Company Name - WinFlexOne.com

advertisement

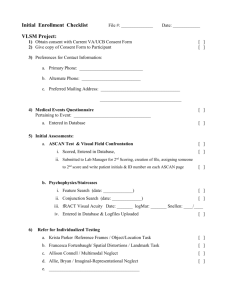

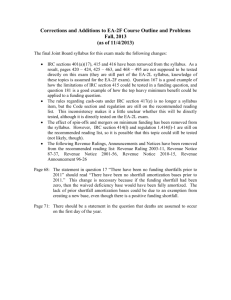

Section 7 Appendix of Forms IRS FORMS CONTAINED IN THIS SECTION ARE SAMPLES ONLY. PLEASE CONSULT WITH YOUR ATTORNEY BEFORE UTILIZING THESE SAMPLES. For current IRS forms, go to: www.irs.gov 2011 7-1 Flexible Benefits Training 2011 7-2 Flexible Benefits Training 2011 7-3 Flexible Benefits Training 2011 7-4 Flexible Benefits Training 2011 7-5 Flexible Benefits Training 2011 7-6 Flexible Benefits Training 2011 7-7 Flexible Benefits Training 2011 7-8 Flexible Benefits Training 2011 7-9 Flexible Benefits Training 2011 7-10 Flexible Benefits Training 2011 7-11 Flexible Benefits Training Date Contact Name Company Address 1 Address 2 City/State/Zip RE: Individual Health Insurance Plans in a Cafeteria Plan Dear [Contact Name]: Due to recent changes in the law, a question has arisen as to the advisability of allowing an "other health insurance premium" conversion option as part of an Internal Revenue Code (IRC) Section 125 plan (cafeteria plan). According to Revenue Ruling 61-146, and an informal opinion by the Office of IRS Chief Counsel, this is a permissible practice. However, several issues must be considered in determining the advisability of allowing such an option. When a salary reduction contribution is made through an IRC §125 plan, the contribution, in effect, becomes an employer contribution. Thus, for many purposes, the individual policy becomes an employer-sponsored plan subject to laws and regulations such as: COBRA HIPAA, including the certification requirements ERISA, including reporting and disclosure requirements Medicare secondary payor rules Nondiscrimination rules under Title VII of the Civil Rights Act In addition, many state group health insurance laws define such arrangements as employer sponsored plans subject to the group health insurance mandates. Many insurance carriers are unwilling to issue individual policies that are brought under the group insurance laws in this manner. For the aforestated reasons, we discourage the practice of allowing "other health insurance premiums" to be a permitted salary reduction option through an IRC §125 plan. If you intend to continue or commence such a practice, we recommend that you notify the carrier of the individual health insurance plan and consult with your legal counsel. If you have any questions, please contact [Name and Phone Number]. 2011 7-12 Flexible Benefits Training 2011 7-13 Flexible Benefits Training 2011 7-14 Flexible Benefits Training 2011 7-15 Flexible Benefits Training 2011 7-16 Flexible Benefits Training 2011 7-17 Flexible Benefits Training 2011 7-18 Flexible Benefits Training 2011 7-19 Flexible Benefits Training 2011 7-20 Flexible Benefits Training 2011 7-21 Flexible Benefits Training 2011 7-22 Flexible Benefits Training 2011 7-23 Flexible Benefits Training 2011 7-24 Flexible Benefits Training 2011 7-25 Flexible Benefits Training Client Engagement Manager • • • • • • • • • • • • • • • • • • • • • • • • 2011 Interview with client to fill out Client Checklist and design Plan Document and Summary Plan Description. Conduct initial discrimination tests. Establish a contact at client’s office that participants will be working with for all questions about the Plan. Provide client with worksheets to determine key employees [IRC 416(i)(1)(A)], highly compensated employees [IRC 414(q)] and those making under $25,000 in annual compensation Distribute general information about the Cafeteria Plan to all employees. Pickup key employee, highly compensated employee and total compensation worksheets. Meet with payroll personnel to discuss salary redirection and reimbursements as they apply to individual paychecks. Enrollment — Group or individual meetings to explain Cafeteria Plan and answer any questions. Advise those with dependent care expenses of childcare credit. Distribute Summary Plan Descriptions to participants within 120 days after plan is adopted. Distribute Summary Plan Descriptions to new employees within 90 days after they become participants. Collect election forms directly from participants or have employer assemble and forward to you. Return short verification letter to each participant restating their annual and per paycheck election for each portion of the Plan. Determine total nontaxable benefits provided to all employees, key employees and highly compensated employees based on annual elections. Test for discrimination (25% Concentration Test for all benefits, 55% Average Benefits