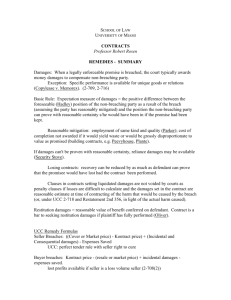

UCP & INCOTERMS

advertisement