BusGrad201415 - University of Miami

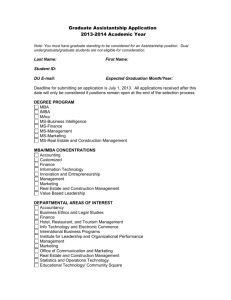

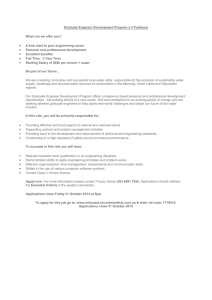

advertisement