OIO 06_JC_2012

advertisement

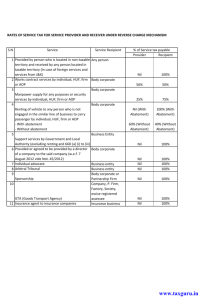

OIO No. 06/JC/2011 Dated : 23.01.2012 lhek “kqYd ,oa dsUnzh; mRikn “kqYd vk;qDrky;] dsUnzh; mRikn “kqYd Hkou] jsl dkslZ] fjax jksM jktdksV-360001 OFFICE OF THE COMMISIONER OF CUSTOMS & CENTRAL EXCISE RACE COURSE RING ROAD, RAJKOT-360001 By RPAD/HAND DELIVERY F.No V.ST/15-370/Adj./2009 Ekwy vkns”k Lka. Order in Original NO. 06/JC/2012 vkns”k dh frfFk 23.01.2012 Date of Order:23.01.2012 tkjh djus dh frfFk Date of Issue:- ,e- KkulqUnje vkns”kdrkZ dk uke : संयक् ु त आयक् ु त Passed by: ds lanHkZ esa : ds0 m-0 “kqYd vk;qDrky;] jktdksV Rajmoti Developers, ‘Nilkanth’, 2, Sardar Patel Society, In the matter of Saru Section Road, Jamnagar. dkj.k crkvksa uksfVl la- V.ST/AR-JMR/16/JC/2011 dated 04.02.2011 M/s &frfFk Show Cause Notice No. & Date. 11. ;g izfrfyfi ml O;fDr dks futh mi;ksx ds fy, fu%'kqYd nh xbZ gSA ftls ;g tkjh fd;k x;k gSA This copy of order is granted free of charges to the person to whom it is issued. 2bl vkns'k ls ;fn dksbZ O;fDr vlarq"V gS rks bl vkns'k ds fo:) fuEufyf[kr dks vihy dj ldrk gSA&vk;qDr ¼vihy½ lhek ,oa dsUnzh; mRikn 'kqYd] jsl dkslZ fjax jksM jktdksVA 2. Any person deeming himself aggrieved by this order may appeal against this order to the Commissioner (Appeals), Customs & Central Excise, Central Excise Bhavan, Race Course Ring Road, Rajkot. 3vihy dk QkeZ ,l-Vh-&4 nks izfr esa Hkjk tk, ,oa mlds lkFk fu.kZ; dh izfrfyfi ;k lsokdj fu;e] 1994 dh dye 8 esa fofufnZ"V vuqlkj vkns'k ds fo:) vihy dh izfrfyfi gksuh pkfg,A 3. The Appeal should be filed in form ST-4 as per Rule 8 of Service Tax Rules, 1994 and it shall be signed by the person as specified in Rule 3 (2) of the Central Excise (Appeals) Rules, 2001. 4ikVhZ }kjk bl vkns'k dks O;fDrxr izkIr fd, tkus dh rkjh[k ls ;k Mkd }kjk izkfIr dh rkjh[k ls rhu eghus ds vanj vihy Qkby dh tkuh pkfg,A 4. The appeal should be filed within three months from the date of receipt of this order. [Section 85 of the Finance Act, 1994]. 5. 5. blds lkFk fuEufyf[kr dkxtkr gksuh pkfg,A The appeal should be accompanied by: ¼v½ ,slk vkns'k dh izfrfyfi ;k nwljs dh d izfrfyfi ftl ij uhps n'kkZ, v?khu fu/kkZfjr dksVZ dh Qhl LVsEi gksuh pkfg,A (a) Copy of this order which should bear court fee stamp as prescribed under Schedule 1 of Article 6 of the Court Fee Stamp Act, 1870, as under: (i) ;fn lCtsDV eSVj dh jde ;k ewY; ;k ewY; 50 :i; ;k 50 :i;s ls de gks rks :i;s 00-25 gksA (i) If the amount or value of subject matter is rupees fifty or less, then Rs.0.25; (ii) ;fn lCtsDV eSVj dh jde ;k ewY; ;k ewY; 50 :i; ;k 50 :i;s ls v/khd gks rks :i;s 00-50 gksA (ii) If such amount exceed Rs.50, then, Rs.0.50 paisa. ¼c½ vihy izfrfyfi ftl ij :i;s 2-50 dh dksVZ Qh LVsEi gksuh pkfg,A (b) A copy of the appeal should also bear a court fee stamp of Rs.2.50. 6. lsok dj ]naM ¼isuYVh½ vkfn ds Hkqxrku dk izek.k A 6. Proof of payment of duty, penalty etc., should also be attached to the original form of appeal. Page 1 of 19 OIO No. 06/JC/2011 Dated : 23.01.2012 Brief Facts of the Case: M/s Rajmoti Developers, ‘Nilkanth’, 2, Sardar Patel Society, Saru Section Road, Jamnagar [hereinafter referred to as "the noticee"] are engaged in construction service and are registered with the service tax department under the category of ‘Commercial or Industrial Construction’ holding registration No. JMN/CCS-09/Stax/2005-06 (new no. AAIFR3168G ST001) since 11.07.2005. 2. Based on intelligence that the noticee were not paying Service Tax on the “Commercial or Industrial Construction” service rendered by them, a detailed inquiry was initiated by the officers of Head Quarters Preventive unit, Rajkot. In this regard, a summons was issued to the partner of the noticee to appear before the Superintendent (Preventive), Central Excise HQ., Rajkot. Accordingly, a statement of Shri Vinod Ratilal Abhangi, Partner of the noticee was recorded on 23.03.2009 under Section 14 of the Central Excise Act, 1944 made applicable to Service Tax by virtue of Section 83 of the Finance Act, 1994, wherein he inter alia stated that he was one of the partners of M/s Rajmoti Developers, Jamnagar; that they were engaged in providing construction services for concrete foundation of wind mill to M/s Suzlon Infrastructure Services Ltd, Pune; that he looked after all the work of the firm; that they were registered with Service Tax department under the category of ‘Commercial or Industrial Construction Service’ since 11.07.2005; that they rendered construction services to M/s Suzlon Infrastructure Ltd, Pune during 2005-06 to 2006-07 and to M/s Suzlon Infrastructure Services Ltd, Pune from 2007-08 onwards; that they purchased and used all the raw material in respect of construction services provided to M/s Suzlon Infrastructure Ltd, Pune and M/s Suzlon Infrastructure Services Ltd, Pune except ‘stub assembly’ which was provided by their clients; that they availed abatement of 67% during the period from April, 2005 to September, 2006; that from October, 2006 to March, 2008, they have not availed any abatement, but charged and paid service tax on full invoice value; that they availed and utilized Cenvat credit in the years 2006-07 and 2007-08; that from 01.04.2008, they were paying Service Tax @4% under Works Contract service; that they were registered under ‘Works Contract Service’. On being shown Service Tax returns for the period April, 2006-September, 2006 and Oct-March, 2007 wherein abatement @67% was Page 2 