BUSINESS Overview Competitive Strengths

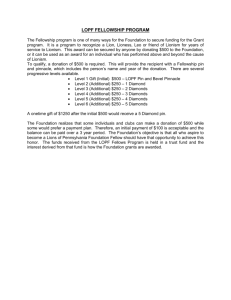

advertisement