US Securities and Exchange Commission

advertisement

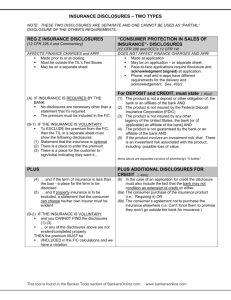

FINANCIAL EXECUTIVES INSTITUTE April 19, 2000 Mr. Jonathan G. Katz Secretary U.S. Securities and Exchange Commission 450 Fifth Street NW Washington, DC 20549-0609 Subject: File No. S7-03-00 Dear Mr. Katz, The Committee on Corporate Reporting (“CCR”) of the Financial Executives Institute appreciates this opportunity to comment on the Securities and Exchange Commission’s proposed rule, “Supplementary Financial Information.” The Financial Executives Institute is a professional organization of more than 14,000 CFOs, controllers, treasurers, and other senior financial executives in the U.S. and Canada, representing both providers and users of financial information. Under the Commission’s proposal, detailed roll-forward disclosures and additional information would be required for (i) all loss contingencies recorded pursuant to FAS 5, including (but not limited to) twelve specific categories suggested by the Commission, and (ii) any long-lived assets separately captioned on the balance sheet including goodwill and other intangible assets. Each major class of loss contingency would require separate presentation. The classes suggested by the Commission (which are not meant to be all-inclusive) include a wide-range of items including allowance for doubtful accounts or notes receivables; allowance for sales returns, discounts and contractual allowances; unamortized discount or premium; excess of estimated costs over revenues on contracts (loss contracts); inventory valuation allowance; valuation allowance for deferred tax assets; liabilities for exit and employee termination costs related to a restructuring or a business combination; liabilities for costs of discontinued operations; liabilities for environmental costs; contingent income and franchise tax liabilities recorded pursuant to FASB Statement 5; product warranty liabilities; and probable losses from pending litigation. To the extent that such a class is composed of varying elements, each significant element must be separately disclosed. The information would be reported for each period for which an Mr. Jonathan G. Katz April 19, 2000 Page 2 income statement is presented and would include the opening balance, additions charged to expense, deductions and other additions not charged to expense (with explanation) and the closing balance. Any changes in assumptions having a material effect on the account would have to be described. Each major class of long-lived assets would require separate presentation, as would elements of goodwill having significantly different useful lives. The information would be reported for each period for which an income statement is presented and would include the opening balance, additions, deductions and the closing balance. Registrants would also be required to disclose any significant and unusual asset additions, abandonments, retirements or other adjustments as well as the nature of changes that are at other than cost. Required disclosures would also include the method of amortization, estimated useful lives and salvage values for each long-lived asset account. CCR members share the Commission’s support for transparent financial reporting, but within reasonable cost/benefit constraints. Cost/benefit issues must be considered in order to ensure that limited resources are apportioned to those areas of financial reporting which will produce the most benefit. The evaluation of costs must also consider the potential harm to companies and shareholders from disclosing proprietary or competitive information. After careful consideration, CCR does not support the Commission’s proposal because it does not pass the cost/benefit test. The level of detailed disclosures goes far beyond the reasonable needs of financial statement users and will be costly to collect and maintain. Additionally, we are extremely concerned about the likely harm to companies and their shareholders from disclosing proprietary information to financially interested parties and potential adversaries, particularly with respect to tax, legal, and environmental reserves. Needs of Users Companies are required by existing disclosure rules to provide information about material events and transactions affecting long-lived assets and loss contingencies, as well as information about significant accounting policies and assumptions related to these items. The Commission got it right in 1994, when it rescinded its previously required detailed fixed asset schedules based upon the overlap with other existing disclosure requirements, and we do not support the Commission’s current proposal to reinstate and expand the scope of such schedules. The Commission’s reasoning in 1994 is equally valid today: Although comments from financial analysts were generally opposed to elimination of these schedules, most commenters supported the proposal, citing the cost of their preparation and audit, and their limited Mr. Jonathan G. Katz April 19, 2000 