of 19 OIO No. 06/JC/2011 Dated : 23.01.2012 availed and simultaneously service tax credit on input services were also availed, he admitted that they availed and utilized service tax credit on input service through oversight in April-September, 2006 ST-3 return but they have not availed abatement in the invoice raised from 01.10.2006 onwards; that abatement shown to be availed in the months of October,2006 and December,2006 in ST-3 return for October, 2006 to March, 2007 was in respect of payment received by them for which they had raised invoices prior to 01.10.2006; that they received 75% to 80% payment from their client on the basis of work performed in running bill; that 2.26 % is deducted as TDS, 2% is deducted as WCT and 5% is deducted as retention money by their client; that retention money is received after one year of completion of work. Shri Vinod Abhangi furnished copies of invoices, ledger accounts, final accounts, Service tax returns of the firm. 4.1 Whereas, scrutiny of invoices furnished by the noticee indicated that the noticee had availed abatement @67%, while charging Service tax to their clients during the period 2005-06 and 2006-07 (upto September, 2006) in terms of notification Nos. 15/2004-ST dated 10.09.2004 and 1/2006-ST dated 01.03.2006. The notification No. 1/2006-ST dated 01.03.2006 interalia prescribes that, “Provided that this notification shall not apply in cases where, (i) the CENVAT credit of duty on inputs or capital goods or the CENVAT credit of service tax on input services, used for providing such taxable service, has been taken under the provisions of the CENVAT Credit Rules, 2004; or (ii) the service provider has availed the benefit under the notification of the Government of India in the Ministry of Finance (Department of Revenue), No. 12/2003-Service Tax, dated the 20th June, 2003[G.S.R. 503 (E), dated the 20th June, 2003].” 4.2 Whereas, scrutiny of Service Tax returns (ST-3) filed by the noticee during the period April, 2006 to September, 2006 revealed that the noticee had availed and utilized service tax credit of input services. Therefore, the benefit of Notification No. 1/2006-ST dated 01.03.2006 was not available to the noticee inasmuch as they had violated the condition of the said notification. Hence, the noticee were required to discharge the Service Tax Page 3 of 19 OIO No. 06/JC/2011 Dated : 23.01.2012 liability on the full invoice value during the period from April, 2006 to September, 2006. The noticee were, therefore, required to pay the differential Service Tax to the tune of Rs. 25,29,420/- (as detailed Annexure-B of this notice). 5.1 The noticee deposed that they had purchased and used all the materials required for rendering the services to their clients except ‘stub assembly’ which was supplied by their client. M/s Suzlon Infrastructure Ltd, Pune and furnished the details of stub assembly supplied by them to the noticee during the year 2005-06 vide letter dated 11.04.2009. The noticee had availed abatement @67 % during the year 2005-06 while raising invoices. The explanation given under Notification No. 15/2004-ST dated 1009-2004 as amended vide Notification No. 04/2005-ST dated 01-03-2005 reads as under : “Explanation.- For the purpose of this notification, the “gross amount charged” shall include the value of goods and materials supplied or provided or used by the provider of the construction service for providing such service.” 5.2 Therefore, the noticee were required to add the value of ‘stub assembly’ supplied by M/s Suzlon Infrastructure Ltd, Pune while discharging their Service Tax liability, which was not done by them. The cost of ‘stub assembly’ supplied by M/s Suzlon Infrastructure Ltd, Pune was Rs.42,00,498/-. Therefore, the noticee was required to pay Service Tax of Rs. 4,28,451/- on the said value addition. 6. Scrutiny of documents submitted by the noticee and the investigation carried out revealed that – (i) the noticee were engaged in rendering construction service for concrete foundation of wind mill towers ; (ii) the services rendered by the noticee were chargeable to Service Tax under the category of ‘Commercial or Industrial Construction Service’ in terms of Section 65(105) (zzq) of the Finance Act, 1994 since 16.06.2005; (iii) The noticee were registered with Service Tax Department under the category of ‘Commercial or Industrial Construction Service’ having Page 4 of 19 OIO No. 06/JC/2011 Dated : 23.01.2012 registration no. JMN/CCS-09/Stax/2005-06 (new no. AAIFR3168G ST001) since 11.07.2005; (iv) the noticee had availed abatement @67% while charging Service tax to its clients during the period 2005-06 and 2006-07 (upto September); (v) the noticee had availed and utilized service tax credit of input services during the period from April, 2006 to September, 2006 and thereby violated the condition of notification No. 1/2006-ST dated 01.03.2006; (vi) The noticee had failed to disclose in the Service Tax return for the period April, 2006 to September, 2006 the fact that they had availed abatement @67 % ; (vii) the noticee was required to pay Service Tax on the full invoice value during the period from April, 2006 to September, 2006. The differential Service Tax payable by the noticee on this count is Rs. 25,29,420/- (as detailed in Annexure-B of this notice); (viii) the noticee had purchased and used all the materials required for rendering the services except ‘stub assembly’ which was supplied by their clients and had availed abatement @67% during the year 200506. They are required to pay Service Tax of Rs. 4,28,451/- on the value of stub assembly supplied by its clients. 