Guidebook for applying for a railway undertaking license (RAS

advertisement

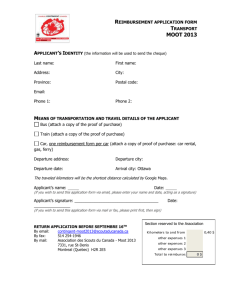

GUIDEBOOK FOR APPLYING FOR A RAILWAY UNDERTAKING LICENCE HELLENIC REPUBLIC REGULATORY AUTHORITY FOR RAILWAYS Athens January 2013 Version 1.1 Σελ. 1 CONTENTS GENERAL INSTRUCTIONS ........................................................................................................ 3 PART A: LEGAL FRAMEWORK ................................................................................................ 4 - Directive 2001/14/EC .............................................................................................................. 4 - P.D. 41/2005 ............................................................................................................................ 4 - M.D. Φ4/οικ.1594/107 .......................................................................................................... 4 - M.D. Φ 4.2/53159/5601 ....................................................................................................... 4 PART B : APPLICATION FORM – COMPANY PROFILE ....................................................... 5 APPLICATION FORM .................................................................................................................. 5 REQUIRED INFORMATION AND LEGAL DOCUMENTS ...................................................... 6 COMPANY PROFILE ................................................................................................................... 8 Α. GENERAL COMPANY INFORMATION .............................................................................. 8 Β. APPLICATION DATA ............................................................................................................. 8 C. OTHER INFORMATION ........................................................................................................ 8 PART C: DATA REQUIREMENTS MODEL OF BUSINESS PLAN ......................................... 9 INTRODUCTION .......................................................................................................................... 9 1. BRIEF COMPANY’ S BACKGROUND ............................................................................... 9 2. BRIEF DESCRIPTION OF APPLICATION FOR A RAILWAY UNDERTAKING LICENCE ........................................................................................................................................ 9 CHAPTER 1: ANALYSIS AND DIAGNOSIS OF THE CURRENT SITUATION OF THE COMPANY................................................................................................................................... 10 1. TURNOVER AND RATES OF SALES GROWTH ............................................................ 10 2. TECHNICAL AND PRODUCTIVITY DATA .................................................................... 12 3. FINANCIAL DATA .............................................................................................................. 13 4. ORGANIZATIONAL STRUCTURE ................................................................................... 19 CHAPTER 2: COMPETITIVE POSITION AND STRATEGY OF COMPANY ....................... 20 5. ANALYSIS AND DIAGNOSIS OF GENERAL BUSINESS ENVIRONMENT ............... 20 6. IDENTIFICATION AND JUSTIFICATION OF COMPETITIVE BUSINESS STRATEGY ............................................................................................................................................... 20 CHAPTER 3: ANALYSIS OF THE PROJECTED STATUS OF THE COMPANY APPLYING FOR RAILWAY UNDERTAKING LICENCE ........................................................................... 21 1. 2. 3. 4. FINANCIAL INFORMATION ............................................................................................. 21 IDENTIFICATION OF QUANTITATIVE TARGETS........................................................ 28 ORGANIZATIONAL STRUCTURE ................................................................................... 29 INVESTMENT PLANS ........................................................................................................ 