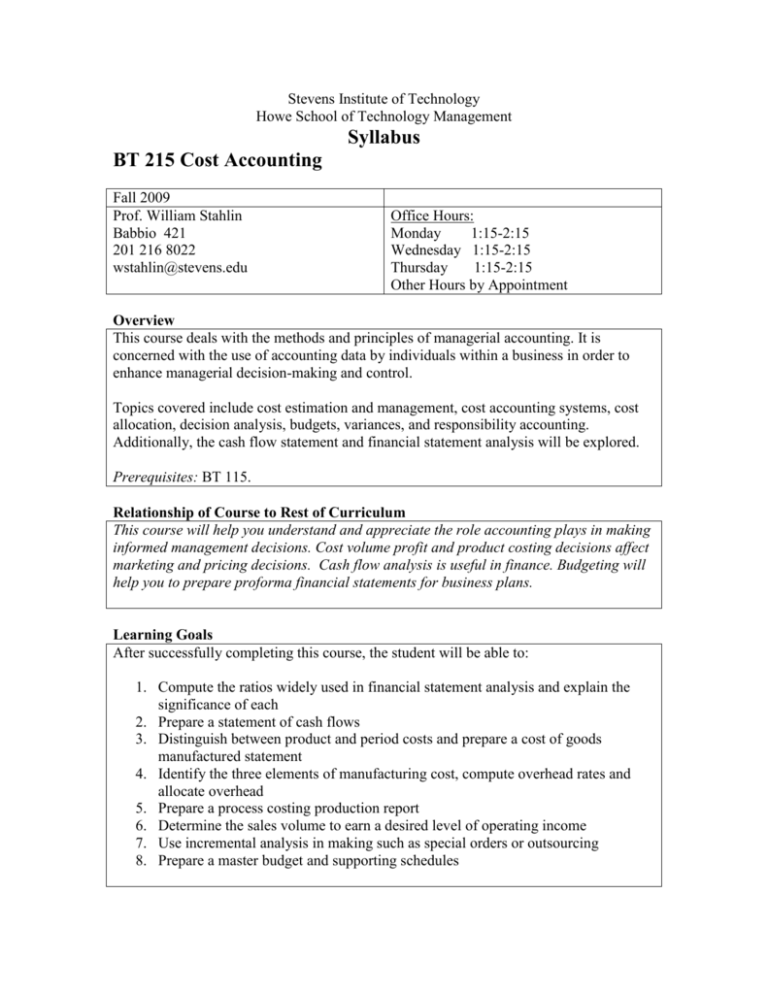

Stevens Institute of Technology

Howe School of Technology Management

Syllabus

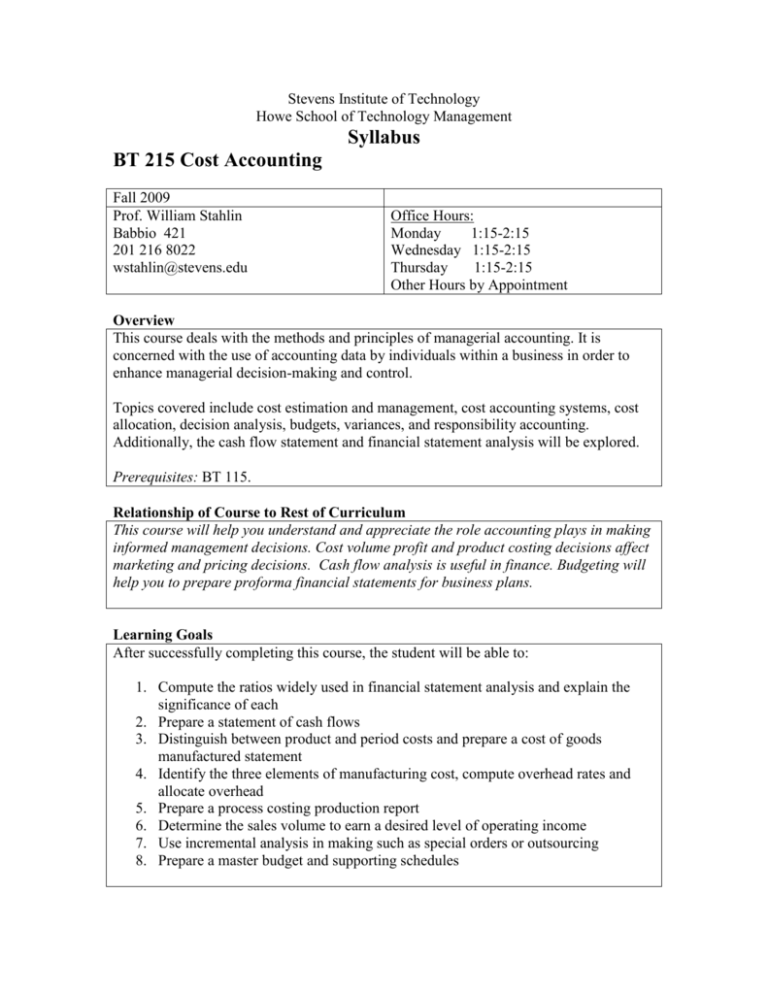

BT 215 Cost Accounting

Fall 2009

Prof. William Stahlin

Babbio 421

201 216 8022

wstahlin@stevens.edu

Office Hours:

Monday

1:15-2:15

Wednesday 1:15-2:15

Thursday

1:15-2:15

Other Hours by Appointment

Overview

This course deals with the methods and principles of managerial accounting. It is

concerned with the use of accounting data by individuals within a business in order to

enhance managerial decision-making and control.