7. From the above, it appeared that the noticee had not paid Service Tax to the tune of Rs. 29,57,871/- including Education Cess as detailed below: Sr Particulars Service Tax No. payable (Rs.) 1. Differential Service Tax payable on account 25,29,420/of violation of condition of notification No. 1/2006-ST dated 01.03.2006 (as detailed in Annexure-B) 2. 3. 8. Service tax on the materials supplied by 4,28,451/M/s Suzlon Infrastructure Ltd, Pune Total 29,57,871/- It appeared that the noticee had contravened the provisions contained in Section 73 of the Finance Act, 1994 inasmuch as they by acts/omission as detailed in paras supra, failed to disclose wholly or truly all the material facts Page 5 of 19 OIO No. 06/JC/2011 Dated : 23.01.2012 required for assessment with a willful intention to evade payment of Service Tax. All the above acts of contravention of Finance Act, 1994 and rules made thereunder, on the part of the noticee appeared to have been committed by way of suppression of facts with intention to evade payment of Service Tax. Therefore, Service Tax to the tune of Rs. 29,57,871/- was required to be recovered from the said noticee by invoking extended period of five years, under the proviso to Section 73(1) of the Finance Act, 1994, along with interest leviable at appropriate rate under Section 75 of the Finance Act, 1994. 9. Therefore, M/s. Rajmoti Developers, Jamnagar vide show cause notice no. V.ST/AR-JMR/16/JC/2011dated 04.02.2011 was called upon to show cause to the Joint Commissioner, Central Excise & Customs, Rajkot, as to why: (i) Differential Service Tax amounting to Rs. 29,57,871/- [Rupees Twenty Nine Lac Fifty Seven Thousand Eight Hundred and Seventy One only] including Education Cess, should not be demanded and recovered from them under Section 73 of the Finance Act, 1994, by invoking extended period of limitation under sub-section (1) of Section 73 of the Finance Act, 1994; (ii) Interest at appropriate rate should not be charged in terms of Section 75 of the Finance Act, 1994 ; (iii) Penalty under Section 76 of the Finance Act, 1994 should not be imposed upon them; (iv) Penalty under Section 77 of the Finance Act, 1994 should not be imposed upon them; (v) Penalty under Section 78 of the Finance Act, 1994 should not be imposed upon them for suppressing and not disclosing the true value of the said taxable service provided by them. DEFENCE SUBMISSION: 10. The noticee filed reply to the SCN vide their letter dated 19.05.2010, wherein, it is inter alia, contended that 1. They had due to oversight inadvertently and bonafide taken the Cenvat credit of Rs. 5,637/- in the half yearly ST–3 Return filed on Page 6 of 19 OIO No. 06/JC/2011 Dated : 23.01.2012 19.10.2006 for the period of April to September–2006 only against the total amount of taxable service of Rs.1,07,66,586/-. Except this credit, no other cenvat credit is taken by them in previous or succeeding period. 2. They had received a notice dated 09.02.2007 from the superintendent of Jamnagar inter alia stating to pay amount of Rs. 5,637 in respect of Cenvat credit taken in the period of April to September - 2006 along with interest @ 13%. In response to the same, they had filed a letter dated 02.03.2007 explaining that the same was eligible to them. Accordingly, SCN was issued to them for the same and subsequently dropped by the AC, S. Tax Div. Rajkot by holding that the credit taken by them is eligible to them. 3. Further, audit was also conducted by the service tax department covering period from April - 2004 to March - 2009 and no query was raised in this regards. However, once again, the proceeding was initiated against them by issuing SCN dated 04.02.2011 by the Joint Commissioner on the ground that they had availed the Cenvat Credit of Rs. 5,637, benefit of abatement under notification no. 1/2006 was not available and therefore differential service tax of Rs. 25,29,420/would be payable as a result of this default. 4. This show cause notice has been issued to them after the expiry of 4 years and 3 month from relevant date. Here relevant date means 30.09.2006 as they had filed their ST – 3 Return for the period of April to September–06. However, as per Section 73, proceeding cannot be initiated after the expiry of one year except it involves fraud or collusion or willful mis-statement or suppression contravention of any of the provision of this chapter. of facts or In their case, extension of period of five years for issuing show cause notice cannot be invoked as they have submitted all the details and not tried to keep secret any detail with intent to evade the payment of duty. Therefore, issuance of show cause notice was in violation of provision of Section 73 of the Finance Act, 1994. 5. However, considering smallness of the amount of Cenvat credit as well as in view of the provision of law, they have reversed the Cenvat Page 7 of 19 OIO No. 06/JC/2011 Dated : 23.01.2012 Credit of Rs. 5,637/- with interest of Rs.3,472/-. They submitted copy of challan in this regard. 