in unearned revenue, for this could possibly be

a red flag. If there is a sudden decrease in unearned revenue, then there would

be an increase in net sales making the ratios of the company increase rapidly.

When this occurs, it could be caused by booking revenue prematurely, meaning

they mark it in their books before they have completed the task or delivered the

goods and the revenue is earned. Looking at Darden’s net sales/unearned

revenue, between the years 2003 and 2004, net sales increase and unearned

revenue decreases. This causes the ratio to rise. However, from 2004 and on,

net sales decrease and unearned revenues increase, causing the ratio to decline.

33

We are not able to determine what happens during 2002 since unearned revenue

was not disclosed during that year. Since there are not any sudden increases in

the ratio, there is no reason to be concerned about accounting fraud. When

comparing the firms in the industry, there is a wide gap between them.

Applebee’s and OSI have very close ratios that are for the most part declining

due to their declining net sales and increasing unearned revenues. Brinker has

fluctuated over the past five years from having a sudden increase in the ratio to

having a sudden decrease.

Net Sales/Inventory

140

130

120

110

100

90

80

70

60

50

40

30

20

2002

2003

DRI

2004

EAT

2005

OSI

2006

APPB

When comparing net sales/inventory, a higher ratio would indicate a

quicker turnover of inventory and a more efficient operation cycle. When a ratio

increases, it is due to either a rise in sales or a drop in inventory, both of which

are very desirable and positive situations. A dramatic rise in this ratio could be

34

an indicator of sales manipulation, as inventory levels must support an increase

in sales. In Darden’s case, it appears that their sales figures are supported by

inventory, thus increasing their reliability.

Core Expense Manipulation Diagnostics

Every company in each industry will most likely deal with a professional

auditor. These analyses will compute core diagnostic ratios to check for potential

expense manipulations by company managers. We have calculated six ratios

based on each of four leading competitors in the field of restaurant casual dining.

Before 2005, Darden Restaurants did not disclose a pension or benefit plan for

its employees. OSI International and Applebee’s also did not disclose any

information about its employee pension plans as shown in the chart below.

35

Core Expense Manipulation Diagnostics

DRI (Darden Restaurants)

Asset Turnover

CFFO/OI

CFFO/NOA

Total Accruals/Change Sales

Pension Expense/ SG&A

Other Employment Expenses/SG&A

2006

1.91

1.49

.17

.75

.28

.17

2005

1.80

1.38

.15

.64

.27

.15

2004

1.80

1.58

.14

.64

N/A

N/A

2003

1.75

1.50

.14

.55

N/A

N/A

2002

1.73

1.46

.16

.45

N/A

N/A

2006

1.87

1.44

.26

.76

.06

.05

2005

1.81

2.00

.17

.85

.06

.04

2004

1.68

1.92

.20

.67

.10

.08

2003

1.69

1.68

.21

.49

.13

.09

2002

1.62

1.58

.19

.46

.14

.08

2006

1.74

2.42

.24

.97

N/A

N/A

2005

1.83

1.59

.27

.85

N/A

N/A

2004

1.87

1.28

.26

.56

N/A

N/A

2003

1.87

1.02

.26

.50

N/A

N/A

2002

1.70

1.17

.37

.49

N/A

N/A

2006

1.28

1.33

.27

.66

N/A

.02

2005

1.23

1.40

.37

.50

N/A

.03

2004

1.29

1.15

.39

.43

N/A

.05

2003

1.35

1.14

.42

.48

N/A

N/A

2002

1.28

1.04

.35

.51

N/A

N/A

EAT (Brinker International)

Asset Turnover

CFFO/OI

CFFO/NOA

Total Accruals/Change Sales

Pension Expense/ SG&A

Other Employment Expenses/SG&A

OSI (Restaurant Partners)

Asset Turnover

CFFO/OI

CFFO/NOA

Total Accruals/Sales

Pension Expense/ SG&A

Other Employment Expenses/SG&A

APPB (Applebee’s)

Asset Turnover

CFFO/OI

CFFO/NOA

Total Accruals/Sales

Pension Expense/ SG&A

Other Employment Expenses/SG&A

Information computed from http://www.mergentonline.com

36

Asset Turnover

2.50

2.00

1.50

1.00

0.50

0.00

2002

2003

DRI

2004

EAT

2005

OSI

2006

APPB

The average asset ratio is calculated by adding the assets for the five most recent quarters and

dividing them by five. “This sector tells you how quickly the company is converting its physical asset base

into sales.” (Darden 10-K)

If the company ratio is low then the degree of capital

intensity will be higher. The overall asset turnover for Darden Restaurants (1.91)

was relatively higher then the industry average of 1.31. Deflated results in this

ratio could be an indication that the firm is not writing off assets, and therein

understating expenses. This is a common tactic to inflate net income. In our

case, we found the firms asset turnover ratio to be fairly indicative of a healthy

firm in the casual dining industry.

