An Examination of Illegal Activity in the

advertisement

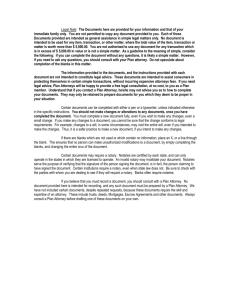

An Examination of Illegal Activity in the Processing of Foreclosures The documentation enclosed is intended to educate recipients about the criminal activity occurring within the foreclosure process. This study was initiated after borrowers were foreclosed on during the trial modification period, short sale processing period, and modification processing period. It has been observed that borrowers responsibly requested accounting verification, made proper and regular payments, and filed correct paperwork for processing. Yet, the foreclosure proceeded, robbing the borrowers of due process. It has also been observed that Judges are not requiring the foreclosure entities to produce proper documentation, and the foreclosure process is being allowed unchecked. It is this writer’s hope that the provision of this information will cause change and accountability within the Courts, the mortgage servicing companies, and the attorneys and processors in the default management functions. Package presented to FBI Atlanta office Wednesday, August 25, 2010. CONTENTS: I. II. III. IV. V. VI. VII. VIII. IX. X. XI. XII. XIII. XIV. XV. XVI. XVII. Why Foreclosures are Happening Illegally, without Correct Documentation: Background Actual Case: Actual Flow from Real Estate Closing to Foreclosure (See Notes: Required documents before foreclosing entity can legally foreclose). Loan File Issue Brought to Forefront by FHFA Subpoena Mortgage Assignments as Evidence of Fraud – article by Lynn E. Szmoniak, Esquire Article: Lender Processing Services (LPS) closed the offices of its subsidiary, Docx, LLC, in Alpharetta, GA New York Times article dated March 8, 2008 highlighting foreclosure mills (see Georgiabased firm mentioned). Article: Attorney General goes after foreclosure mills Article: Florida AG Investigates Foreclosure Mill Law Firms Article: Florida AG Unveils Foreclosure Mills Probe Trust Assignment Fraud Letter to SEC Compare These Signatures documentation from Lynn E. Szymoniak, Esquire Too Many Jobs documentation from Lynn E. Szymoniak, Esquire Class action suit filed in New York against “foreclosure mill” attorneys and banks Justice Schack strikes again in U.S. Bank v. Emmanuel JP Morgan Chase Bank vs. Hank J. Pocopanni; Marilyn G. Pocopanni, et al: Fraud on the Court. Attorney’s fees – reason attorneys are eager to foreclose. Court cases concerning MERS (excerpts) XVIII. FRAUD EXAMPLES (ACTUAL CASES) Case A – Manufactured assignment showing alleged forged signatures by foreclosure attorneys signing as representatives of MERS. Notary did not witness. Assignment filed just prior to sale date. Screen print of McCalla Raymer website showing Associate Attorneys’ names. Screen print showing notary appointment date (outside of the 4 year limit). No corporate seal. 1 Case B – Manufactured assignment showing alleged forged signatures by Citibank representative signing on behalf of MERS and proven forged notary signature. Screen prints of Jaime Hardcastle. Copy of Jaime Hardcastle’s personal residence Deed to Secure Debt showing authentic signature. State of Missouri Secretary of State Notary Public Oath of Office and Official Signature Filing shows actual notary signature. No corporate seal. Case C – Manufactured assignment showing another alleged forged signature of the same Jaime Hardcastle present on the assignment of Mary Ann Houser Tavarez. Copy of Jaime Hardcastle’s personal residence Deed to Secure Debt showing authentic signature. Case D – Promissory Note with forged endorsement (same person used on two endorsements!). Manufactured assignment showing alleged forged signatures by foreclosure attorneys signing as representatives of MERS. Notary signature forged, as evidenced by official Certificate of Appointment of Notary Public. Deed Under Power showing foreclosure attorneys signing as representatives of Wells Fargo. Notary signature forged, as evidenced by official Certificate of Appointment of Notary Public. No corporate seal. Case E – Manufactured assignment showing alleged forged signatures by foreclosure attorneys signing as representatives of MERS. Notary signature allegedly forged. No corporate seal. 2