MACROECONOMICS - Post University

advertisement

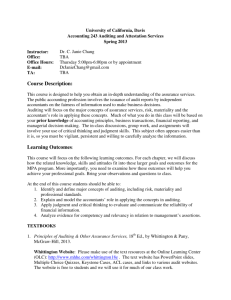

University of Bridgeport Ernest C Treftz School of Business Auditing 520 Introduction to Auditing Course Title: Auditing Instructor: Frederick Harmon Course Number Audit 520 Semester, year: Fall 2014 Semester Hours: 3 Thursdays, 3:30PM to 6:00 PM Instructor Contact Information: (203-258-1465) FHarmon@bridgeport.edu or jfharmon2002@yahoo.com If necessary, student conferences will be on an individual basis by mutually convenient appointment. Course Description: This course examines the basic concepts of the auditing profession and will prepare students to sit for the CPA exam. The course will show students how to audit financial statements for public and private companies. We will learns generally accepted auditing standards (GAAS) and generally accepted accounting principles (GAAP) and their application. Required texts and Materials Auditing, A Risk Based Approach, 7e, Rittenburg, Johnstone, and Gramling Johnstone, Gramling, & Wittenberg, South Western-Cengage Learning We will also be using a variety of supplemental material in the course. The instructor will provide material and additional information during the course. Course Objective: Auditing is one of the most important, but highly misunderstood disciplines, in the accounting profession. The financial auditor will encounter a set of ever -increasing demands imposed by the government, the accounting industry, and client companies themselves. The skill sets the professional auditor will need for due diligence performance and the broad array of issues which he/she will encounter, necessitate many types of experience and analysis. This course will provide a firm foundation for those interested in careers as public accountants as well as financial managers. Competencies to be Learned: Upon Successful Completion of this course, the student will: Fraud evaluation, risk analysis and corporate governance knowledge. An in depth understanding of the COSO internal control standards Creation and documentation of work papers, legal environments, and pertinent laws that govern the profession. Familiarity with GAAS, evidentiary requirements, and the types of opinions issued in the auditing profession. A review of current audit analysis tools including software Liability issues, ethics, and quality audits Master the audit process for various financial functions such as revenue cycles, cash and marketable securities, inventory, Be able to evaluate accounting estimates, depreciation methods, reserves, and non-transactional accounting methods University of Bridgeport Ernest C Treftz School of Business Auditing 520 Understand the payable cycle, purchasing, and cash flow processes and their internal control. Create of audit programs for debt obligations and stock holder’s equity. Develop statistical Sampling techniques for audit testing. Work as a member of an audit team on complex auditing issues. Provide a framework for the CPA review and testing in the audit area. Attendance/Tardiness/Participation: Regular class attendance is expected and will be recorded at the end of each class session. Tardiness will not be tolerated, as it is disruptive to those who make the effort to be on time and to the lecture/discussion in progress. Texting or using cell phones during class will not be tolerated ALL ASSIGNMENTS MUST BE DONE IN WORD OR EXCEL- NO WRITTEN ASSIGNMENTS ACCEPTED IF YOU HAVE A LAPTOP COMPUTER OR ELECTRONIC DEVICE WITH EXCEL, PLEASE BRING IT TO CLASS Course requirements: Students are expected to prepare in advance of each class meeting. The teaching methodology relies heavily on experiential recall, lecture, student participation, and the ability to relate knowledge from various sources to the discussion at hand. Grading: Grading is based on the following combination of activities: Midterm Examination 20 pts Final Examination 20 pts Group Assignments 20pts Written Assignments 20pts Homework Participation 20 pts Special Needs: If a student has any special requirements which may impact performance in the course, he/she should contact the instructor as soon as possible, so that alternative study assignments can be arranged. Policy on missed assignments, tests, quizzes, or exams: Assignments and tests all have scheduled dates. There is no provision for “make ups”. Late papers will not be accepted. Failure to turn in a paper will decrease final grade by 25% Changes in the course schedule: Any changes in this syllabus will be presented at regular class meetings. University of Bridgeport Ernest C Treftz School of Business Auditing 520 Academic Resource Center The Academic Resource Center is available for IDEAL students seeking help in their studies. The Center is staffed by writing professionals and peer tutors. More information can be found at: http://myub.bridgeport.edu/academics/academicrescenter/Pages/default.aspx The Center is located in the Wahlstrom Library, Room 506. Hours of operation are Mondays –Thursday 9am – 6pm and Fridays 9am – 1pm. Make an appointment or walk-in: Telephone: 203-576-4290. Online Tutoring is available at: www.etutoring.org. To use this free service you must have a UBNet account. Obtaining a UBNet Account Every registered student should obtain a UBNet Account. The account allows you to access your grades, access library services, access online tutoring, access the computers in computer labs, and provides an email account in which the University sends out information. Go to: http://www.bridgeport.edu/ubnet - Click on “New UBNet Account” and follow the instructions. The @bridgeport.edu email address is the official email the University uses to send information to you. You can have your Bridgeport.edu email forwarded to any other email account you use. Following the activation of your UBNet account (takes 24 hours), login at: http://www.bridgeport.edu/email and click on “forwards” at the top of the page. Follow the directions to forward email messages to your other account. Academic Policies The policy of the University is that all students will attend all scheduled classes. Periodically, in case of emergency, the student may no be able to attend. Please notify the instructor in advance in such cases. Further, it is the policy of the university that the student will supplement class hours on a 2:1 basis. That is, for this course which is 3 credit hours, it is the expectation that the student will commit to six hours of out of class time devoted to this course.