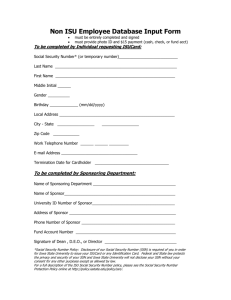

SSN: "Religious Objection"

advertisement

SSN: "Religious Objection"

42 USC 405(c)(2)(B)(i)

Rev. 13: 16-17

I write this memorandum in order to clearly delineate the law with regard to the Social Security

Number (SSN), and my use of the phrase "Religious Objection" in the SSN space on job

applications and other requests for disclosure. I usually annotate this phrase with a citation of the

federal law that shows the authority of the Commissioner of Social Security to assign SSNs,

which is found within Title 42 of the United States Code (U.S.C.) at §405(c)(2)(B)(i). I do this

more and more as time goes by, so you will find that I am quite familiar with the laws enacted by

Congress, and the regulations promulgated by the Secretary of the Treasury and by the Secretary

of Health and Human Services in this area.

Most people erroneously believe that every American is required to have a SSN. When asked

about this requirement, the Social Security Administration acknowledges this fact as follows:

"The Social Security Act does not require a person to have a Social Security number

(SSN) to live and work in the United States, nor does it require an SSN simply for

the purpose of having one."

The only statute which authorizes the issuance of SSNs to classes of individuals is 42 U.S.C.

§405(c)(2), which provides:

(B)(i) In carrying out the Commissioner's duties under subparagraph (A) and

subparagraph (F), the Commissioner of Social Security shall take affirmative

measures to assure that social security account numbers will, to the maximum extent

practicable, be assigned to all members of appropriate groups or categories of

individuals by assigning such numbers (or ascertaining

that such numbers have already been assigned):

(I) to aliens at the time of their lawful admission to the United States either for

permanent residence or under other authority of law permitting them to engage in

employment in the United States and to other aliens at such time as their status is so

changed as to make it lawful for them to engage in such employment; [WHO needs

an number in order to WORK in the US?]

(II) to any individual who is an applicant for or recipient of benefits under any

program financed in whole or in part from Federal funds including any child on

whose behalf such benefits are claimed by another person; and [If one does not wish

to receive any federal funds, one need not apply.]

(III) to any other individual when it appears that he could have been but was not

assigned an account number under the provisions of subclauses (I) or (II) but only

after such investigation as is necessary to establish to the satisfaction of the

Commissioner of Social Security, the identity of such individual, the fact that an

account number has not already been assigned to such individual, and the fact that

such individual is a citizen or a noncitizen who is not, because of his alien status,

prohibited from engaging in employment; and, in carrying out such duties, the

Commissioner of Social Security is authorized to take affirmative measures to assure

the issuance of social security numbers: [doesn't say MUST or REQUIRED here,

does it?]

(IV) to or on behalf of children who are below school age at the request of their

parents or guardians; and

(V) to children of school age at the time of their first enrollment in school.

As you can see, domestic Americans not seeking federal benefits simply are not within the class

of individuals who may lawfully obtain SSNs. Certainly I am not in these classes because I am

not an alien, I do not collect and do not want to collect social security benefits (the system is

bankrupt anyway), and I am obviously not a child. This limitation of power was forced upon the

Congress, as in 1935 the Railroad Retirement Act it failed constitutional muster according to the

U.S. Supreme Court:

"The catalogue of means and actions which might be imposed upon an employer in

any business, tending to the satisfaction and comfort of his employees, seems

endless. Provision for free medical attendance, nursing, clothing, food, housing, and

education of children, and a hundred other matters might with equal propriety be

proposed as tending to relieve the employee of mental strain and worry. Can it fairly

be said that the power of Congress to regulate interstate commerce extends to the

prescription of any or all of these things? It is not apparent that they are really and

essentially related solely to the social welfare of the worker, and therefore remote

from any regulation of commerce as such? We think the answer is plain. These

matters obviously lie outside the orbit of congressional power." Railroad

Retirement Board v.Alton Railroad Co., 295 U.S. 330, 55 S. Ct. 758 (1935)

Furthermore, the federal government has stated in the public record in the case of EEOC v.

Information Systems Consulting, CA3-92-0169-T, in the United States District Court, N.D.

