GOVERNMENT GAZETTE PENSION FUNDS ACT amended

advertisement

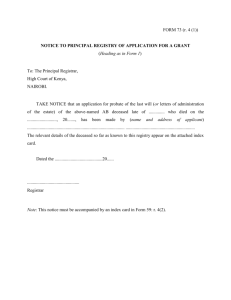

GOVERNMENT GAZETTE ______________________________________________________________________ Vol. III PRICE 5c PRETORIA 26 JANUARY 1962 No. 162 ______________________________________________________________________ GOVERNMENT NOTICES DEPARTMENT OF FINANCE No. R. 98 26 January 1962 PENSION FUNDS ACT, 1956 ______________________________________________ The State President has, under the powers vested in him by section thirty-six of the Pension Funds Act, 1956 (Act No. 24 of 1956), as amended, made the following regulations in substitution for the regulations published by Government Notice No. 1720, dated 8 th November, 1957:______________________________________________ REGULATIONS. PENSIONS FUNDS ACT, 1956. ________________________________________________ In these regulations – “Act” means the Pension Funds Act, 1956, as amended, and all terms employed herein which have been defined in the Act shall bear the meanings assigned to them in the Act; “foreign fund” means a fund referred to in section two (2) of the Act; “person managing the business of the fund” includes the committee, committee of management, board of trustees or like body administering the fund; “principal officer” means the principal executive officer referred to in section eight of the Act who may be a member of the body administering the fund; “privately administered fund” means a fund other than the funds referred to in sections two (1), two (2), two (3)(a)(i) and two (3)(a)(ii) of the Act; “state-controlled fund” means a fund referred to in section two (3)(a)(i) of the Act; “underwritten fund” means a fund referred to in section two (3)(a)(ii) of the Act. _________________________________________ PART I __________________________________________ MANNER IN WHICH AND TIME WITHIN WHICH APPEALS TO THE MINISTER ARE TO BE PROSECUTED UNDER SECTION THREE 1. Every pension fund or person desiring to appeal to the Minister, in terms of section three (3) of the Act from any decision of the Registrar, shall within one month after the pronouncement of the decision at issue, lodge a written notice of appeal with the Registrar, which shall clearly set out the decision it is desired to appeal from and the grounds for the appeal. Such notice of appeal shall be signed by the principal executive officer of the fund (if the appeal is at the instance of a pension fund) or in the case of an appeal by an individual or partnership, by the individual or by one of the partners, as the case may be, or by his duly authorized representative. In the case of an appeal by any person who is not a natural person the notice of appeal shall be signed on behalf of such person as follows, that is to say(a) if such person is a committee of individuals, by the person for the time being at the head of the committee; (b) if such person is an association of persons, by the individual who is for the time being at the head of the board of directors or other committee controlling such association. 2. Upon receipt of the notice mentioned in regulation 1 the Registrar shall prepare a statement of the reasons for his decision. The Registrar shall dispatch a copy of the statement to the appellant by registered post, and require the appellant to declare, in writing, within 30 days of the dispatch of the statement, or within such further period as the Registrar may upon application before the expiry of the said 30 days, approve, whether he proposes to continue with his appeal or not. 3. If the appellant declares that he does not propose to continue with his appeal or if he does not furnish the Registrar with a reply within the period prescribed in regulation 2, the appeal shall automatically lapse. 4. If the appellant declares, within the period prescribed if regulation 2, his intention to continue with his appeal, he shall with his declaration lodge with the Registrar a reply to the statement mentioned in regulation 2. 5. Upon receipt of the appellant’s declaration and reply the Registrar shall as soon as may be transmit to the Minister(a) the notice of appeal mentioned in regulation 1; (b) the statement prepared by him and mentioned in regulation 2; (c) the declaration and reply mentioned in regulation 4; and (d) all other relevant documents 6. The Minister may require the appellant or the Registrar to furnish him, in writing, with any further or other information which he may consider necessary for a just decision on the appeal. 7. Upon receipt of the Minister’s notification of his decision on the appeal the Registrar shall immediately communicate that decision to the appellant by registered post. ______________________________________ PART II _____________________________________ DOCUMENTS AND PARTICULARS TO BE FURNISHED WHEN APPLYING FOR REGISTRATION UNDER SECTION FOUR. _________________________ PRIVATELY ADMINISTERED FUNDS. 8. Every application for registration of a privately administered fund shall consist of a letter signed by the person managing the business of the fund for the time being or on behalf of the employer participating in the fund, in which- (i) is applied for registration of the fund; (ii) is reflected the full title of the fund; (iii) is given the full address (which must not only be a post office box number) of the registered office of the fund; and (iv) is given the name of the person for the time being, or who will upon registration of the fund be, administering the fund or for the time being at the head of the body administering the fund; and shall be accompanied by- (a) two copies of the rules of the fund duly certified, as explained in regulation 18, by the applicant as being the rules which will become effective on the date of registration of the fund or the date of commencement of the fund, whichever is the later. If friendly society business will be carried on by the fund as contemplated in section one (1)(x) of the Act the rules covering such friendly society business are also to be submitted if they do not form part of the pension fund rules; (b) two copies of a certificate by a valuator as to the soundness of the rules from a financial point of view. The name, address and professional qualifications and experience of the valuator must be indicated in the certificate. If no valuator has been employed by the fund or if financial methods will be adopted by the fund which will render periodic investigations by a valuator unnecessary, such other information regarding the financial soundness of the rules as the applicant may possess together with an explanation as to why a certificate by a valuator is not available, must be furnished; (c) two copies of a document (for example an extract from the articles of association of the participating company and a copy of the directors’ resolution, etc.) to indicate the authority in terms of which the fund was established. If no such authority exists this fact must be clearly stated; (d) the prescribed registration fee of R20 which must be paid otherwise than by means of revenue or postage stamps. FOREIGN FUNDS. 9. An application for registration of a fund referred to in section two (2) of the Act shall be in the form set out and be accompanied by all the documents and particulars mentioned in regulation 8. In addition the applicant shall submit a memorandum in which are set out(a) the reasons why exemption is claimed under section two (2); (b) the names and registered addresses of the head offices of all the employers participating in the fund; (c) the number of members of the fund- (i) outside the Republic of South Africa; (ii) in the Republic who are South African citizens; (iii) in the Republic who are not South African citizens. STATE-CONTROLLED FUNDS. 