background

advertisement

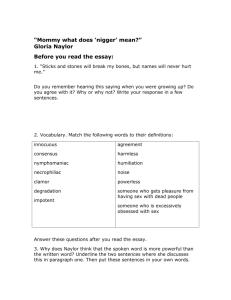

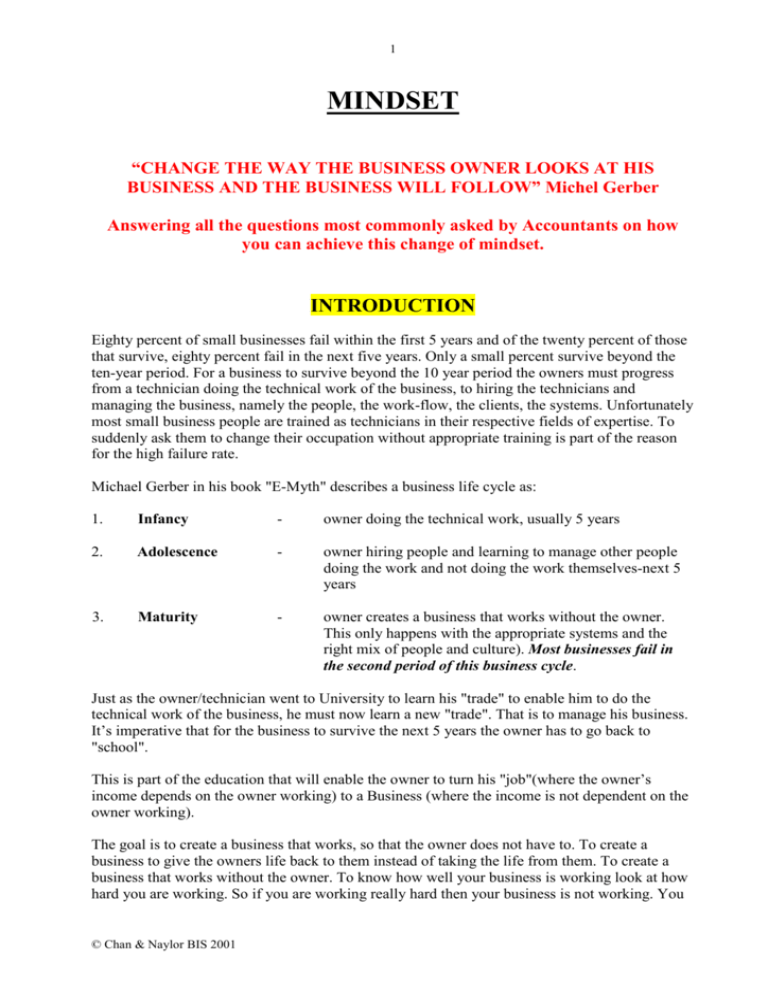

1 MINDSET “CHANGE THE WAY THE BUSINESS OWNER LOOKS AT HIS BUSINESS AND THE BUSINESS WILL FOLLOW” Michel Gerber Answering all the questions most commonly asked by Accountants on how you can achieve this change of mindset. INTRODUCTION Eighty percent of small businesses fail within the first 5 years and of the twenty percent of those that survive, eighty percent fail in the next five years. Only a small percent survive beyond the ten-year period. For a business to survive beyond the 10 year period the owners must progress from a technician doing the technical work of the business, to hiring the technicians and managing the business, namely the people, the work-flow, the clients, the systems. Unfortunately most small business people are trained as technicians in their respective fields of expertise. To suddenly ask them to change their occupation without appropriate training is part of the reason for the high failure rate. Michael Gerber in his book "E-Myth" describes a business life cycle as: 1. Infancy - owner doing the technical work, usually 5 years 2. Adolescence - owner hiring people and learning to manage other people doing the work and not doing the work themselves-next 5 years 3. Maturity - owner creates a business that works without the owner. This only happens with the appropriate systems and the right mix of people and culture). Most businesses fail in the second period of this business cycle. Just as the owner/technician went to University to learn his "trade" to enable him to do the technical work of the business, he must now learn a new "trade". That is to manage his business. It’s imperative that for the business to survive the next 5 years the owner has to go back to "school". This is part of the education that will enable the owner to turn his "job"(where the owner’s income depends on the owner working) to a Business (where the income is not dependent on the owner working). The goal is to create a business that works, so that the owner does not have to. To create a business to give the owners life back to them instead of taking the life from them. To create a business that works without the owner. To know how well your business is working look at how hard you are working. So if you are working really hard then your business is not working. You © Chan & Naylor BIS 2001 2 are doing the work that the business should be doing. A business is made up of people and systems and you should be creating the systems and managing both to produce the work. Your role should be simply ensuring the systems are working and you are getting the best out of your people. To achieve this the first thing that needs to change is for the owners to change the way they look at their business. The owners business will not change unless the owner changes. Fiona Anson of the Small Business Clinic describes the definition of "insanity" as "expecting a different result but still doing things the same way". Nothing will change if nothing changes. The owner MUST SAY to themselves, "IF I WAS NOT HERE, HOW WOULD THIS GET DONE? (whatever it may be). So everything the owner does in their business must be followed up with "how will this get done if I was not here to do it?" By changing the way the owner thinks about his business it begins the new journey. BACKGROUND David Naylor and Edward Chan began their Accountancy business on the 1st July 1990 with a receptionist/typist. Naive and young we thought we would just do the work ourselves, have no staff or the problems associated with staff. We were not ambitious and only wanted a hassle free lifestyle. We thought that by working for ourselves it would give us the lifestyle we wanted. The business grew by an average of 30% per annum over the next 6 years. We were into our Adolescence stage of our business cycle where we were faced with failure. We were both working between 80 to 100 hours a week and could only see this getting worse, not better. When we compared what we earned with the hours of unpaid time we put into our practice it simply was not worth the effort. We were totally BURNT OUT, despondent, disillusioned with the work, the hours, putting pressure on the family life. We were desperate for a solution to our problems and the lack of lifestyle. The business we thought would give us life was actually taking the life from us. We looked at selling the whole or part of the Practice. Perhaps selling the smaller clients, bringing in more partners etc. All seemed to simply address the symptoms and not the problem. This would have been a bandage and not a cure. Bringing in Partners seemed to address the short-term issues but was expensive (because partners expect to earn around $250,000). Partners also brought with them a whole new series of problems. Selling small clients meant I was left with large clients and still working just as hard. Selling the whole business and going into something