Test, and 25% Owners Test for the dependent care portion of the Plan). Test for discrimination at the beginning of the Plan based on annual election amounts and at least quarterly thereafter based on year-to-date contributions. Keep accurate records throughout the Plan Year for changes of family status, terminations, and new employees. Keep your client and participants informed of account balances through company statements and individual employee statements. Reconcile to client’s year-to-date records quarterly. Two months before the Plan year end — inform employees of account balances including year-to-date contributions, claims, and disbursements plus a reminder of their annual election amount, the amount they need to request by Plan year end, the number of grace days allowed after the Plan year end, and their risk of forfeiture. Thirty days prior to Plan year end — send individual reelection forms showing last year’s elections and stating any changes that will take place in the new Plan year. Enrollment — Group or individual meetings to explain Cafeteria Plan and answer any questions. Advise those with dependent care expenses of childcare credit. By January 31 of every year — furnish participants in dependent care portion of Plan with W-2 showing total benefits provided for their taxable year through the Cafeteria Plan. Plan year end plus grace days expiration — test for discrimination based on total disbursements from the Plan and send final reports to advise client and participants of any forfeitures or pre-funded amounts. Complete Form 5500. All required forms and schedules are due by the last day of the 7th month after the plan year-ends. If needed, File Form 5558 “Application for Extension of Time To File Certain Employee Plan Returns” to obtain an extension of time for 2 ½ months. (Suspended for Fringe Benefit Plans.) Final Discrimination Testing - test for discrimination at the end of the Plan based on total disbursement amounts. 7-26 Flexible Benefits Training Flexible Spending Account Plan Application 1.Legal Name of Company Sponsoring Plan ______________________________________ 2. Business Entity Type: C Corp. Sole Proprietorship Partnership Not-For-Profit Government Entity or church S Corp. Limited Liability Company 3. Principal Business Activity _______________________________________________ 4. Federal Employer Identification Number (Must be 9 digits): __ __ -- __ __ __ __ __ __ __ 5. Contact Person _________________________________ Title __________________________________________ 6. Street Address (No PO Boxes): ____________________________________________ City, State, Zip: _________________________________________________ 7. Phone Number Fax Number E-mail Address 8. Effective Date – This FSA plan will be: ( ) A new plan effective as of (date) _______________________ ( ) An amendment and restatement is effective as of (date) ____________________ (1) This amendment and restatement is effective as of (date) ______________________ (2) State the effective date of the original plan (date) ___________________ (3) State the plan number (consult your last Form 5500 and/or plan document for this number assigned to your plan) ________ 9. Plan Year – The first plan year for the FSA will be: A 12-consecutive-month period beginning (date) ___________ and ending (date) __________________ A short plan year beginning (date) ____________________and ending (date) ____________________ 10. Employer’s Principal Office – This FSA plan shall be governed under the laws of the: State of ____________________________ Commonwealth of __________________________ 11. All employees are eligible for the FSA Plan: Except: Employees not eligible under Employers group medical plan Part-time Employees expected to work less than ___ hours per week Commissioned Employees Union Employees Other (type & attach) 12. All employees can enter the FSA Plan: Same as Employer’s group medical plan _____ days after date of hire 13. Benefits – The benefits selected below shall be included in the FSA Plan: 2011 Medical expenses not covered by insurance and 7-27 Flexible Benefits Training annual maximum per participant shall be $_____________ (typical limits are between $1,500 and $2,600 annually) Adult and child daycare expenses Health and other insurance (select coverages below): __Health Insurance Premiums __Disability insurance** __Critical Illness Insurance __Dental Insurance __Vision Care Insurance __ Accidental Death/Dismemberment __Group-term Life Insurance* __Cancer Insurance __Other Insurance (specify) _____ *Group-term life insurance up to $50,000 coverage **If disability insurance is paid for on a pretax basis, any benefits received are taxable to the employee Note: Insurance products with a return-of-premium feature cannot be paid for on a pretax basis. Individual Health and Disability Insurance 14. Contributions – The contributions for the FSA Plan will be: Employee (salary reduction) contributions only Employer contributions only Both salary redirection and Employer contributions $ ________annually per Participant $_____Employer contributions convertible to cash 15. Legal names(s) of affiliated company(ies) that will be covered by this plan: (provide names, tax ID numbers and full addresses on attachment) 16. Total number of employees ___________ 17. Pay cycles – Payroll is provided (weekly, semi-monthly, monthly, etc.) _________________________ Deductions to begin ________________________________ Payroll is prepared: __In house __Out sourced (specify payroll company): ___________________________________________ Pricing Information 18. Fee for a New Plan setup or restatement. Call for quote 19. Fee for Participant Services. $__ per month/participant. Client is billed by Admin. Co. each month. 20. Fee for Annual Plan Compliance. $__ per month is billed by Administrative Company Shipping Instructions 21. Shipping method (FSA setup kit is shipped within 2 business days): Date Received Date Application Signed Client Number Full Administration Plan Doc/5500 Only Accounting Use Set-up Fee Monthly Charge per participant Annual Fee Lead Source (Company Name) Relationship Manager (Agent Name) Commission Schedule Anticipated First Billing Month Additional Notes If Individual Health and Disability Insurance marked – send advice letter. 2011 7-28 Flexible Benefits Training March 8, 2016 Dear One of the services we provide for your Flexible Benefit Plan is discrimination testing. In order to perform the discrimination testing; please complete the enclosed questionnaires identifying the Key and Highly Compensated employees for your plan year 2001. One of the discrimination tests is performed on all qualified benefits that are part of your Flexible Benefit Plan. Although we track the amounts contributed to the flexible spending accounts (Health Care Reimbursement and Dependent Care), we need the following information for the insurance premium portion of the plan. Total dollar amount of salary redirections for the insurance benefits that are part of your Plan. for the Key Employees: $ ___________ for all other employees $___________ - Please provide this information for these premiums for the Month of June Provide the total number of employees eligible to participate in the Dependent Care Portion of your plan. _____________________. This should be every employee that is eligible for your Section 125 Cafeteria Plan. Once we have received this information, we will perform the tests and advise if your Flexible Benefit Plan has failed the discrimination testing. No notice will be returned if your Plan is found to be nondiscriminatory. Please return the information to our office as soon as possible. If you have any questions, please feel free to contact me. My telephone number is. Sincerely, 2011 7-29 Flexible Benefits Training IRC Section 125 — Cafeteria Plan Highly Compensated Employees — IRC 414(q) ______________________________________________ (Company Name) Plan Year Ended ________________ List all employees who fit into one or more of the following categories. An employee may be classified as highly compensated on the basis of more than one category. When listing highly compensated employees, list each employee only once. 1. List all employees with more than 5% ownership during the prior or current plan year. ______________________________ ______________________________ ______________________________ ______________________________ 2. List all employees who are a spouse or relative (within the meaning of IRC Section 318) of any individual listed in number 1 above. 3. ______________________________ ______________________________ ______________________________ ______________________________ List the employees earning more than $95,000 (2005) (indexed) in the prior plan year.* ______________________________ ______________________________ ______________________________ ______________________________ * An employer may elect to treat as highly compensated under the $95,000 compensation test only those employees who are also in the top-paid 20% group. 