CGA-Canada PA1 Examination Blueprint

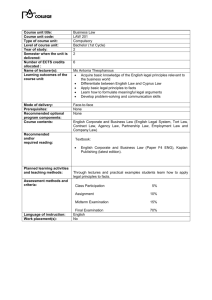

advertisement

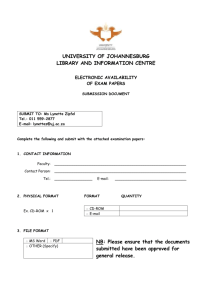

PA1 EXAMINATION BLUEPRINT 2013 Effective Date: January 2013 Table of Contents About the Examination Blueprint ......................................................................................................................... 2 PA1 Examination ................................................................................................................................................... 2 PA1 Course ........................................................................................................................................................ 2 Prerequisite Courses for the PA1 Examination.................................................................................................. 3 Competency Weightings ....................................................................................................................................... 3 Structure of the Examination................................................................................................................................ 6 Examination Competency Coverage ..................................................................................................................... 7 Scoring Model and Evaluation of Candidate Performance................................................................................... 7 PA1 Examination Blueprint 2013 PA1: Issues in Professional Practice Examination Blueprint About the Examination Blueprint The PA1: Issues in Professional Practice examination has been constructed using an examination blueprint — a widely accepted tool used within professions to design certification examinations. CPA, CGA blueprints specify the range of coverage for each examinable competency area, question type (for example, multiplechoice or constructed response case analysis), number of questions, time limit, scoring model, and method used to evaluate candidate performance. Candidates are encouraged to use this blueprint to prepare for the PA1 examination. PA1 Examination The PA1 examination is comprehensive and integrative. Its purpose is to evaluate the ability of a candidate for the CPA, CGA designation to demonstrate the competencies required for entry to the profession. The focus of the PA1 examination is on professional practice from the perspective of an accountant external to the organization providing assurance, taxation, or business advisory services. The examination provides a valid, reliable, and fair opportunity for each candidate to demonstrate the competencies expected of a 1 newly-certified CPA, CGA in three broad areas of contemporary accounting practice: Leadership , Professionalism, and Professional Knowledge. It assesses a candidate’s ability to integrate a wide range of professional knowledge and apply that knowledge, along with ethical considerations, to the practice of accounting and related fields of management activity. Central to this evaluation is the ability to demonstrate competence in areas such as leadership, decision making, integrative approach to problem solving, and communicating. The examination evaluates the candidate’s ability to fulfill the responsibilities of a financial management professional at all times in a manner that reflects these professional qualities and skills. Passing the PA1 examination is part of the education, experience, and examination requirements for certification. PA1 Course The PA1 course is intended, primarily, to help candidates prepare for the PA1 examination. In addition, the course aims to further develop candidates’ professional qualities and skills. The course includes a series of assignments that emulate questions and cases typical of those found on the PA1 examination. The assignments provide opportunities to practise analyzing and responding to cases. As one of the main purposes of the course is to build candidates’ skills in analyzing cases and demonstrating competence, for the course assignments, the competencies are organized into six groups: Financial Accounting and Reporting, Assurance and Other Related Services, Taxation, Ethics and Trust, Core-related competencies, and Professional qualities and skills. On the assignments, candidates are assessed on individual competencies, which are aggregated by group in order to guide candidates’ study and preparation efforts. This evaluation method is used to qualify candidates for writing the PA1 examination and is slightly different than the evaluation method used in the PA1 examination. The Introduction to PA1 course module contains more information on how to best use the PA1 course to prepare for the PA1 examination. 1 Leadership, Professionalism, and Professional Knowledge represent the three broad groups of competencies outlined in the CPA, CGA competency framework. 