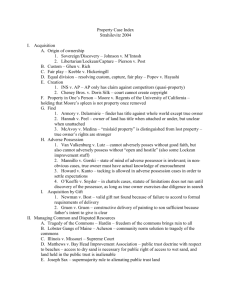

Property Outline

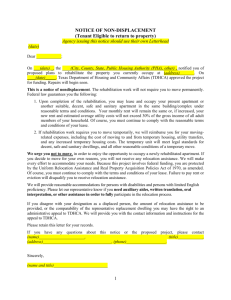

advertisement