6. They had claimed the Cenvat credit in the half yearly ST–3 Return for the period April – September 06 only for Rs. 5,637/- and service tax payable (as stated in the show cause notice) on account of violation of condition of notification no. 1/2006 was Rs. 25,29,420/-. Therefore, the comparing the differential service tax payable with the amount of Cenvat credit, their claim of Cenvat credit was very small as compare to abatement claimed and if abatement was not granted it would cause them genuine hardship. 7. They relied on the decision of Tribunal in the case of C.C.E., Vadodara v. Ram Krishna Travels Pvt. Ltd., 2010(17) S.T.R. 165 and stated that by relying on the above decision, they had paid the service tax with appropriate interest equal to Cenvat Credit taken and made the default good. They requested to take the lenient view and condone the default by granting the benefit of abatement under notification no. 1/2006. 8. During the Financial year 2005-06, Suzlon Infrastructure Ltd. had supplied “Stub Assembly” amounting to Rs. 42,00,498/-. That this issue was barred by limitation on the same ground as stated in previous paras and therefore, they were not liable to pay service tax of Rs. 4,28,451/- on issue of material by Suzlon Infrastructure Ltd. amounting to Rs. 42,00,498/-. 9. Without prejudice to the above, they submitted that if service tax was payable on the material supplied by Suzlon Infrastructure Ltd., the amount of service tax should have been computed as under: Particulars Material supplied by Suzlon Infra. Ltd Less: Abatement 1/2006 Service Tax @ 10.20% 10. Amount(Rs.) 42,00,498/28,14,334/13,86,164/1,41,389/- However, in the show cause notice, amount of service tax was calculated without considering notification no. 1/2006. the benefit of abatement under They requested to consider the amount of Page 8 of 19 OIO No. 06/JC/2011 Dated : 23.01.2012 service tax payable as calculated above in case of any adverse decision taken against us. 11. Regarding interest under Section 75 of the Finance Act, 1994, they stated that they paid the service tax liability with interest and hence there was no loss to the revenue. Regarding penalty under Section 76 of the Finance Act, 1994, they stated that were not liable to pay the amount of service tax stated in the show cause notice, penalty u/s. 76 cannot be imposed. Further they had not committed any contravention which attracted penalty under Section 77 of the Finance Act, 1994, hence initiation of penalty proceedings u/s 77 is bad in law and void ab initio. Further, there was no any willful default or fraud or collusion or willful misstatement made by them and therefore penalty proceedings under Section 78 of the Finance Act, 1994 was required to be dropped. Further, penalty u/s 76 as well as u/s. 78 of the Finance Act, 1994 had been initiated without considering the amendment made by insertion of proviso in Section 78 w.e.f 10.05.08. Therefore, the penalty u/s. 76 is imposed then penalty u/s. 78 is not imposable. 12. They requested to consider the above matter and drop the proceedings. They also requested for personal hearing. PERSONAL HEARING 11. Personal hearing in the matter was held on 01.11.2011, which was attended by Shri Vinodbhai, partner of the noticee and Shri Kaushal Thakar, the authorised representative of the noticee. They briefed the defence reply dated 15.06.2011 and requested to decide the case on merits. ADDITIONAL SUBMISSION FILED ON 12TH JANUARY, 2012 12. The authorized representative of the noticee filed additional reply vide letter dated 11.01.2012, wherein, besides reiterating the arguments made in their earlier reply, he has also cited the case law of CCE, Ahmedabad vs. Khyati Tours & Travels-2011 (24) S.T.R. 456 and Com. of Service Tax, Ahmedabad v. Amola Holdings Pvt. Ltd.-2009 916) STR 46 and stated that the facts of the above cases are very much similar to the facts of their case and hence requested to take a lenient view and condone the default by Page 9 of 19 OIO No. 06/JC/2011 Dated : 23.01.2012 granting the benefit of abatement under Notification no. 1/2006. DISCUSSION AND FINDINGS: 13. I have carefully gone through the entire case records, SCN issued and defence put forth in writing as well as contentions raised during personal hearing. The points to be decided in the present proceedings are: (i) Whether the noticee is liable to pay differential service tax of Rs. 25,29,420/- on the “Commercial or Industrial Construction” service rendered by them, on account of violation of condition of Notification No.1/2006-ST dated 01.03.2006 for the period of April-2006 to September-2006? (ii) Whether the noticee is liable to pay service tax of Rs.4,28,451/- on material i.e. ‘Stub Assembly’ supplied by M/s Suzlon Infrastructure Ltd., Pune during the year 2005-06? (iii) Whether the show cause notice is barred by limitation? (iv) Whether the noticee is liable for imposition of penalty under Section 76, 77 and 78 of the Finance Act, 1994 and interest under Section 75 of the Finance Act, 1994 as proposed in the SCN? 14. Regarding violation of condition of Notification No. 1/2006-ST dated 1.3.2006, the show cause notice proposes that the noticee during the period April, 2006 to September, 2006 have availed and utilized service tax credit of input services and hence the benefit of this notification is not available to the noticee as they have violated the condition of the said notification. Accordingly, the show cause notice proposes that the noticee are required to discharge the service tax liability of Rs.25,29,420/- on the full invoice value during the period from April, 2006 to