2 PA1 Examination Blueprint 2013 Prerequisite Courses for the PA1 Examination In order to be eligible to the PA1 examination, a candidate must: Have completed the university CPA, CGA program leading to the recognized bachelor’s degree or the equivalent; Have passed or been exempted from the technical competencies examinations (AU2 and TX2); Have passed the prerequisite courses to PA1 in the short graduate program. Note: please note that different eligibility criteria apply for students registered in the master’s degree holders program. Integration and application of the technical knowledge assessed in these courses will be examined in the PA1 examination. The PA1 examination also requires that candidates be current with professional material such as applicable accounting standards, the Canadian Income Tax Act with Regulations, and the Code of Ethics of CPA. Competency Weightings For assessment purposes, the PA1 examinable competencies are organized into three categories: core competencies; core-related competencies; and professional qualities and skills. Core and core-related competencies comprise all of the Professional Knowledge competencies, as well as competencies in Ethics and Trust. Core competencies are from the areas of Financial Accounting and Reporting; Assurance and other related services; Taxation; and Ethics and Trust. Core-related competencies are drawn from Management Accounting; Finance and Financial Planning; Business Environment; and Information Technology. Professional qualities and skills comprise Leadership (Strategic and Organizational Leadership; Organizational Effectiveness; Individual and Team Leadership and Development) and Professionalism (Stakeholder Focus; Communication; Integrative Approach; Problem Solving; Professional Self-evaluation). Table 1 shows the competency area percentage weightings for the PA1 examination. For professional qualities and skills, there is no set percentage weighting; candidates are required to demonstrate these qualities and skills in a manner applicable to their role in specific cases. For core and core-related competencies, the weightings represent the approximate percentage of competencies associated with each area on an examination. The ranges are designed to provide flexibility in building the examination; they reflect the relative importance of these competency areas to the work of a professional accountant in the context of providing assurance, taxation, and business advisory services. Table 1 also includes a sample of competencies associated with each competency area. 3 PA1 Examination Blueprint Professional qualities and skills Table 1: PA1 Blueprint Weightings Competency Area Sample Competencies Percentage Weighting Leadership; Stakeholder focus; Communication; Integrative approach; Problem solving; Professional selfevaluation Preparing information in formats appropriate for specific purposes; communicating in a clear and concise manner; managing the expectations of clients and stakeholders; applying an integrative approach to problem solving; committing to continuous self improvement; and advising on issues of corporate governance. All cases require candidates to demonstrate professional qualities and skills 4 PA1 Examination Blueprint 2013 Core competencies Financial Accounting and Reporting Assurance and Other Related Services Taxation Ethics and Trust Core-related competencies Management Accounting Finance and Financial Planning Business Environment Information Technology Advising on, evaluating, and interpreting an organization’s external reporting requirements; selecting and implementing appropriate accounting and reporting methods in accordance with applicable accounting standards; and providing strategic advice based on financial information. Enhancing the reliability of financial information for stakeholders through independent assurance services; evaluating an organization’s external and internal reporting requirements; evaluating compliance with rules, regulations, and standards; developing audit plans; and designing internal controls over financial reporting. Recommending tax strategies that align with an organization’s business plan; advising on tax consequences of business decisions; making after-tax determinations; and ensuring compliance with tax laws and regulations. Applying professional ethical standards in accordance with the Code of Ethics of CPA; protecting the public interest; exercising integrity and professional judgment; and exercising due diligence. Designing and evaluating management accounting and performance measurement systems that align with corporate strategy; recommending and implementing improvements to business operations; and advising on a variety of business operations. Providing strategic advice on corporate transactions; advising on financing to meet short- and long-term organizational goals; building and implementing financial plans that support the strategic plan; and developing risk management strategies and policies. Using essential knowledge of economics, law, business, government, not-for-profit organizations, and the global business environment to provide integrated business services, advise on business operations and decisions, develop business plans, and evaluate risk management policies. Managing technology changes; advising on the development of IT strategy in all areas of business; evaluating and advising on the choice of technology tools and platforms for information needs; and evaluating the impact of new technologies. 20% – 25% 15% – 20% 10% – 20% 10% – 15% 5% – 10% 5% – 10% 5% – 10% 5% – 10% 5 PA1 Examination Blueprint 2013 Structure of the Examination The PA1 examination consists of multiple-choice questions and constructed response questions (two short case analyses and a comprehensive case analysis), as described in Table 2. Twenty of the multiple-choice questions are operational; that is, candidates’ responses are scored and contribute to their overall performance evaluation. Up to five additional questions are pre-test questions; that is, they are included for pre-test purposes only. Accordingly, while candidates’ responses are scored on these pre-test questions, their scores on these questions do not contribute to a candidate’s overall performance. Cases are developed to reflect realistic and typical scenarios faced by newly-certified accountants providing assurance, taxation, or business advisory services. Cases may contain exhibits that represent the types of information that a candidate would realistically