The problem – How to define a depreciation rule that

advertisement

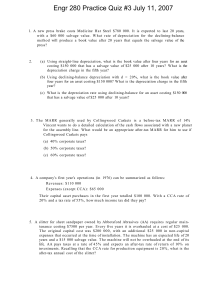

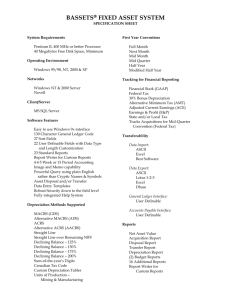

The problem – How to define a depreciation rule that automatically reduces salvage value of 10% from cost and calculates depreciation beginning from the first day of the month of purchase of asset. Basically this is a Straight Line depreciation that for example divides the (Cost-salvage) by 36 equal periods. To do this we have to configure 2 things, Depreciation Rules P12851 and Depreciation Formulas P12853. First go to P12851 and click Add Choose Initial Term Appointment as “blank” which is First Day of Month of Purchase. Choose Compute Direction as “R” which denote Remaining Months Can leave all the above blank. Life from = 1 Life Thru = Life/12 in this case (36/12)+1 = 4, this is because this is the year in which the depreciation ends, which could be the 4th year from purchase year if the purchase happened anytime after Jan. Now you see there are 3 formulas involved to fulfill this requirement. The logical order for them is as follows Salvage formula – This defines the salvage component of the asset Basis Formula – This defines the Basis for the Depreciation Formula Depreciation Formula – The final formula used to calculate depreciation. **Remember to tick the Disable Edit checkbox on all Depreciation Rules before using them. To define these formulas go to P12853 Depreciation Formula Revisions. Here we start by defining a formula for 10% Salvage value. Click on Add The formula is defined using codes or elements as they are called above. We use 01 and 12 for calculating the salvage value. 01 = Asset cost and 12 = Formula Multiplier Constant. Hence in the formula we define 01*12 and in the Multiplier/Constant field we define the factor to multiply, in this case 0.1. Remember to tick the Disable Edit checkbox on all formulas before using them. For the Basis formula there is a predefined formula ID 500 called Remaining Basis which is defined as 01+02-07 or Asset Cost + Accumulated Depreciation Prior – Salvage. Hence Basis is the Net Asset Value of the asset. This is the amount that has to be spread equally over the remaining periods of the asset life. Do you see formula ID 107 called SL Remaining Periods? The formula defined is (10/05)*06. This means (Basis Amount/Asset Life Period Remaining at)*Asset Life Periods in Current. Fill in these formulas in the relevant fields for the Depreciation Rule as below Click on the Edit Disable checkbox. Now you can create a Depreciation Default Coding P12002 and attach this Depreciation rule to the Default code