Frank, Rimerman + Co. LLP | Assurance & Advisory Update

Frank, Rimerman + Co.

LLP

|

Assurance & Advisory Update

FASB’s Accounting Standards Codification: An Easier Way to Research

Accounting Standards

September 14, 2009

Nathan Schouest, Manager – Assurance and Advisory Services

On July 1, the Financial Accounting Standards Board (FASB) launched the FASB Accounting Standards

Codification (the Codification) as the sole source of authoritative non-governmental U.S. generally accepted accounting principles (GAAP). The Codification will be effective for financial statements that cover interim and annual periods ending after September 15, 2009. The Codification combines all authoritative GAAP and supersedes all existing accounting standards as explained by Financial

Accounting Standard No. 168, The FASB Accounting Standards Codification and the Hierarchy of

Generally Accepted Accounting Principles. All other accounting literature not included in the Codification is considered non-authoritative, except for Securities and Exchange Commission (SEC) content and interpretive releases, which are still authoritative under GAAP. The Codification includes limited SEC

guidance (identified with an “S” in the Codification reference).

What Is the Codification?

The Codification does not change GAAP, but it is a significant structural change in the organization of accounting pronouncements. The Codification uses a “top-down” approach, beginning with the broadest topics (for example, General Principles, Presentation, Assets, Liabilities, and so on) down through subtopics, sections, and the more specific subsections. The new structure is designed to help users quickly locate authoritative guidance on specific topics. Because the Codification replaces existing standards, it will affect the way companies reference GAAP in financial statements and accounting policies. The Codification is now completely electronic and can be viewed at the FASB website

(

http://asc.fasb.org

). You can see a basic view without charge, but the professional view costs $850 per user (as of this writing).

What’s New Under the Codification?

1. All “nonessential content” has been eliminated, including historical text, historical Basis for

Conclusions, and other content not deemed necessary to convey GAAP requirements.

2. The new platform uses a computer-based model designed to reduce research time and help resolve accounting issues and questions. Users can search by topic and feel confident that all the current, relevant guidance on this topic is in one location.

3. The Codification will be immediately updated as new pronouncements are issued giving users “real-time” access to the most current information available. For pronouncements with future effective dates, this content will be identified as “Pending.” Once new guidance is effective, the old material will be removed from the Codification and the new guidance will no longer be titled “Pending.”

Frank, Rimerman + Co.

LLP

|

Assurance & Advisory Update

4. As updates are issued, Accounting Standards Updates (ASU’s) will be numbered based upon sequence in any given year. For example, in 2010, the updates will be numbered ASU 2010-

001, ASU 2010-002, ASU 2010-003, and so on. We will no longer see EITF Abstracts, FASB

Interpretations, FASB Staff positions, or new FASB statements.

5. The newly created Codification technological platform and format is consistent with the online International Financial Reporting Standards (IFRS) system which will assist FASB in future standard setting processes as GAAP moves towards convergence with IFRS.

6. The Codification gives companies an opportunity to review their disclosures and transition the wording from technically specific references to “plain-English” descriptions. Although it will continue to be appropriate to refer to old FASB references (for example, SFAS 123(r)) we will increasingly see references in footnotes to financial statements describing an entities policy as “share-base-payment accounting.”

What’s Stays the Same Under the Codification?

The Codification does not change the rigorous standard setting process put in place by the FASB.

Published exposure drafts, public board meetings, and public comment periods will still occur in order to ensure due diligence by the FASB. All pre-Codification Standards are still available to users in the

Codification and can be found using the FASB’s “Cross Reference” tool (included in the subscription fee).

Overall the Codification will make researching GAAP more user friendly and easier to navigate than prior

FASB research tools. The underlying principles in accounting do not change, only the way we access them. For more information you can contact your research company representative or visit the FASB codification website directly (

http://asc.fasb.org

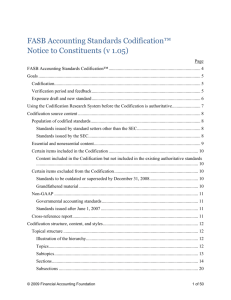

). The FASB has made several tutorials available for review and provided a comprehensive Notice to Constituents which details the history behind the transition and allows readers to obtain a better understanding of the content, style and structure of the

Codification.

Nathan joined Frank, Rimerman + Co. LLP in 2004 and is currently a manager in our Assurance and Advisory Department. He has extensive assurance experience with venture backed, privately held companies in a variety of industries including pre-IPO software and high-technology companies, privately held professional service companies and not-for-profit organizations. He is experienced in revenue recognition and equity accounting. Nathan holds a

Bachelor of Business Economics with an Accounting Emphasis, and a double major in Philosophy from the University of California at Santa Barbara. He is a member of the American Institute of Certified Public Accountants and the

California Society of Certified Public Accountants.

Frank, Rimerman + Co.

LLP

© 2009 Frank, Rimerman + Co. LLP www.frankrimerman.com

Passion Works Here