2011 7-30 Flexible Benefits Training IRC Section 125 — Cafeteria Plan Key Employees — IRC 416(i)(1)(A) __________________________________ (Company Name) Plan Year Ended __________________ List all employees who, at any time during the current plan year, fit into one or more of the following four categories. An employee may be classified as a key employee on the basis of more than one category. When listing key employees, list each employee in each category. 1. 2. 3 Officers* with annual compensation greater than $140,000 (indexed)]: _________________________________ _________________________________ _________________________________ _________________________________ Employees with more than 5% ownership: ________ __________________________________ _________________________________ _________________________________ _________________________________ _________________________________ _________________________________ _________________________________ Employees with more than 1% ownership and annual compensation greater than $150,000: _________________________________ _________________________________ *The determination as to whether an employee is an officer should be made on all the facts and circumstances. Generally the term “officer” means an administrative executive. According to regulations under 414(q), an officer includes the president, vice-presidents, general manager, treasurer, secretary, and comptroller of a corporation and any other person who performs duties corresponding to those normally performed by persons occupying those positions. So, for example, all of the employees of a bank who have the title of vice-president or assistant vice-president are not necessarily officers unless they have the authority of an officer. Similarly, an employee who has the authority but not the title would be considered an officer. Sole proprietorships, partnerships, and associations, among other unincorporated entities, may have officer for this purpose. No more than 50 employees shall be treated as officers. If there are less than 50 employees who are treated as officers, no more than the greater of 1) three employees or 2) 10% of all employees will be treated as officers. 2011 7-31 Flexible Benefits Training IRC SECTION 105 (h) Medical Expense Reimbursement Plans Percentage Test A plan is not discriminatory as to eligibility if it satisfies one of the following percentage tests. The medical expense reimbursement plan benefits: A. 70% or more of all employees. or B. 80% or more of all the employees who are eligible to benefit under the plan if 70% or more of all employees are eligible to benefit under the plan. 1. Total employees __________ 2. Total inelgible (see line 6, Excluded Employees Form) __________ 3. Employees eligible under the plan (subtract (1) from (2)) __________ 4. Employees excluded from benefiting __________ 5. Employees eligible to benefit (subtract 4 from 3) __________ 6. Number of employees participating in plan __________ 7. Percent of eligible nonexcluded employees who participate (divide (6) by (3)). If > 70% stop. Do not complete the remainder of this form. __________ Complete (8) only if (7) is less than 70% and complete (9) only if (8) is 70% or more: 8. 9. Percent of nonexcluded employees who are eligible to participate (divide (5) by (3)) __________ Percent of eligible employees who are participating (divide (6) by (5)) __________ Conclusion: If line (7) is > 70%, the plan has satisfied requirement A above. If line (8) is > 70% and line (9) is 80% or more, the plan has satisfied requirement B above. 2011 7-32 Flexible Benefits Training IRC Section 105(h) Medical Expense Reimbursement Plans Benefits Available Test Answer the following questions. YES NO 1. Are any benefits under the plan available only to highly compensated individuals? If yes, this plan is discriminatory. Highly compensated individuals must include excess benefits in gross income. 2. Are all benefits available for the dependents of highly compensated individuals also available on the same basis for dependents of all other employees who are participants? If no, the plan is discriminatory. Highly compensated individuals must include excess benefits in gross income. 3. Is the plan’s maximum limit for the amount of reimbursement which may be paid to a participant for any single benefit, or combination of benefits based on: A. Percent of compensation? B. Participant’s age? C. Years of service? If yes to A, B, or C this plan is discriminatory. Highly compensated individuals must include excess benefits in gross income. 7 4. 5. 