be presented with in the given situation. These exhibits may take the form of financial statements; notes to the statements; notes from a meeting with the client, colleague, or a third party; or other source documents. For both types of cases, candidates are expected to clearly demonstrate their ability to integrate and apply professional knowledge to the specific facts of the case and to demonstrate the professional qualities and skills required to produce a recommendation. The short case analyses are more focused and assess fewer competencies than the comprehensive case analysis. Table 2: PA1 Examination Structure Item Type Multiple choice Short case analysis Comprehensive case analysis Description Multiple-choice questions require candidates to select from a set of given options. The questions require professional knowledge and may require analysis, synthesis, evaluation, or application of professional judgment. A short case analysis requires candidates to focus on and respond to analytical and integrative aspects of the case. Candidates are expected to perform an analysis of the factors in the case, including identifying and evaluating issues, outlining alternative actions and solutions, and presenting recommendations, advice, or conclusions. The comprehensive case analysis requires candidates to perform an in-depth analysis of the factors in the case, including identifying and evaluating issues, outlining alternative actions and solutions, and presenting recommendations, advice, or conclusions. The comprehensive case is usually of significant breadth, depth, and complexity. Approximate Number of items Suggested time limit 20–25 40–45 minutes 2 45–55 minutes per case 1 90–110 minutes 6 PA1 Examination Blueprint 2013 Examination Competency Coverage The CPA, CGA competency framework outlines 130 specific competencies that are considered by the Ordre des CPA du Québec to be essential qualifications of a newly-certified professional accountant. A competency is a specific behavior whereby a professional applies knowledge, skills, and/or professional values. The CPA, CGA competencies were validated by a practice analysis survey of CPA, CGAs. They cover 17 subject areas: financial accounting and reporting; management accounting; assurance and other related services; finance and financial planning; business environment; information technology; taxation; strategic and organizational leadership; organizational effectiveness; individual and team leadership and development; ethics and trust; stakeholder focus; communication; integrative approach; problem solving; professional development; and professional self-evaluation. The framework also outlines the required proficiency level for each competency (Level A: Mastery; Level B: Comprehension; and Level C: Awareness). The PA1 examination is designed to assess a critical sample of the competencies found in the CPA, CGA competency framework. All of the examinable competencies, along with their required proficiency levels, are listed in Table 3. Scoring Model and Evaluation of Candidate Performance A decision about a candidate’s Pass or Fail status is based on the evaluation of the candidate’s performance across all competencies within the examination. A standard setting process is used to determine a single passing point for the examination. Each multiple-choice question assesses only one core or core-related competency; performance on these competencies is assessed as either competent (correct response selected) or not competent (incorrect response selected). Each case analysis question assesses multiple competencies within the areas of core and core-related competencies. Candidate performance on core and core-related competencies is assessed using performance level ratings ranging from ‘0’ (the candidate’s response fails to address the competency) to ‘4’ (the candidate’s response exceeds the level expected of a newly-certified accountant). Each case also assesses professional qualities and skills. For each professional quality and skill assessed in a case, candidates are evaluated on whether or not they demonstrated the professional quality or skill in a manner that meets the level expected of a newly-certified accountant. A candidate’s overall examination performance is primarily based on performance on core and core-related competencies, with consideration given to performance on professional qualities and skills. Table 3: Examinable Competencies for the PA1 Examination2 Proficiency Level PROFESSIONAL QUALITIES & SKILLS A=Mastery B=Comprehension C=Awareness Stakeholder Focus PR:SF:01 2 Anticipates and meets the needs and expectations of internal and external stakeholders (develops a sound understanding of the organization and its business environment, determines what information is needed by various stakeholders, seeks feedback from various stakeholders, provides relevant and timely information for decision making) A There is overlap in the competencies to be demonstrated on both the PA1 and PA2 examinations, as is the case in practice. 