37

CFFO/OI

3.00

2.50

2.00

1.50

1.00

0.50

0.00

2002

2003

DRI

2004

EAT

2005

OSI

2006

APPB

This area of ratios gives us the reader a comparison of the source of

income for a firm by comparing the operating end of cash flows by operating

income. A smaller percentage could be caused by a decrease in cash flow

operations or an increase in operating income on the income statement. Darden

Restaurants has shown a pretty even level of outcome for the past five years. As

a whole, this industry has done an excellent job of matching cash flows from

operations to total income

38

CFFO/NOA

0.45

0.40

0.35

0.30

0.25

0.20

0.15

0.10

0.05

0.00

2002

2003

DRI

2004

EAT

2005

OSI

2006

APPB

This ratio of cash flow from operations relates itself with property, plant,

and equipment found in the balance sheet. The higher the percentage ratio, the

more cash is being generated from these total assets. This ratio is a good check

point to feel out whether the firms cash flow from operating activities is

supported by their plant, property, and equipment. If this ratio blows up over

time, it may indicate that the firm is artificially inflating their results. We did not

find any such problems in Darden’s numbers. While there has been an increase,

we feel that the market as a whole seems be increasing progressively since 2002

and will more than likely continuing this trend because of the expanding

industry, and thus we are not concerned.

39

Total Accruals/Sales

1.20

1.00

0.80

0.60

0.40

0.20

0.00

2002

2003

DRI

2004

EAT

2005

OSI

2006

APPB

The ratio above shows how the total accrual liabilities of companies match

up with a company’s total net income (earnings). This is important because

accruals allow expenses to be reported when incurred, not paid. This area of

consolidation has shown a rising trend in the accrual/sales ratio as shown in the

chart above. This is a result of firms reporting their long-term debt directly on

their balance sheets each year. This ratio measures how timely the firm is in

recognizing accrued expenses. The higher the ratio, the more efficient the firm

is. In Darden’s case, we found the firm to be right around the average for their

industry. Combined with their reasonable ratio of 0.6, we believe that this

increases the believability of Darden’s information.

40

Pension Expense/SG&A

0.30

0.25

0.20

0.15

0.10

0.05

0.00

2002

2003

DRI

2004

EAT

2005

OSI

2006

APPB

This ratio (pension expense/SG&A) compares the companies employee

benefit plan to that of the other operating expenses in “sales, general, and

administrative”. This option will allow employers to forecast or estimate the

direction that their pension programs may take. These expenses can accurately

be described as “people expenses” and one must worry about possible

manipulation. If this ratio decreases dramatically, one must worry about all of

the estimations that go into pension expenses. (It is possible that a company

may be underestimating these expenses.) However, in Darden’s case, it seems

41

as though this ratio is very reasonable, i.e. that the firms pension expenses are

supported by its SG&A expenses. Furthermore, when compared with the

industry, the ratio seems even more reliable.

Other Employment Expense/SG&A

0.18

0.16

0.14

0.12

0.10

0.08

0.06

0.04

0.02

0.00

2002

2003

DRI

2004

EAT

2005

OSI

2006

APPB

This ratio (other employment expense/SG&A) computes the difference

between a firms employer expense (ex. health care, medical expenses) to that of

other operating expenses as in “sales, general, and administrative.” Other non

pension expenses could also include post-retirement benefits which Darden

Restaurant began in early 2005. Since there is a very limited history regarding

this ratio for Darden, we are unable to come up with a definitive interpretation of

42

the results. We can say that, in general, the results produced are not by

themselves cause for concern. Since Darden’s ratio is much higher than the

industry, we conclude that their “other expenses” number is believable and is

supported by their SG&A total.

Potential Red Flags

By evaluating several categories of the financial statements one can

identify potential red flags. Several ratios, changes in accounting policies, and

drastic changes in figures across multiple years on the financial statements can

indicate red flags. These red flags must be identified in order to properly

evaluate the company.