Topics covered include cost estimation and management, cost accounting systems, cost

allocation, decision analysis, budgets, variances, and responsibility accounting.

Additionally, the cash flow statement and financial statement analysis will be explored.

Prerequisites: BT 115.

Relationship of Course to Rest of Curriculum

This course will help you understand and appreciate the role accounting plays in making

informed management decisions. Cost volume profit and product costing decisions affect

marketing and pricing decisions. Cash flow analysis is useful in finance. Budgeting will

help you to prepare proforma financial statements for business plans.

Learning Goals

After successfully completing this course, the student will be able to:

1. Compute the ratios widely used in financial statement analysis and explain the

significance of each

2. Prepare a statement of cash flows

3. Distinguish between product and period costs and prepare a cost of goods

manufactured statement

4. Identify the three elements of manufacturing cost, compute overhead rates and

allocate overhead

5. Prepare a process costing production report

6. Determine the sales volume to earn a desired level of operating income

7. Use incremental analysis in making such as special orders or outsourcing

8. Prepare a master budget and supporting schedules

Pedagogy

The course will employ lectures, class discussion, in-class individual assignments, and

review of homework assignments. There will be approximately 5 quizzes (the lowest quiz

will be dropped and there are no make ups for missed quizzes) and three exams. The third

exam will be comprehensive.

There are 2-3 homework problems in each chapter (highlighted in bold on the

assignments schedule) that must be submitted through My Accounting Lab. In order to

get credit for your homework you must score a 75% or higher.

The other assigned problems are available through My Accounting Lab. Many students

indicated they prefer to do all homework problems through My Accounting Lab.

Solutions are available immediately once an answer is submitted. You can try problems

repeatedly with different numbers as well.

Required Texts

Accounting, 7th edition, Horngren and Harrison; Pearson Prentice Hall, 2007

ISBN 0-13-243960-3

My Accounting Lab access code (Comes with the Horngren text)

Merrill Lynch, How to Read a Financial Statement (emailed to you)

Grading Requirements

Assignment

Homework, in-class participation, assignments and

attendanceQuizzesExams (2) 20% each

Comprehensive Final

Total Grade

Grade %

15%;

15%;

40%

30%

100%

Ethical Conduct

Stevens Honor System: Enrollment into the undergraduate class of Stevens signifies a student’s

commitment to the Honor System. It is the responsibility of each student to become acquainted

with and to uphold the ideals set forth in the Honor System Constitution. All students are

reminded that, as a condition of being admitted to Stevens, they will uphold and adhere to the

standards of the Stevens Honor System. Specific student responsibilities include:

Maintaining honesty and fair play in all aspects of academic life at Stevens

Writing and signing the pledge, in full, on all submitted academic work

Reporting any suspected violations to an Honor Board member or to the Dean of

Undergraduate Academics

Cooperating with the Honor Board during investigations and hearings

2

BT 215 Course Schedule

Assigned Problems in Bold are to Be

Completed Using My Accounting Lab

Chapter Title

16

Cash Flow Statements

Class and Homework Assignments

16 – 3, 4, 5, 6, 7, 16, 17, 18, 20, 34, 35,

36

17.

Financial Statement Analysis

17 - 1, 2, 3, 4, 5, 6, 7, 8, 13, 17, 25, 26,

27

18

Management Accounting: An

Introduction

19

Job Order Cost Systems and

Overhead Allocations

18 - 3, 4, 5, 6, 7, 8, 9, 10, 11, 12, 17,

19, 20, 21, 22, 23, 24, 27, 28

19 – 1, 2, 3, 4, 6, 7, 8, 9, 10, 11, 13,

14, 15, 17, 19, 20, 22, 25, 26 (1)

Exam 1 Chapters 16, 17, 18, 19

Process Costing

20 – 2, 3, 4, 5, 6, 7, 8, 9, 10, 11, 12, 13,

19, 20, 23

21.

Cost-Volume-Profit Analysis

21 - 1, 2, 3, 5, 6, 10, 13, 14, 17, 18,

20, 21, 22, 26

22.

The Master Budget and

Responsibility Accounting

22 - 4, 5, 6, 7, 8, 9, 10, 11, 13, 14, 18

23.

Flexible Budgeting and

23 -3, 7, 8, 15, 17, 18, 20, 25, 28 (1, 4)

20.

Standard Costs

25.

Special Decisions

25 - 1, 2, 3, 4, 5, 6, 7, 15, 16, 17, 18, 20,

27, 28, 30

24.

Activity Based Costing and

24 - 2, 3, 4, 5, 6, 7, 8, 9, 10, 13, 14, 15,

16, 17

Other Cost Management Tools

Comprehensive Exam –

All Chapters

3