Page 3 usefulness…The Commission believes that adequate quantitative disclosure regarding property, plant and equipment is elicited by Accounting Principle Board Opinion No. 12… which requires disclosure of total depreciation expense for each period and the balances of major classes of depreciable assets. Where the age of capital assets may be indicative of increasing maintenance and replacement budgets, the registrant would be expected to disclose the material reasonably likely effects on operating trends, capital expenditures and liquidity pursuant to Item 303 of Regulation S-K.1 APB Opinion No. 12 remains in effect today, and there are similar overlaps with respect to existing disclosure requirements for other long-lived assets and loss contingencies that would also be covered by the Commission’s current proposal. For example, APB Opinion No. 17, Intangible Assets, requires disclosure of the method and period of amortization of an entity’s intangible assets; FASB Statement No. 121, Accounting for the Impairment of Long-Lived Assets and for Long-Lived Assets to Be Disposed Of, requires disclosures about impaired assets; SEC Staff Accounting Bulletin No. 100, Restructuring and Impairment Charges requires disclosures about impaired assets and restructuring reserves; and APB Opinion No. 20, Accounting Changes requires disclosures about changes in estimates. Other disclosures about loss contingencies are required by FASB Statement No. 5, Accounting for Contingencies, as well as by the numerous accounting standards governing other specific categories of loss contingencies and allowances. Furthermore, the Commission’s own rules for Management’s Discussion and Analysis require disclosure about material trends, risks and uncertainties. The required statement of cash flows also provides significant details about both cash and non-cash transactions affecting these balances. We are not aware of widespread or significant lapses in compliance with the current disclosure requirements. However, enhanced compliance with the existing disclosure rules would be vastly preferable to more costly, detailed, tabular disclosures that would encompass both material and immaterial items. If the Commission believes that the existing disclosure rules are not being followed, then the solution is improved compliance and enforcement, not more rules. In support of reinstating the fixed asset schedule, the Commission references an October 19, 1998 letter from the Association for Investment Management and Research (“AIMR”). In their letter, the AIMR quotes an analyst who states, “financial reporting standards must cast their net widely…In order for critical data to be available when needed, they must be required even when such data are not especially useful.”2 In a world of finite resources, disclosures that are “not 1 Release 33-7118, Financial Statements of Significant Foreign Equity Investees and Acquired Foreign Businesses of Domestic Issuers and Financial Schedules (December 13, 1994 [59 FR65632] 2 Letter to Lynn Turner, Chief Accountant, Securities and Exchange Commission from the Financial Accounting Policy Committee of the Association for Investment Management and Research dated October 19, 1998. Mr. Jonathan G. Katz April 19, 2000 Page 4 especially useful” should be weeded out, not expanded. While we respect the views of the analyst community, we believe that the Commission’s proposed additional disclosure requirements for long-lived assets and loss contingencies fall into the category of information that is “not especially useful.” From a cost/benefit perspective, these additional disclosures cannot be justified. Costs of Collecting and Maintaining Data In estimating the costs of collecting and maintaining the data required to provide the proposed disclosures, the Commission indicates that it relied on information provided by a single diversified, multi-division registrant. As illustrated in Table 1, we took the Commission’s estimates, assumed that the disclosure requirements would be in place for at least ten years, and discounted using a 7% interest rate. This produced an estimated compliance cost of approximately $87,000 per registrant and a grand total of approximately $250,000,000 across the Commission’s estimate of 2,900 affected registrants. Whatever perceived benefits might be derived from the Commission’s proposal, they do not justify imposing a $250,000,000 cost on U.S. shareholders. This large figure is based on the cost estimates provided in the Commission’s own proposal. However, many CCR members have indicated that the start-up and ongoing annual costs of implementing the proposal will be significantly greater than the Commission’s estimates. This is because the amount of detailed information that a diversified, multi-divisional company doing business in multiple locations would be required to capture under the Commission’s proposal is far in excess of what is currently needed to manage the business or comply with current disclosure requirements. Although the