September,2006. On the other hand, the noticee have contended that they have claimed the Cenvat Credit in the half yearly ST-3 Return for the period April-September-2006 only for Rs.5,637/- and as per SCN service tax payable, on account of violation of condition of Notification No. 1/2006, is Rs.25,29,420/-. They have further contended that on comparing the differential service tax payable with the amount of Cenvat credit, the claim of Cenvat credit is very small as compared to abatement claimed; that they have paid service tax of Page 10 of 19 OIO No. 06/JC/2011 Dated : 23.01.2012 Rs.5,637/- with appropriate interest of Rs.3,472/- equal to Cenvat credit taken and made the default good and if abatement is not granted it will cause genuine hardship to them. The noticee have also submitted the copy of challan as a proof of payment of service tax with interest equal to cenvat credit taken/utilized by them. They have also relied upon few case laws. 15. The noticee is engaged in construction service and are registered with the Service Tax Department under the category of ‘Commercial or Industrial Construction’ as defined under Section 65(105)(zzq) of the Finance Act, 1994. The noticee have availed the benefit of Notification No. 1/2006-ST dated 1.3.2006 and paid service tax on abated value of 33% of the invoice value. To appreciate the issue better I reproduce the relevant portion of the notification as below: Effective rate of Service tax for specified services — Percentage of abatements S. No. Sub-clause Description of of clause taxable service (105) of Section 65 (1) (2) 7. (zzq) (3) Commercial or industrial construction service. Conditions Percentage (4) (5) This exemption shall not apply in such cases where the taxable services provided are only completion and finishing services in relation to building or civil structure, referred to in subclause (c) of clause (25b) of section 65 of the Finance Act. 33 Explanation. - The gross amount charged shall include the value of goods and materials supplied or provided or used by the provider of the construction service for providing such service. Provided that this notification shall not apply in cases where, (i) the CENVAT credit of duty on inputs or capital goods or the CENVAT credit of service tax on input services, used for providing such taxable service, has been taken under the provisions of the CENVAT Credit Rules, 2004; or (ii) the service provider has availed the benefit under the notification of the Government of India in the Ministry of Finance (Department of Revenue), No. 12/2003-Service Tax, dated the 20th June, 2003. 13. It is seen that this notification clearly stipulates that for availing the benefit of abatement, the benefit of Cenvat credit of duty Page 11 of 19 OIO No. 06/JC/2011 Dated : 23.01.2012 paid on inputs or capital goods or the Cenvat Credit of service tax on input services, used for providing such taxable service, under Cenvat Credit Rules, 2004 should not have availed. In the present case on hand, I find that the noticee have availed the Cenvat Credit of Rs.5,637/- during the half year April-2006 to September, 2006 and also claimed the abatement and paid service tax on abated value of 33%, hence service tax of Rs.25,29,420/- is demanded from them vide impugned show cause notice for violation of condition of this notification. However, as contested by the noticee, I find that the noticee have reversed the wrongly availed Cenvat Credit of Rs.5,637/alongwith interest of Rs.3,472/-, hence the same can be treated as if no credit was availed by the noticee. I also find that the noticee have also contended that except this credit no other cenvat credit is taken by them in previous or succeeding period. Further, the following case laws, upon which the noticee has relied upon, is squarely applicable in their case. (i) Kyati Tours & Travels vs. Commissioner of C. Ex. Ahmedabad as reported in 2011(24) S.T.R. 456(Tri-Ahmd.) (ii) C.C.E., Vadodara vs. Ram Krishna Travels Pvt. Ltd. as reported in 2010 (17) S.T.R. 487 (Tri-Ahmd.) In the case of Kyati Tours & Travels vs. Commissioner of C. Ex. Ahmedabad as reported in 2011(24) S.T.R. 456(Tri-Ahmd.) while allowing the appeal of the party, the Hon’ble Tribunal has held that as the appellants have admittedly reversed the credit alongwith interest, the benefit of the notification in question would be available to them. The para no. 4 and 5 of the said judgments are reproduced below: “4. It is seen that the appellant had reversed the wrongly availed Modvat credit along with interest, the same will have the effect as if no credit was availed by the appellants. The law on the above point is very clear and stands settled by various decisions of judicial as also the quasi judicial authorities. For the sake of convenience we may refer to the order passed by Commissioner (Appeals) in the case of Om Shanti Travels, Ahmedabad being Order-in-Appeal No. 197/2010(STC)/MM/ Commr(A)/Ahd dated 9-82010, wherein after summarising the entire case law, the benefit stands extended to the assessee. We reproduce the relevant paragraphs from the said order :- Page 12 of 19 OIO No. 06/JC/2011 Dated : 23.01.2012 “8. The appellant cited the case of M/s. Hello Minerals Water Private Limited v. UOI reported in 2004 (174) E.L.T. 422 (Allahabad). I have gone through this judgment. In Para 18 of this judgment it has been held by the High Court that if the exemption is subject to nonavailment of modvat credit on inputs, the subsequent reversal of modvat credit amounts to non-taking of credit on inputs and the benefit of exemption notification number 15/94-C.E., is to be granted, even when reversal of credit on inputs was done at Tribunal stage. 