7 PA1 Examination Blueprint 2013 Communication PR:CM:01 Selects an appropriate medium to convey information, ideas, and results considering the need for confidentiality and privacy PR:CM:02 Prepares information in formats appropriate for specific purposes (audit reports, memos, management letters, consulting reports, financial reports) PR:CM:03 Communicates information in a timely, clear, and concise manner (explains quantitative and qualitative information in language adapted to various stakeholders) PR:CM:04 Projects a professional image in communications A A A A Integrative Approach PR:IA:01 PR:IA:02 PR:IA:03 Aggregates information from a variety of sources and perspectives to assess the impact of issues on the organization (obtains multiple opinions when evaluating contentious issues and reconciles these various opinions) Evaluates the interrelationship of an issue on different functions of the organization and applies concepts and approaches within and across functional areas to develop integrative solutions (coordinates the relevant accounting, assurance, finance, information technology, and taxation implications of events and transactions) Evaluates implications and assesses the appropriateness of solutions beyond the immediate or short term (considers potential impact of decisions on other systems and processes, such as internal controls, impact on other departments, or other functional areas) A A A Problem Solving PR:PS:01 PR:PS:02 PR:PS:03 PR:PS:04 PR:PS:05 Defines the scope of the problem Collects, selects, verifies, and evaluates information relevant to the problem Integrates and analyzes data for patterns, relationships, and trends Generates and evaluates alternative solutions Creates final recommendations, including an action plan A A A A A Professional Self-evaluation PR:SE:01 PR:SE:02 PR:SE:03 Acts within the scope of professional competence (does not attempt to provide expert advice in areas of specialized knowledge outside own capabilities and qualifications) Knows when and how to refer to other professionals and experts (seeks advice or refers clients in areas such as law, IT, financial instruments, international business development) Applies professional skepticism (maintains an inquisitive mind that is vigilant for potential misstatements, considers where problems are likely to arise and monitors these areas) A A A Leadership: Strategic and Organizational Leadership LD:SO:02 Evaluates the organization’s strengths, weaknesses, opportunities, and threats (reputation, process, finances, human resources, location, brand recognition, competition) A 8 PA1 Examination Blueprint 2013 LD:SO:04 LD:SO:06 LD:SO:07 Evaluates and advises on the impact of specific changes in strengths, weaknesses, opportunities, and threats (credible reputation, high employee turnover, competitor going out of business, new competitor entering market) Develops, implements, and updates the organization’s operational plan in alignment with the strategic plan (business, financial, and IT plans; pricing and market share strategies; customer satisfaction; quality control; product innovation) Communicates the requirements and expected performances of the organization’s operational plan to all key stakeholders (key steps, milestones, resource requirements) A B A Leadership: Organizational Effectiveness LD:OE:01 Analyzes and evaluates results and information from business activities and processes against objectives and benchmarks, and advises on further action (conducts and reports on gap analysis) LD:OE:02 Designs, evaluates, and reports on internal control systems to ensure organizational effectiveness LD:OE:03 Advises on issues of corporate governance (audit committee independence, executive compensation, directors’ liability, board accountability) LD:OE:04 Conducts business process reviews of existing systems, processes, and controls within the organization (identifies, recommends, and evaluates enhancements, including policy, program, and process changes to effect cost containment and/or productivity improvements) A A A A Leadership: Individual and Team Leadership and Development LD:IT:04 LD:IT:05 Solicits and acts on input from individuals and teams in order to optimize individual and team effectiveness (fosters free exchange of ideas, reserves judgment, explains reasons for final decisions) Evaluates performance of individuals and teams and provides timely and constructive feedback A A CORE COMPETENCIES Financial Accounting and Reporting PK:FA:01 PK:FA:02 PK:FA:03 Formulates, analyzes, and processes transactions in accordance with applicable professional standards (standards for not-for-profit, public and private corporations, and the public sector) Evaluates, interprets, and advises on accounting policies and procedures in accordance with professional standards (standards for not-for-profit, public and private corporations, and the public sector) Researches, evaluates, and advises on the appropriate accounting treatment for complex transactions (step-by-step acquisitions, fair value determinations, encumbrances, endowment trusts, financial instruments) A A A 9 PA1 Examination Blueprint 2013 PK:FA:04 PK:FA:05 PK:FA:06 PK:FA:07 PK:FA:08 PK:FA:09 PK:FA:12 Implements and updates accounting policies and procedures in accordance with professional standards (appropriate accounting policies for amortization and inventory valuation, revenue recognition, and capitalization) Interprets and advises on the organization’s reporting obligations (determining appropriate basis of accounting, determining required reporting to shareholders and to government and regulatory agencies) Ensures the preparation of timely, reliable, and relevant financial information (financial system design, quality control systems for financial reporting, internal controls) Develops policies and procedures for documenting and maintaining supporting information for transactions and events (record retention policy, preservation of the audit trail) Prepares financial statements and related disclosures appropriate for external users and in compliance with regulatory standards (interim financial statements, pro forma statements, environmental impact, longrange forecasts, management discussion and analysis [MD&A]) Develops, prepares, analyzes, and interprets relevant financial and nonfinancial performance measures (comparative financial