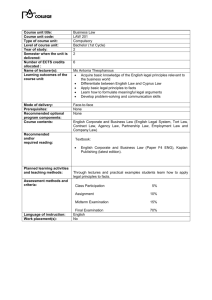

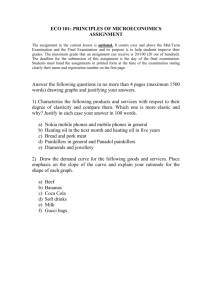

Advanced Taxation - The Malaysian Institute Of Certified Public

advertisement

NEW CPA QUALIFICATION & TRANSITIONAL ARRANGEMENTS FOR REGISTERED STUDENTS The Institute, after wide consultation with the CPA training offices and education institutions, has designed a new examination structure and training programme that focus on training CPAs as business professionals. The new CPA qualification builds on the profession’s traditional strengths while focusing on the needs of modern business. In addition to introducing a new examination structure, the Institute is also introducing a new qualification, the Professional Certificate in Accountancy. NEW CPA QUALIFICATION 1. Structure of the New Examination The new CPA examination consists of two levels of examinations: A Professional Stage Examination consisting of six subjects divided into two modules, which cover the concepts and principles underpinning accountancy in all its disciplines. An Advanced Stage Examination consisting of three independent modules of one paper each, which cover advanced aspects of auditing, financial reporting, taxation and business management. The emphasis is on equipping new CPAs with technical and strategic business skills relevant to modern business. The components of the examinations are: Professional Stage Examination (PSE) Module A Financial Accounting and Taxation Business and Company Law Management Information and Control Module B Financial Reporting Auditing and Assurance Business Finance and Management Advanced Stage Examination (ASE) Module C Advanced Taxation Module D Advanced Financial Reporting Module E Advanced Business Management & Integrative Case Study 1 2. Assessment The assessment process is designed to ensure that potential CPAs have gained the knowledge, skills and professional values fundamental to becoming a CPA. Apart from the final written examinations, there is continuous assessment throughout each module at the advanced stage. The assessment process comprises the following components : The existing method of assessment, comprising a 3-hour written examination for each paper, is maintained for the Professional Stage Examination (PSE). Students will be allowed to sit for the examination by module and to retain the credit for passes earned in each module. A new assessment method will be introduced for the Advanced Stage Examination (ASE). Each of the 3 modules in ASE can be undertaken separately and a student’s performance in a module will be based on the following assessment components: – – 20 hours of workshop sessions consisting of discussion, presentation and written assignments 30% Final Module Examination (3 – 4 hours written examination) 70% The new assessment method aims to enhance students’ inquiry and research capabilities as well as communication skills through participation in workshop sessions. The final module examination will test students’ mastery and application of technical knowledge and skills, aimed at enhancing their problem-solving and intellectual skills. 3. Entry Requirements The minimum entry qualification to the CPA examination is a recognised degree or a diploma in accountancy at the tertiary level. Graduates with a degree in accountancy will be eligible for exemption from the Professional Stage Examination while those with a non-relevant degree will be required to undergo a conversion course, to gain appropriate foundation in accountancy and related subjects, before they are eligible to join the CPA programme. 2 4. Training Schemes The various options of training under the current system will be streamlined into two streams as follows: Stream I is the traditional route of training where a student works in the office of a CPA in public practice under a training contract, and sits for the MICPA examinations at the same time. This stream of training is targeted at students who plan to build a career in public accountancy practice. Stream II is designed for students who wish to seek a career in commerce, industry or the public sector. The students are not required to enter into a training contract but must maintain a training log book as a record of their practical experience. Practical training must be obtained in an approved training organisation (ATO) under the supervision of a member of MICPA or one of the professional bodies approved by MICPA. The students may undertake the MICPA examinations prior to the commencement of practical training or during the training period. 5. Practical Experience Requirements Practical experience forms a crucial part of a CPA’s qualification process. All students are required to obtain not less than 3 years of practical experience in accounting and/or auditing and at least two of the following technical categories : 6. Taxation Insolvency Financial Management Information Technology Requirements for Admission as CPA The following requirements must be satisfied in order to qualify as a CPA: Completion of the Professional Stage Examination or exemption being granted on the basis of a recognised degree in accountancy; Completion of the Advanced Stage Examination; and Having obtained not less than 3 years of approved practical experience. 