29 Σελ. 2 GENERAL INSTRUCTIONS This guidebook informs the applicant companies about the procedure which should be followed for obtaining a railway undertaking license, in order to meet the terms of the legal framework (P.D. 41/2005, M.D. Φ.4/οικ.1594/107 G.G. Β 56/25.01.2012 & M.D. Φ 4.2/53159/5601 G.G. B 25/10.01.2013). The data tables help to qualitative analysis and presentation of the application. The tables presented in Chapters 1, 2 and 3 are indicative and include the minimum required data for the application. For the presentation of the tables, the applicant company may use any format it considers suitable, as long as all the required data are submitted. The amounts should be referred in thousands of euros. The application is submitted by one company (or joint venture). The application has to be signed by the legal representative of the company. Σελ. 3 PART A: LEGAL FRAMEWORK - - - Directive 2001/14/EC of the European Parliament and the Council on the allocation of railway infrastructure capacity and the levying of charges for the use of railway infrastructure and safety certification P.D. 41/2005 “Harmonization of the Greek legislation to EU Directives 91/440/EEC and 95/18/ΕC as they were amended by Directives 2001/12/EC and 2001/13/EC, respectively, together with Directive 2001/14/EC on the development of community railways, the licensing of railway undertakings and the allocation of railway infrastructure capacity and the levying of charges for the use of railway infrastructure and safety certification, and abolition of P.D.’s 324/1996, 76/1998 and 180/1998.” (G.G. Α’ 60/07.03.2005) M.D. Φ4/οικ.1594/107 “On the licensing of railway undertakings.” (G.G. Β’ 56/25.01.2012) - M.D. Φ 4.2/53159/5601 “Readjustment of the application fee for obtaining a railway undertaking license, according to Presidential Decree 41/2005 G.G.60/Α’ “ 25/10.01.2013). (G.G. B’ Σελ. 4 PART B : APPLICATION FORM – COMPANY PROFILE APPLICATION FORM APPLICATION TO REGULATORY AUTHORITY FOR RAILWAYS COMPANY NAME: …..……………..…….… Please approve our company’s request for VAT REG. NO: ……………………..….…..… obtaining a railway undertaking license, in HEADQUARTERS: .………………..…..…… accordance with the provisions of P.D. TEL. NO: ………………………………..……. 41/2005, M.D. Φ.4/οικ. 1594/107 (G.G. FAX NO: …………………………….….…..… 56/25.01.2012) and M.D. Φ4.2/53159/5601 WEB PAGE: …………………………...……. (G.G. Β’ 25/10.01.2013) Contact person: Attached, we submit all the documents listed Name: ………………………………….……….. below. Position: ………………………..……………….. Tel. No: ..…………….………………………….. Legal Representative’s signature E-mail: ..…………………………………………. Fax No: ..………………………………….…..… DATE: …………..………………………………. Σελ. 5 REQUIRED INFORMATION AND LEGAL DOCUMENTS The application must be accompanied by the following required information and legal documents: 1. A full set of essential credentials, properly legalized, by which the undertaking’s legal founding arises to be true, and by which the persons who are responsible for administering it, or for representing it, are defined together with their alternates (Article 3 par.1.a, M.D.). 2. Properly legalized copies of the identity document of the legal representatives of the applicant, or, in case of foreigners, of their passports (Article 3 par.1.b, M.D). 3. Criminal Record certificate or document of equivalent validation / sworn statement / solemn protestation of each person legally representing the applicant company (Article 42, P.D 41/2005 and Article 3 par.1.c, M.D). 4. Confirmation issued by a judicial or administrative authority that the applicant has not been declared bankrupt (Article 42, P.D 41/2005 and Article 3 par.1.d, M.D). 5. Confirmation issued by a judicial or administrative authority that the applicant has not been placed in administration or has not been put under liquidation (Article 42, P.D. 41/2005 and Article 3 par. 1.e, M.D.). 6. Confirmation issued by a judicial or administrative authority for not applying for a bankruptcy reconciliation of the applicant. 7. Tax contribution compliance certificate of the applicant (Article 42, P.D. 41/2005 and Article 4 par.2.a, M.D.). 8. Social security contribution compliance certificate by insurance authorities for the contributions have to be paid for staff employed by the applicant (Article 42, P.D. 41/2005 and Article 4 par.2.c, M.D.). 9. Available funds of the applicant, such as cash, bank deposits, bonds and credit lines from financial institutions (par. 1.a, Section A’, Annex II, Article 49, P.D. 41/2005). 10. Other assets available as security (Item b, Section A’, Annex II, Article 49 P.D. 41/2005). 11. Working capital (current assets and current liabilities), Par. 1.c, Part A’, Annex II, Article 49, P.D. 41/2005. 12. Relevant costs, including purchase costs and down payments to account for vehicles, land, buildings, installations and rolling stock (par.1.d, Part A’, Annex II, Article 49, P.D. 41/2005). 13. Charges on an undertaking's assets. (par.1.e, Part Α΄, Annex ΙΙ, Article 49, P.D. 41/2005). 