10. An application for registration of a fund which claims exemption under section two (3)(a)(i) of the Act shall be in the form set out and be accompanied by all the documents and particulars mentioned in regulation 8. In addition the applicant shall submit a memorandum in which reasons are set out as to why exemption is claimed under section two (3) (a) (i) of the Act. UNDERWRITTEN FUNDS. 11. An application for registration of a fund which claims exemption under section two (3) (a) (ii) of the Act shall be in the form set out in regulation 8 and be accompanied by the documents and particulars mentioned in paragraphs (a), (c) and (d) of that regulation. In addition the application shall submit a certificate by the insurance company concerned to the effect that- (a) an insurance policy has been or will be issued by it in terms of the rules of the fund; and (b) the rules submitted by the applicant are those in force at the date of application. PART III _____________________________ FINANCIAL STATEMENTS AND STATISTICS TO BE FURNISHED BY REGISTERED FUNDS. _____________________________ 12. Every registered fund shall not later than the 30 th day of June of every year following the year in which the fund registered, submit the following to the Registrar of Pension Funds, Private Bag 238, Pretoria, under cover of a letter signed by the principal officer:- (a) three copies of a revenue account, prepared in the form of Schedule A to these regulations, in respect of the financial year which ended on the 31st December immediately preceding; (b) three copies of a balance sheet, prepared in the form of Schedule B, as at the end of the said financial year; (c) two copies of those of statements 1 to 13 set out in Schedule D which are applicable to the fund; (d) two copies of all reports (other than the report on the balance sheet) by the auditor relating to any of the activities of the fund during the financial year to which the revenue account and balance sheet relate; (e) two copies of any annual report the fund may have presented to its members in respect of the said financial year; (f) two copies of any other statement or report the fund may have presented to its members in respect of any of its activities during the said financial year; (g) two copies of a list containing the names of all the employers participating in the fund except where such names are incorporated in the rules of the fund in which case this fact need only be mentioned in the covering letter. Once a complete list has been furnished subsequent returns need only mention changes thereto; and (h) two copies of a return prepared in the form of Schedule C relating to the fund’s membership. 13. If it is not possible to comply with paragraph (d), (e) or (f) of regulation 12 above due to the fact that no such reports were made or no such statement were presented or if there was no change in the list of participating employers referred to in paragraph (g), this fact shall be mentioned specifically in the covering letter. 14. The name of the fund and the financial year to which the documents relate shall be given on each sheet of paper submitted under regulation 12 above. ___________________________________ PART IV ____________________________________ REPORTS BY VALUATOR AND STATEMENTS OF ASSETS AND LIABILITIES. ______________________ 15. A registered fund which carries on only pension fund business referred to in paragraph (a) or (b) of the definition of “pension fund organization” in section 1 (1) of the Act shall, whenever the fund sends a summary of a report of a valuator in terms of subsection (1) of section 16 of the Act to every employer participating in the fund, cause any such summary to be prepared by the valuator concerned in a form substantially corresponding to the form of Schedule F to these Regulations. 16. Every registered fund which in addition to its pension fund business carries on friendly society business as defined in section two of the Friendly Societies Act, 1956, shall in regard to its pension fund business comply with the requirements of section sixteen of the Act. If(a) any of the friendly society business of the fund is subject to actuarial scrutiny in terms of the rules, such friendly society business shall be investigated and reported upon by a valuator at the same time as the pension fund business is investigated and reported upon in terms of section sixteen of the Act and the reports on the pension fund and the friendly society business shall be submitted together; or (b) none of the friendly society business is subject to actuarial scrutiny in terms of the rules, a statement to that effect shall accompany the valuation report in respect of the pension fund business submitted in terms of section sixteen of the Act. 17. Any registered fund which desired authority to prepare a statement of liabilities and assets in lieu of causing its financial condition to be investigated and reported upon by a valuator in terms of section sixteen of the Act, shall apply to the Registrar for the necessary authority in terms of section seventeen. Such application, which may be submitted at the same time as the application for registration under regulation 8, shall be accompanied by a memorandum setting out in detail the reasons as to why an investigation by a valuator is considered unnecessary. __________________________________ PART V. _________________________________ SIGNING OF DOCUMENTS. ________________ 18. Rules.- Both copies of the rules of a fund which accompany the application for registration must be certified as follows on the first page or on the cover if the rules are in the form of a booklet: “Certified that these are the rules of the XYZ Pension Fund which will become effective on the date of registration / commencement* of the fund.” *Delete whichever not applicable. If the applicant is the person managing the business of the fund the certificate is to be signed by the person for the time being at the head of the administering body and by one other member thereof. If the application is made on behalf of the participating employer the certificate must clearly indicate the capacity in which the applicant signed the document, e.g. as secretary of the company. 19. Annual Accounts and Statements. – For the purposes of section twenty of the Act the accounts and statements prescribed in Schedules A, B, C and those applicable in D will be regarded as one document and must be accompanied by the following certificate: “Certified that to the best of our knowledge the attached accounts and statements in respect of the XYZ Pension Fund for the year ended 31st December, 19….., are true and correct.” The certificate which must be signed as explained in regulation 20, may either be on a separate sheet of paper or be endorsed on Schedule A or where all the documents are bound in one volume be on the cover thereof. The accounts and statements need not be signed elsewhere except by the auditor on the balance sheet. 