3 7. Proposed ASE Programme for Local Accounting Graduates To encourage students pursuing a degree in accountancy to join the CPA programme, Module C and Module D of the Advanced Stage Examination (ASE) will be offered as optional courses in the final year programme of the Bachelor of Accountancy degree conducted by approved universities. The bases of assessment for Module C and Module D will be the same as that set out in paragraph 2 above except that the workshop sessions will be conducted on campus. Upon completion of Module C and Module D, the student will be entitled to a Professional Certificate in Accountancy. The student will be eligible to sit for Module E after he has obtained the Bachelor of Accountancy degree and completed at least nine months of approved training. Students who pursue this pathway will be eligible for admission as a CPA upon fulfilling the following requirements: 8. Having obtained the Bachelor of Accountancy degree Completion of the MICPA Advanced Stage Examination Having obtained not less than 3 years of approved practical experience Professional Certificate in Accountancy A Professional Certificate in Accountancy (PCA) will be awarded to students who have completed Module C and Module D of the Advanced Stage Examination, without the requirement for practical experience. The PCA is intended to be a qualification in its own right to meet the needs of persons who want a qualification beyond an academic degree or diploma. It also provides flexibility in the attainment of the CPA qualification. A PCA holder is given the option to start a career in a commercial, industrial or public sector organisation which is not currently training CPA students, and continue to study and qualify as a CPA at a later stage of his career. 9. Implementation of New Examination The new CPA examination will be introduced in two stages, as follows: Professional Stage Examination – with effect from the November 2002 examination Advanced Stage Examination – with effect from the May 2003 examination 4 TRANSITIONAL ARRANGEMENTS FOR REGISTERED STUDENTS 1. Comparison of Current and New Examination Structures The new syllabus for the Professional Stage Examination (PSE) will be examined for the first time in November 2002 and the Advanced Stage Examination (ASE) in May 2003. A comparison of the current and new examination structures is shown in Table 1. Table 1 : Comparison of Current and New Examination Structures Current Structure New Structure Professional Examination I (PE I) Professional Stage Examination (PSE) Module 3 Module A Audit Fundamentals Financial Accounting & Reporting I Information Systems Financial Accounting and Taxation Business and Company Law Management Information and Control Module 4 Module B Managerial Planning & Control Company Law & Practice Organisational Management Financial Reporting Auditing and Assurance Business Finance and Management Professional Examination II (PE II) Advanced Stage Examination (ASE) Module 5 Module C Advanced Taxation Financial Accounting & Reporting II Advanced Taxation Module D Advanced Financial Reporting Module E Advanced Business Management & Integrative Case Study Module 6 Audit Practice Business Finance & Strategy There will be a certain degree of syllabus mismatch and a knowledge gap for students who began their examination studies on the current syllabus and have to sit the examination based on the new syllabus. These students will need to undertake additional studies on transferring to the new structure. 5 2. Transitional Arrangements 2.1 The arrangements for transition to the new examination structure are based on the following principles: (i) Students who hold exemptions from one or more papers in the current examination structure will be granted exemption from the equivalent paper(s) in the new examination structure. (ii) Students who have completed any of the modules in the current examination structure will be given credit for the equivalent papers in the new examination structure. (iii) Students who pass any papers at the last sitting under the current examination structure (i.e. May 2002 for Professional Examination I and November 2002 for Professional Examination II) will be given credit for the equivalent papers in the new examination structure while students who fail any papers will be required to sit the equivalent papers in the new examination structure. Students at Professional Examination I will receive their conversion statements in August 2002 while students at Professional Examination II in February 2003. Credit will be given to the papers passed in the current examination structure as shown in Table 2. Table 2 : Conversion Arrangements Current Structure Credit Given under New Structure Professional Examination I (PE I) Professional Stage Examination (PSE) Audit Fundamentals Auditing and Assurance Financial Accounting & Reporting I Financial Accounting & Taxation Financial Reporting Information Systems No equivalent Managerial Planning & Control Management Information & Control Company Law & Practice Business and Company Law Organisational Management Business Finance & Management Professional Examination II (PE II) Advanced Stage Examination (ASE) Advanced Taxation Advanced Taxation Financial Accounting & Reporting II Audit Practice Advanced Financial Reporting Business Finance & Strategy Advanced Business Management & Integrative Case Study 6 2.2 Transition from Professional Examination I to PSE (a) Students who have completed the current Professional Examination I (PE I) either at the May 2002 or earlier sitting, will be eligible to proceed to ASE in the new structure. (b) The following conversion arrangements will apply to students who are in the process of taking the current PE I : (i) Students who hold exemptions from one or more papers in the current PE I will be granted exemption from the equivalent paper(s) in PSE. Students who have passed Module 3 or Module 4 in the current PE I will be given credit for the equivalent papers in PSE. In addition, credit will be given for the equivalent paper(s) in PSE to students who sit the May 2002 examination and obtain a pass in one or more papers in the current PE I. No credit will be given to individual papers passed at examination sittings prior to May 2002. (ii) The paper-for-paper exemption or credit will be given according to the basis shown in Table 2. Students will have to sit the corresponding outstanding papers in PSE for which exemption or credit has not been given in the manner set out in the examination regulations. (iii) Students who hold a referred or referred again result in the May 2002 examination will sit the equivalent paper in PSE as shown in Table 2 with the exception that a student who is referred Financial Accounting & Reporting I in the current PE I is required to sit only Financial Reporting in PSE. The student will be given two opportunities to sit the referred paper provided that if the student fails at the first opportunity, he has obtained a marginal fail. If the student obtains a fail or bad fail at either referral attempt, he must then sit PSE (provided he has not become time-barred) in the same way as students in (i) above. (iv) Students who are at their last attempt at the November 2002 sitting when the first session of PSE is conducted will be allowed an additional attempt so that each student is given a minimum of 2 attempts (excluding referral attempts) at PSE, to be taken consecutively. 