14. Published annual financial statements - balance-sheets and profit-and-loss statements for the three years before the year of the application. As far as it is concerned with companies which have not gone through three (3) completed years of operation, only the available data shall be presented. Regarding a newly founded company the financial statement - balance-sheet for the startup, or equivalent documents, are required. The financial statements presented shall be accompanied by relevant certified public accountants’ reports, relevant audit certificates, as well as copies of the annual reports. A Company which belongs to a Group of Companies shall additionally present consolidated financial statements. (Article 4 par.1.c, M.D.). 15. A Business Plan (BP) of the applying Company. In the BP the presumed financial statements and the expected income statement adjustments for the definition of financial resources and cash flows for the next 3 years following the date of submission of the application shall be presented and analyzed so that the financial proficiency and sustainability of operation of the applying Railway Undertaking may be established. Further data should be included in the BP, for example about facilities and any Σελ. 6 investment plans, by means of which the applicant provides the railway services. Furthermore, the company’s partners / shareholders, the legal representative, the Board of Directors, the potential participation in other companies and the status of competition and strategy are mentioned. (Article 4 par.1.d, M.D.). 16. Expert report, if submitted by the applicant, and appropriate documentation from a bank, public savings bank, financial auditor or certified public accountant, which include information on data referred in par.1, Part A’, Annex II, Article 49, P.D. 41/2005. 17. Documents that prove existing business ties and shareholding of the applicant in other Companies or Groups of Companies. (Article 4 par.1.b, M.D.). 18. Chart showing the organizational and administrative structure of the applicant (Article 42 par. 3.f P.D. 41/2005). 19. Information on professional competence (Article 45, P.D. 41/2005 & Article 5, M.D.). 20. Properly legalized copies of all the insurance contracts as proof of civil liability coverage (Article 42, P.D. 41/2005 & Article 6 par. b, M.D.). 21. Fee to the State for the amount of three thousand (3.000) euros. Σελ. 7 COMPANY PROFILE Complete the following information to the extent you deem necessary. Α. GENERAL COMPANY INFORMATION 1. Name 2. Activity sector 3. Working scope 4. Headquarters 5. Annexes / branches 6. Date of establishment 7. Number of staff Β. APPLICATION DATA 1. Brief description of the requested license 2. Type of rail transportation (passenger / freight) 3. Train composition (traction units / hauled stock) 4. Network coverage (total / partial) 5. Geographical scope of transport services (national / international) 6. Transport demand forecast data, at least for the next three years (in passenger km / tone km) 7. Available resources (manpower, equipment) C. OTHER INFORMATION 1. Partners or shareholders 2. Legal representative α) Name β) Address γ) ID No 3. Board of Directors 4. Participation in other companies a) Name b) Percentage of participation c) Activity sector Σελ. 8 PART C: DATA REQUIREMENTS MODEL OF BUSINESS PLAN INTRODUCTION 1. BRIEF COMPANY’ S BACKGROUND The applicant company should briefly present its profile, including name, subsidiaries, details of the legal representative, activity sector, most important events and assets. 2. BRIEF DESCRIPTION OF APPLICATION FOR A RAILWAY UNDERTAKING LICENCE It is a brief description of the application of the company. Particularly, the company should present justification for applying, analysis of railway services that the company seeks to offer (e.g. international rail passenger transport) and the method of implementing them, analysis of competitive advantages, of the current situation and of the future performances. Additionally, necessary assumptions regarding key economic variables of business, such as, among other, the acquisition and management of assets, revenues, cost of goods sold and the cost of raising financial resources, should be mentioned. Σελ. 9 CHAPTER 1: ANALYSIS AND DIAGNOSIS OF THE CURRENT SITUATION OF THE COMPANY 1. TURNOVER AND RATES OF SALES GROWTH Shows the growth of sales of the company (overall and especially in transport services), and the percentage of added value, based on the annual financial statements for three, before the application period, fiscal years. Note that you should make a brief explanation of the calculation of added value to the business to which the application relates, in relation to all services / products of the