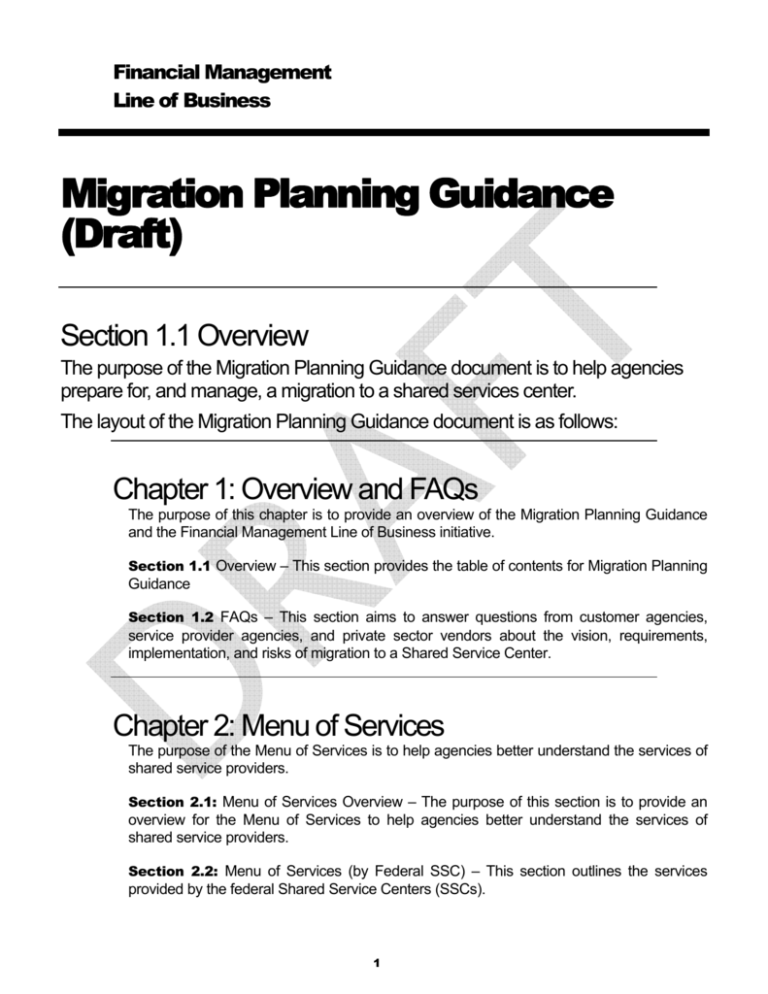

Migration Planning Guidance

advertisement