7 2.3 Transition from Professional Examination II to ASE The following conversion arrangements will apply to students who are in the process of taking the current Professional Examination II (PE II): (i) (ii) Students who have passed Module 5 but not Module 6 in the current PE II will be given credit for Advanced Taxation in ASE. In addition, students who sit Module 6 at the November 2002 examination and: who obtains a pass in Audit Practice in Module 6 will be given credit for Advanced Financial Reporting in ASE; or who obtains a pass in Business Finance & Strategy in Module 6 will be given credit for Advanced Business Management & Integrative Case Study in ASE. Students who have passed Module 6 but not Module 5 in the current PE II will be given credit for Advanced Business Management & Integrative Case Study in ASE. In addition, students who sit Module 5 at the November 2002 examination and: who obtains a pass in Advanced Taxation in Module 5 will be given credit for Advanced Taxation in ASE; or who obtains a pass in Financial Accounting & Reporting II in Module 5 will be given credit for Advanced Financial Reporting in ASE. (iii) Students who sit both Module 5 and Module 6 in the current PE II at the November 2002 examination and who obtains a pass in some of the papers will be given credit for the equivalent paper(s) in ASE according to the basis shown in Table 2. No credit will be given to individual papers passed at examination sittings prior to November 2002. (iv) Students who have not completed the current PE II will have to sit the corresponding outstanding papers in ASE for which credit has not been given in the manner set out in the examination regulations. (v) Students who are at their last attempt at the May 2003 sitting when the first session of ASE is conducted will be allowed an additional attempt so that each student is given a minimum of 2 attempts at ASE, to be taken consecutively. 8 3. Time Limit to Complete Examination The normal time-bar for completing the whole of the MICPA examination will be extended by the additional attempt(s) granted for completing PSE or ASE as a result of the transition to the new examination structure. 4. Transfer of Stream of Student Registration Effective July 1, 2001, the CPA training programme has been streamlined into two streams, i.e. Stream I and Stream II as described under the New CPA Qualification. The following transitional arrangements apply to students registered under the old Stream II and Special Stream III. (a) Students under Old Stream II Students registered under the old Stream II, who are currently serving a training contract, are allowed to continue serving the training contract until its completion. They are not required to transfer their registration to the new Stream II and to terminate their training contract. In the case of a student registered under the old Stream II whose principal has left the employ of the approved training organisation before the completion of his training contract, the training contract will be allowed to lapse and the student is required to transfer his registration to the new Stream II. The period of the training contract that the student has served will be recognised as forming part of the practical experience requirement for admission to membership provided it is not less than 12 months or the student continues his employment with the approved training organisation. The remaining period of the requisite practical experience is to be met in accordance with the requirements for students under the new Stream II as described under the New CPA Qualification. (b) Students under Special Stream III All students registered under Special Stream III (non-articleship stream for local accounting graduates) who are currently undertaking the MICPA examination are allowed to remain under this Stream for the unexpired portion of the 2-year period allowed for such registration, after which they will be required to transfer their registration to Stream I or the new Stream II. For students who are currently working in accounting firms, it is to their advantage to transfer their registration to Stream I as soon as practicable, i.e. to enter into a training contract with a member of the Institute in practice. Students under Special Stream III who have completed the MICPA examination but not the practical experience requirements are required to apply for admission as a provisional member of the Institute within 6 months from the date the student is notified that he has passed all of the Institute’s examinations. Any student who fails to comply with this requirement may be called upon to show cause why his studentship should not be revoked. 9 5. New Examination Regulations and Syllabus A copy of the new examination regulations and syllabus is sent to all registered students. Students who are required to resit the equivalent paper(s) in the new examination structure should pay particular attention to the changes in syllabus, which may require additional studies. 6. Pilot Examination Questions To assist students gain a clear understanding of the requirements of the new syllabus, a set of pilot examination questions based on the new syllabus will be sent to students as follows: Professional Stage Examination in July 2002 Advanced Stage Examination in January 2003 10