company. Table 1.1.1: Total company sales All amounts in thousands euros 1st year 2nd year 3rd year Total sales Percentage change (%) Domestic sales Percentage change (%) Sales abroad Percentage change (%) Table 1.1.2: Total sales and added value for company’s activities All amounts in thousands euros 1st year 2nd year 3rd year Total sales (1) Expenses by type (2) Administrative expenses Selling expenses Rents of fixed equipment Depreciation Added value (3) = (1) - (2) Added value analysis Wages and salaries Interest Surplus Σελ. 10 Table 1.1.3: Total company sales resulting from the activities of transport All amounts in thousands euros 1st year 2nd year 3rd year Domestic sales (1) Percentage change (%) Size of domestic market (2) Percentage change (%) Domestic market share held by the company (1:2) Sales abroad (3) Percentage change (%) Total sales (4) = (1) + (3) Percentage change (%) Sales share from transport operations to total (Table 1.1.1) Σελ. 11 2. TECHNICAL AND PRODUCTIVITY DATA The technical and productivity data are presented of the last three years through qualitative and quantitative presentation of the mechanical equipment, new technologies, new and / or innovative production methods and quality assurance procedures. Table 1.2.1: Investment elements and method of funding All amounts in thousands euros 1st year 2nd year 3rd year Investment elements Buildings, Facilities Mechanical equipment Other investments Method of funding Grants (1) Loaned funds (2) Domestic banks loans Foreign banks loans Suppliers credits Other loaned funds Equity participation (3) Total (4) = (1) + (2) + (3) Σελ. 12 3. FINANCIAL DATA The financial data of the last three years Are presented and analyzed, i.e. the financial results and profitability of the applicant company in relation to sales and capital employed. Table 1.3.1: Turnover breakdown All amounts in thousands euros 1st year 2nd year 3rd year 1st year 2nd year 3rd year 1st year 2nd year 3rd year Domestic sales Foreign sales Total sales Table 1.3.2: Sales Cost breakdown All amounts in thousands euros Α’ Materials Β΄ Materials Circulation Costs (fuel, energy) Packaging materials Spare Parts-tools (consumed in production) Remuneration of personnel Maintenance costs Changes in inventories Other overhead costs (broken down where necessary) Total cost of sales Table 1.3.3: Profit and loss account All amounts in thousands euros Turnover (Table 1.3.1) LESS Cost of sales (Table 1.3.2) Gross operating profit LESS Administrative expenses Expenses for research/development Selling expenses Σελ. 13 Operating Profit NOT INCLUNDING Investments incomes Interest Other incomes LESS Exchange rate differences Other costs Results before interest, depreciation and taxes LESS Interest Results before depreciation and taxes LESS Depreciation (total) Net operating results (before tax) Table 1.3.4: Distribution of results All amounts in thousands euros 1st year 2nd year 3rd year 1st year 2nd year 3rd year Net operating results (before tax) (Table 1.3.3) (+ or -) Balance results (from previous years) LESS Income taxes Profits for distribution Statutory reserves Other reserves Dividends payable Balance carried forward Table 1.3.5: Balance sheet data All amounts in thousands euros Installation expenses Installation expenses LESS Depreciation Undepreciated value of installation costs Fixed assets Intangible assets LESS Depreciation Σελ. 14 Undepreciated value of Intangible assets Tangible assets LESS Depreciation Undepreciated value of tangible assets Investments and other long term receivables Undepreciated value of fixed assets Circulating assets Stocks Requirements Debt securities Available Total circulating assets GRAND TOTAL ASSETS EQUITY CAPITAL Capital (share etc.) Reserve funds Results carried forward PROVISIONS FOR LIABILITIES OR EXPENSES OBLIGATIONS Long-term Short-term GRAND TOTAL LIABILITIES Table 1.3.6: Sources and Uses of Funds All amounts in thousands euros 1st year 2nd year 3rd year CHANGES IN CAPITAL MOVEMENT INPUT Increase in cash Increase supplier credits Increase in short-term bank loans Increase in other liabilities Σελ. 15 reduction in stocks Decrease in receivables TOTAL INPUT (1) OUTPUTS Decrease in reserve Reduce supplier credits Decrease in short-term bank loans Decrease in other liabilities Increase in stocks increase in receivables TOTAL OUTPUTS (2) CHANGE IN CAPITAL MOVEMENT: (3) = (1) – (2) OTHER SOURCES AND USES OF FUNDS SOURCES Profit before tax Increase of share capital State aid Increases long-term loans and credits Other inputs TOTAL SOURCES (4) USES New installation costs LESS Depreciation Net increase