results, trend/ ratio/industry analysis, key performance indicators) Evaluates and advises on financial accounting and related systems (cash management, accounts payable, accounts receivable, credit control, inventory) A A A A A A A Assurance and Other Related Services PK:AS:01 PK:AS:02 PK:AS:03 PK:AS:04 PK:AS:05 PK:AS:06 PK:AS:07 Evaluates and consults on the organization’s internal and external reporting needs and related assurance requirements (level of assurance required, attestation versus direct reporting audit, review or compilation engagement, special report engagement) Determines and advises on whether to accept an engagement consistent with professional standards (evaluates potential clients, communicates with predecessor auditor, checks for conflict of interest) Determines the scope of the engagement or management audit (contents of engagement letter, client expectation, limitations on scope, timing, sign-offs) Evaluates risks and business issues (nature of organization, control environment) to determine their impact on the engagement or management audit (extent, materiality, nature, and timing of engagement) Develops a plan for the engagement or management audit (staffing, use of specialists, time budget, technological tools, timing of the engagement, timing of the management audit) Develops and/or modifies procedures for the engagement or management audit (prepares review or audit procedures, modifies audit procedures in the presence of fraud risk factors or known errors) Executes the engagement or management audit in accordance with professional standards (understands the purpose of the selected procedures, completes audit procedures as intended) A B B A B A B 10 PA1 Examination Blueprint 2013 PK:AS:08 PK:AS:09 PK:AS:10 PK:AS:11 PK:AS:12 Identifies, evaluates, and advises on internal control systems, and communicates weaknesses to the appropriate level of the organization (financial approval authority, credit control, segregation of duties, evaluation of fraud risk factors) Advises on the design and implementation of new or enhanced internal controls (to strengthen systems and operational controls, to reduce exposure to business risks, to enhance operating effectiveness, to comply with rules and regulations) Analyzes and documents the evidence and results of the engagement or management audit to develop conclusions (prepares working papers with sufficient detail and clarity to support the conclusion) Develops and advises on a framework for detection of fraud (payroll fraud, billing fraud, computer fraud, forensic investigation procedures) Summarizes conclusions and prepares a report, letter, or memo (appropriate review or auditor’s report, management letter, comfort letter, representation letter, memo to partner, exit interview, internal audit report) A A B A B Taxation PK:TX:01 PK:TX:02 PK:TX:03 PK:TX:04 PK:TX:06 PK:TX:08 Determines and advises on taxpayer’s regulatory requirements and exposure (filings, use of special elections, reporting requirements) Determines and advises on taxpayer’s tax liability (taxes related to income, consumption, payroll, property) Ensures compliance with all taxation reporting and filing requirements (timely filing of income tax returns and elections, appropriate withholding and remittances) Reviews, advises on, and replies to assessments and reassessments Analyzes and advises on tax-planning issues (purchase or sale of shares or assets, succession planning, reorganizations) Evaluates and advises on tax implications of alternative business decisions (lease versus buy, dividend versus salary, sharing small-business deductions, contract versus employee) A A A B B A Ethics and Trust PR:ET:01 PR:ET:02 PR:ET:03 PR:ET:04 PR:ET:05 PR:ET:06 Applies professional ethical standards (understands and follows the word and spirit of Code of Ethics of CPA, takes action in response to situations that are contrary to the ethical code of the profession) Exercises integrity and a high level of professional judgment Maintains objectivity and independence in appearance and fact (avoids real and perceived conflicts of interest) Protects the public interest (maintains and raises the visibility of the ethical nature of the profession and professional accounting standards) Plans and exercises due diligence (plans and constructs due diligence checklist for mergers and acquisitions or public listing cases; conducts financial statement reviews with financial due diligence; conducts operations and manages with due diligence) Ensures confidentiality of stakeholder information (protects proprietary information) A A A A A A 11 PA1 Examination Blueprint 2013 PR:ET:07 Demonstrates professional courtesy (notifies another firm that an issue has arisen about its work) A CORE-RELATED COMPETENCIES Management Accounting PK:MA:01 Designs, evaluates, and advises on the organization’s performance measures to ensure alignment with corporate strategy, and recommends changes as required (KPIs and balanced scorecards) PK:MA:02 Develops, analyzes, and monitors operational plans and budgets, and recommends corrective action as needed (annual budgets, special project budgets, budget variance analysis) PK:MA:03 Identifies, assesses, and advises on information required for management decision making (cost-volume-profit relationships, cost classifications and flows, market or industry data, non-financial factors) PK:MA:04 Designs, evaluates, and advises on the organization’s management accounting systems to ensure that information is relevant, accurate, and timely (costing models, non-financial reporting, planning and forecasting, activity-based cost models, KPIs and balanced scorecards, responsibility accounting) PK:MA:05 