Eco 301 Name_______________________________

advertisement

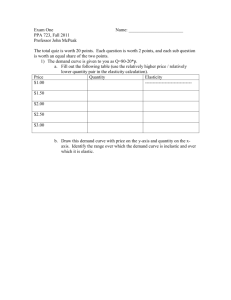

Eco 301 Test 1 Name_______________________________ 16 October 2009 75 points. Please write all answers in ink. Please use pencil and a straight edge to draw graphs. Allocate your time efficiently. 1. A group has chartered a bus to New York City. The driver costs $100, the bus costs $500, and tolls will cost $75. The driver's fee is nonrefundable, but the bus may be canceled a week in advance at a charge of only $50. At $18 per ticket, how many people must buy tickets so that the trip need not be canceled? With more than a week to go, the $100 driver's fee and the $50 bus cancellation fee are sunk costs. If the trip takes place, the additional costs will be the remaining $450 of the bus fee plus the $75 in tolls, for a total of $525 in additional costs. If at least 30 tickets will be sold, it makes sense to continue the trip, since total revenue ($540) will exceed the additional cost. S d 2. The market for DVDs has supply and demand curves given by P = 2Q and P = 42 — Q , respectively. a. How many units will be traded at a price of $35? At a price of $14? Which participants will be dissatisfied at these prices? At prices of 35 and 14, there will be 7 DVDs traded in the market. At P=35, sellers are dissatisfied. They would like to sell 17.5 units. At P=14, buyers are dissatisfied, because they would like to buy 28 units. b. What quantity of DVDs at what price will be sold in equilibrium? The supply and demand curves, shown in the diagram, intersect at P=28, Q=14 c. What is the total revenue from DVD sales? Total revenue is (28)(14) = 392. 3. Consider the demand curve Q = 100 - 50P. a. Draw the demand curve and indicate which portion of the curve is elastic, which portion is inelastic, and which portion is unit elastic. P 2 1 elastic unit-elastic . 50 inelastic 100 Q b. Without doing any additional calculation, state at which point of the curve expenditures on the goods are maximized, and then explain the logic behind your answer. At (1, 50), total revenue is maximized since this is the unit-elastic point. At higher prices, revenue decreases since it is the elastic region. The percentage decrease in quantity is greater than the percentage increase in price meaning that the total revenue declines. At lower prices, revenue again decreases since it is the inelastic region. The percentage increase in quantity is less than the percentage decrease in price meaning that the total revenue declines. 4. Jones spends all his income on two goods, X and Y. The prices he paid and the quantities he consumed last year are as follows: Px = 15, X = 20, Py = 25, and Y = 30. If the prices next year are Px = 6 and PY = 30, and Jones's income is 1020, will he be better or worse off than he was in the previous year? (Assume that his tastes do not change.) The two budget lines and last year's optimal bundle are shown in the diagram. A closer look at the tangency point for last year's bundle shows that this year Jones can afford a bundle he prefers to last year's. Jones buys more X and less Y because X is now relatively cheaper than Y. Eco 301 Test 1 Name_______________________________ 10 October 2008 100 points. Please write all answers in ink. Please use pencil and a straight edge to draw graphs. Allocate your time efficiently. 1. Suppose demand is P = 600 — Q and supply is P = Q in the soybean market, where Q is tons of soybeans per year. The government sets a price support at P = $500/ton and purchases any excess supply at this price. In response, as a long-run adjustment, farmers switch their crops from corn to soybeans, expanding supply to P = (1/2)Q. a. How does excess supply with the larger supply compare to excess supply prior to the farmers switching crops? With a price support of P = $500/ton and the original supply of P = Q, quantity supplied must be Q = P = 500 tons. Meanwhile, quantity demanded is Q = 100 tons, so excess supply is 500 – 100 = 400 tons. With the expanded supply of P = (1/2)Q, quantity supplied grows to Q = 2P = 1000 tons. Quantity demanded is still Q = 100 tons, so excess supply grows to 1000 – 100 = 900 tons. b. How much more does the government have to spend to buy up the excess supply? The extra 900 – 400 = 500 tons the government has to buy of excess supply costs the government $500/ton, so the added expenditure is 500(500) = $250,000. 2. Suppose you are a government politician and need to collect revenue by taxing a product. For political reasons, you want the burden of the tax to fall mostly on consumers, not firms (who have been substantial contributors to your campaign fund). What should you look for when picking a product to tax? Explain. For the tax burden to fall mostly on consumers rather than producers (buyers rather than sellers), you want to find a product (or products) for which the quantity supplied is very responsive to price but quantity demanded is less responsive to price. Addictive goods like cigarettes and alcohol may fit this description. 3. Suppose the demand for crossing the Golden Gate Bridge is given by Q = 10,000 - 1000P. a. If the toll (P) is $3, how much revenue is collected? P=$3, Q=8000, Revenue=$21,000 b. What is the price elasticity of demand at this point? ε = (P/Q)(1/slope) = (3/7000)(-1000) = - 3/7 c. Could the bridge authorities increase their revenues by changing their price? A price increase will increase revenue since current price is in the inelastic region. d. The Red and White Lines, a ferry service that competes with the Golden Gate Bridge, began operating hovercrafts that made commuting by ferry much more convenient. How would this affect the elasticity of demand for trips across the Golden Gate Bridge? Since substitution chances are increased, demand for the bridge will become more elastic. 4. When the price of gasoline is $l/gal, you consume 1000 gal/yr. Then two things happen: (1) The price of gasoline rises to $2/gal and (2) a distant uncle dies, with the instruction to his executor to send you a check for $1000/yr. If no other changes in prices or income occur, do these two changes leave you better off than before? Assume the consumer's original income was M. His original budget constraint is a; after the gas price increase, it is b; and after the money from his uncle it is c. At the very end, he can afford the original bundle he bought. But his indifference curve at the original optimum is below his new budget constraint. By decreasing his gas consumption and increasing other goods consumption, he can reach a higher indifference curve. (see dotted indifference curve) 4. Consider the following two scenarios: a. You have just purchased a house for $200,000. The very next day, the prices of all houses, including the one you just bought, double. b. You have just purchased a house for $200,000. The very next day, the prices of all houses, including the one you just bought, fall by half. In each case, how does the price change affect your welfare? (Are you better off before the price change or after?) When the price of housing doubles, your budget constraint becomes B2, which also contains your original bundle A Because C, the optimal bundle on B2, lies on a higher indifference curve than A the effect of the housing price increase is to make you better off. When the price of housing falls by half, your budget constraint becomes B3, which also contains your original bundle A. Because D, the optimal bundle on B3, lies on a higher indifference curve than A, the effect of the housing price drop is to make you better off.