20. Other Documents. – Any document (excluding a letter) other than those referred to in regulations 18 and 19 must be signed on the first page thereof as prescribed in section twenty of the Act, namely – (a) where the fund is administered by one individual, by – (i) such individual; and (ii) the principal officer; (b) where the fund is administered by a committee or trustees, by – (i) the person for the time being at the head of such committee or trustees; (ii) one other member of the committee or a trustee; and (iii) the principal officer. In the case of (a) there must be two signatures by different individuals. In the case of (b) there must be three signatures but as the principal officer may be a member of the committee or a trustee it is possible that his may be two of the three signatures, i.e. at least two different individuals must sign the document. ____________________________ PART VI. ___________________________ AUDITORS. _____________ 21. (a) Within 30 days of the registration of the fund the person managing the business of the fund shall notify the Registrar in writing of the name and address of the auditor of the fund. (b) Whenever a registered fund has appointed a new auditor, the person managing the business of the fund shall within 30 days as from the date of such appointment give notice thereof in writing to the Registrar which notice shall state the name and address of the auditor and contain a statement to the effect that such appointment was made in accordance with the provisions of the rules of the fund. 22. The revenue account and balance sheet referred to in paragraph (a) and (b) of regulation 12 shall be prepared in the form set out in Schedule A and B respectively and the balance sheet shall be accompanied by a report signed by the auditor of the fund in the form shown in Schedule B, but if the auditor is unable to sign the report in the form so shown without qualification, the report shall be in such form as he wishes provided that it shall deal with the matters referred to in the report shown in Schedule B and shall include his reasons for being unable to sign the report without qualification. _______________________ PART VII. _______________________ GENERAL. ______________ 23. No registered fund shall change its registered address unless the procedure prescribed in its rules for the amendment of the rule pertaining to the registered address has been followed and the amendment of the rule has been registered by the Registrar. 24. (a) Within one month from the date of the passing of a resolution for the alteration or rescission of any rule or for the adoption of any additional rule the principal officer of the fund shall submit to the Registrar – (i) four copies of the resolution adopted together with a certificate signed as explained in regulation 20 to the effect that the resolution has been adopted in accordance with the provisions of the rules of the fund; (ii) if the alteration or rescission of or addition to the rules affects the financial condition of the fund, a certificate by a valuator as to the financial soundness of the alteration, rescission or addition or, if no valuator has been employed, such information regarding the financial soundness of the altered, rescinded or added rule as the fund may possess; (iii) a statement explaining the necessity for the alteration or rescission of or addition to the rules. (b) No alteration or rescission of or addition to the rules shall be valid before registration by the Registrar in terms of section twelve (4) of the Act, and such alteration, rescission or addition shall take effect either as from the date determined by the fund concerned, or if no such date has been so determined, as from the date of the registration thereof. 25. On payment of the fees prescribed in Schedule E any person may between the hours of 9 a.m. and 12 noon and 2 p.m. and 3.30 p.m. on Mondays to Fridays inspect at the office of the Registrar or may make a copy of or take an extract from any document mentioned in the Schedule or may obtain from the Registrar a copy of or an extract from any such document. Any amount payable in terms of this regulation shall be paid by way of revenue stamps. 26. Any person who has failed to make a return or to transmit or deposit a scheme, report, account, statement or other document within the time prescribed in the appropriate provisions of the Act or within any extended period allowed by the Registrar in terms of section thirtythree (1) of the Act, shall, without derogation from the provisions of section thirty-seven (1) of the Act, thereafter be permitted to furnish such return or to transmit or deposit such scheme, report, account, statement or other document subject to the payment of a penalty of R10 for every day during which he has remained in default. 27. For the purpose of section 19 (5) (b) (iii) of the Act the rate of interest is thirteen per cent per annum with effect from 1st January 1987. “Limits relating to assets in which a registered fund may invest In this regulation – 28. (1) (a) “any other stock exchange within the common monetary area” means any stock exchange authorized by or under the laws of a country of the common monetary area to function as, or carry on the business of, a stock exchange in that country; (b) “banking institution” means an institution registered under the Banks Act, 1965 (Act 23 of 1965), and includes a deposit-taking instution registered provisionally or finally in terms of the Deposit-taking Institutions Act, 1990 (Act 94 of 1990) of the Republic of South Africa; (c) “building society” means a building society registered in terms of the Building Societies Act, 1986 (Act 23 of 1986); (d) “common monetary area” means the Kingdom of Lesotho, the Kingdom of Swaziland and the Republic of South Africa; (e) “linked policy” means a contract under which no investment guarantees are given by the insurer, either explicitly or implicitly, and in respect of which investment benefits are determined solely by reference to the value of specific assets to which the contract is linked and which assets are actually held by or on behalf of the insurer in terms of section 20(1) of the Insurance Act, 1943 (Act 27 of 1943); (f) “local authority” mans a local authority council as defined in section 1 of the Local Authorities Act, 1992 (Act 23 of 1992); (g) “market value”, in relation to – (i) the value of every quoted asset, means the price at which it was quoted on the Namibian Stock Exchange or any other stock exchange within the common monetary area within a period of three months immediately preceding the date to which the statement relates, which value shall be shown in the statement at an amount not exceeding the value determined according to the price last so quoted: Provided that if such quotation relates to a date other than the date to which the statement of assets relates the said amount shall be properly adjusted in the case of - (aa) any interest-bearing asset, by the difference between the amount of the interest which had accrued from the last date on which interest was payable up to the date of the quotation in question and the corresponding amount of interest accrued up to the date to which the statement relates; and (bb) any share on which dividends have been declared, by the difference between the amount of any dividend which had been declared but not paid on the date of the quotation in question and the amount of any dividend which had been declared but not paid on the date to which the statement relates; (ii) assets to which the provisions of paragraph (i) do not apply, means the value determined in accordance with section 19(5A) of the Act; (h) “Post Office Savings Bank” means the Post Office Savings Bank controlled and managed by the Namibia Post Limited under the Posts and Telecommunications Act, 1992 (Act 19 of 1992); (i) “property company” means a company – (i) of which 50% of more of the market value of its assets consists of immovable property, irrespective of whether such property is held directly by the company as registered owner or indirectly by way of ownership of the shares of the company which is the registered owner of the property or which exercises control over the company which is the registered owner of the property: or (ii) of which 50% or more of its income is derived from investments in immovable property, or from an investment in a company 50% or more of the income of which is derived from investments