ANNUAL REPORT • 2014 - MTD ACPI Engineering Berhad

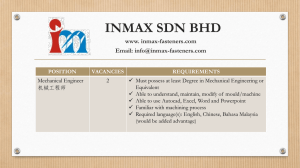

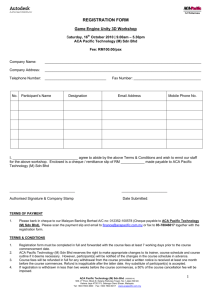

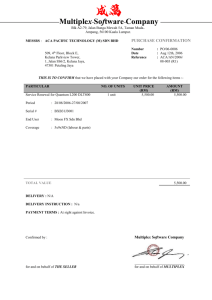

advertisement