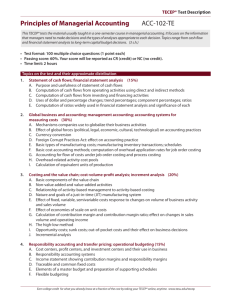

costing method that includes all manufacturing costs

advertisement

Absorption costing: costing method that includes all manufacturing costs – direct materials, direct labor, and both variable and fixed manufacturing overhead – in unit product costs. Common fixed cost: fixed cost that supports more than one business segment, but is not traceable in whole or in part to any one of the business segments. Segment: any part or activity of an organization about which managers seek cost, revenue, or profit data. Segment margin: segment’s contribution margin less its traceable fixed costs. It represents the margin available after a segment has covered all of its own traceable costs. Traceable fixed cost: any fixed cost that is incurred because of the existence of a particular business segment and that would be eliminated if the segment were eliminated. Variable costing: costing method that includes only variable manufacturing costs – direct materials, direct labor, and variable manufacturing overhead – in unit product costs. Contribution margin = Sales – variable expenses Unit contribution margin = contribution margin/ # of units Contribution margin ratio = contribution margin/ sales Unit sales to attain target profit = (target profit + fixed expenses) / Unit contribution margin Dollar sales to attain target profit = (target profit + fixed expenses) / Contribution margin ratio Plantwide overhead rate = total estimated manufacturing overhead / total estimated machine hours Action analysis report: report showing what costs have been assigned to a cost object, such as a product or customer, and how difficult it would be to adjust the cost if there is a change in activity. Activity: an event that causes the consumption of overhead resources in an organization. Activity-based costing (ABC): costing method based on activities that is designed to provide managers with cost information for strategic and other decisions that potentially affect capacity and therefore fixed as well as variable costs. Activity-based management (ABM): management approach that focuses on managing activities as a way of eliminating waste and reducing delays and defects. Activity cost pool: “bucket” in which costs are accumulated that relate to a single activity measure in an activity-based costing system. Activity measure: allocation base in an activity-based costing system; ideally, a measure of the amount of activity that drives the costs in an activity cost pool. Batch-level activities: activities that are performed each time a batch of goods is handled or processed, regardless of how many units are in the batch. The amount of resource consumed depends on the number of batches run rather than on the number of units in the batch. Benchmarking: systematic approach to identifying the activities with the greatest potential for improvement. Customer-level activities: activities that are carried out to support customers, but that are not related to any specific product. Duration driver: measure of the amount of time required to perform an activity. First-stage allocation: the process by which overhead costs are assigned to activity cost pools in an activity-based costing system. Organization-sustaining activities: activities that are carried out regardless of which customers are served, which products are produced, how many batches are run, or how many units are made. Product-level activities: activities that relate to specific products that must be carried out regardless of how many units are produced and sold or batches run. Second-stage allocation: process by which activity rates are used to apply costs to products and customers in activity-based costing. Transaction driver: simple count of the number of times an activity occurs. Unit-level activities: activities that are performed each time a unit is produced. Budget: detailed plan for the future that is usually expressed in formal quantitative terms. Planning: developing goals and preparing various budgets to achieve those goals. Control: involves gathering feedback to ensure that the plan is being properly executed or modified as circumstances change. Responsibility accounting: a manager should be held responsible only for items that the manager can control to a significant extent. Continuous/Perpetual budget: 12-month budget that rolls forward one month (or quarter) as the current month (or quarter) is completed Self-imposed/Participative budget: budget that is prepared with the full cooperation and participation of managers at all levels. Budget committee: usually responsible for overall policy relating to the budget program and for coordinating the preparation of the budget itself. Master budget: consists of a number of separate but interdependent budgets that formally lay out the company’s sales, production, and financial goals. 1. Sales budget: detailed schedule showing the expected sales for the budget period. 2. Production budget: lists the number of units that must be produced to satisfy sales needs and to provide for the desired inventory. Merchandise purchases budget (If not manufacturing): Amount of goods to be purchased from suppliers during the period. 3. Direct materials budget: Details the raw materials that must be purchased to fulfill the production budget and to provide for adequate inventories. 4. Direct labor budget: shows the direct labor-hours required to satisfy the production budget. 5. Manufacturing overhead budget: lists all costs of production other than direct materials and direct labor. 6. An ending finished goods inventory budget: budget that helps determine cost of unsold units 7. Selling and administrative expense budget: lists budgeted expenses for areas other than manufacturing. 8. Cash budget: detailed plan showing how cash resources will be acquired and used. 9. Budgeted income statement 10. Budget balance sheet Planning budget: prepared before the period begins and is valid for only the planned level of activity. Flexible budget: an estimate of what revenues and costs should have been, given the actual level of activity for the period. Activity variances: difference in the level of activity between the planning budget from the beginning of the period and the actual level of activity. Revenue variance: difference between what the total revenue should have been, given the actual level of activity for the period, and the actual total revenue. (F Actual > Flexible, U if Actual < Flexible) Spending variance: difference between how much a cost should have been, given the actual level of activity and the total amount of the cost (F Actual < Flexible, U if Actual > Flexible) Management by exception: investigate discrepancy to find the cause of the problem and eliminate it. Ideal standards: Attainable only under the best circumstances. Practical standards: Tight but attainable. Standard price per unit: reflects the final, delivered cost of the materials Standard quantity per unit: reflects the amount of material required for each unit of finished product as well as an allowance for unavoidable waste. Standard rate per hour: for direct labor