else meant I was simply going from one problem to another problem. The answer was we had to change the way we looked at our business and change the way we ran our business. We had to stop "doing" and start MANAGING. Unfortunately this was totally against the grain. After all, we were taught to be technicians (Accountants). We filled out timesheets and our worth was judged by the amount of chargeable time we were able to put out. We were programmed into doing the work. This then became the way we ran our business. Unfortunately this moulded our thinking, and restricted the amount of our output to the number of hours in the day. This restricted our income earning capacity. Worse than that, it became the principle upon which we ran our businesses and that was the problem. We thought that by doing the work ourselves and not hiring someone meant more dollars in our pockets, so let’s just do a few more hours. After all the harder I worked the more chargeable time I was able to invoice the more I can earn. Soon we spent time on things that we could not charge © Chan & Naylor BIS 2001 3 our full rates for, such as invoicing and general admin matters. So to keep the clients happy we simply worked longer hours. The losers were us. We have simply put a lid on our income. WHY? Because we are NOT MANAGING and we are doing. After all being a technician is burned into the fibres of our character. To change this paradigm was not easy. After all, years of habit forming that was built into the fabric of our being could not be changed overnight. It was going to be a slow and painful journey. We not only had to change ourselves but also still had a mountain of tax work that needed to be done. How do we work ON the business and, at the same time, work IN the business to get the work out the door and keep the clients happy. The change occurred over a 2-year period. The evidence that our system was working was 2 years after we began the process we found our messages from clients dropped down to virtually nil. At this point we were worried that we had lost all our clients and we had made a huge mistake. Upon speaking to each of our Client Managers we discovered they were all still with us. Our systems were working and that meant we did not have to. Today we work a 35-hour week. Our turnover is close to $2 million, and we have 16 staff. We do not do any of the technical work at all including our own Tax Returns. We don't even know how to do a BAS. Our income is 4 times what it was before we changed and it is no longer restricted to the hours in the day. There is now no limit to the amount we can earn. Based on our growth rate we would each earn an extra $80,000 next year without very much effort from either of us. We get one or two phone calls a week from clients and we can go on extended holidays without worrying about a loss of income or a loss of business. The business is now earning us income while we are on holidays. We have not seen some of the clients now for over 5 years. We still do not advertise and our growth rate, instead of going down has actually gone up to 42% per year since we started working ON and not IN our business. More importantly we now have the choice to work or not to work because we have created a business that produced the work we use to have to produce ourselves. We charge out less than 2 hours a week. That clearly demonstrates that we do not produce the work, rather our business is now producing the work. Our business is 5 times the size it was 4 year ago but 10 times more under control. We believe we can double our turnover without needing to put another partner on. The number of partners that are required to control the work is a reflection of the lack of system strength in the business. We struggled to handle $250,000 fees each. Today we are handling $1 million each and could handle $2 million each. Our goal is to NOT HAVE A SINGLE PIECE OF PAPER ON OUR DESK. The better managed our business is the less we have to do. Our business is now working and has given us the choice to work or not to work. It has given back our lives that it so viciously took from us. We realise now that we did it to ourselves because we tried to become managers without the education to show us how to be effective. We created a monster ourselves which ruled over our lives simply because we did not educate ourselves with how to manage. This second section now forms part of the Education that is required to run and manage a business effectively. © Chan & Naylor BIS 2001 4 QUESTION (1): WHAT ARE THE SECRETS OF ACHIEVING WHAT YOU HAVE? ANSWER: It’s about Managing and not "Doing". Its not about doing one thing a thousand times better but doing a thousand things 1% better. It’s not the product or the type of service that is provided that makes the difference between a successful business and an unsuccessful business. Two courier companies have exactly the same product (delivering parcels) yet one may be so much more successful than the other. The difference is simply in how it’s managed. One does a thousand things 1% better than the other one. Ensuring the little things in your business are looked after and the big picture will look after itself. It’s about working ON your Business and not IN your Business. Your role should simply be in 3 areas: 1. 