in immovable property; (j) “regional council” means a regional council as defined in section J of the Regional Councils Act, 1992 (Act 22 of 1992). (k) “the Namibian Stock Exchange” means the Namibian Stock Exchange licensed under the Stock Exchanges Control Act, 1985 (Act 1 of 1985). “(2) Subject to the provisions of this regulation, a fund may invest only in assets set out in column 1 of the Annexure to the extent that the market value of the investment in any such asset, expressed as a percentage of the market value of the total assets of the fund, does not exceed the percentage set out in column 2 of the Annexure in respect of such asset: Provided that – (a) the aggregate of the market value of investments in assets referred to in items 5 and 6 in column 1 of the Annexure, expressed as a percentage, shall not exceed 90%; (b) the aggregate of the market value of investments in assets referred to in items 5, 6, 7 and 8(e) in column 1 of the Annexure, expressed as a percentage, shall not exceed 95%, of the market value of the total assets of the fund.”; “(2A) Despite subregulation (1), a fund must, subject to subregulation (2B), invest in unlisted investments in Namibia a minimum of 5% of the total assets of the fund: Provided that the unlisted investments may cumulatively not exceed 10% of the assets of the fund: Provided further that the fund must invest – (a) a minimum of 2% of its assets in unlisted investments from 1 January 2008 to 31 December 2008; (b) a minimum of 3,5% of its assets in unlisted investments from 1 January 2009 to 31 December 2009; (c) (2B) a minimum of 5% of its assets in unlisted investments from 1 January 2010. Before a fund invests in an unlisted investment in Namibia, the entity in which the investment is intended must – (a) be in possession of a certificate by an auditor registered under the Public Accountants’ and Auditors’ Act, 1951 (Act No. 51 of 1951), and approved by the registrar certifying its compliance with the International Financial Reporting Standards as prescribed by the International Accounting Standards Board; (b) adhere to internationally accepted norms on good corporate governance; (c) have Namibian ownership of at least 25%, prior to any investment by a fund; (d) comply with such other requirements that the registrar, with the concurrence of the Minister, may determine from time to time. (2C)(1) A shareholder, director, member, partner, or other owner or officer of an entity referred to in subregulation (2B), persons rendering advisory or administrative services to a fund, including but not limited to asset managers or investment managers, their shareholders, directors, members or other officers or any person connected to the business of the fund desiring to invest in an unlisted investment of that entity share, who has interest or information that may cause a conflict of interests to arise between any of such persons and the fund must disclose such interest or information to the registrar without delay. (2) The registrar, either as a result of the disclosure referred to in subregulation (1) or on his or her own volition, may conduct such investigation into the affairs of any of the parties to any investment of a fund as the registrar thinks fit. (2D) A fund may not use the service of any investment manager or asset manager, approved under section 4(1)(f) of the Stock Exchanges Control Act, 1985 (Act No. 1 of 1985) or any other adviser, in connection with the placement of an unlisted investment, without the prior written approval of the registrar, subject to such practice notes or conditions as the registrar may impose. (2E) A fund, on a quarterly basis commencing 1 January each year following the commencement of this regulation, must – (a) report to the registrar the placement of investments in unlisted investments in such format; and (b) provide such information, as the registrar may determine. (2F) For the purposes of subregulations (2A) to (2E), an “unlisted investment” means a “share” as defined in the Companies Act, 1973 (Act No. 61 of 1973), and excludes – (a) a share in a company listed on any stock exchange; and (b) a debt instrument or any other investment as the registrar, with the concurrence of the Minister, may determine by notice in the Gazette.” (3) (a) In the application of this regulation with regard to the total assets of a fund, including any fund exempted under section 2(3)(a)(ii) of the Act, a policy issued to the fund concerned by an insurer carrying on long-term insurance business as contemplated in the Insurance Act, 1943, which – (a) is not a linked policy; or (b) is a linked policy, and the fund has obtained from the insurer a certificate indicating that the assets held by the insurer in respect of his or her net liabilities under the said policy meet the distribution requirements of assets referred to in the Annexure, shall be deemed not to be an asset of the fund. (b) In the case of a linked policy, in respect of which no certificate as contemplated in paragraph (a) has been obtained, the fund shall obtain a statement in writing containing particulars of the extent to which the value of the benefits under such policy is determined by the market value of assets referred to in the Annexure, and the market value of such assets shall be deemed to be assets of the fund and, in the case of a fund exempted under section 2(3)(a)(ii) of the Act, the certificate shall furnish the reasons for not complying with the aforementioned distribution requirements of assets as referred to in the Annexure. (c) The statements and certificate referred to in paragraphs (a) and (b) shall be furnished at the end of each financial year of the fund or, in the case of a fund which is exempted in terms of section 2(3)(a)(ii) of the Act, at the end of the insurer’s financial year by the valuator of the insurer concerned or by his or her delegate. (4) Where the membership of a fund, including any fund exempted in terms of section 2(3)(a)(ii) of the Act, is not compulsory and the fund operates by means of individual policies or certificates issued in respect of each member of the fund by an insurer carrying on long-term insurance business as contemplated in the Insurance Act, 1943, such policies or certificates shall not be subject to the provisions of this regulation if the assets held by the insurer in respect of his or her liabilities under the said policies or certificates comply with the requirements of regulation 34 of the regulations made under the Insurance Act, 1943. Provided that assets consisting of shares in a company incorporated outside Namibia shall, if such shares have been – (i) designated by the Minister by notice in the Gazette for the purposes of this subregulation; and (ii) acquired on the Namibian Stock Exchange. be regarded as assets invested in Namibia”. “(5) Despite subregulation (2), and without prejudice to subregulations (3) and (4), and the Annexure to this regulation, a fund must keep invested inside Namibia not less than 35% of the market value of its total assets: Provided that assets consisting of shares acquired in a company incorporated outside Namibia, which shares are listed and have been acquired on the Namibian Stock Exchange, are, for the purpose of this regulation, regarded as assets invested in Namibia, but may not exceed the value of investments inside Namibia by – (a) 30% from 1 June 2008 to 31 May 2009; (b) 25% from 1 June 2009 to 31 May 2010; (c) 20% from 1 June 2010 to 31 May 2011; (d) 15% from 1 June 2011 to 31 May 2012; and (e) 10% from 01 June 2012”, (5A) (a) Every fund shall within six months after the end of each financial year, furnish the registrar with a return in such form as he or she may prescribe which shall contain such particulars as he or she may require in order to determine whether the fund is complying with subregulation (2). (b) Every fund shall within 30 days after each date referred to in paragraphs (b) and (c) of subregulation (5), furnish the registrar with a return in such form as he or she may prescribe which shall contain such particulars as he or she may require in order to determine whether the fund is complying with that subregulation”. “(5B) Any investment made outside the common monetary area must comply with such limitations as may be determined under the Currency and Exchanges Act, 1933 (Act No.9 of 1933) from time to time.” (6) The registrar may on prior written application by a fund grant such fund written exemption from any of the provisions of this regulation upon such conditions as he or she may impose. “ANNEXURE LIMITS OF INVESTMENT (REGULATION 28) Item Column1 Column 2 Categories or kinds of assets percentage Maximum of aggregate market value of assets of fund 1. Bills, bonds or securities issued or guaranteed by loans to or total guaranteed by the Government of the Republic of Namibia 2. 