Texas, Dallas Division, that "... the Internal Revenue Code and the Regulations promulgated

pursuant to the code do not contain an absolute requirement that an employer provide [to the IRS]

an employee social security number ..."

In this case, the federal government prosecuted Information Systems Consulting, Inc., of Texas

for summarily firing a man because he did not have an SSN. The EEOC shows in this case that

the controlling statutes for information reporting on a 1099 are 26 USC 6041 and 26 CFR

301.6109-1.

26 USC 6041. Information at source

(a) Payments of $600 or more

All persons engaged in a trade or business and making payment in the course of such

trade or business to another person, of rent, salaries, wages, premiums, annuities,

compensations, remunerations, emoluments, or other fixed or determinable gains,

profits, and income (other than payments to which section 6042(a)(1), 6044(a)(1),

6047(e), 6049(a), or 6050N(a) applies,

And other than payments with respect to which a statement is required under the

authority of section 6042(a)(2), 6044(a)(2), or 6045), or $600 or more in any taxable

year, or, in the case of such payments made by the United States, the officers or

employees of the United States having information as to such payments and required

to make returns in regard thereto by the regulations hereinafter provided for, shall

render a true and accurate return to the Secretary, under such regulations and in such

form and manner and to such extent as may be prescribed by the Secretary, setting

forth the amount of such gains, profits, and income, and the name and address of the

recipient of such payment.

(b) omitted

(c) Recipient to furnish name and address

When necessary to make effective the provisions of this section, the name and

address of the recipient of income shall be furnished upon demand of the person

paying the income.

Please note well that there is no mention of any identifying number in this mandate from

Congress. The question then becomes what is the manner and extent as prescribed by the

Secretary. This is found in part 301 of the regulations for Title 26:

[Code of Federal Regulations]

[Title 26, Volume 17, Parts 300 to 499]

[Revised as of April 1, 1999]

- From the U.S. Government Printing Office via GPO Access

[CITE: 26CFR301.6109-1]

[Page 68-74]

TITLE 26--INTERNAL REVENUE

(Continued)

PART 301--PROCEDURE AND ADMINISTRATION--Table of Contents

Sec. 301.6109-1 Identifying numbers.

(a) and (b) omitted

(c) Requirement to furnish another's number. Every person required under this title

to make a return, statement, or other document must furnish such taxpayer

identifying numbers of other U.S. persons and foreign persons that are described in

paragraph (b)(2)(i), (ii), (iii), or (vi) of this section as required by the forms and the

accompanying instructions. The taxpayer identifying number of any person

furnishing a withholding certificate referred to in paragraph (b)(2)(vi) of this section

shall also be furnished if it is actually known to the person making a return,

statement, or other document described in this paragraph (c). If the person making

the return, statement, or other document does not know the taxpayer identifying

number of the other person, and such other person is one that is described in

paragraph (b)(2)(i), (ii), (iii), or (vi) of this section [foreign persons!], such person

must request the other person's number. The request should state that the identifying

number is required to be furnished under authority of law. When the person making

the return, statement, or other document does not know the number of the other

person, and has complied with the request provision of this paragraph (c), such

person must sign an affidavit on the transmittal document forwarding such returns,

statements, or other documents to the Internal Revenue Service, so stating. A person

required to file a taxpayer identifying number shall correct any errors in such filing

when such person's attention has been drawn to them.

If you go and look at the entire regulation on the internet, you will first notice that the list of

persons from whom to solicit an SSN described in (b)(2) are all foreign persons. There is no

requirement to ask for a number from a citizen. Second, notice that when the return is made

without an SSN, that an affidavit of transmittal is required which states that the payor requested

the number. In the event that your company ends up paying me in excess of $600 for this

calendar year, I would be pleased to provide such a sample affidavit. There is no absolute

requirement for a citizen to have an SSN in order to work within the states of the Union.

The penalty statute for not putting a taxpayer id number on a return used to be at 26 USC 6676.

This was repealed in 1989. The current penalty statutes are 26 USC 6721 thru 6724. Note well

in IRC 6724 that there is no penalty for "reasonable cause" so long as there is no "willful

neglect". You asked for a number, and I could not give you something I do not possess. This

most certainly constitutes reasonable cause for you not to put it on the 1099.