Our ratio analysis showed no major variations from their normal trends

However, small changes were noticed in the year 2005 in the sales to account

receivables, sales to inventory, and income to cash flow from operations ratios.

These changes could possibly be explained by the closing of several restaurants

in the year 2004. We also noticed a spike in restructuring and impairment

charges in 2004, which could also be explained by the closing of restaurants.

There have been no changes in accounting policies since 1996. This

indicates no apparent red flags in their accounting policies. As well, they have

not changed auditors since 1996. This could signify a partnership between

Darden and its external auditor. The auditor could have some incentive to ignore

inaccuracies of the financial statements.

Darden clearly states their financial obligations with respect to their

operating leases. These future obligations are worth approximately $425 million.

This is a large financial obligation which has an adverse affect on the cash flows

of the company.

43

Darden does not clearly state write-offs from inventory spoilage as well as

comped meals. This may or may not be an issue for the company; however it is

not addressed in any financial statements. This could be a potential red flag.

The company has a defined benefit pension plan. These pension plans are

a large future obligation for Darden. Also Darden’s forecast of decreasing health

care expenses does not coincide with current health care trends. Their

undervaluation could pose future expenses which the company may not be

prepared for.

After the evaluation of potential red flags we have come to the conclusion

that there are no major red flags. However, there are some red flags that still

deserve proper consideration.

Fixing Accounting Distortions

While for the most part we found Darden’s financial statements to be

fairly transparent, there were several areas which require further analysis. The

area which we are most concerned with is the recognition of leases as “operating

leases.” To examine the effect that recognizing these expenses as capital leases

has, we used Darden’s previously established discount rate of 3.25%. We

believe this is a reasonable figure, as it slightly outpaces inflation over the past 5

years. Once calculated, we found that recognizing the $425 million in obligations

as current liabilities would result in an increase to liabilities of $411 million.

Given Darden’s current balance of $1.7 billion in liabilities, this represents an

increase of 23%. We find this to be a significant understatement in liabilities.

While this is consistent with industry trends, as most of Darden’s competitors

recognize leases in a similar way, we feel this represents important information

to consider in ratio analysis, among other things.

44

Financial Analysis, Forecast Financials, and Cost of

Capital Estimation

Profitability and growth are the two key factors that are used to value a

firm’s current performance and future outlook. This section uses financial ratios

and a cash flow analysis to forecast the growth of the firm over the next ten

years. Before we can forecast the future growth, a series of ratios must be

computed to obtain a true picture of the current value of the firm. The ratios are

divided up into three sections: liquidity, profitability, and capital structure. With

these ratios, we can determine how the firm is changing its business structure

and then be able to more accurately forecast future performance. The forecasts

are estimates and should not be valued as facts or error free.

Financial Analysis

The ratio analysis takes the past and present financial reports and

determines liquidity, profitability, and capital structure ratios that will be used to

help better forecast the future growth and value of the firm. By conducting a

ratio analysis, we not only can see the firm’s current growth, but we can

compare it to its competitors. This analysis allows us to determine whether the

firm is competitive among their competitors in the industry or whether they are

outliers. If we discover that a firm in an outlier in many aspects, then it could

indicate that the firm is not performing efficiently and therefore can lead to a

false perception of the firm’s value.

Liquidity Analysis

Liquidity ratios are a class of financial measurements used in determining

whether a company can pay off its short-term debt obligations. The ability for

firm’s to cover short-term debt with cash is a critical factor when creditors are

45

looking for payment from the company borrowing money. The current ratio and

quick asset ratio are of significant importance because they show if the firm has

enough resources (liquidity) to pay back its debts over the next 12 months. The

inventory and accounts receivable calculations show the number of times that

the company’s accounts receivable and inventory is collected or turned over

throughout the year. Generally creditors would prefer to see higher numbers

with these ratios because this reduces the risk of the loan. The chart below

breaks down the four most competitive companies within the casual dining

industry: Darden Restaurants, Brinker International, OSI Restaurants, and

Applebee’s.