50% Deposits with and credit balance in a current or savings account with a banking institution, including negotiable deposits, and money market instruments in terms of which such banking institution is liable, including deposits in the Post Office Saving Bank. 3. Per banking institution 20% Post Office Savings Bank 20% Bills, bonds or securities issued or guaranteed by or loans to or guaranteed by – (a) A local authority or regional council authorized by law to levy rates upon immovable property, per local authority or regional Council (b) A state-owned enterprise Total investments of a fund in assets referred to item 3 4. 20% 20% 30% Bills, bonds or securities issued by or loans to an institution, which bills, bonds, securities or loans the Registrar had approved in terms of section 19(1)(h) of the Act prior to the deletion of that section by section 8(a) of Act 53 of 1989, and also bills, bonds and securities issued by or loans to an institution, which bills, bonds, securities or loans the Registrar has likewise approved before the deletion of the said section 19(1)(h): Per institution 5. Bills, bonds or securities issued by the government of or by a local authority in a country other than Namibia, which country the registrar had approved in terms of section 19(1)(i) of the Act prior to the deletion of that section by section 8(a) of Act No.53 of 1989, and also bills, bonds or securities issued by an institution, which institution the registrar likewise had approved before the deletion of the said section 19(1)(i): 20% Per institution 6. 10% Immovable property, units in unit trust schemes in property shares, and shares in, loans to and debentures, both convertible and nonconvertible of property companies Provided that the investment in a single property or property 20% development project is limited to 7. 5% Preference and ordinary shares in companies (excluding shares in property companies), convertible debentures, whether voluntary or compulsorily convertible (but excluding such debentures of property companies) and units in a unit trust scheme as defined in the Unit Trusts Control Act, 1981 (excluding units in unit trust schemes in property shares or a unit trust of which the underlying does not consist of at least 95% securities listed on a stock exchange): (a) With effect from 1 January 2008 to 31 January 2009; and 70% (b) With effect from 1 February 2009 65% Provided that (a) a fund may apply to the registrar for exemption from the provisions of paragraphs (a) and (b); (b) shares and convertible debentures in a single company listed on any stock exchange within the common monetary area other than in the development sector: (i) with a market capitalization of N$5000 million or less; 5% (ii) with a market capitalization greater than N$5000 million 10% (c) shares and convertible debentures in a single company listed on the Namibian Stock Exchange 5% (i) with a market capitalization of N$1000 million or less; 5% (ii) with a market capitalization greater than N$1000 million; 10% 8. Claims secured by mortgage bonds on immovable property, debentures (listed and unlisted but excluding convertible debentures) or any other secured claims against natural persons (excluding loans referred to in paragraph (c) of item 8 of this Annexure) or companies (excluding loans to and debentures of property companies) 25% Provided that – 9. (a) a claim against any one individual is limited to 0.25% (b) a claim against any single company is limited to 5% Any other asset not referred to in this Annexure per category or kind of asset 2.5% But excluding – (a) moneys in hand; (b) loans granted to members of the fund concerned in accordance with – (i) the provisions of section 19(5) of the Act; and (ii) such exemptions as may have been granted to the fund in terms of section 19(6) of the Act; (c) investments in the business of a participating employer to the extent that it has been allowed by an exemption in terms of – (i) the proviso to section 19(4) of the Act, or (ii) section 19(6) of the Act. SCHEDULE “A” ______________ ___________________________________________FUND. ________________ REVENUE ACCOUNT FOR THE YEAR ENDED 31ST DECEMBER, 19____. Expenditure. Revenue. 1. Administration expenditure: (a) Salaries and wages…………… 1. Income from investments(4): __________ (a) Interest ………………………..____________ (b)Valuator ……………………………...__________ (b) Dividends……………………._____________ (c) Auditor ………………………….. ___________ (c) Rent (5)………………………. ____________ (d) Other ……………………………. ___________ _____________ ____________ 2. Profit on sale/redemption of investments….________ 3. Amount by which investments were written up(³)_____ (e) Less amount recovered from employer ____________ 4. Amount paid by employer to raise interest income to guaranteed minimum level…………………..________ 2. Other expenditure (¹) (specify)-………..____________ 5. Other (8) (specify)……………………………_________ 3. Depreciation (specify)…………………._____________ 6. Shortfall for the year carried down……….._________ 4. Provisions(²)(specify)………………….._____________ 5. Loss on sale/redemption of investments..__________ 6. Amount by which investments were written down (³) 7. Surplus for the year carried down……….___________ __________ R___________ R___________ 1st January, 19…(9)___ 8. Benefits(7): - 7. Balance of pension fund as at (a) Pensions (i.e. regular periodical payments)…_________ 8. Contributions during the year (10):- (b) Lump sum awards on retirement or death…..__________ (a) By members……………________ (c) Lump sum awards under circumstances other (b) By employers………….________ than (b) above (8) ………………………………__________ (d)Other (11) (specify) …………………………….__________ ________ 9. Amounts received on transfer from other funds.._____ 10. Surplus for the year brought down………._________ 9. Amounts transferred to other funds…………__________ 10. Shortfall for year brought down ……………___________ 11. Balance of pension(9) fund as at 31st December, 19..