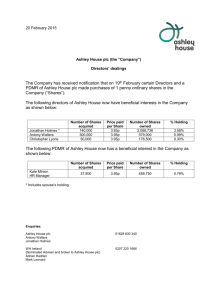

Britvic Annual Report

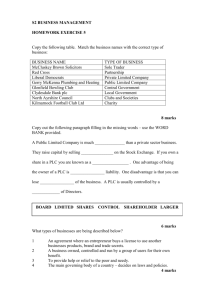

advertisement