8.1 The above judgment of the High Court is based on five member bench decision of the Tribunal in the case of Franco Italian Company Private Limited v. C.C.E., 2000 (120) E.L.T. 792. This judgment in turn based on the Supreme Court judgment in the case of Chandrapur Magnet Wire Private Limited v. C.C.E., Nagpur, 1996 (81) E.L.T. 3. 8.2 I have gone through the Hon’ble Supreme Court of India’s judgment in the above mentioned case, and I find that it has been laid down/held that debit entry in modvat credit account indicates as if no credit was taken on such inputs. This judgment has been followed in a number of Tribunal judgments. The latest has been a case of the Commissionerate of Service Tax itself in the case of CST, Ahmedabad v. M/s. Amola Holdings Private Limited. This judgment was given in order No. A/1148/WZB/AHD/09 dated 1-6-2009. This judgment also stands accepted by the Commissionerate and hence I follow the same and hold that reversal or debit of modvat credit in this case of 9595 rupees amounts to non-availment of modvat credit and accordingly, the appellant is eligible to the benefit under Notification No. 1/2006.” 5. Inasmuch as the appellants have admittedly reversed the credit along with interest, we find that benefit of the notification in question would be available to them. Accordingly, we set-aside the impugned order and allow the appeal with consequential relief to the appellants. Stay petition also get disposed off.” In the case of C.C.E vs. Ram Krishna Travels Pvt. Ltd. as reported in 2010(17) S.T.R. 487(Tri-Ahmd.) while rejecting the appeal of the department, the Hon’ble Tribunal has held that the respondents have admittedly reversed the credit, hence no infirmity in the view adopted by Commissioner (Appeals). The para no. 2, 3 and 4 of the said judgments are reproduced below: “2. The short issue involved in the matter is as to whether the Respondent was disentitled to the benefit of abatement under Notification No. 1/06S.T. and thereby liable to pay differential service tax of Rs. 57,547/-, merely because they availed Cenvat credit amounting to Rs. 1,198/simultaneously with such abatement benefit for the month of March 2006 Page 13 of 19 OIO No. 06/JC/2011 Dated : 23.01.2012 (the month during which for the first time, the condition of non-availment of Cenvat credit of service tax paid on input service was introduced. 3. That admittedly, the respondent had forthwith reversed the Cenvat credit of Rs. 1,198/- together with interest of Rs. 80/- thereon, which was the offending Cenvat credit on input services availed during March 2006. That there is absolutely no dispute over the quantification of such Cenvat credit amount as well. 4. Commissioner (Appeals) by taking note of the Hon’ble Supreme Court’s judgment in the case of Chandrapur Magnet Wires Pvt. Ltd. v. CCE. reported in 1996 (81) E.L.T. 3 (S.C.) as also by taking note of the Hon’ble Allahabad High Court’s judgment in the case of Hello Minerals Water (P) Ltd. v. UOI reported in 2004 (174) E.L.T. 422 (All.) has held in favour of the assessee. In as much as the respondents have admittedly reversed the credit, I find no infirmity in the view adopted by Commissioner (Appeals). The appeal filed by the Revenue is accordingly rejected.” 16. I find that both the above cited cases are squarely applicable to the present case as the facts of all these cases are similar. In the present case also the noticee have reversed the wrongly availed Cenvat Credit alongwith interest, hence the benefit of abatement under Notification No. 1/2006-ST dated 1.3.2006 is available to them. Accordingly, I allow the benefit of the said notification to the noticee by giving the effect as if no credit was availed by the noticee and accordingly set aside the demand of service tax of Rs.25,29,420/-. 17. Regarding non-payment of service tax on “Stub Assembly” supplied by their client M/s Suzlon Infrastructure Ltd., Pune to the noticee during 200506, I find that as per explanation given under 15/2004-ST dated 10-09-2004 as amended vide Notification No. 04/2005-ST dated 01-03-2005 it is clear that the gross amount charged shall include the value of goods and materials supplied or provided or used by the provider of the construction service for providing such service. Hence, the value of ‘Stub Assembly’ of Rs.42,00,498/- supplied to noticee by their client M/s Suzlon Infrastructure Ltd., Pune is required to be added in the gross value for calculating service tax for the year 2005-06. The noticee have also not disputed the fact with regard to inclusion of value of ‘Stub Assembly’ in the gross value of service provided by them for calculating the service tax liability. However, they have contested that if service tax is payable on the material supplied by M/s Suzlon Infrastructure Ltd., the amount of service tax should have been computed as under: Page 14 of 19 OIO No. 06/JC/2011 Dated : 23.01.2012 Particulars Material supplied by Suzlon Infra. Ltd Less: Abatement 15/2004-ST dated 10-09-2004 as amended Net Taxable value (abated value) Service Tax @ 10.20% Amount(Rs.) 42,00,498/28,14,334/13,86,164/1,41,389/- The noticee have not availed any Cenvat Credit during the period 2005-06 and hence they cannot be debarred from the benefit of payment of service tax on abated value of 33% as provided vide Notification No. 15/2004-ST dated 10-09-2004 amended vide Notification No. 4/2005-ST dated 1-3-2005. Therefore, the contention of the noticee is acceptable and the benefit of abatement is rightly available to them under said Notifications. Accordingly I hold that they are required to pay service tax of Rs.1,41,389/- only on abated value @33% of Rs.13,86,164/-. 