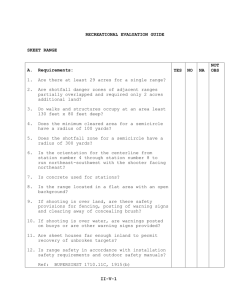

Course Material. - Regional Training Institute,Allahabad

advertisement