installation costs New investments LESS Depreciation Net increase in fixed assets Decrease in long-term loans and credits Payment of dividends Payment of income tax Other uses TOTAL USES (5) Note: (3) = (5) – (4) Σελ. 16 Table 1.3.7: Cash flow 1st year All amounts in thousands euros 2nd year 3rd year CASH FLOW FROM OPERATING Total receipts from the operation Earnings from sales Other earnings Total payments for operating Payments to suppliers Employees Payments Other costs Interest payments Tax payments TOTAL CASH FLOW FROM OPERATING (1) CASH FLOW FROM INVESTMENTS Change in assets Change in long term involvement TOTAL CASH FLOW FROM INVESTMENTS (2) CASH FLOW FROM FINANCING Change in share capital Change in bank lending Change in dividends Financial expenses TOTAL CASH FLOW FROM FINANCING (3) TOTAL CASH FLOW (4) (4) = (1) + (2) + (3) Σελ. 17 Table 1.3.8: Ratios 1st 2nd year year 3rd year Liquidity General liquidity Immediate liquidity Stocks + Requirements + Cash + Securities Current Liabilities Requirements + Cash + Securities Current Liabilities Capital structure Total depts Total indebtedness X 100 Total assets Coverage of Earnings before interest and taxes financial expenses from operating Interest payments income Short-term debt obligations Short term bank loans X 100 Sales Activity Inventory turnover rate Cost of sales Average stock level Demands Days debt collection Turnover rate of assets Sales / 360 Sales Total assets Efficiency Earnings before taxes Net profit margin X 100 Sales Earnings before taxes Return on Equity X 100 Own funds Return on Invested Capital Earnings before taxes X 100 Total assets Magnification Average annual sales growth rate -1 Average annual rate of change in income before taxes -1 Σελ. 18 4. ORGANIZATIONAL STRUCTURE The anticipated overall organizational chart of the company and its development is presented. Additionally, it is presented in detail the general administration, organization of accounting and analysis / cost control, organization of marketing, sales and distribution network, the organization of production, organization of research and development, human resources in each section by category and training, and operating costs in the above sections. Specifically, the request shall include the following: a) General business organization chart, in diagram format, based on the organization into Divisions and Departments such as financial management and sales promotion. In addition, it should refer to information systems used by the company. b) Brief description of activities and tasks carried out by the Directorates and Departments of the company based on the above chart. c) Presentation of human resources by category and skill training. Special reference should be made to the skills and experience of manpower on rail transport. d) Presentation of the operating costs of each department. Σελ. 19 CHAPTER 2: COMPETITIVE POSITION AND STRATEGY OF COMPANY 5. ANALYSIS AND DIAGNOSIS OF GENERAL BUSINESS ENVIRONMENT CHAPTER 1: ANALYSIS AND DIAGNOSIS OF THE CURRENT SITUATION OF THE COMPANY Includes analysis and diagnosis of the broader business environment (economic, technological, productive, demographic etc.), as well as sectorial - competitive environment (especially at the microeconomic action level), in order to draw conclusions about the company’s competitive position. This analysis and diagnosis is based on: a) Presentation of domestic and international market research conclusions, on supply and demand, for the rail transport services to be provided by the applicant company. b) Presentation of technology and know-how used by the company regarding international standards. c) Analysis of the company’s economic environment, taking into account factors that affect both domestic and international markets. Indicatively, trends and prospects, weaknesses and threats and the market dynamics of rail transportation (e.g. sectors / customers and their financial performance and prospects), are reported. d) Analysis of the company’s demographic environment, taking into account the factors that affect it (e.g. population and income trends). e) Analysis of the technological - productive company’s environment, taking into account factors that affect it (e.g. technological achievements). f) Analysis of the company’s competitive environment, taking into account factors that affect it. Indicatively, the uniqueness of services, alternative - substitute services, the number of competitors, the size of competitors (compared to the size of the market), the elasticity of demand, the pricing policy of the company etc., are reported. 