2. 3. Developing and improving Systems, Systems, Systems Recruiting and surrounding yourself with great people Training, Training, Training both your staff and your clients to do things the way you want them done (never do the work for them but rather teaching, supporting and nurturing them to produce the most they can possibly produce). Leveraging your efforts through your staff. Its much easier to manage 10 staff, each looking after 150 clients, to each produce NET Profits (after their own wages and overheads) of $50,000 each x 10 = $500,000 than it is to look after 1500 clients yourself. Change the way you look at your employees from someone that costs you money to someone that makes you money. Hence instead of thinking "the more staff I have the more its costing me" TO "the more staff I have the more money I'm making" - provided you manage them appropriately. Michael Gerber in his book "The E-Myth" said your business is made up of 4 areas: 1. 2. 3. 4. Marketing Administration Operations Human Resources Most owners spend all their time in Operations (producing the product or service) and very little time in the other areas. This is akin to a car that’s only got one of its cylinders working. It runs very roughly and certainly is not efficient. There must be sufficient time spent in each of the 4 areas. The only way there is sufficient time for this to occur is if the owner was to hire and teach/train an employee to produce the work (operations). This will then free the owner to do the RIGHT KIND of work. Managing and not "doing". © Chan & Naylor BIS 2001 5 QUESTION (2): HOW HAVE YOU GROWN YOUR BUSINESS SO MUCH WITHOUT ANY ADVERTISING, ESPECIALLY SINCE YOU DON'T EVEN SEE THE CLIENTS YOURSELF? ANSWER: There are mainly 5 areas that you need to work on: 1. Most practitioners (without knowing it) put a lid on the growth of their practice by the way they structure their resources (their staff). They have their staff and themselves working at 110% of capacity. What this does is it turns a lot of business away because you cannot get it done quick enough or you unintentionally give the impression that you are too busy to take on any more work. So the first rule is to ensure your staff are at 85% capacity so they can attend to emergency type jobs that come through the door. 2. Sow seeds constantly so that you can harvest a crop in the future. Heaven help the farmer who is so busy harvesting his crop that he forgets to sow seeds in the next field. Most of us are so busy harvesting we think we do not need to sow seeds. It’s not when you are ready, its when your clients are ready to do business that you need to be in the forefront of their minds. You can only be at the forefront of their minds if you constantly touch base with them. The research shows that you need to touch base no less than 9 times per year. Certainly you should not let 3 months go by without touching base. We do this by newsletters, Christmas cards, birthday cards, seminars, special newsworthy events etc. 3. Work your client base. There is a gold mine within your own database. Why else is every industry like financial planners, insurance and finance brokers after the Accountant’s database? Cash Flow projections, budgets, DIY Superfunds, lodging ABN’s for client when they could do it themselves, PAYG Annual Elections – we are constantly looking out for these opportunities when other accountants do it for free. We can do this because we are not doing the work. We have others doing the work, which frees our time to look for these opportunities. 4. Differentiate yourself from everybody else, because if you are the same as everybody else, you can only be judged by your price. If you are different then they are unable to compare you on price alone. Add value to the service you provide: we have done a video on negative gearing into property. This costs $6 to produce but adds enormous value to the service as they cannot get this video from any other accountant. 5. Increase your business by 20% without going outside your client base via the traditional 4 ways to increase your business: a. b. c. d. Increase the number of clients by 5% by sowing seeds and paying a $150 referral fee for new clients. Increase the frequency of transactions by 5% by seeing your clients for extra things such as cash-flows, budgets, business plans etc. Increase the average dollar sale by 5% with Financial Planning, Finance loans etc Stop the loss of clients by 5% by the use of Loyalty Programs similar to Fly Buys or something new. © Chan & Naylor BIS 2001 6 QUESTION (3): THE BIGGEST PROBLEM IS TO KEEP YOUR STAFF MOTIVATED AND PRODUCTIVE AND STILL REMAIN PROFITABLE.HOW HAVE YOU BEEN ABLE TO DO THIS? ANSWER: We adopt the 1/3,1/3,1/3 rule. Namely we mark up our wages cost by 3. 