Wills Estates and Trusts Outline

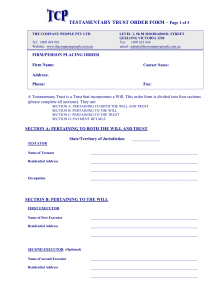

advertisement