___ R_________ R_________ NOTES. (1) For example premiums paid on policies held, or income which accrued on amounts held for deferred payments and which was transferred to the accounts of the beneficiaries. (2) For example provision for valuators’ fees. Amounts placed on reserve are also to be shown here. (3) For example where stock was purchased other than at redemption value. (4) The amounts must indicate the nett result after adjustments had been made in respect of income received in advance and income accrued on investments. (5) This should be rental received less direct expenses. (6) Amongst others this item will cover unclaimed moneys forfeited, increase in surrender values of policies held, excess proceeds of policies over their book values, etc. (7) Account must be taken of benefits awarded but not yet paid out. (8) This item covers payments on resignation, dismissal, etc., and includes contributions, interest, etc. paid under such circumstances. (9) If the fund is a provident fund the word “pension” must be changed to “provident”. For the purpose of this schedule a provident fund means a fund which, in terms of its rules, does not provide for the payment of annuities, i.e. which makes lump sum payments to members upon termination of their membership irrespective of whether the lump sums are paid in single amounts or in installments. (10) Contributions in advance and arrear must be brought into account. Contributions other than normal recurrent contributions must be shown separately under this item. (11) If benefit fund business is carried on in addition to the pension or provident fund business this must be shown here. SCHEDULE “B” _____________ ____________________________________________FUND. _______________ BALANCE SHEET AS AT 31ST DECEMBER, 19……………… FUNDS AND LIABILITIES – 1. Fund Account: (a) Pension Fund …………………………………………………… …………….. (b) Provident Fund (¹) ……………………………………………… …………….. (c) Benefit Fund (4) ………………………………………………… …………….. ___________ 2. Reserves (specify) ………………………………………………………………. ……………… 3. Provisions (specify) …………………………………………………………………… ……………... 4. Sundry creditors: (a) Contributions received in advance…………………………………. ……………… (b) Interest received in advance ………………………………………. ……………… (c) Other (²)………………………………………………………………… ……………… ___________ ………………. ___________ ASSETS – 1. Fixed property (at cost)…………………………………………………… ……………… Less accumulated depreciation……………………………………………. ……………… ___________ ………………. 2. Properties in possession……………………………………………………………. 3. Office furniture and equipment (at cost)…………………………………. ……………… Less accumulated depreciation……………………………………………. ……………… ……………… ___________ ………………. 4. Investments in the Republic: (a) Stock and other holdings ……………………………………………… ………………. (b) Shares …………………………………………………………………. ………………. (c) Units in Unit Trust Schemes …………………………………………. ………………. (d) Debentures …………………………………………………………….. ………………. (e) Loans …………………………………………………………………… ………………. (f) Deposits and savings accounts ………………………………………… ………………. (g) Other ……………………………………………………………………… ………………. ___________ ………………. 5. Investments outside the Republic……………………………………………………….. 6. Sundry debtors:(a) Arrear contributions (³)…………………………………………………… ………………. (b) Interest accrued on investments………………………………………… ………………. (c) Dividends receivable……………………………………………………… ………………. (d) Other ……………………………………………………………………… ………………. ………………. ___________ ………………. 7. Cash at bank and in hand: (a) In the Republic …………………………………………………………… ………………. (b) Outside the Republic…………………………………………………….. ………………. ___________ ………………. 8. Payments in advance……………………………………………………………………. …… ………………. 9. Other (specify)…………………………………………………………………………… …… ………………. ___________ Note – (1) Commitments and contingent liabilities are to be indicated by way of a note. (2) Any amount the employer undertook to pay in future in respect of past service must be shown by way of a note. REPORT BY AUDITOR. We have examined the accompanying balance sheet and revenue account which, in our opinion, are properly drawn up so as to exhibit a true and fair view of the financial position of the Fund as at 31st December, 19…., and of its revenue and expenditure for the year ended on that date. We certify that the rules of the Fund with regard to fidelity cover have been complied with and that according to the information and explanations given to us and as shown in the books and records of the Fund the loans granted were granted in accordance with the provisions of the Pensions Funds Act, 1956, and the rules of the fund. ………………………………… Signature. NOTES. (1) Refer to NOTE (9) on Schedule “A”. (2) Benefits awarded but not yet paid must be included here. (3) Include here contributions which were due and payable during the year by the employer in respect of past service. Amounts calculated by the valuator to be necessary to bring the Fund to a financial sound condition are not included until such time as they become due and payable. (4) Refer to NOTE (11) on Schedule “A”. (5) Show the rate of exchange employed in converting to currency of the Republic any foreign currency in which any liability or asset exists. (6) The Republic included the Territory of South West Africa. ___________________ SCHEDULE “C” ___________________ ________________________________________________FUND. MEMBERSHIP STATISTICS IN RESPECT OF THE YEAR ENDED 31ST DECEMBER, 19…. In the Republic Outside the Republic (1) Number of members (other than pensioners) on 31 December…………. ………….. ……………. (2) Number of persons in receipt of regular periodical payments on 31st December………… …………….. st Totals …………………………………………………………………………… ________ ___________ ………….. ………………. ________________________ SCHEDULE “D”. _______________________ NOTE – (1) Attention is specifically invited to regulation 12(c) in terms of which only the applicable statements hereunder are to be completed. (2) Special care should be taken to see that totals reflected in the different statements are, where such are indicated, in accordance with the corresponding totals in the balance sheet or revenue account. (3) Statements 1 to 12 refer to investments held and payable in the Republic only whilst Statement 13 refers to other investments. __________________________ STATEMENT 1. __________________________ …………………………………………………Fund. Financial Year ended …………………………………………. FIXED PROPERTY (in the Republic). Nature of Situated at Property Cost close as at Cost of Previous Year of Total Cost at Nett Improvements End during and Current Year Additions of Income If Property is Mortgaged. Current Year, during Current i.e. Rentals Year. Received less direct Amount Mortgagee Expenses Total cost at end of year……………………………….. Less Depreciation ……………………………………… Book value at end of year (asset item 1 of Balance Sheet) Total nett income (Item 4 (c) of Revenue Account)…… _______________________ STATEMENT 2 _______________________ …………………………………………………Fund Financial Year ended………………………………………… PROPERTY IN POSSESSION(¹) Nature of Property Situated at Date taken. Possession Debt when Aggregate Possession taken. Amount due at End of Current Year in Respect of Capital, Interest and Charges incidental to taking over. Total (Asset item 2 of Balance Sheet)………………………………………………. ________________________________________________________________________________________ NOTE.-(¹) Property which ad to be brought in due to default by the mortgagor and which has not as yet been sold. __________________________ STATEMENT 3. __________________________ …………………………………………..Fund. Financial Year Ended………………………………………… STOCK AND OTHER HOLDINGS (excluding accrued interest). Book value as per Redemption Asset Item 4 (a) in Value Balance sheet (¹) (a) Government of the Republic (²)…………………………… …………………. ……………………….. (b) Provincial administrations and Local Authorities(³)……… …………………. ……………………….. (c) Rand Water Board and Escom………………………….. …………………. ……………………….. (d) Land and Agricultural Bank of S.A.