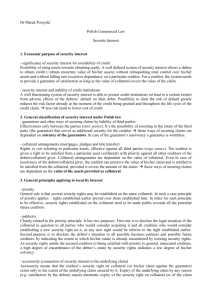

Introduction

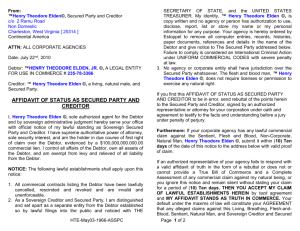

advertisement