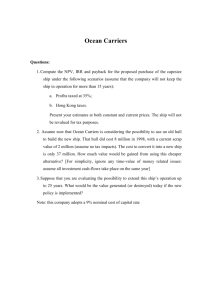

1. The structure of shipping shipper (sea) carrier consignee

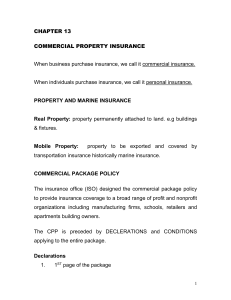

advertisement