1. 2. 3. 33% - Wages cost 33% - Overheads Cost 33% - Profit We have been able to achieve the following: 1. 2. 3. 35% - Wages 25% - Overheads 40% - Profits We have been able to achieve 40% profits and keep staff motivated and productive by ensuring that senior Client Managers are effectively delegating the bulk of their work to juniors. Turn their role from "doing" to managing. They are responsible to manage the relationship with the client and the work is done by a support member on a lower charge out rate. We have ensured that the Client Managers are not doing mundane low level work, which helps keep them motivated, and at the same time the work is produced at a lower cost which increases profitability. QUESTION (4): HOW DID YOU REDUCE THE WORKLOAD EVEN THOUGH YOUR TURNOVER HAS INCREASED AT AN INCREDIBLE RATE? ANSWER: We simply made each Client Manager take "ownership" of a portfolio of clients. Instead of looking after 1,500 clients I made each of our 10 Client Manager's look after 150 clients each. We then started educating our clients about the benefits of using the Client Managers in the first instance. The Client managers were there to answer any day to day questions and prepare their Income Tax Returns. They were there to work IN their business and the partners worked ON their business. We educate our clients in all our literature sent out eg engagement letters, Introduction to Chan & Naylor, tax return letters etc. Performance is measured by the Surveys sent to clients with every Tax Return prepared and we measure their fee budgets monthly. Our client manager’s results are measured by the quality of the surveys received from them. We then introduced an intensive system of staff training. It was easier to look after 10 client managers than to look after 1,500 clients. We carry out 60 hours a year of staff training, the majority of which is on their social and communication skills. The better trained your team are, the less you have to do. It makes sense therefore to ensure that they are as well trained as possible. We now spend 80% of our time on preventative measures. This has reduced the number of “fires” that needed to be attended to. The more we worked On the business the less we had to work IN the business. Working ON the business involves creating systems and training people. Every time a system was created and a person trained, the system and trained staff took over the workload and required less involvement from the partners. We found that over time, the system © Chan & Naylor BIS 2001 7 and the people started to do the work that we used to do. We now have a business that works so that we don’t have to. QUESTION (5): YOU’VE TALKED ABOUT SYSTEMS AND YOU’VE TALKED ABOUT MANAGEMENT. WHAT IS YOUR SYSTEM TO MANAGE YOUR PEOPLE AND YOUR CLIENTS? ANSWER: You cannot manage people so don’t even try. You can only create systems to manage people. The system we have adopted is known as EMRR (pronounced “Emma”). It stands for: E: Creating the EXPECTATION right up front with both staff and clients. For our staff we use our guarantees and budgets for each team member. This sets the standards and goals up front. For the clients we use engagement letters, newsletters, price lists etc. M: MONITOR and MANAGE – make your role that of assisting the client managers. Help the staff by coaching and training to enable them to reach their targets but never do the work for them. We keep our clients informed of the progress of their work fortnightly. R: You must measure the RESULTS of everything you do. What you can measure you can manage. Our team performance is measured by the surveys sent to clients with every tax return and we measure their fee budgets monthly. Our client manager’s results are measured by the quality of the surveys received from their clients. R: Stands for REWARD. We reward our staff by our "Star Award" Program and a bonus structure we have in place. We reward our clients by our loyalty and referral fee program. QUESTION (6): IF I LET MY STAFF GET TOO CLOSE TO THE CLIENT HE MAY END UP TAKING THE CLIENT WITH HIM ANSWER: We have developed a corporate identity/culture where the client identifies with our Company rather than with any individual including the partners. For a start we all have uniforms. Different people from the firm contact the client for different things, so the relationship with the client is being developed between the company as a whole and not with any one individual. Our Intranet system sets the standards upon which everybody in the office deals with the client in the same way. For example the phone is answered in exactly the same way irrespective of who answers the phone. Our Intranet System sets out every procedure right down to how the client likes his coffee or tea. When the client comes in for an appointment the receptionist is able to say: "Hi Brian, you're here for your 10 am appointment and how about your usual black