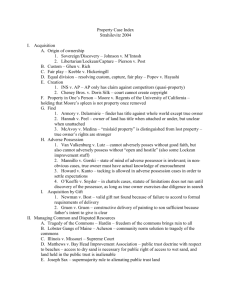

Property Outline

advertisement