#1 Free Legal Website

FindLaw.com is the leading and largest online resource for legal information. For basic legal issues

to more complex ones, you’ll find thousands of helpful articles, a legal community to get answers to

your specific questions, an attorney directory, blogs, news, DIY forms, and much more.

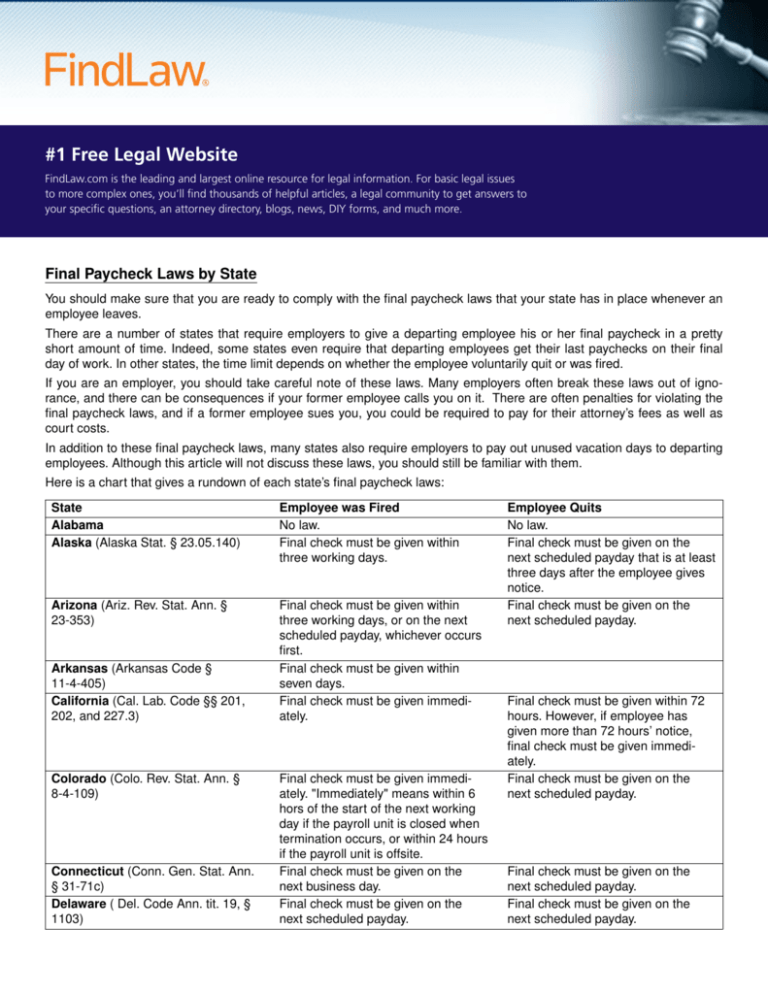

Final Paycheck Laws by State

You should make sure that you are ready to comply with the final paycheck laws that your state has in place whenever an

employee leaves.

There are a number of states that require employers to give a depar ting employee his or her final paycheck in a pretty

shor t amount of time. Indeed, some states even require that departing employees get their last paychecks on their final

day of work. In other states, the time limit depends on whether the employee voluntarily quit or was fired.

If you are an employer, you should take careful note of these laws. Many employers often break these laws out of ignorance, and there can be consequences if your former employee calls you on it. There are often penalties for violating the

final paycheck laws, and if a former employee sues you, you could be required to pay for their attorney’s fees as well as

cour t costs.

In addition to these final paycheck laws, many states also require employers to pay out unused vacation days to departing

employees. Although this article will not discuss these laws, you should still be familiar with them.

Here is a chart that gives a rundown of each state’s final paycheck laws:

State

Alabama

Alaska (Alaska Stat. § 23.05.140)

Employee was Fired

No law.

Final check must be given within

three working days.

Arizona (Ariz. Rev. Stat. Ann. §

23-353)

Final check must be given within

three working days, or on the next

scheduled payday, whichever occurs

first.

Final check must be given within

seven days.