includes hourly wages, employment taxes, and fringe benefits. Standard hours per unit: the direct labor time required to complete a unit of product. Standard cost per unit: for variable manufacturing overhead is computed the same way as for direct materials or direct labor. Quantity variance: the difference between how much of an input was actually used and how much should have been used and is stated in dollar terms using the standard price of the input. Price variance: the difference between the actual price of an input and its standard price, multiplied by the actual amount of the input purchased. Standard quantity allowed/ Standard hours allowed: amount of an input that should have been used to produce the actual output of the period. Quantity Variance: AQ X SP – SQ X SP = SP (AQ – SQ) Price Variance: AQ X AP – AQ X SP = AQ (AP – SP) Spending Variance: AQ X AP – SQ X SP Would be unfavorable if the amount that was actually spent exceeded the amount that should have been spent. Materials quantity variance: measures the difference between the quantity of materials used in production and the quantity that should have been used according to the standard. Materials price variance: measures the difference between what is paid for a given quantity of materials and what should have been paid according to the standard. Labor efficiency variance: measures the productivity of direct labor. Widely believed that increasing direct labor productivity is vital to reducing costs. Labor efficiency variance = (AH X SR) – (SH X SR) = SR(AH – SH) Labor rate variance: price variance for direct labor Labor rate variance = (AH X AR) – (AH X SR) = AH (AR – SR) Variable overhead efficiency variance = (AH X SR) – (SH X SR) = SR (AH – SH) Variable overhead rate variance = (AH X AR) – (AH X SR) = AH (AR – SR) Decentralized organization: decision making authority is spread throughout the organization rather than being confined to a few top executives. Responsibility center: For any part of an organization whose manager has control over and is accountable for cost, profit, or investments. Cost center: has control over costs, but not over revenue or the use of investment funds. Profit center: has control over both goods and revenue, but not over the use of investment funds. Investment center: has control over cost, revenue, and investments in operating assets. Return on investment (ROI): defined as net operating income divided by average operating assets. ROI = Net operating income/Average operating assets Net operating income: income before interest and taxes and is sometimes referred to as EBIT Operating assets: include cash, accounts receivable, inventory, plant and equipment, and all other assets held for operating purposes. ROI = Margin X Turnover Margin = Net operating income/Sales Turnover = Sales/Average operating assets ROI = Net Operating Income / Sales * Sales / Average operating assets Residual income: net operating income that an investment center earns above the minimum required return on its operating assets. Economic Value Added (EVA*): adaptation of residual income that has been adopted by many companies. Delivery cycle time: the amount of time from when a customer order is received to when the completed order is shipped. Throughput time (Manufacturing cycle time): amount of time required to turn raw materials into completed products. Manufacturing cycle efficiency (MCE): relates the value-added time to the throughput time. MCE = Value-added time (process time) / Throughput (manufacturing cycle) time Balanced scorecard: consists of an integrated set of performance measures that are derived from and support a company’s strategy. Relevant costs: costs that differ between alternatives. Relevant benefits: benefits that differ between alternatives. Avoidable cost: cost that can be eliminated by choosing one alternative over another. Sunk cost: cost that has already been incurred and cannot be avoided regardless of what a manager decides to do. Vertically integrated: The involvement by a company in more than one of the activities in the entire value chain from development through production, distribution, sales, and after-sales service. Split-off point: that point in the manufacturing process where some or all of the joint products can be recognized as individual products. Special order: A one-time order that is not considered part of the company’s normal ongoing business. Sell or process further decision: decision as to whether a joint product should be sold at the split-off point or sold after further processing. Relaxing (elevating) the constraint: Action that increases the amount of a constrained resource. Equivalently, an action that increases the capacity of the bottleneck. Make or buy decision: decision concerning whether an item should be produced internally or purchased from an outside supplier. Joint products: two or more products that are produced from a common input. Joint costs: costs that are incurred up to the split-off point in a process that produces joint products. Constraint: limitation under which a company must operate, such as limited available machine time or raw materials that restricts the company’s ability to satisfy demand. Bottleneck: machine or some other part of a process that limits the total output of the entire system. Capital budgeting: the process of planning significant investments in projects that have long-=term implications such as the purchase of new equipment or the introduction of a new product. Cost of capital: the average rate of return a company must pay to its long-term creditors and shareholders for the use of their funds. Internal rate of return: discount rate at which the net present value of an investment project is zero; the rate of return of a project over its useful life. Factor if the internal rate of return = (Investment required) / (Annual cash inflow) Net present value: the difference between the present value of an investment project’s cash inflows and the present value of its cash outflows. Out-of-pocket costs: actual cash overlays for salaries, advertising, repairs, and similar costs. Payback period: the length of time that it takes for a project to fully recover its initial cost out of the net cash inflows that it generates. Payback period = (Investment required) / (Annual net cash inflow) Postaudit: the follow-up after a project has been approved and implemented to determine whether expected results were actually realized. Preference decision: decision in which the alternatives must be ranked. Project profitability index: the ratio of a net present value of a project’s cash flows to the investment required. Project profitability index = (Net present value of the project)/(Investment required) Screening decision: a decision as to whether a proposed investment project is acceptable. Simple rate of return: the rate of return computed by dividing a project’s annual incremental accounting net operating income by the initial investment required. Simple rate of return = (Annual incremental net operating income) / (Initial investment) Working capital: current assets less current liabilities.