18. It is also contended by the noticee that the demand is time barred as the ingredient required for suppression of facts are not present. The show cause notice has been issued to them after the expiry of 4 years and 3 month from relevant date and here relevant date means 30.09.2006 as they have filed their ST-3 Returns for the period of April to September-06. Further, the audit has also been conducted by the service tax department covering period from April-2004 to March-2009 and no query has been raised in this regard. On careful study of the circumstances of the case, it is seen that the noticee is registered with the department and paying service tax and filing returns. However, the noticee failed to show correct taxable value in their ST-3 Returns filed for disputed period. The non addition of the value of the stub assembly in the assessable value is not reflected in the returns. This came to the knowledge of the department only after the investigation was commenced by the preventive. They also failed to disclose these correct facts before the audit party while conducting audit of their records. Since the noticee is well aware of the provisions of law, being registered with the department, there cannot be any ambiguity about liability to service tax. When the noticee has not disclosed the facts of non addition of the goods provided by the service receiver in the assessable value the only conclusion that can be arrived at is that the noticee has certainly suppressed the facts from the department with an intent to evade payment of appropriate tax. As per Section 73 of the Finance Act, 1994 Page 15 of 19 OIO No. 06/JC/2011 Dated : 23.01.2012 when there is a suppression of facts with intent to evade payment of service tax, extended period is invokable. Hon. High Court of Gujarat, in the case of CCE, Surat-I Vs. Neminath Fabrics Pvt. Ltd. – 2010 (256) ELT 369 (Guj.), held that Demand - Limitation - Extended period - Knowledge of Department, effect - Suppression admitted but Tribunal held demand as barred by limitation importing concept of knowledge of Department, as submitted - Proviso to Section 11A(i) of Central Excise Act, 1944 provides for a situation whereunder provisions of sub-section (i) ibid recast by legislature extending period within which SCN issued - Proviso cannot be read to mean that because there is knowledge, suppression which stands established disappears - Concept of knowledge, by no stretch of imagination, can be read into the provisions - Suppression not obliterated, merely because Department acquired knowledge of irregularities. - What has been prescribed under the statute is that upon the reasons stipulated under the proviso being satisfied, the period of limitation for service of show cause notice under sub-section (1) of Section 11A, stands extended to five years from the relevant date. [paras 15, 16, 20] Section 73 of the Finance Act, 1994 and section 11A of the Central Excise Act, 1944 are pari material and hence the judgment is squarely applicable to the present case. In view of the above, I conclude that the suppression clause is properly invoked in the present case and for the same reason, the noticee is liable for imposition of penalty under section 78 of the Finance Act, 1994. 19. With regard to the demand of interest, I find that the noticee has so far not paid the service tax due to the exchequer. Section 75 of the Finance Act, 1994 provides that every person liable to pay service tax in accordance with the provisions of section 68 or the rules made thereunder, who fails to credit the tax or nay part thereof to the account of the Central Government within the period prescribed, shall pay simple interest at such rate fixed by the Central Government by notification, for the period by which such crediting of the tax or any part thereof is delayed. Thus, it is clear that interest is chargeable from an assessee who has withheld the payment of any tax as and when it is due and payable. Interest is compensatory in character as held by the Hon’ble Supreme Court in the case of Pratibha Processors Vs. Union of India reported in 1996 (88) E.L.T. 12 (S.C.). In Pratibha Processors (supra), the Hon’ble Apex Court held as follows: Page 16 of 19 OIO No. 06/JC/2011 Dated : 23.01.2012 “13. In fiscal Statutes, the import of the words – “tax”, “interest”, “penalty”, etc. are well known. They are different concepts. Tax is the amount payable as a result of the charging provisions. It is a compulsory exaction of money by a public authority for public purposes, the payment of which is enforced by law. Penalty is ordinarily levied on an assessee for some contumacious conduct or for a deliberate violation of the provisions of the particular statute. Interest is compensatory in character and is imposed on an assessee who has withheld payment of any tax as and when it is due and payable. The levy of interest is geared to actual amount of tax withheld and the extent of the delay in paying the tax on the due date (emphasis supplied). Essentially, it is compensatory and different from penalty – which is penal in character.” Thus, interest is chargeable from the noticee for the period for which they have withheld the tax payable. 