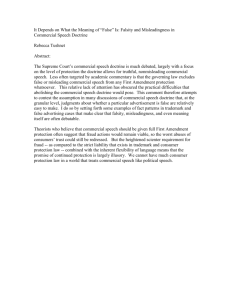

The New Private-Regulation Skepticism

advertisement