2011 Is the plan’s maximum limit for the amount of reimbursement, uniform to all participants and for all dependents of employees who are participants?* If no, this plan is discriminatory. Highly compensated individuals must include excess benefits in gross income. Are waiting period uniform to all participants? If no, this plan may be discriminatory. Highly compensated individuals must include excess benefits in gross income. 7-33 Flexible Benefits Training Nondiscriminatory Classification Test Reg. Section 410(b) ____________________________________ (Company Name) Plan Year Ended ____________________ Total Highly Nonhighly Employees Compensated Compensated 1. Total employees ___________ ___________ __________ 2. Employees ineligible under the plan ___________ ___________ __________ 3. Total eligible employees (Subtract line 2 from line 1) _______ (A) ________ 4. Total employees excluded from benefiting ________ (B) ___________ ___________ _________ 5. Total employees eligible to benefit (Subtract line 4 from line 3) ___________ ___________ 6. Concentration of nonhighly compensated employees ________ (C) _________ % (Divide Nonhighly compensated (B) by Total Employees (A)) 7. Safe Harbor percentage _________ % 8. Unsafe Harbor percentage _________ % 9. Percentage of nonexcluded, nonhighly compensated employees eligible to benefit under the plan. (Divide Nonhighly Compensated (C) by Nonhighly Compensated (B)) _________ % Conclusion: If line 9 is less than line 7, then it fails the Nondiscriminatory Classification Test. 2011 7-34 Flexible Benefits Training Nondiscriminatory Classification Test Reg. Section 410(b) 2011 NHCE Concentration Percentage Safe Harbor Percentage Unsafe Harbor Percentage 0-60% 61% 62% 63% 64% 65% 66% 67% 68% 69% 70% 71% 72% 73% 74% 75% 76% 77% 78% 79% 80% 81% 82% 83% 84% 85% 86% 87% 88% 89% 90% 91% 92% 93% 94% 95% 96% 97% 98% 99% 50.00% 49.25% 48.50% 47.75% 47.00% 46.25% 45.50% 44.75% 44.00% 43.25% 42.50% 41.75% 41.00% 40.25% 39.50% 38.75% 38.00% 37.25% 36.50% 35.75% 35.00% 34.25% 33.50% 32.75% 32.00% 31.25% 30.50% 29.75% 29.00% 28.25% 27.50% 26.75% 26.00% 25.25% 24.50% 23.75% 23.00% 22.25% 21.50% 20.75% 40.00% 39.25% 38.50% 37.75% 37.00% 36.25% 35.50% 34.75% 34.00% 33.25% 32.50% 31.75% 31.00% 30.25% 29.50% 28.75% 28.00% 27.25% 26.50% 25.75% 25.00% 24.25% 23.50% 22.75% 22.00% 21.25% 20.50% 20.00% 20.00% 20.00% 20.00% 20.00% 20.00% 20.00% 20.00% 20.00% 20.00% 20.00% 20.00% 20.00% 7-35 Flexible Benefits Training Indexed Figures The indexed compensation levels for determining who is a highly compensated employee or a key employee are as follows. TYPE OF EMPLOYEE BASE YEAR 1987 2009 2010 2011 Highly Compensated Employee $75,000 $110 ,000 $110,000 $110,000 Top Paid Group of 20% $50,000 $110,000 $110,000 $110,000 Key Employee, Officer $45,000 $160,000 $160,000 $160,000 2011 7-36 Flexible Benefits Training IRC Section 129 — Dependent Care Assistance Plan 55% Average Benefits Test IRC 129(d)(8) (Applies to plan years beginning after December 31, 1989) __________________________________ (Company Name) Plan Year Ended _______________ STEP 1 Nontaxable benefits paid to highly compensated employees ________________ (A) Number of highly compensated employees ________________ (B) _____ Average benefits paid to highly compensated employees (A/B) (C) STEP 2 Nontaxable benefits paid to nonhighly compensated employees ________________ (D) Number of nonhighly compensated employees _________________ (E) Average benefits paid to nonhighly compensated employees (D/E) ______ (F) STEP 3 ______ Average benefits paid to highly compensated employees (A/B) (C) Ratio X 55% ______ Average benefit threshold for nonhighly compensated employee Conclusion: ______ (G) If (F) is less than (G), then all amounts paid to the highly compensated employees under IRC Section 129 are taxable. NOTE: When applying this test, in the case of any benefits provided through a salary redirection agreement, the employer may disregard all employees whose compensation falls below any specified amount that is less than $25,000, all employees who have not attained age 21 and completed 1 year of service, and employees covered by a collective bargaining agreement. CAUTION: Some people have interpreted this test to include all eligible employees in the denominator. Others believe that only employees electing dependent care assistance are to be included in the denominator. The IRS has not issued any regulations regarding the exact method of computing the Average Benefits Test but seems to favor using all eligible employees. 