20. Since the noticee has delayed payment of service tax due, the noticee appears liable to be penalized under section 76 of the Finance Act, 1994, also. The use of the words, “who fails to pay such tax, shall pay, in addition to such ….… a penalty which shall not be less than two hundred rupees for every day during which such failure continues….” in section 76, ibid indicates that it was an in-built provision in the statute itself for payment of penalty at a specified scale for every day for delay, in addition to the tax and interest, leviable thereon under section 75 of the Finance Act, 1994. The words “shall pay” as used in section 76 of the Finance Act, 1994, in regard to penalty on account of non payment of tax within the stipulated time indicate that the penalty there under has to be paid mandatorily by the tax payer. 21. Regarding imposition of penalty under Section 77 of the Finance Act, 1994, I find that the noticee has not filed correct ST-3 return for the period under dispute though they are well aware of the provisions of law, being registered with the department and for such contraventions; penalty under Section 77 of the Finance Act, 1994 is imposable 22. The noticee have contended that after insertion of provision to Section 78 w.e.f. 10.5.2008, penalty if imposed under Section 76 of the Finance Act, 1994 then penalty under Section 78 of the Finance Act, 1994 is not imposable. In this regard I find that Section 78, vide its fifth proviso Page 17 of 19 OIO No. 06/JC/2011 Dated : 23.01.2012 provides that ‘if penalty is payable under this section, the provisions of section 76 shall not apply’. The proviso supra thus prohibits imposition of penalty under section 76 ibid, if the finding is that the concerned entity is liable to penal action under section 78 ibid. However, the said fifth proviso to section 78 ibid was inserted vide Finance Act, 2008, w.e.f. 10.05.2008. Since the acts of non-payment of service tax due in accordance with the law in this case pertain to the period prior thereto, the said fifth proviso to section 78 ibid can’t apply to the case in hand and, as such, in accordance with the law prevalent at the material time, the noticee is liable to penalty under section 76 as well as section 78 of the Finance Act, 1994. . For my above decision I rely upon the following Case Laws: (i) Assistant Commissioner of Central Excise V/s. Krishna Poduval reported at 2006 (1) S.T.R.185 (Ker) (ii) Commissioner of Central Excise, Chandigarh V/s. Grewal Trading Company-2010 (18) STR 350 (Tri-Delhi) In this case, since the noticee has failed to pay the tax within the due date as indicated hereinbefore, penalty under Section 76, ibid, is imposable on the noticee at the rate prescribed therein. Quantification of penalty payable under Section 76 ibid is possible only when the noticee fully discharges the service tax liability alongwith interest due on account of delayed payment of tax. However, as specified in Section 76, ibid, penalty payable thereunder shall not exceed the amount of service tax payable. 23. In view of the above, I pass the following order: ORDER 1. I confirm and demand the Service Tax of Rs.1,41,389/- (Rupees One Lakh Forty One Thousand Three Hundred Eighty Nine Only) under proviso to Section 73(1) of the Finance Act 1994. I drop the remaining demand of Rs.28,16,482/-. 2. I order the noticee to pay interest on the amount of service tax confirmed at Sl. No. 1 above, at the appropriate rate under Section 75 of the Finance Act 1994. 3. I impose a penalty of Rs. 200/- per day or two percent per month on the demand confirmed at Sl. No. 1 above, whichever is higher, on Page 18 of 19 OIO No. 06/JC/2011 Dated : 23.01.2012 the noticee, under the provisions of Section 76 of the Finance Act, 1994 starting with the first day after the due date till the date of actual payment of service tax, provided that the total amount of the penalty payable in terms on this account shall not exceed the service tax payable as confirmed at Sl. No. 1 above. 4. I impose a penalty of Rs.5,000/- (Rupees Five Thousand Only) under Section 77 of the Finance Act, 1994. 5. I impose a penalty of Rs.1,41,389/- (Rupees One Lakh Forty One Thousand Three Hundred Eighty Nine Only) under the provisions of Section 78 of the Finance Act, 1994. If the amount, as determined under Sr. No. 1 above, is paid within 30 days from the receipt of the order along with interest payable then as per proviso to Section 78 the penalty will be only 25% of the service tax determined at Sl. No. 2 above. The benefit of reduced penalty shall be available only if the amount of penalty so determined has also been paid within the period of thirty days from the date of receipt of the order. (M.GNANASUNDARAM) JOINT COMMISSIONER F. No. V.ST/15-370/Adj./09 To, M/s. Rajmoti Developers, ‘Nilkanth’, 2, Sardar Patel Society, Saru Section Road, Jamnagar. Copy to : 1. 2. 3. 4. 5. The Assistant Commissioner (RRA), Central Excise, Rajkot. The Deputy Commissioner, Service Tax Division, Rajkot. The Deputy Commissioner, Tax Recovery Cell, HQ, Rajkot. The Superintendent, Service Tax Range-Jamnagar. Guard file. Page 19 of 19