6. IDENTIFICATION AND JUSTIFICATION OF COMPETITIVE BUSINESS STRATEGY Based on the above analysis, the -up to date - competition strategy of the company, is presented, in order to evaluate its competitive position. Also, the future competitive strategy is defined and evaluated. Note that, the assumptions’ analysis on which the expected competition strategy is based has to be included. Σελ. 20 CHAPTER 3: ANALYSIS OF THE PROJECTED STATUS OF THE COMPANY APPLYING FOR RAILWAY UNDERTAKING LICENCE It should be provided a three-year business plan, which is connected with the railway business of the applicant and which includes: a) Objectives of the applicant. b) Basic assumptions of the business plan analysis. c) Detailed plans for the fields: i) Development of products and services ii) Sales, marketing and distribution of products iii) Development of organizational structure iv) Supply of raw materials, inventory management, procurement of materials and equipment It should be clarified that the plans are accompanied by a detailed description of the planned actions and by a time schedule for their implementation. At the same time it should be submitted an executive summary of the business plan. Are presented and analyzed the financial data of the last three years, i.e. the financial results and profitability of the applicant company in relation to sales and capital employed. 1. FINANCIAL INFORMATION Financial information includes analysis of financial data of the three year business plan based on goals, strategies and action plans. Table 3.1.1: Financing a business plan All amounts in thousands Euros 1st year 2st year 3st year Equity Borrowed funds Domestic Banks’ loans Short long-term Foreign Banks’ loans Short long-term Appropriations of Financial Institutions Subsidies Grants Σελ. 21 Total Table 3.1.2: Analysis of the projected turnover 1st year All amounts in thousands Euros 2st year 3st year Domestic sales Income from the railway services (RS) Type of RS Type of RS Others income Total domestic sales (1) Foreign sales Income from the Railway Services (RS) Type of RS Type of RS Others revenue Total foreign sales (2) Total sales (3) Note : (3) = (1) + (2) Table 3.1.3: Analysis of the projected cost of sales All amounts in thousands Euros 1st year 2st year 3st year 2st year 3st year Α’ Materials Β΄ Materials Circulation Costs (fuel, energy) Packaging materials Spare Parts-tools (consumed in production) Remuneration of personnel Maintenance costs Changes in inventories Other overhead costs (broken down where necessary) Total cost of sales Table 3.1.4: Projected profit and loss account All amounts in thousands Euros 1st year Turnover (Table 3.3.2) LESS Cost of sales (Table 3.1.3) Σελ. 22 Gross operating profit LESS Administrative expenses Expenses for research/development Selling expenses Operating Profit NOT INCLUNDING Investments incomes Interest Other incomes LESS Exchange rate differences Other costs Results before interest, depreciation and taxes LESS Interest Results before depreciation and taxes LESS Depreciation (total) Net operating results (before tax) Table 3.1.5: Projected distribution of results All amounts in thousands euros 1st year 2nd year 3rd year 2nd year 3rd year Net operating results (before tax) (Table 1.3.3) (+ or -) Balance results (from previous years) LESS Income taxes Profits for distribution Statutory reserves Other reserves Dividends payable Balance carried forward Table 3.1.6: Proactive State Sources and Uses of Funds All amounts in thousands euros 1st year CHANGES IN CAPITAL MOVEMENT INPUT Σελ. 23 Increase in cash Increase supplier credits Increase in short-term bank loans Increase in other liabilities reduction in stocks Decrease in receivables TOTAL INPUT (1) OUTPUTS Decrease in reserve Reduce supplier credits Decrease in short-term bank loans Decrease in other liabilities Increase in stocks increase in receivables TOTAL OUTPUTS (2) CHANGE IN CAPITAL MOVEMENT: (3) = (1) – (2) OTHER SOURCES AND USES OF FUNDS SOURCES Profit before tax Increase of share capital State aid Increases long-term loans and credits Other inputs TOTAL SOURCES (4) USES New installation costs LESS Depreciation Net increase installation costs New investments LESS Depreciation Net increase in fixed assets Decrease in long-term loans and credits Payment of dividends Payment of income tax Other uses TOTAL USES (5) Note: (3) = (5) – (4) Σελ. 24 Table 3.1.7: Projected treasury plan All amounts in thousands euros 1st year 2nd year 3rd year 1st year 2nd year 3rd year CASH FLOW FROM OPERATING Total receipts from the operation Earnings from sales Other earnings Total payments for operating Payments