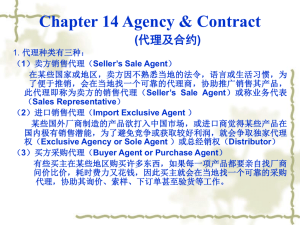

documentary risk in commodity trade

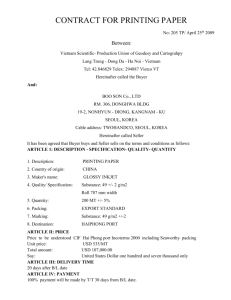

advertisement