TUITION ASSISTANCE PROGRAM PAYLESS SHOESOURCE

TUITION ASSISTANCE PROGRAM

PAYLESS SHOESOURCE

PLAN DOCUMENT

AS AMENDED & RESTATED EFFECTIVE JANUARY 1, 2014

PURPOSE The purpose of the Tuition Assistance Program is to help associates develop skills that enhance their career opportunities and their ability to perform by providing financial assistance to associates who are pursuing a college degree from an accredited institution.

EFFECTIVE

DATE

PROGRAM

ELIMINATION

NOTICE

This document was originally effective for courses commencing on or after

August 1, 1998. This document is amended and restated effective January 1, 2014.

The company’s tuition assistance program was discontinued effective January 1, 2014.

A one semester transition period was provided for current participants who meet certain requirements. Outside of the transition period, no new tuition applications will be approved for 2014. To be eligible for the one-semester (Spring 2014) transition period, an associate must meet the following criteria:

• Must successfully have completed their Fall 2013 coursework and submitted their reimbursement request as required or submit documentation confirming their enrollment in Fall 2013 courses if reimbursement was not requested solely because their 2013 benefit had already been exhausted, and

• Must apply and be approved for Spring 2014 participation for coursework that begins no later than March 1, 2014.

•

Must have funds eligible for reimbursement in the Spring 2014 semester.

The following program details apply only to those associates who meet the eligibility criteria outlined above:

ELIGIBILITY The Tuition Assistance Program is available to all Payless ShoeSource (the

“Company”) domestic associates and select international associates, who have completed at least six months of service before the class for which they seek reimbursement begins. Tuition assistance is not available to associates covered under a collective bargaining agreement unless and until the Company agrees.

Class attendance and study must be accomplished without interference with the associate’s regular job responsibilities. When needed and possible (given the requirements of the business), an associate’s work schedule may be adjusted at the discretion of the associate’s direct supervisor. Failure to maintain satisfactory job performance may result in forfeiture of tuition assistance.

The Corporate HR Benefits Team must be informed of any changes to the program of study (including incomplete or unsatisfactory coursework, substitution of classes, changes in degree programs, etc). Failure to provide this information on a timely basis may result in forfeiture of tuition assistance.

COURSE(S)

COVERED

Courses of study leading to a bona fide degree will be considered for reimbursement.

Both undergraduate and graduate level courses will be considered for reimbursement.

Based on your associate category on the day classes begin, some undergraduate degrees

Page 1

must be business-related. All graduate level degree plans must be directly related to the business. All coursework must be with an accredited institution for higher learning.

The Company has the final authority to determine what is business-related.

U.S. Associates (including Puerto Rico):

Associate Category

Undergraduate

Degree – Must be related to the

Business?

Part-time – Stores, Corporate and

Eastern and Western DCs

Full-time – Stores

No

No

Store Leader/Group Leader/TS and

Full-time Eastern and Western DCs

No

Full-time – Corporate and Field Yes

Graduate Degree –

Must be related to the

Business?

Yes

Yes

Yes

Yes

Canada Associates:

Category

Associates Working < 25 hours

Undergraduate Degree

– Must be related to the Business?

Graduate Degree –

Must be related to the

Business?

Stores and Corporate

Associates Working > 25 hours

Stores

Store Leader/Group Leader/TS

No

No

No

Yes

Yes

Yes

Corporate and Field

Full-time – Stores

Store Leader/Group Leader/TS and

Full-time Eastern and Western DCs

Full-time – Corporate and Field

Yes

$3,000 USD

$3,000 USD

Yes

Courses Not Covered

•

Courses taken at the request of Company management.

•

Courses required for the associate’s current responsibilities.

•

Courses over the six (6) semester hours or seven (7) quarter hours per enrollment

period maximum.

• Degree extension programs or courses that do not result in an additional degree

being obtained

COSTS COVERED The cost of the course of study will be reimbursed within the following guidelines:

Tuition, books (purchased or rented), lab fees and student activity fees will be reimbursed to the maximums outlined below during any “rolling” 12-month period.

U.S. Associates (including Puerto Rico):

Maximum Reimbursement Category

Part-time – Stores, Corporate and

Eastern and Western DCs

$500 USD

$1,000 USD

Page 2

Canada Associates:

Category

Associates Working < 25 hours

Stores and Corporate

Associates Working > 25 hours

Stores

Store Leader/Group Leader/TS

Corporate and Field

Maximum Reimbursement

$550 CAD

$1,100 CAD

$3,300 CAD

$3,300 CAD

Costs Not Covered

▫ Travel, parking, and late fees are not eligible for reimbursement.

