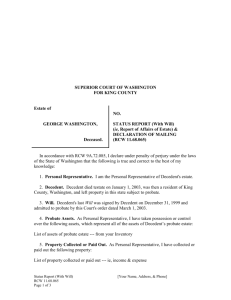

Judge Russell Austin

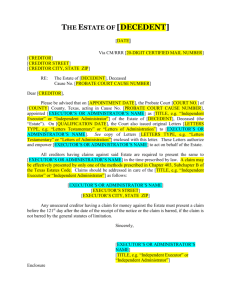

advertisement