information to be provided is readily available from books and records maintained within the organization taken as a whole, the organizational level at which the detailed information is maintained can significantly affect the cost of retrieving, analyzing and summarizing the information. The review and analysis work that would have to be performed at each consolidating level of the organization would accumulate rapidly, with substantial cost. Potential Harm from Disclosing Proprietary Information CCR members are extremely concerned about the harm to companies and their shareholders that would likely result from disclosing proprietary information to financially interested parties and potential adversaries, particularly with respect to tax, legal, environmental, and similar loss contingencies. As noted above, companies are required by existing disclosure rules to provide information about material events and transactions affecting loss contingencies, as well as information about significant accounting policies and assumptions related to Mr. Jonathan G. Katz April 19, 2000 Page 5 these items. The Commission’s proposal would go far beyond those existing requirements by requiring detailed information about movements in virtually every loss accrual account. The incremental information that would be provided under the Commission’s proposal would be immaterial from the perspective of the shareholder, but could be very significant to financially interested parties who could take advantage of disclosed information to strengthen their negotiating position versus the company. For example, a loss accrued by a company could be seen by adversaries as an admission of liability or the starting point for settlement negotiations. In addition, there are many lawsuits brought against companies for nuisance value or simply to induce settlements, many of which are without merit. The Commission’s proposal could increase the incidence of such lawsuits by providing a needless level of detailed disclosures and “red flags” upon which opponents could pounce. In our view, it will not be practicable for companies to disclose gross movements in individual categories of reserves without giving away proprietary information or increasing the risk of nuisance suits. Furthermore, we do not see how the information that would be required under the proposal could be described at an aggregate level in any meaningful way. Disclosed increases or decreases in legal, tax or environmental reserves could reveal a company’s negotiating plan, litigation strategy, or tax return position to financially interested parties who could benefit from such disclosure at the expense of the company’s shareholders. This type of information would normally be protected by attorney-client privilege. Considerable harm to the company could result from these disclosures. The Commission’s proposal creates a very unlevel playing field, by requiring one side to reveal its hand while the other side does not. In addition, details on inventory and warranty allowances and other disclosures of proprietary information will unfairly benefit U.S. and non-U.S. competitors who are not subject to these disclosure requirements. We are in no way suggesting that material information should be withheld from shareholders. Our concern is that the level of detail proposed by the Commission goes far beyond those needs, to the extent of potential harm to the company and its shareholders. The Commission’s proposal does not document a widespread demand for these detailed disclosures, and existing disclosure requirements are already in place to ensure that all material items are disclosed. In view of the concerns expressed above, we do not see a strong argument for additional disclosures in this area. Mr. Jonathan G. Katz April 19, 2000 Page 6 Responses to Specific Questions Our comments on the specific questions raised by the Commission are set out below. 1. Are there other specific loss accrual or valuation accounts that should be added to the list of accounts identified within proposed Item 302(c)? No. In fact, we do not believe that the Commission should combine such disparate types of loss accruals into a single disclosure requirement. It would be more sensible for disclosures to be tailored to the underlying nature of the loss accrual, rather than a “one-size-fits-all” approach. 