Final check must be given immediately.

Arkansas (Arkansas Code §

11-4-405)

California (Cal. Lab. Code §§ 201,

202, and 227.3)

Colorado (Colo. Rev. Stat. Ann. §

8-4-109)

Connecticut (Conn. Gen. Stat. Ann.

§ 31-71c)

Delaware ( Del. Code Ann. tit. 19, §

1103)

Final check must be given immediately. "Immediately" means within 6

hors of the start of the next working

day if the payroll unit is closed when

termination occurs, or within 24 hours

if the payroll unit is offsite.

Final check must be given on the

next business day.

Final check must be given on the

next scheduled payday.

Employee Quits

No law.

Final check must be given on the

next scheduled payday that is at least

three days after the employee gives

notice.

Final check must be given on the

next scheduled payday.

Final check must be given within 72

hours. However, if employee has

given more than 72 hours’ notice,

final check must be given immediately.

Final check must be given on the

next scheduled payday.

Final check must be given on the

next scheduled payday.

Final check must be given on the

next scheduled payday.

District of Columbia (D.C. Code §

32-1303)

Final check must be given on the

next business day.

Florida

Georgia

Hawaii (Haw. Rev. Stat. § 388-3)

No law.

No law.

Final check must be given immediately, or on the next business day if

there are conditions that prevent

immediate payment.

Idaho ( Idaho Code §§ 45-606,

45-617)

Final check must be given on the

next scheduled payday, or within 10

days, whichever occurs first. However, if employee makes a written

request for earlier payment, within 48

hours of receiving the request.

Final check must be given on the

next scheduled payday.

Final check must be given on the

next scheduled payday.

Illinois (820 Ill. Comp. Stat. 115/5)

Indiana (Ind. Code §§ 22-2-9-2 and

22-2-5-1)

Iowa ( Iowa Code Ann. § 91A.4.))

Maryland ( Md. Lab. & Emp. Code

Ann. § 3-505)

Massachusetts (Mass. Ann. Laws

ch. 149 § 148)

Final check must be given on the

next scheduled payday.

Final check must be given on the

next scheduled payday.

Final check must be given on the

next scheduled payday or within 14

days, whichever occurs later.

Final check must be given on the

next scheduled payday, or within 15

days, whichever occurs earlier.

Final check must be given on the

next scheduled payday or within two

weeks after a demand from the

employee, whichever is earlier.

Final check must be given on the

next scheduled payday.

Final check must be given immediately.

Michigan ( Mich. Comp. Laws §§

408.474, 408.475)

Minnesota ( Minn. Stat. §§ 181.13,

181.14)

Final check must be given on the

next scheduled payday.

Final check must be given immediately.

Kansas ( Kan. Stat. Ann. § 44-315)

Kentucky (Ky. Rev. Stat. Ann. §

337.055)

Louisiana (La. Rev. Stat. Ann. §

23:631)

Maine (Me. Rev. Stat. Ann. tit. 26, §

626)

Final check must be given on the

next scheduled payday, or within

seven days, which occurs first.

No law.

No law.

Final check must be given on the

next scheduled payday. However, if

employee gave at least one pay

period’s notice, final check must be

given immediately.

Final check must be given on the

next scheduled payday, or within 10

days, whichever occurs first. However, if employee makes a written

request for earlier payment, within 48

hours of receiving the request.

Final check must be given on the

next scheduled payday.

Final check must be given on the

next scheduled payday. If the

employee has not given a forwarding

address, the employer must wait until

10 days after the employee demands

wages or provides an address where

the final check can be mailed.

Final check must be given on the

next scheduled payday.

Final check must be given on the

next scheduled payday.

Final check must be given on the

next scheduled payday, or within 14

days, whichever occurs later.

Final check must be given on the

next scheduled payday, or within 15

days, whichever occurs earlier.

Final check must be given on the

next scheduled payday or within two

weeks after a demand from the

employee, whichever is earlier.

Final check must be given on the

next scheduled payday.

Final check must be given on the

next scheduled payday or on the Saturday that follows an employee’s resignation if there is no scheduled payday.