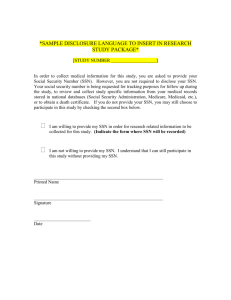

When you make the 1099 information return, you put the name and address (which you already

have), the amount, and you can write "none" or "religious objection" in the taxpayer id space.

Then sign, notarize and attach the affidavit that I would provide and there will be no penalties.

The most important and relevant reason, however, is that I have a religious objection to the

inventorying of human flesh as foretold in the Holy Bible in the Book of Revelations, Chapter 13,

verses 16-17:

16 "And he causeth all, both small and great, rich and poor, free and bond, to receive

a mark in their right hand, or in their foreheads:"

17 "And that no man might buy or sell, save he that had the mark, or the name of

the beast, or the number of his name.":

It is quite evident to me, considering there is no law to compel a citizen to participate in national

socialism against his will, and considering that an SSN is the first thing everyone asks for when

one makes any type of application, that the social security number itself must be the mark of the

beast as foretold in Revelations. I realize that this must seem "extreme" to you, but I remind you

that I am a Computer Scientist, and quite a rational human being concerning worldly affairs.

However, it is my faith that compels my actions. How would the Almighty have looked upon the

actions of the Good Samaritan if the Samaritan were required by some law to help the unfortunate

victim on the roadside? I simply wish to be able to pursue my life, my liberty, and my happiness

without undue federal burden in accordance with my deeply held religious beliefs. There are

many Supreme Court cases that show that Congress cannot unduly burden the religious beliefs of

its citizens:

"The door of the Free Exercise Clause stands tightly closed against any governmental regulation

of religious beliefs as such, Chantwell v. Connecticut, [310 U.S. 296, 303]. "Government may

neither compel affirmation of a repugnant belief", Torcase v. Watkins, 367 U.S. 488; nor penalize

or discriminate against individuals or groups because they hold religious views abhorrent to the

authorities, Fowler v. Rhode Island, 345 U.S. 67; nor employ the taxing power to inhibit the

dissemination of particular religious views, Murdock v. Pennsylvania, 319 U.S. 105; Follett v.

McCormick, 321 U.S. 573; cf. Grosjean v. American Press Co., 297 U.S. 233.

"It is too late in the day to doubt that the liberties of religion and expression may be infringed by

the denial of or placing of conditions upon a benefit or privilege, American [374 U.S. 398, 405]

Communications Assn. v. Douds, 339 U.S. 382, 390; Wieman v. Updegraff, 344 U.S. 183, 191192; Hannegan v. Esquire, Inc., 327 U.S. 146, 155-156. For example, in Fleming v. Nestor, 363

U.S. 603, 611, the Court recognized with respect to Federal Social Security benefits that "[t]he

interest of a covered employee under the Act is of sufficient substance to fall within the

protection from arbitrary governmental action afforded by the Due Process Clause. In Speiser v.

Randall, 357 U.S. 513, we emphasized that conditions upon public benefits cannot be sustained if

they so operate, whatever their purpose, as to inhibit or deter the exercise of First Amendment

freedoms." [Sherbert v. Verner, 374 U.S. 398]

In our legal system, members of the American public are charged with knowledge of the limits of

the statutory authority of government agencies and employees; see Federal Crop Ins. Corp. v.

Merrill, 332 U.S. 380, 68 S.Ct. 1 (1947). Government agencies are bound by and must follow the

limits upon their authority established by law; see United States v. Spain, 825 F.2d 1426 (10th

Cir. 1987); and Civil Aeronautics Board v. Delta Air Lines, Inc., 367 U.S. 316, 322, 81 S.Ct.

1611 (1961). Currently, the SSA lacks the authority to issue SSNs to individuals outside the

classes described in the above §405. Further, pursuant to 18 U.S.C. §1001, it is a crime for

anyone to submit false information to a government agency.

I therefore must comply not only with man's law, but with the laws handed down to me by my

Creator. Your company must comply with federal law in this regard and not discriminate against

me based solely upon my religious beliefs. Should your company find that I am not a qualified

candidate, so be it; but I would ask for you to respect my religious beliefs and consider my

application based upon my qualifications, my skills and my experience. Some folks have a bit of

trouble with all of this. They do not realize that the law is written and must be understood by

people of reasonable intelligence or it is void for vagueness. So I offer to indemnify and post

bond for those who think this should be necessary.

