Britvic Annual Report

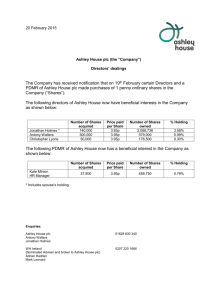

advertisement