Final check must be given on the

next scheduled payday.

Final check must be given on the

next scheduled payday. However, if

the payday is less than five days after

the last day that the employee works,

the employer must pay on the next

payday or 20 days after the

employee’s last day of work, whichever is earlier.

Mississippi

Missouri ( Mo. Ann. Stat. § 290.110)

Montana ( Mont. Code Ann. §

39-3-205)

Nebraska (Neb. Rev. Stat. §

48-1230)

Nevada (Nev. Rev. Stat. §§ 608.020

-- 608.030)

New Hampshire (N.H. Rev. Stat.

Ann. § 275:44)

New Jersey (N.J. Stat. Ann. §

34:11-4.3)

New Mexico (N.M. Stat. Ann. §§

50-4-4 and 50-4-5)

New York (N.Y. Labor Laws § 191)

North Carolina (N.C. Gen. Stat. §

95.25.7)

North Dakota (N.D. Cent. Code §

34-14-03)

Ohio (Ohio Rev. Code Ann. §

4113.15)

No law.

Final paycheck must be given immediately.

If employee is laid off or fired for

cause, final paycheck must be given

immediately. The employer has the

option of maintaining a written policy

that extends this time to the next

scheduled payday or within 15 days,

whichever is earlier.

Final check must be given on the

next scheduled payday or within two

weeks, whichever occurs first.

Final check must be given immediately.

Final check must be given within 72

hours. However, if employee is laid

off, final check may be given on the

next scheduled payday.

Final check must be given on the

next scheduled payday.

Final check must be given within five

days.

Final check must be given on the

next scheduled payday.

Final check must be given on the

next scheduled payday.

Final check must be given on the

next scheduled payday or within 15

days, whichever occurs first.

No law.

Oklahoma ( Okla. Stat. Ann. tit. 40, §

165.3)

Oregon (Or. Rev. Stat. § 652.140)

Final check must be given on the

next scheduled payday.

Final check must be given by the end

of the next business day.

Pennsylvania (43 Pa. Cons. Stat.

Ann. § 260.5)

Rhode Island (R.I. Gen. Laws §

28-14-4)

South Carolina (S.C. Codified Laws

§ 41-10-50)

Final check must be given on the

next scheduled payday.

Final check must be given on the

next scheduled payday.

Final check must be given within 48

hours or on the next scheduled payday, but not more than 30 days.

No law.

No law.

Final paycheck must be given on the

next scheduled payday or within 15

days, whichever is earlier.

Final check must be given on the

next scheduled payday or within two

weeks, whichever occurs first.

Final check must be given on the

next scheduled payday or within

seven days, whichever occurs first.

Final check must be given on the

next scheduled payday or within 72

hours (if the employee gave at least

one pay period’s notice).

Final check must be given on the

next scheduled payday.

Final check must be given on the

next scheduled payday.

Final check must be given on the

next scheduled payday.

Final check must be given on the

next scheduled payday.

Final check must be given on the

next scheduled payday.

Final check must be given on the first

day of the month for wages that were

earned in the first half of the prior

month, or on the fifteenth day of the

month for wages earned in the second half of the prior month.

Final check must be given on the

next scheduled payday.

Final check must be given immediately if the employee has given at

least 48 hours’ notice. If employee

does not give notice, final check must

be given within five days or the next

scheduled payday, whichever occurs

first.

Final check must be given on the

next scheduled payday.

Final check must be given on the

next scheduled payday.

No law.

South Dakota (S.D. Codified Laws

§§ 60-11-10, 60-11-14)

Tennessee ( Tenn. Code. Ann. §

50-2-103)

Texas ( Texas Code Ann., Labor §

61.014)

Utah ( Utah Code Ann. § 34-28-5)

Vermont ( Vt. Stat. Ann. tit. 21 § 342)

Virginia ( Va. Code § 40.1-29)

Washington (Wash. Rev. Code §

49.48.010)

West Virginia ( W. Va. Code §

21-5-4)

Wisconsin ( Wis. Stat. Ann. §

109.03)

Wyoming ( Wyo. Stat. Ann. §

27-4-104)

Final check must be given on the

next scheduled payday or when the

employee returns the employer’s

proper ty.