▫ Fees for entrance examinations (i.e. SAT, GMAT, LSAT) and exception examinations.

▫ Fees for certifications or preparatory courses for certifications.

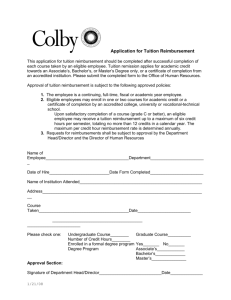

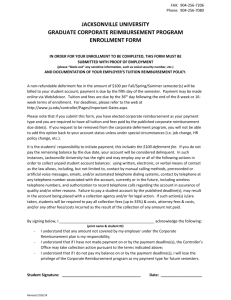

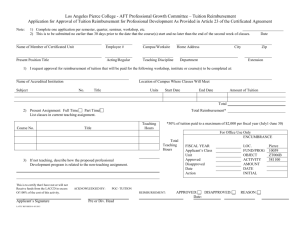

REIMBURSEMENT The following procedures are applicable for each enrollment period:

PROCEDURES ▫ Approval by the associate’s immediate supervisor is required prior to enrollment.

▫ Associates must submit their application to the Corporate HR Benefits Team before the first day of classes.

▫ Reimbursement will be provided after course completion and verification of a grade of C (70% if a letter grade is not designated) or higher.

▫ Within 60 days of the completion of the course, detailed receipts from the college or university must be submitted for tuition and activity fees with a legible copy of the grade report to:

▫ If the associate received educational assistance from other sources during the enrollment period, the Company will reimburse the amount not covered by the other source(s) of assistance to the applicable maximum benefit.

▫ Reimbursement amount is based on associate’s category on the day classes begin.

▫ Reimbursement will be provided for completion of not more than six (6) semester hours or seven (7) quarter hours per enrollment period.

PAYLESS SHOESOURCE, INC.

ATTENTION: TUITION ASSISTANCE COORDINATOR

P.O. BOX 1189

TOPEKA, KANSAS 66601

USA

Note: Credit card receipts/statements are not acceptable as proof of payment for reimbursement.

▫ If the associate has received a grade of C (70% if a letter grade is not designated) or higher, reimbursement will be issued for the appropriate amount. Costs for incomplete courses or courses for which a grade below C (70% if a letter grade is not designated) was received will not be reimbursed.

▫ Approval for tuition assistance must be requested prior to every semester.

Associates enrolled in programs that run on a 12- or 18-month enrollment period must submit requests for tuition assistance based on the semester schedule outlined by their program.

Page 3

INCOMPLETE OR The following guidelines regarding incomplete or unsatisfactory grades are applicable

UNSATISFACTORY for each course during an enrollment period:

PROGRESS ▫ If an associate cannot complete a course due to illness, injury or unusual work situations, the associate may still be eligible for reimbursement. Reimbursement will be made upon approval by the associate’s supervisor and the Corporate HR

Benefits Team.

▫ If, during the enrollment period, an associate is unable to complete the course because of a transfer within the Company, reimbursement will be made for the costs incurred through the end of the approved enrollment period. A statement by the associate’s supervisor must accompany this request for approval by the Corporate

HR Benefits Team.

▫ An associate who voluntarily leaves the Company prior to completing the course will not be reimbursed for the costs associated with the course.

▫ Generally, an associate who is terminated prior to completing the course will not be reimbursed for the costs associated with the course.

▫ If a course is dropped for reasons other than those mentioned above, the associate will not be reimbursed for course costs.

In no case will advances be issued to associates or to educational institutions. ADVANCES

APPROVAL

PROCESS

The request for tuition assistance must be initiated by the associate using the

Application for Approval of Tuition Assistance. This request will be reviewed and a recommendation for approval or denial made by the associate’s supervisor. The

Corporate HR Benefits Team makes the final decision for approval or disapproval. The associate will be notified in writing of the approval or denial as soon as administratively feasible.

TAX LIABILITY U.S. Associates - Currently under U.S. Internal Revenue Code Section 127, reimbursement for undergraduate and graduate studies under this program is not considered taxable income and will not be reported in the associate’s W-2 annual earnings.

Puerto Rico Associates – Reimbursement under this program is considered taxable income for associates participating in Puerto Rico and will be reported in the

Associate’s W-2 annual earnings.

Canada Associates – Reimbursement under this program is considered taxable income for associates participating in Canada and will be reported in the associate’s T-4 annual earnings.

The tax consequence for participation in other jurisdictions may vary.

AMENDMENT OR The Company shall have the right to amend or terminate the Plan, in whole or in part, at any time in its sole discretion. TERMINATION

QUESTIONS Please refer to the Benefits website at www.mycollectivebrands.com for additional information.

Page 4