Implements, monitors, and updates management accounting systems (costing models, non-financial reporting, planning and forecasting, activitybased cost models, KPIs and balanced scorecards, responsibility accounting) PK:MA:06 Analyzes and evaluates information from management accounting systems, and makes decisions (pricing and costing decisions, transfer pricing decisions, make or buy decisions, performance-based compensation plans) PK:MA:07 Recommends organizational improvements based on results from management accounting systems (cost reduction strategies, revenue growth, business process re-engineering, compensation criteria) B A A A A A B Finance and Financial Planning PK:FN:01 PK:FN:02 PK:FN:03 PK:FN:05 Advises on financing to meet the organization’s goals (ensures adequate credit facilities, determines pricing needed to implement strategic goals, evaluates loans, ensures liquidity and solvency and conditions, manages relationships with the organization’s banks) Advises on the capital structure of the organization to maximize the organization’s value (determines the appropriate debt-to-equity ratio; advises on public share offerings, debt structure, asset securitization strategy; assesses lease versus buy decisions) Develops financial risk management policies and monitors exposure in order to manage the level of financial risk (hedging policy, investment policy, insurance coverage) Recommends changes to risk management policies in line with economic and business changes (assesses impact on liquidity, cash flows, and financial condition) A B B B 12 PA1 Examination Blueprint 2013 PK:FN:06 PK:FN:07 PK:FN:08 PK:FN:09 PK:FN:10 PK:FN:11 Develops financial plans and monitors forecasts in alignment with strategic and operational plans of organizations and/or individuals (financial plans, projections, proposals, and trend analyses; pro forma and projected financial statements; translates operational plans into cash requirement plans) Manages cash flow and working capital (sets working capital levels including bank balances, receivable balances, and payable balances; formulates policies for granting credit to customers and making payments to suppliers; hedges market risks — interest rates, foreign exchange, commodity risks) Analyzes and advises on financial instruments to meet the organization’s need (advises on the appropriate mix of equity, debt, and derivative instruments) Develops and assesses financial KPIs (determines an appropriate cost of capital for an organization, determines economic value added [EVA]) Evaluates and advises on capital investments, mergers and acquisitions, or sale of a business (analyzes potential acquisitions, projects postacquisition synergies, prepares and reviews valuation reports, formulates plans for joint ventures) Assesses the value of a business (assesses tangible and intangible assets, prepares reports for potential acquisition or sale of a business) A A B B B B Business Environment PK:BE:03 PK:BE:06 PK:BE:07 PK:BE:08 PK:BE:09 Anticipates and recognizes market factors and stakeholders’ interests, and adapts business decisions and processes (changes to market share through acquisitions, diversification, or divestment of certain business units; supply chain management; customer relationship management; agency theory) Identifies, analyzes, and evaluates enterprise risk factors (market, legal, environmental, technological, operational) Develops, evaluates, and advises on the organization’s risk management policy and processes Implements and advises on measures to mitigate enterprise risk (works with management to develop a risk management matrix) Advises on the development of business continuity planning (critical business functions, business continuity management, disaster recovery, liability insurance, contingency planning, key-person insurance, staff succession plan, product life cycle planning) B A B B B Information Technology PK:IT:01 PK:IT:02 Advises on the development of IT strategy (IT strategic plans for financial accounting, reporting, and management information systems; strategies to support end-user computing; standards and practices for information systems as they relate to financial information, green IT) Selects and uses appropriate business technology tools in the workplace (spreadsheets, tax compliance software, generalized audit software, online knowledge bases) B A 13 PA1 Examination Blueprint 2013 PK:IT:03 PK:IT:04 PK:IT:05 PK:IT:06 PK:IT:07 Aligns financial and related information systems with the organization’s strategic and business plans (advises on systems that monitor and report on organizational performance, manages or controls the organizational information system as it relates to financial information) Evaluates and advises on the impact of new technologies on business processes (e-commerce; Internet, intranet, and extranet technologies; biometrics) Advises on the design, development, and implementation of IT projects including specific applications software (enterprise resource planning systems, user-acceptance testing, business requirements definition, installation upgrades; systems, methods, and procedures design; processing, data storage, input, and output design; conversion strategies for system delivery, design for application controls) Advises on implications of IT acquisitions and vendor selection (prepares requests for proposals and quotations and evaluates responses; evaluates financial and contractual aspects of acquisition of hardware and software) Evaluates and advises on the safeguarding of IT assets to ensure organizational ability to meet business objectives (analyzes and evaluates IT controls, control environment, systems acquisition and/or development) B B B B B 14