2011 7-37 Flexible Benefits Training IRC Section 129 — Dependent Care Assistance Plan 25% Concentration Test for Principal Shareholders or Owners — IRC 129(d)(4) _________________________________________________ (Company Name) Plan Year Ended_____________________________ Nontaxable benefits paid to principal shareholders or owners _____ (A) Nontaxable benefits paid to all participants Total benefits paid (B) Percentage of benefits paid to principal shareholders or owners (A/ B)% ______(C) Conclusion: If (C) is greater than 25%, all amounts paid to highly compensated participants under IRC Section 129 are taxable. 2011 7-38 Flexible Benefits Training IRC Section 137 — Adoption Assistance Plan 5% Concentration Test for Principal Shareholders or Owners — IRC 137(a)(3) __________________________________ (Company Name) Plan Year Ended _______________ Nontaxable benefits paid to principal shareholders or owners Nontaxable benefits paid to all participants (A) _______ Total benefits paid (B) Percentage of benefits paid to principal shareholders or owners (A : B) % (C) Conclusion: If (C) is greater than 5%, all amounts paid to shareholders and owners under IRC Section 137 are taxable. 2011 7-39 Flexible Benefits Training IRC Section 125 — Cafeteria Plan 25% Concentration IRC 125(b)(2) __________________________________________ (Company Name) Plan Year Ended_____________________________ Total nontaxable benefits paid to all participants who are key employees __________(A) Total nontaxable benefits paid to all other participants ____________ Total nontaxable benefits paid _____________(B) Percent of nontaxable benefits paid to participants who are key employees (A / B) ____________% (C) Conclusion: If (C) is greater than 25%, participants who are key employees will include in income any “nontaxable benefits” received for the plan year. 2011 7-40 Flexible Benefits Training Discrimination Tests Guide for Cafeteria Plans (2011) “Haves” Name 1. Percentage Test or 2. Classification Test (410(b)) HC HC 3. Benefits Available Test HC 4. Discriminatory in Operation HC Exclude 1 2 3 4 5 Definition §105 5 highest pd officers Owns more >10% stock Apply 318 Highest pd 25% of all eligibles Calculation Consequences 70% / 80% Test 1HC$ X (HC$/Total$) Excess Reimbursement Excess Reimbursement 1HC$ - Max limit for NHCs Excess Benefits 1HC$ - Max limit for NHCs Excess Benefits § 125 1. Eligibility HC 2. Contributions and Benefits HC 3. 25% Concentration Test Key 1. Contributions and Benefits HC 2. Classification Test (410(b)) HC 3. 55% Average Benefits Test HC 4. 25% Concentration Test (5% Owner’s Test) An officer Owns >5% stock An HCE Apply 152 Officer & >$140,000(I) >5% ownership >1% ownrshp & $150,000 Apply 318 (416(i)) § 129 6 7 8 4 5 9 401(b) Limit 3 YOS Participate 1st day HC Taxed Facts and Circumstances HC Taxed Key$ / Total$ = ≤25% .333 X Nonkey = Key$ limit >5% owner prior/current Apply 318 >$95,000 prior year (414(q)) “5% owner” Keys Taxed After end of plan year, total $ taxable Can adjust during year Everyone can elect same benefits HC Taxed HC Taxed >5% Owner Apply 1563 HC$/HCs eligible = A NHC$/NHCs eligible = B B/A must be ≥ 55% HC Taxed “5%Owner”$/Total$ ≤ 25% HC Taxed §137 1. Classification Test (410 (b)) 2. 5% Concentration Test HC 414(q) “Shareholders” or “Owners” Indexed figures Highly Compensated Employee Top Paid Group of 20% Key Employee, Officer Base Year 1987 $75,000 $50,000 $45,000 1. Employees with less than 3 YOS 2. Employees not attained age 25 3, Part-time or seasonal who work less than 35 hrs 4, Union 5. Nonresident aliens with no US income 6. Not completed 6 MOS 7. Work less than 17 ½ hrs 8. Work not more than 6 mos per year 9. Under age 21 2011 4 HC Taxed >”5%”$/Total$ ≤ 5% >5%Owner Spouse or Dependent of above 2009 2010 $110,000 $110,000 $110,000 $110,000 $160,000 $160,000 2011 $110,000 Look back year $110,000 Look back year $160,000 Look back year 318: Spouse, children, grandchildren, or parents 152: Spouse and dependents 7-41 Flexible Benefits Training “5%” Taxed 2011 7-42 Flexible Benefits Training 2011 7-43 Flexible Benefits Training Employee/Participant Flexible Benefit Plan — Authorization for Direct Deposit of Reimbursement Claims Employee/Participant Name: ____________________________ Employee SSN __________________ Company Name: ______________________________________ I hereby authorize (insert Plan administrator name here). to initiate credit entries to my: checking account or savings account indicated below and the depository named below (Depository) to credit the same to such account. **An