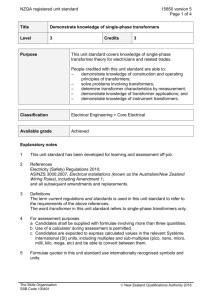

Review of Minimum Energy Performance Standards for Distribution

advertisement