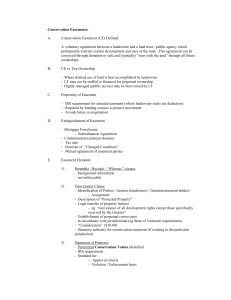

Virginia's Property II Outline

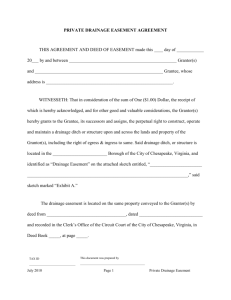

advertisement