2. Should specific percentage tests be used to trigger specific account disclosures within the proposed rules? For example, should disclosure of loss accrual account activity be required only when the balance sheet item and change during the period exceeds a certain pre-established numerical threshold (for example, 5% of total assets or 3% of pretax income)? If so, what is an appropriate threshold? Yes, a materiality threshold should be provided. SEC Staff Accounting Bulletin No. 99, Materiality, provides guidelines for assessing materiality that do not depend on numerical thresholds. However, given the broad scope of the Commission’s proposal, we believe that a quantitative threshold is necessary to identify those items that are sufficiently material to warrant the level of detailed disclosure that would be required. The proposal indicates that the disclosure about long-live assets would be required to support the account balances of any long-lived asset separately captioned on the balance sheet. This builds on the existing Regulation S-X requirements for separate disclosure of asset and liability categories that exceed 5% of total assets and liabilities, respectively. Similarly, we believe that any new disclosure requirements for loss accrual and valuation accounts should be limited to individual categories which exceed 5% of total liabilities. 3. Should the placement of the proposed data be moved within MD&A or to some other section of the filing to enhance the prominence of the disclosures? In many cases, existing GAAP or SEC disclosure requirements will dictate where these disclosures should be located. The Commission’s proposal should not disturb these existing disclosures or require redundant disclosures. With respect to incremental disclosures that might be required solely in response to the Commission’s proposal, we agree with the proposal that such disclosures should be Mr. Jonathan G. Katz April 19, 2000 Page 7 provided as supplementary financial information outside of the audited financial statements and MD&A. 4. Should presentation of the proposed data be limited to the Form 10-K? Yes. It is our understanding that, under current SEC rules, disclosures of Supplementary Financial Information must be included in the Annual Report to Shareholders. If the Commission imposes additional disclosure requirements in this area, presentation should be limited to the Form 10-K and not extended to the Annual Report. 5. Should the disclosure requirements be restricted to those registrants that exceed a certain size or meet some other threshold? If so, what would be the appropriate threshold? We do not believe that the burden imposed by the proposal would fall disproportionately on smaller companies. Therefore we do not believe that a size threshold would be appropriate. 6. Are there circumstances where registrants may appropriately exclude disclosure about loss accruals related to litigation because of concerns about confidentiality while still conforming with GAAP? If so, please describe such circumstances in detail. Please see our comments above under “Potential Harm from Disclosing Proprietary Information.” As noted therein, our concerns are not limited to litigation reserves but extend to other types of loss contingencies including tax and environmental reserves. 7. Should the disclosures concerning valuation and loss accrual account activity be required when interim financial statements are presented? No. Our concerns about the cost/benefit deficiencies of the proposal would be multiplied if the information was required to be disclosed more frequently than on an annual basis. 8. Should the disclosures concerning changes in property, plant, equipment, and intangible assets and related accumulated depreciation, depletion, and amortization be required when interim financial statements are presented? Please see response to Question 7 above. ******************** Mr. Jonathan G. Katz April 19, 2000 Page 8 In addition to the comments noted above, we are concerned that the Commission’s proposal does not include a proposed effective date for the new disclosure requirements. In our view, the information that would be required under the proposal is not currently available, and considerable lead time would be required to institute the necessary data capture processes and procedures. In addition, it would not be practicable to go back and capture data for prior periods. Accordingly, while we do not support the proposed disclosure requirements, we encourage the Commission to make any new disclosures effective on a prospective basis, with adequate lead-time for modifying information systems. In our view, the additional disclosure requirements arising from the Commission’s proposal could not realistically be implemented earlier than for year 2002 reporting. We would be pleased to discuss our views further with the Commission. Sincerely, Philip D. Ameen Philip D. Ameen Chairman FEI Committee on Corporate Reporting Attachment TABLE 1 Analysis of SEC Cost Estimates for Supplementary Financial Disclosures Year 1 2 3 4 5 6 7 8 9 10 NPV @ 7% Hours 247 $ 17 17 17 17 17 17 17 17 17 Reserves Cost 30,875 2,125 2,125 2,125 2,125 2,125 2,125 2,125 2,125 2,125 Hours 133 $ 35 35 35 35 35 35 35 35 35 Assets Cost 16,625 4,375 4,375 4,375 4,375 4,375 4,375 4,375 4,375 4,375 Total Per Registrant Hours Cost 380 $ 52 52 52 52 52 52 52 52 52 47,500 6,500 6,500 6,500 6,500 6,500 6,500 6,500 6,500 6,500 87,079 Total for 2,900 Registrants Hours Cost 1,102,000 150,800 150,800 150,800 150,800 150,800 150,800 150,800 150,800 150,800 $ 137,750,000 18,850,000 18,850,000 18,850,000 18,850,000 18,850,000 18,850,000 18,850,000 18,850,000 18,850,000 252,527,690