actual voided check must be attached** Staple voided check here This form will be not be processed without a voided check Account Number: ________________________________________________ ______________ Depository (Financial Institution): _________________________ City:______________________________________________ ___ Branch:____________________ State :________________________ Bank ACH Transit Routing Number ________________________________________________ This authority will remain in full force and effect until MHM Business Services, Inc. has received written notification from me of its termination in such time and in such manner as to afford MHM Business Services a reasonable opportunity to act on it. Signature _________________________________________ Date ______________________ Fax or mail to: 1-555-555-1212 Company Name Company Address 2011 7-44 Flexible Benefits Training 2011 7-45 Flexible Benefits Training 2011 7-46 Flexible Benefits Training Guide to Allowable Medical Expenses Reimbursed through an IRC Section 125 Cafeteria Plan 1. Date Expense Incurred a. Services were rendered during employer’s cafeteria plan year b. Services were rendered during the participant’s eligible period of coverage 2. Whose medical expenses can you include? a. Participant b. Spouse c. Dependents i. A person that lived with participant for the entire year as a member of participant’s household or is related to participant. ii. Person was a U.S. citizen or resident, or a resident of Canada or Mexico for some part of the calendar yea in which participant’s tax year began. iii. Participant provided over half of that person’s total support for the calendar year. iv. Adopted child 1. Child qualified as participant’s dependent when the medical services were provided. v. Child of divorced or separated parents 1. If either parent can claim a child as a dependent under the rules for divorced or separated parents, each parent can include the medical expenses he or she pays for the child even if an exemption for the child is claimed by the other parent. vi. Support claimed under a multiple support agreement 1. If participant is considered to have provided more than half of a person’s support under such an agreement, the participant can claim medical expenses for that person. 3. Medical Definitions a. Amounts paid for the diagnosis, cure, mitigation, treatment or prevention of disease, or for the purpose of affecting any structure or function of the body. b. Transportation for and essential to medical care c. Legally obtained drugs or biologicals that require the prescription of a physician or is proved to be medically necessary for use by individual d. Cosmetic surgery or other similar procedure to treat a deformity relating to congenital abnormality, a personal injury, or disfiguring disease. i. Procedure promotes the proper function of the body e. Excess Cost f. Capital expense item for medical care i. Permanently improve property ii. Only expenses in excess of the increase in the value of the related property iii. Operation or maintenance expenses of a qualifying medical capital asset 2011 7-47 Flexible Benefits Training 4. Primary Purpose Test a. Was the expense incurred at the direction or suggestion of a physician? b. Did the treatment bear directly on the physical condition in question? c. Did the treatment have a direct or proximate therapeutic relation to the bodily condition so as to justify a reasonable belief that it would produce the desired results? d. Was the treatment proximate in time to the onset or recurrence of the disease or condition so as to make the treatment specific to the condition rather than for general physical improvement? 5. “But For” Test a. Would the medical expense have been incurred “but for” the disease or illness? 6. Reasonableness Test a. Is the medical expense reasonable? b. Is the expenditure for other than personal, living, and family expenses? 7. Factual Determination Test a. Based on the facts and circumstances, was the medical expense incurred to prevent or alleviate a medical condition? 2011 7-48 Flexible Benefits Training 8. 2011 7-49 Flexible Benefits Training 2011 7-50 Flexible Benefits Training 2011 7-51 Flexible Benefits Training 2011 7-52 Flexible Benefits Training 2011 7-53 Flexible Benefits Training 2011 7-54 Flexible Benefits Training 2011 7-55 Flexible Benefits Training 2011 7-56 Flexible Benefits Training 2011 7-57 Flexible Benefits Training 2011 7-58 Flexible Benefits Training 2011 7-59 Flexible Benefits Training 2011 7-60 Flexible Benefits Training