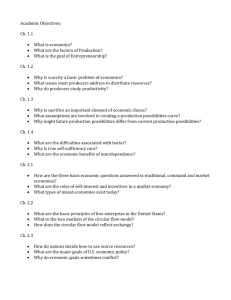

Thinking Like a Modern Economist

advertisement