Chapter#9 Test - Taxes

advertisement

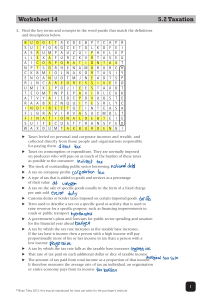

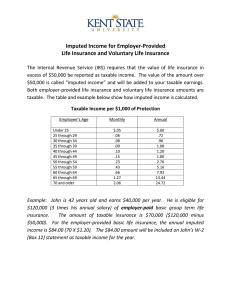

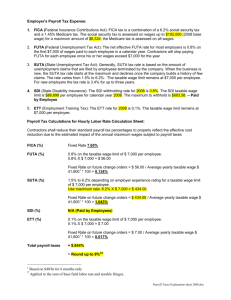

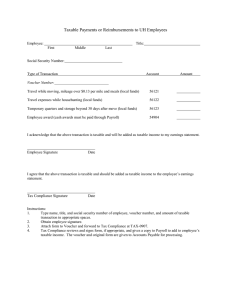

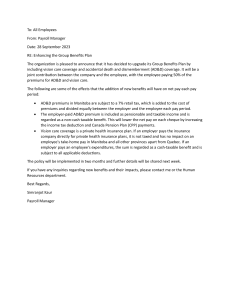

ECONOMICS MR. MILEWSKI FALL 2011 Chapter#9 Test - Taxes Know the following terms: sin tax individual income tax sales tax progressive tax regressive tax tax loophole proportional tax excise tax intergovernmental revenues FICA taxes Know the following concepts: What are the economic effects taxes can have? What are the three criteria for effective taxes? What is the ability-to-pay principle of taxation? What is an exception or oversight in the tax law that allows some people and businesses to avoid paying taxes called? Paying $1,000 tax on $10,000 of taxable income, $4,000 on $20,000 of taxable income, and $20,000 on $60,000 of taxable income in an example of a tax system that is _________________________________ . What type of tax is the individual income tax? What is the single largest source of revenue for the federal government? Why does the government use indexing to revise tax brackets so that workers do not pay higher taxes? (Hint: prices change over time.) What are the payroll taxes that are deducted directly from people's paychecks called? The gift tax is used to prevent people from avoiding the ________________ tax. What is the largest source of revenue for states? Which property tax raises the most revenue for local governments? What are the three largest sources of revenue for local governments? What is intangible personal property? What tax deductions can appear on a payroll withholding statement? Where does the authority to levy a federal income tax come from? APPLYING SKILLS Using Charts and Tables: Study the chart and answer the questions below. Federal Income Tax for Single Taxpayers with No Dependents Adjusted Year Gross Income 1975 1995 $10,000 $1,506 $540 $20,000 $4,153 $2,040 $30,000 $8,018 $3,573 $40,000 $12,765 $6,373 $50,000 $18,360 $9,173 1998 $457 $1,958 $3,458 $5,595 $6,549 Source: Infoplease.com 1. How much did a single taxpayer who earned $20,000 in 1995 pay in taxes? 2. What does the chart compare? 3. What trend does the data reveal? Justify your answer using the figures in the table.

![-----Original Message----- From: K.Audette [ ]](http://s2.studylib.net/store/data/015587928_1-66e3b3936af11bf9c348b9a1cff2a224-300x300.png)