ADVANCE WITH ACCOUNTING

advertisement

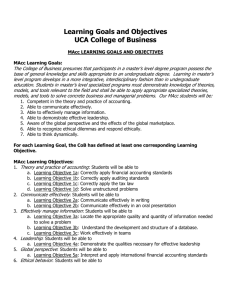

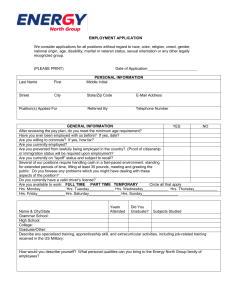

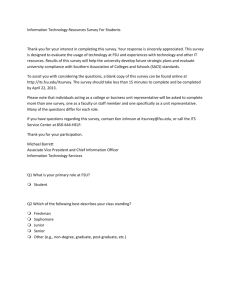

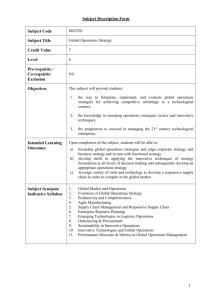

master of accounting • business.fsu.edu/MAcc ADVANCE WITH ACCOUNTING MAcc adds value to any career Broaden your resume with a two-year Master of Accounting (MAcc) degree for non-accounting majors from Florida State University’s College of Business. Build a business foundation, then develop the quantitative, analytical and research skills every accountant needs to make sound business decisions. Our MAcc program can be used to fulfill the necessary requirements to sit for the Uniform Certified Public Accountant (CPA) Examination in the state of Florida and prepares you for an exciting career in public or corporate accounting. business.fsu.edu/MAcc FLORIDA STATE UNIVERSITY COLLEGE OF BUSINESS • • • • • • Application deadlines: June 1 for fall entry; Oct. 1 for spring entry; March 1 for summer entry Complete the full-time program in six semesters or less Learn from our dedicated faculty members who are rich in academic and industry experience Network with our well-placed alumni serving in top jobs, ranging from the large, international accounting firms to state government Become part of Florida State’s legacy of high passing rates on the CPA exam Accredited by The Association to Advance Collegiate Schools of Business (AACSB) “The faculty members at FSU have created an environment where students are able to apply concepts instead of just learn them.” — Jeff Barbacci, CPA and Director of Audit, Thomas Howell Ferguson P.A. master of accounting • business.fsu.edu/MAcc International Acclaim. Individual Attention.™ Curriculum The two-year MAcc program consists of foundation courses the first three semesters and major courses the final three semesters as follows: Foundation coursework (17 courses, 51 credit hours) ACG2021 – Introduction to Financial Accounting (3 hrs) ACG2071 – Introduction to Managerial Accounting (3 hrs) ACG3101 – Financial Accounting and Reporting I (3 hrs) ACG3111 – Financial Accounting and Reporting II (3 hrs) ACG3341 – Cost Accounting I (3 hrs) ACG4401 – Accounting Information Systems (3 hrs) ACG4632 – Auditing Theory and Application I (3 hrs) TAX 4001 – Federal Tax Accounting I (3 hrs) TAX 4011 – Federal Tax Accounting II (3 hrs) BUL 3330 – Law for Accountancy (3 hrs) CGS2518 – Spreadsheets for Business (3 hrs) ECO2023 – Principles of Microeconomics (3 hrs) ECO2013 – Principles of Macroeconomics (3 hrs) FIN 3403 – Financial Management of the Firm (3 hrs) MAC2233 – Calculus for Business and Nonphysical Sciences (3 hrs) QMB3200 – Quantitative Methods for Business Decisions (3 hrs) STA 2023 – Fundamentals of Business Statistics (3 hrs) Please note: Candidates who have taken any of these courses may meet with the MAcc program advisor to have their transcripts evaluated to determine what past coursework can be counted toward the degree program’s requirements. Graduate coursework (11 courses, 33 credit hours) Each of the MAcc’s four majors are typically taken as four courses in the spring and fall semesters and three courses in the summer: Accounting Information Systems Major: Prepares students for careers in accounting information systems, system analysis, consulting, account­ing system design and accounting software implementation. Provides an understanding of business processes and electronic commerce. Leads to careers with large public accounting firms, systems consulting firms or large corporations. Assurance Services Major: Provides students with skills related to the practice and theory of auditing and related services. Emphasizes building teamwork and technical skills. Leads to auditing work at large, international public accounting firms. Corporate Accounting Major: Allows students to build coursework that is critical for entry-level accounting and finance positions at medium and large corporations. Emphasizes technical skills necessary for success in the various areas of corporate accounting. Leads to a career at corporations, government entities and other organizations. Taxation Major: Provides students with meaningful opportunities to develop the technical, analytical and research skills necessary for a successful career in tax practice. Emphasizes lessons in primary and secondary tax law sources to identify and to investigate alternative tax treatments and solve complex tax issues. Leads to a career with large international CPA firms as tax specialists. Please note: Graduate coursework is scheduled to begin in the second year (fourth semester), but may be started in the last semester of foundation coursework with the approval of the MAcc program director. Required curriculum for each major may be found at business.fsu.edu/ MAcc. Program requirements are subject to change. Cost of degree Each two-year MAcc program course’s tuition depends on whether it is an undergraduate or graduate course. The program follows the university’s tuition rates. For a complete list of current estimated costs, visit business.fsu.edu/MAcc. Consideration for departmental financial aid is made only for the three semesters of graduate work and is awarded on a competitive basis. Admission guidelines Admission to the Master of Accounting program is highly competitive. The decision is based on a portfolio of qualifications, including prior academic performance, work experience, entrance exam scores (such as the GMAT or GRE) and letters of recommendation. The entrance exam is a university requirement that may be waived if an applicant meets certain criteria. For exact criteria and instructions on requesting waivers, see business.fsu.edu/waive. Application process for MAcc two-year program I. The following items should be submitted through the Florida State Graduate Application portal, available exclusively online at https://admissions.fsu.edu/gradapp: • Applicant’s statement of purpose for pursuing the MAcc degree (1-2 pages) • Current resume/C.V., clearly indicating work experience including dates and positions held. • Three (3) letters of recommendation from employers or former college professors that speak specifically to the applicant’s ability to successfully complete the MAcc program (submitted by the recommenders in the online application). • Nonrefundable application fee of $30.00 (see University Application or go to http://fees.fsu.edu) II. The following items should be sent to the Admissions Office, PO Box 3062400, 282 Champions Way, Florida State University, Tallahassee, FL 32306-2400: • One (1) official transcript from all colleges and universities attended • Florida Resident Affidavit, if applicable (see University Application or http://admissions.fsu.edu/images/pdf/residency.pdf) • Official GMAT/GRE score(s) and, if applicable, TOEFL/IELTS score(s) (The TOEFL/IELTS score is a University requirement for international applicants; therefore, it cannot be waived). The code to send GMAT scores to Florida State is PN8K567, and the code to send GRE or TOEFL scores is 5219. Note to international applicants: For more information concerning financial responsibilities, degree equivalency, etc., please visit http://admissions.fsu.edu/international/admissions/graduate.cfm Graduate Programs | (850) 644-6458 | gradprograms@business.fsu.edu