to suppliers Employees Payments Other costs Interest payments Tax payments TOTAL CASH FLOW FROM OPERATING (1) CASH FLOW FROM INVESTMENTS Change in assets Change in long term involvement TOTAL CASH FLOW FROM INVESTMENTS (2) CASH FLOW FROM FINANCING Change in share capital Change in bank lending Change in dividends Financial expenses TOTAL CASH FLOW FROM FINANCING (3) TOTAL CASH FLOW (4) (4) = (1) + (2) + (3) Table 3.1.8: Projected balance sheets All amounts in thousands euros Installation expenses Installation expenses LESS Depreciation Undepreciated value of installation costs Σελ. 25 Fixed assets Intangible assets LESS Depreciation Undepreciated value of Intangible assets Tangible assets LESS Depreciation Undepreciated value of tangible assets Investments and other long term receivables Undepreciated value of fixed assets Circulating assets Stocks Requirements Debt securities Available Total circulating assets GRAND TOTAL ASSETS EQUITY CAPITAL Capital (share etc.) Reserve funds Results carried forward PROVISIONS FOR LIABILITIES OR EXPENSES OBLIGATIONS Long-term Short-term GRAND TOTAL LIABILITIES Table 3.1.9: Projected Ratios 1st year 2nd 3rd year year Liquidity Σελ. 26 General liquidity Immediate liquidity Stocks + Requirements + Cash + Securities Current Liabilities Requirements + Cash + Securities Current Liabilities Capital structure Total depts Total indebtedness X 100 Total assets Coverage of financial Earnings before interest and taxes expenses from operating income Short-term debt obligations Interest payments Short term bank loans X 100 Sales Activity Inventory turnover rate Cost of sales Average stock level Demands Days debt collection Turnover rate of assets Sales / 360 Sales Total assets Efficiency Earnings before taxes Net profit margin X 100 Sales Earnings before taxes Return on Equity X 100 Own funds Return on Invested Capital Earnings before taxes X 100 Total assets Magnification Average annual sales growth rate -1 Average annual rate of change in income before taxes -1 Σελ. 27 2. IDENTIFICATION OF QUANTITATIVE TARGETS Annual quantitative targets to be achieved during the first three years after obtaining the railway undertaking license are shown below. Table 3.2.1: Projected quantitative targets 1st year VALUE / QUANTITY Quantity Percentage change (%) Value in thousands Euros 2st year Percentage change (%) Quantity Percentage change (%) Value in thousands Euros 3st year Percentage change (%) Quantity Percentage change (%) Value in thousands Euros Percentage change (%) Passenger transport Domestic Foreign Freight transport Domestic Foreign Total Note: The unit of measurement in passenger transport is passenger – km and in freight transport is tn-km. 1st year OTHERS TARGETS Description 2st year Unit of Percentage measurement* change (%) Description 3st year Unit of Percentage measurement* change (%) Description Unit of Percentage measurement* change (%) Facilities Equipment Human resources** *: Completed with the appropriate unit of measurement. **: Analyzed by specialty. Σελ. 28 3. ORGANIZATIONAL STRUCTURE The anticipated overall organizational chart of the company and its development is presented. Additionally, it is presented in detail the general administration, organization of accounting and analysis / cost control, organization of marketing, sales and distribution network, the organization of production, organization of research and development, human resources in each section by category and training, and operating costs in the above sections. Specifically, the request shall include the following: a) General business organization chart, in diagram format, based on the organization into Divisions and Departments such as financial management and sales promotion. In addition, it should refer to information systems used by the company. b) Brief description of activities and tasks carried out by the Directorates and Departments of the company based on the above chart. c) Presentation of human resources by category and skill training. Special reference should be made to the skills and experience of manpower on rail transport. d) Presentation of the operating costs of each department. 4. INVESTMENT PLANS Potential investment projects are presented by the applicant company associated with the provision of railway services. For each one of them should be given details for: a) Objectives of the project. b) Sources of financing. c) Implementation Schedule. d) Description of the project. e) Presentation of benefits expected. g) Evaluation of a project based on: 1) the method of net present value and 2) the Internal Rate of Return (IRR). Σελ. 29