coffee with one sugar" We do not allow the team member to do it their way. It must be done the "Chan & Naylor" way. Most owners who allow their team members to do it their way is because they themselves have not developed a systemised way of doing it. If the team member does it their own way then the owner loses both ways. He loses if the team member is bad because the client will get upset. He also loses if the team member is extremely good and does it his own way (because you do not have a system to follow so he does it his own way). Eventually the client will get accustomed to doing his way and when he leaves he could take the client with him. Even if he doesn't take the © Chan & Naylor BIS 2001 8 client, the client is so use to the way he did things that he may not agree to change to a new team member and leaves for another firm. It is extremely important you develop "a way of doing things" and have everybody follow it religiously. This is non negotiable. QUESTION (7): HOW DID YOU GET YOUR CLIENTS TO DEAL WITH SOMEBODY ELSE IN YOUR PRACTICE? ANSWER: The research shows that 80% of customers do not care who serves them as long their experience in dealing with your firm is 80% the same. The other 20% only want you to deal with them. For this last 20% its better that you refer them to your competitor. This 20% will put a lid on the growth of your business and confine you to slaving for them with little reward or appreciation. Its better they screw up your competitors business rather than screwing up yours. Our system to deliver the experience to the client in 80% the same way is through the use of "checklists". Its not the checklist that is important but rather the experience of going through a checklist. So now it does not matter who takes the client through the checklist the experience is pretty much the same. When we did this, the clients no longer complained about needing the partner to do the work. Coupled with our constant education program through our newsletters about the benefits of using the Client Manager. The new clients have absolutely no problems with this. Our existing clients took a 2-year period to readjust. However it was due to the bad habits we created in them in the first instance that made it harder for them to change. It was not their fault but rather our fault for creating this bad habit within them. The bad habits created in them by us meant that the longer this went on the deeper the hole we were digging for ourselves. Even the smallest things like, if I have the client on the phone and he wants to make an appointment I still pass him over to my secretary or receptionist (even if I have the appointment book in front of me). We believe that 80% of our service is ones social skills (treating the client well, communicating at the client’s level) and 20% of the service is our technical ability (doing the Tax return competently). So we spend 80% of the staff training on their social skills and 20% of the time on their technical skills. Even how to shake hands properly. The surveys that we put out constantly come back with comments about how "nice" our staff treats them. The last survey showed 98.5% gave our firm a rating of excellent/good service. 100% said they would refer our firm to family and friends. The system we have developed to manage this is a 9 point GUARANTEE for our service (or a full refund of their fees). Both the team member and the partner sign this. So every time the team member signs this it reinforces in his/her mind what is expected of him/her without the partner having to constantly remind them. At the same time a survey is enclosed which gives the client an opportunity to rate the service offered by everyone from our receptionist to the partner. So if the team member is aware that he/she is being rated there tends to be a bit more accountability. This has lifted the "bar" and everyone lives and is judged by the same standards. QUESTION (8): WHY IS IT THAT YOU DO NOT HAVE A PROBLEM FINDING STAFF? ANSWER: If you have developed systems ie. “a way of doing things” and these systems are simple to use and easily accessible by all staff, then you become system dependent not people © Chan & Naylor BIS 2001 9 dependent. Finding qualified, experienced staff is difficult and they are expensive. Let’s face it, every Accountant is looking for this type of person. If you have developed systems you can leverage ordinary people (para-professionals and undergraduates) into producing extra ordinary results and there is a huge pool of these people in the marketplace and they are less expensive. We can hire undergraduates and girls and boys from high school (obviously with sound educational skills) and leverage them through our system and they become productive very quickly. The intranet helps us through this process with every checklist, procedure, standard, job description being at their fingertips. This minimises down time in the training phase. We also undertake a structured training program