46

Liquidity Analysis

DRI (Darden Restaurants)

Current ratio

Quick Asset Ratio

Inventory Turnover

Receivables Turnover

Working Capital Turnover

Inventory Days

A/R Days

2002

2003

2004

2005

2006

Change on

Liquidity

0.74

0.30

19.63

150.18

4.16

18.59

2.43

0.51

0.12

20.93

160.39

4.82

17.44

2.28

0.51

0.10

19.60

165.37

4.86

18.62

2.21

0.39

0.08

17.40

144.56

3.64

20.98

2.53

0.37

0.07

22.28

154.15

4.08

16.38

2.37

Unfavorable

Unfavorable

Favorable

Favorable

No Change

Favorable

No Change

2002

2003

2004

2005

2006

Change on

Liquidity

0.47

0.11

31.63

127.68

-18.01

11.54

2.86

0.54

0.22

36.90

94.90

-22.86

9.89

3.85

1.05

0.70

26.89

97.74

170.40

13.58

3.74

0.57

0.21

22.24

86.65

-21.77

16.41

4.21

0.49

0.22

28.79

79.01

-16.28

12.68

4.62

No Change

Favorable

Unfavorable

Unfavorable

Favorable

Unfavorable

Unfavorable

2002

2003

2004

2005

2006

Change on

Liquidity

0.73

0.91

24.79

271.98

66.83

14.72

1.34

0.79

0.46

16.50

211.95

-42.83

22.13

1.72

0.596

0.30

18.81

163.47

-21.47

19.41

2.23

0.52

0.27

19.10

123.46

-16.93

19.11

2.96

0.56

0.21

16.26

181.99

-15.74

22.45

2.01

Unfavorable

Unfavorable

Unfavorable

Unfavorable

Unfavorable

Unfavorable

No Change

2002

2003

2004

2005

2006

Change on

Liquidity

0.60

0.36

53.41

27.77

-15.89

6.83

13.14

0.58

0.33

34.99

27.14

-13.83

10.43

13.45

0.66

0.33

22.94

24.67

-19.14

15.91

14.79

0.46

0.26

46.02

28.34

-10.08

7.93

12.88

0.56

0.38

91.25

24.67

-14.66

4.00

14.80

Unfavorable

No Change

Favorable

Unfavorable

Favorable

Favorable

Unfavorable

EAT (Brinker International)

Current ratio

Quick Asset Ratio

Inventory Turnover

Receivables Turnover

Working Capital Turnover

Inventory Days

A/R Days

OSI (Restaurant Partners)

Current ratio

Quick Asset Ratio

Inventory Turnover

Receivables Turnover

Working Capital Turnover

Inventory Days

A/R Days

APPB (Applebee’s)

Current ratio

Quick Asset Ratio

Inventory Turnover

Receivables Turnover

Working Capital Turnover

Inventory Days

A/R Days

(All decimals rounded 2 places)

47

Current Ratio

Current Ratio

1.20

1.00

0.80

0.60

0.40

0.20

0.00

2002

2003

DRI

2004

EAT

2005

OSI

2006

APPB

The current asset ratio is computed by dividing total current assets by

total current liabilities. This ratio shows how many resources are available and

whether the firm can pay off its current debt. In this case, bigger is better and a

ratio around 1.00 for most businesses is preferred. A current asset ratio of 1

literally means that the firm has exactly enough current assets (assets converted

to cash within one year) to cover its current liabilities (liabilities due inside of one

year). When comparing Darden and its competitors over a five year period, it is

safe to say that each of them carry a current ratio of less than one. While this

could represent an inability for these firms to pay off their short-term debt

obligations within terms, it is worth noting that “A current ratio of less than 1.0

does not necessarily signal problems unless this weak current ratio shows

persistent inability of a company to meet short term obligations.”

(investorglossary.com)

48

Comparing it to the industry, Darden Restaurants shows a slightly lower

current ratio than its competitors with a slowly declining trend. If Darden

continues to show an inability to increase in this area, they may have future

problems concerning liquidity. Brinker (EAT) is the only company that has

surpassed 1.00 in 2004 but has since declined dramatically. We believe that due

to the nature of the casual dining industry, it is actually the norm to carry a

current asset ratio of less than one. Clearly, however, the fact that Darden’s

ratio has declined for each of the past 5 years is cause for some concern.

Quick Asset Ratio

Quick Asset Ratio

1.00

0.90

0.80

0.70

0.60

0.50

0.40

0.30

0.20

0.10

0.00

2002

2003

DRI

2004

EAT

2005

OSI

2006

APPB

The quick asset ratio (acid test ratio) is computed by adding the cash

(equivalents), securities, and accounts receivables and dividing it by the total

current liabilities. This ratio measures a company’s ability to meet its obligations

of debt with liquidity. Usually a number greater than 1 is preferred by creditors.

The only company which showed significant improvement over the 5 year period

we examined was Applebee’s (APPB). Brinker (EAT) showed a neutral trend

49