I thank you for your kind attention to this matter, and await your comments,

Brad L. Barnhill

EXCERPTS FROM

EEOC v. Information Systems Consulting

CA3-92-0169-T

IN THE

UNITED STATES DISTRICT COURT

NORTHERN DISTRICT OF TEXAS

DALLAS DIVISION

1.

From the EEOC's Letter of Determination, Dated May 2, 1990 (p.2):

"The evidence supports the charge that there is a violation of Title VII of the 1964

Civil Rights Act, as amended, ... Section 706(b) of Title VII requires that if the

Commission determines there is a reasonable cause to believe that the charge is true,

it shall endeavor to eliminate the alleged unlawful employment practice by informal

methods of conference, conciliation, and persuasion. Having determined there is

reasonable cause to believe the charge is true, the Commission now invites the

parties to join with it in a collective effort toward a just resolution of this matter."

2. From the Affidavit of Tim Fitzpatrick, September 29, 1989 (p.3):

"After discussions with the IRS, the company discovered that if Mr. Hanson did not

provide the company with a Social Security Number, the company would be in

violation of the Internal Revenue Regulations and subject to various penalties."

3.

From the Plaintiff's Response to Defendant's Motion to Dismiss, April 1, 1992 (pp. 8-9):

"...the Internal Revenue Code and the Regulations promulgated pursuant to the code do not

contain an absolute requirement that an employer provide an employee social security number to

the IRS. Internal Revenue Code Section 6109(a)(3) states:" Any person required under the

authority of this title to make a return, statement or other document with respect to another

person, shall request from such person, and shall include in any such return, statement, or

document, such identifying number as may be prescribed for securing proper identification of

such other person.

26 U.S.C. § 6109(a)(3) (Supp.1992)

"The IRS regulation interpreting section 6109 provides:"

"If he does not know the taxpayer identifying number of the other person, he shall

request such number of the other person. A request should state that the identifying

number is required to be furnished under the law. When the person filing the return,

statement, or other document does not know the number of the other person, and has

complied with the request provision of this paragraph, he shall sign an affidavit on

the transmittal document forwarding such returns, statements, or other documents to

the Internal Revenue Service so stating.

Treas. Reg. § 301.6109-1(c) (1991).

"The applicable IRS statute and regulation place a duty on the employer to request a taxpayer

identifying number from the employee. If document must be filed and the employer has been

unable to obtain the number but has made the request then the employer need only include an

affidavit stating the request was made."

The Government also avers that:

"In 1989, Internal Revenue Code Section 6676, 26 U.S.C. § 6676 (1989), set forth the penalties

for failing to supply the IRS with identifying numbers as required by the code...a $50.00 penalty

will be imposed for failure of an employer to provide an identifying number on any document

filed with the IRS unless it is shown that the failure was due to reasonable cause and not willful

neglect. The Treasury Regulation Interpreting the Statute states:

Under Section 301.6109-1(c) a payor is required to request the identifying number

of the payee. If after such a request has been made, the payee does not furnish the

payor with his identifying number, the penalty will not be assessed against the

payor.

Treas. Reg. § 3106676-1 (sic)(1989)."

"Public Law 101-239, Title VII, Section 7711(b)(1), Dec. 19, 1989, 103 Stat. 2393, repealed

Section 6676 of the Internal Revenue Code, 26 U.S.C. § 6723 (Supp. 1992) has governed the

failure to comply with information reporting requirement. However, Internal Revenue Code

Section 6724, 26 U.S.C. § 6724 (Supp. 1992), provides for a waiver of any penalties assessed

under the code upon a showing of reasonable cause. Section 6724(a) provides:

No penalty shall be imposed under this part with respect to any failure if it is shown

that such failure is due to reasonable cause and not willful neglect.

26 U.S.C. § 6724(a) (Supp. 1992)."

4.

From the Consent Decree, dated November 4, 1992 (p.4):

"The defendant . . . shall be permanently enjoined from terminating an employee or refusing to

hire an individual for failure to provide a social security number . . . If an employee or applicant

for employment advises the defendant that he does not have a social security number . . . the

defendant shall request, pursuant to Section 6724 of the Internal Revenue Service Code {sic}, 26

U.S.C. § 6724, a waiver of any penalties that may be imposed for failing to include an employee's

social security number on a 1099.