with all staff members. We train the staff on both the social aspects (active listening, how to deal with difficult problems and clients etc) and the technical issues (legislative changes and BAS, Tax etc). We are consistent and persistent with the training as this enables us to leverage the skills and knowledge across all the staff. The more knowledgeable the staff the less involved the partners has to be. CONCLUSION Accountants say to me "I don't want to grow any more." What they are really saying is "I don't want to have to do the work that comes with growth." I have yet to meet someone who doesn't want growth and the wealth that comes with it, if they were able to have it without the pain. You can only do it without pain through systems and the right people. Due to our success we are constantly being asked by other Accountants to teach them how to do what we have achieved. What they are constantly looking for is that one thing we do 1,000% better than them. What they don't realise its about doing 1000 things 1% better than them. Its getting the little things right and the big picture looks after itself. They are amazed when I tell them I have never done a BAS and that all our returns are lodged on time. In fact I don't even prepare my own Tax Return. We literally work ON our business and not IN our business. The analogy I use is that the Managing Director of Qantas is not a pilot. In fact heaven help Qantas if he was busy flying a plane and not managing his business. We literally walk our talk to the extent that we say the same things to our clients. We do not do their work ourselves because we would be working IN their Business and not ON their Business. We work ON the strategic issues of their business only. We spend a lot of time educating our clients and showing them how to do this. We certainly had to do it ourselves first. Only the other day a client called to say that it was only through the education via our newsletters, seminars, meetings etc was he able to turn his self-employment into a "proper business." Now he has the choices in life that makes him rich (he believed that being rich is having choices in life. He now has the choice to work or not to work). He would not have been able to achieve that through another Accountant. Contrary to what everybody else is saying about compliance. We think compliance is great. Where would you get a business that the government requires clients to come to you to get their work done? Where everybody else has gone wrong is they try to do the compliance work by themselves. Lack of systems means you have to "do it yourself". Doing it yourself means you are under pressure to do it at a cost. At a typical partner’s rate of $165 per hour, naturally this becomes uneconomical. Also for a professional it is completely without challenge and mundane. © Chan & Naylor BIS 2001 10 But if you were able to systemise it so that someone else (a para-professional) on a lower charge out rate produces it a cost that leaves you with a profit, I would do it every day and what a great business. Bring on the compliance! Most Accountants come up with excuses why they can't get someone else to do the work eg "my clients only want me to do it" "I can't trust anybody else to do it." The biggest hurdle is their own thinking. We have simply said "how can we do this, rather than, I can't do this?" And yes we have made mistakes over the years but through trial and error we have hit onto a formulae that works. This is reflected in our growth and how well everything is now under control. You can see that a business is not managed well when they say to you that they cannot find staff. They have simply reacted to growth rather than planned for growth, which has now left them short staffed. By proper management, which includes planning ahead, anticipating, training etc, a well-run business should have juniors being trained in anticipation of "when" someone leaves and not "if" someone leaves. In theory a well-managed business should not have staff shortages. Have you ever heard of McDonalds being short staffed? Of course not. They are extremely well managed businesses. Over the next few years the small Accountancy firms who persist in running their practices like practices instead of like businesses will be put under further pressure from government regulations etc and they will "burn out". They simply cannot sustain the pace of change. They will either have to get bigger or merge or consolidate or simply sell out. Due to today’s complex laws, the IT industry, the constant requirements to be more than "an Accountant" the days of the sole practitioner offering a "family like" service are numbered. There will still be some around but they will be totally burnt out, cynical about their clients and may even come to hate their clients. Create a business that gives you life, not one that takes the life from you. Wishing you a successful transformation of your "job" to a business. Chan and Naylor © Chan & Naylor BIS 2001