(4)………………….. …………………. ……………………….. (e) South African Reserve Bank……………………………. …………………… ……………………….. (f) Institutions approved under section 19 (1)(e) (list fully) …………………… ……………………….. TOTAL (Asset item 4 (a) in Balance Sheet)………….. …………………… ……………………….. _______________ _________________ NOTES. (1) Explain how the book value have been determined. (2) National Savings Certificates are to be included but balances with the Post Office Savings Bank to be shown in Statement 8. (3) Loans repayable over a specified number of years are to be included but deposits with local authorities are to be excluded as they must appear in Statement 8. (4) Deposits with the Land and Agricultural Bank of South Africa are to be shown in Statement 8. _______________________________ STATEMENT 4. ______________________________ ……………………………………………….Fund. Financial Year ended………………………………………… SHARES. (a) Quoted(¹)Number of Nominal Value. shares. Book per value as Dividends Balance Received. Remarks(4)(5) Sheet (i) Preference shares (List fully) (ii) Ordinary shares (List Fully) TOTAL (b) Unquoted(²)Number of Nominal Value. shares. Book per value as Dividends Balance Received. Remarks(4)(5) Sheet (i) Preference shares (List fully) (ii) Ordinary shares (List Fully) TOTAL (c) Building Society Shares(³): Book value per balance sheet……………………………… R__________ (d) Aggregate of Book Value Totals under (a), (b) and (c) above………………………… R__________ NOTES. (1) “Quoted” – Any shares for which a buyer’s price or sales price has been officially recorded by a recognized Stock Exchange on or after the 1st October of the financial year to which the balance sheet relates. (2) Building society shares are not to be included under the heading “unquoted” as they must be shown under (c). (3) Building society shares do not qualify for the purposes of section 19(1). (4) In the case of any of the preference shares being redeemable this fact must be mentioned in this column and redemption value quoted. (5) If the Fund holds the majority shares in any company this fact must be mentioned in this column. ______________________________ STATEMENT 5. ______________________________ ………………………………………….Fund. Financial Year ended…………………………………………………… INVESTMENT IN UNIT TRUST SCHEMES. Names of Scheme. Number of Units. Value as at end of the Book Value Financial Year. TOTAL(¹)………………………………………………………………… _________________ ________________________________________________________________________________________ NOTE.-(¹) The aggregate of this column must be equal to asset item 4 (c) in the Balance Sheet. _______________________________ STATEMENT 6 _______________________________ ………………………………………………Fund. Financial Year ended………………………………………… DEBENTURES. Redemption Value Market Value Book Value as per Whether Balance Sheet(²). (a) Quoted(¹) (List fully) TOTAL……………………………………………………………… R_____________ ______________ NOTES. (1) “Quoted” – Any debentures for which a buyer’s price or sales price has been officially recorded by a recognized Stock Exchange on or after the 1st of October of the financial year to which the balance sheet relates. (2) The aggregate of the totals given here must be as per asset item 4 (d) in the Balance Sheet _____________________________ STATEMENT 7. _____________________________ …………………………………………Fund. Financial Year ended…………………………………………………… LOANS(¹) (granted and payable in the Republic). (a) Loans to members of the Fund [Section 19(5).] Aggregate amounts outstanding- i) on security of first mortgage bonds and second bonds where the Fund also holds the first bonds(²)……………………………………………. ii) ……………………….. on security of second or other bonds where the Fund does not hold the first bonds …………………………………………………………… ……………………….. iii) in terms of section 19 (5) (b) i.e. where no security is furnished…………… ……………………….. iv) on security other than above (specify the security furnished)……………… ……………………….. Sub-Total……………………………………………………………………….. ……………………….. _________________ (b) Loans to Non-members- i) On security of first mortgage bonds:(²) Urban properties No……………………..Amount………………………… ……………………….. Farm properties No…………………….. Amount…………………………. ……………………….. Sub-Total…………………………………………………………………….. ……………………….. _________________ ii) On security of second or other mortgage bonds(²): Urban properties No…………………….Amount…………………………. ……………………….. Farm properties No……………………. Amount…………………………. ……………………….. _________________ Sub-Total……………………………………………………………………. iii) ……………………….. On security of Participation Certificates:- Name of Issuer of Certificate. Amount Advanced. Originally Amount Owing at Interest Rate. End of Financial Year. Sub-Total………………………………………………….R________________ ________________________________________________________________________________________ iv) On security other than (i), (ii) or (iii) above:- Name of Debtor. Amount Advanced. Interest Rate. Particulars Security. of Amount Owing at End of the Financial Year. Sub-Total……………………………………………………………………………….. __________________ ________________________________________________________________________________________ (c) Aggregate of the five sub-total above (³)……………………………………………..R_________________ NOTES. (1) Only loans provided for in section 19 (5) or which are secured must be included in this statement. Unsecured loans, unsecured deposits with institutions other than those in Statement 8, call money, etc., must be reflected in Statement 9. (2) The bonds must be registered in the name of the fund. (3) The aggregate of the sub-totals must be as per asset item 4 (e) in the Balance Sheet. __________________________________ STATEMENT 8. _________________________________ ……………………………………………..Fund. Financial Year ended………………………………………… ______________ DEPOSITS AND SAVINGS ACCOUNT BALANCES(¹) (as contemplated in section 19 (1) of the Act). Amount Interest Rate(³) a) Banking institutions(²)……………………………………… ……………………. ……………………….. b) Building societies(4)………………………………………. ……………………. ……………………….. c) National Finance Corporation……………………………. ……………………. ……………………….. d) Local authorities…………………………………………… ……………………. ……………………….. e) Post Office Savings Bank……………………………….. ……………………. ……………………….. f) Land and Agricultural Bank of South Africa……………. ……………………. ……………………….. TOTAL(5)………………………………………………….. ……………………. ________________ NOTES. 1) Deposits and savings accounts with institutions other than those mentioned in this statement must be reflected in Statement 9. 2) This item must not include any “cash at bank” or amounts on current account which have been included in asset item 7 (a) in the balance sheet. 3) If different rates are applicable indicate the maximum and the minimum in every case. 4) Building society shares including subscription shares do not qualify for section 19(1) and are, therefore, not to be shown here but under item (c) in Statement 4. 5) This total must be as per asset item 4 (f) in the Balance Sheet. _________________________________ STATEMENT 9. ________________________________ …………………………………………….Fund. Financial Year ended………………………………………… ____________ UNSECURED ADVANCES(¹) Name of Debtor. Amount Term Advanced. Loan(²). of Interest Rate. Amount owing Remarks(³)(4) at End of the Financial Year. TOTAL(5)………………………………………………………….. _______________ ________________________________________________________________________________________ NOTES. (1) Unsecured loans to members of the fund must be excluded from this statement. All other investments whether called loans, deposits, call money or anything else must be included in this statement. (2) Indicate whether the amount is repayable on demand or on a specified date or whether subject to notice. (3) If any repayment of capital or payment of interest is overdue, particulars are to be given in this column. (4) If any advance has been made to a company in which the fund holds the majority shares, this fact must be mentioned in this column. (5) This total together with the total in Statement 10 must be s per asset item (4) (g) in the Balance Sheet. _____________________________ STATEMENT 10. _____________________________ ……………………………………………Fund. Financial Year ended………………………………………… _____________ OTHER INVESTMENTS IN THE REPUBLIC. Description(¹) of Investment and Basis on which Investment was Valued. Book Value of Investment. TOTAL(²)………………………………………………………………… -----------------------------------_______________________ ________________________________________________________________________________________ NOTES. (1) The description required is to be of such a nature as to enable an independent person to estimate the value of the investment. (2) This total together with that in Statement 9 must be as per asset item 4 (g) in the Balance Sheet. _____________________________ STATEMENT 11 ____________________________ ………………………………………………..Fund. Financial Year ended………………………………………… _____________ ASSETS HELD IN COMPLIANCE WITH SECTION 19 (1) OF THE ACT. 1. Total assets of the fund as per balance sheet……………………………………… Less (a) Assets held outside the Republic to cover liabilities there(¹)………… ………………. ………............ (b)Value of insurance policies held by and included in total assets of the fund(²)………………………………………………… ………………. ____________ ………………… ____________ 2. Total assets of the fund as reduced……………………………………………….. ………………… 3. 40 Percent of total assets as reduced (i.e. of Item 2 above)………………….. ………………… 4. Assets held to meet section 19 (1)(a) Stock and other holdings (³)…………………………………………………… ………………. (b) Deposits and savings accounts(4)…………………………………………… ………………. (c) Cash at bank and in hand(5)………………………………………………….. ………………. ____________ ……………….... 5. Assets which do not qualify for section 19(1) because they are encumbered (section 19(3))(a) Stock and other holdings(³)…………………………………………………… ……………….. (b) Deposits and savings accounts(4)………………………………………….. ……………….. ____________ ………………… 6. Reference number of exemption granted (if any) under section 19 (6) of the Act………………………………………. NOTES. 1. Refer to circular P.F. 2. 2. Refer to section 19 (2) of the Act – This value to correspond with the balance sheet values. 3. Items 4 (a) and 5 (a) must be equal to the total book value in Statement 3. 4. Items 4 (b) and 5 (b) must be equal to the total in Statement 8. 5. This item must be equal to asset item 7 (a) in balance sheet. _____________________________ STATEMENT 12. ____________________________ ……………………………………………..Fund. Financial Year ended………………………………………….. ____________ COMPLIANCE WITH SECTION 19 (4) OF THE ACT. Amount invested in the business of an employer participating in the fund or in the business of any subsidiary company of such employer and the amount advanced to such employer or subsidiary company. Employer Subsidiary Company. Company. Total (a) Stock and other holdings(¹) (b) Shares (c) Debentures (d) Secured loans (e) Unsecured advances(²) (f) Other ________________________________________________________________________________________ Reference number of excemption granted (if any) under section 19(4) or 19 (6) of the Act……………………… __________________________ NOTES. (1) This item refers to stock and other holdings as set out in Statement 3. (2) Arrear contributions payment of which is less than 30 days overdue do not represent investments-see asset item 6 (a) in balance sheet-and must not be included in this item. __________________________ STATEMENT 13. __________________________ INVESTMENTS HELD AND PAYABLE OUTSIDE THE REPUBLIC. In the case of investments held and payable outside the Republic the investments must be classified under the same headings as indicated in Statements 1 to 12 and the information required in those statements is to be given in respect of those investments together with an indication as to the country in which the investments were made or are being held. __________________________ SCHEDULE “E”. __________________________ INSPECTION OF DOCUMENTS AT THE OFFICE OF THE REGISTRAR AND THE TAKING OF EXTRACTS THEREFROM. ___________ PRESCRIBED FEES. Fee Payable. R (a) For inspection of or taking making copies of or taking extracts from any one or more of the following documents relating to any one fund………………………………………… 2,00 (i) Rules of the fund. (ii) Last revenue account and balance sheet. (iii) Last report by a valuator. (iv)Last statement of assets and liabilities in terms of section 17 of the Act. (v) Any scheme under the provisions of section 18 of the Act. (b) For any photostatic or double-spaced typewritten copy of or extract from any 50c per single of the documents mentioned in (a) above made by the Registrar, per A4 page or portion thereof (c) 0,50 For authentication by the Registrar of any copy made or extract taken Under (a) or (b) above, per A4 page or portion thereof. (d) For amendment of the rules of a fund, per resolution (e) For certifying or confirming that a fund is registered in terms of 1,00 5,00 subsection (3) or (4) of section 4 of the Act or that its name has been changed or its rules amended [except for purposes of item (d)] (f) For search fee per fund for service rendered in respect of items (a), (b) or (c) above (g) 1,00 2,00 For perusal of documents for the purposes of item (c) above, per A4 page or portion thereof 1,00 __________________________________________ _______________________________________________ ____________________________ SCHEDULE F ____________________________ FORM OF SUMMARY OF REPORT OF VALUATOR (REGULATION 15) Name of fund ………………………………………………………………………………………………………………. Financial year ……………………………………………………………………………………………………………… Valuator ……………………………………………………………………………………………………………………… Particulars of financial condition 1. The balance sheet value of the net assets of the fund, after deduction of current liabilities and any liabilities arising from the pledging, hypothecation or other encumbering of the assets of the fund ……………………………………………………………………………………………………………………….. 2. The actuarial value of assets of the fund, for purposes of comparison with the accrued liabilities* of the fund ……………………………………………………………………………………………………………………….. 3. A brief description of the basis employed in calculating the actuarial value of assets ……………………………………………………………………………………………………………………….. ……………………………………………………………………………………………………………………… 4. The accrued liabilities* of the fund ……………………………………………………………………………………………………………………….. 5. Any other particulars deemed necessary by t he valuator for purposes of this summary ……………………………………………………………………………………………………………………… ……………………………………………………………………………………………………………………… ………………………………………………………………………………………………………………………. 6. A statement as to whether the fund was in a sound financial condition for the purposes of the Pension Funds Act, 1956 ……………………………………………………………………………………………………………………… ………………………………………………………………………………………………………………………. Prepared by me: …………………………………… ………………………………. (Date) (Signature of valuator) No. R. 99 26 January 1962. PENSION FUNDS ACT, 1956 – STATISTICAL INFORMATION. _____________________ I, THEOPHILUS EBENHAEZER DÖNGES, Minister of Finance, acting in terms of the powers vested in me by sub-section (1) of section two of the Pension Funds Act, 1956 (Act No. 24 of 1956), as amended – (1) hereby withdraw Government Notice No. 1721 dated 8th November, 1957; and (2) hereby prescribe that any pension fund which has been established in terms of an agreement published or deemed to have been published under section forty-eight of the Industrial Conciliation Act, 1956 (Act No. 28 of 1956), shall, before the 30th day of June of every year, furnish the Registrar of Pension Funds, Private Bag 238, Pretoria, with the following statistical information in respect of the year which ended on the 31st December immediately preceding: - Number of members (other than pensioners) at the end of the year ………………. Number of persons in receipt of regular periodic payments at the end of the year ………………. Benefit payments made during the year: (a) as pensions (i.e. regular periodic payments) ………………. (b) as lump sum awards on retirement of death ………………. (c) as lump sum payments under circumstances other than (b) above ………………. T. E. DÖNGES, Minister of Finance.