Final check must be given on the

next scheduled payday or within 21

days, whichever is later.

Final check must be given within six

days.

Final check must be given within 24

hours.

Final check must be given within 72

hours.

Final check must be given on the

next scheduled payday.

Final check must be given on the

next scheduled payday.

Final check must be given within 72

hours.

Final check must be given on the

next scheduled payday or within one

month, whichever occurs first. If the

termination is a result of a merger,

relocation or liquidation of the business, final check must be given within

24 hours.

Final check must be given within five

business days.

Final check must be given on the

next scheduled payday or when the

employee returns the employer’s

proper ty.

Final check must be given on the

next scheduled payday or within 21

days, whichever is later.

Final check must be given on the

next scheduled payday.

Final check must be given on the

next scheduled payday.

Final check must be given on the

next scheduled payday, or on the

next Friday if there is no scheduled

paydays.

Final check must be given on the

next scheduled payday.

Final check must be given on the

next scheduled payday.

Final check must be given immediately if the employee has given at

least one pay period’s notice. If the

employee has not provided such

notice, final check must be given on

the next scheduled payday.

Final check must be given on the

next scheduled payday.

Final check must be given within five

business days.

The FindLaw Guide to Online Fraud and Identity Theft

FINDLAW.COM

EMPOWERS

PEOPLE WITH TRUSTED,

TIMELY AND INTELLIGENT

LEGAL INFORMATION

BLOGS – FindLaw Blogs present timely news that has

real-life implications, deliver important information

and discuss law-related entertainment.

FINDLAW ANSWERS – A vibrant, interactive online

community where everyday people can ask legal

questions and get real-time answers from legal

professionals and others with similar experiences.

NEWS & NEWSLETTERS – Updated throughout the

day and night and covering a wide range of legal

topics, FindLaw.com’s News page presents current

legal news, keeping people informed and educated.

FIND A LAWYER – An easy-to-search database

of more than one million lawyers and law firms. It

provides detailed information, enabling people to

contact a qualified lawyer when they are ready.

DO-IT-YOURSELF FORMS & CONTRACTS – FindLaw.

com provides accurate legal documents for common

legal matters. Choose from a library of easy-to-use,

low-cost, accurate legal forms for everyday legal issues.

FINDLAW VIDEO – On FindLaw.com, you’ll find an

online directory of more than 1,500 short videos

dedicated exclusively to legal topics and attorney and

law firm profiles.

Connect With Us

FindLaw.com has an entire social media team

dedicated to providing our users with as many

options as possible to join, participate in, and learn

from the FindLaw community. Some of the social

key channels are the following:

•

FindLaw for Consumers on Facebook

Making the law easy to access with interactive

legal updates aimed at starting conversations,

informing followers of their legal rights and

providing a forum for questions and resources

•

HAVE A LEGAL QUESTION?

NEED TO FIND AN AFFORDABLE,

QUALIFIED ATTORNEY?

Protect yourself, your family or

your business with a legal plan

or form from LegalStreet

@FindLawConsumer on Twitter

Tweeting interesting, entertaining and

informative legal news everyday

Copyright © 2013 FindLaw, a Thomson Reuters business. All rights reserved. The information

contained in this article is for informational purposes only and does not constitute legal advice.

The use and distribution of this article is subject to the Creative Commons BY-NC-ND license, which

Learn More: Tips to Help Protect Your Identity, Protect

Find a Consumer Protection

can be viewed at http://creativecommons.org/licenses/by-nc-nd/3.0/.

You must

attribute

articleFraud,

by Stolen Identity:

Yourself

from

Online the

Auction

Attorney Near You

to Do work. You may not

providing the title of the article, FindLaw copyright notice and link toWhat

the original

use the article for commercial purposes and you may not alter or transform this article in any way.

Follow us on

A Thomson Reuters Business