List of Case Studies on Strategy - Case Catalogue IV

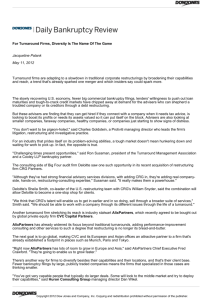

advertisement